Clean Energy Dividends: Three Pioneering Green Hydrogen Stocks Generating Income And Profits

Texas is freezing. California is burning. A pandemic is raging. One couldn’t ask for more obvious signs that something is seriously wrong with the environment. Almost every scientist in the world agrees that we need to get to net-zero carbon emissions by 2050 — or things will get worse still.

But until recently, there has been very little public discussion of the one zero-emission energy source that is so resilient that it works in outer space.

The Apollo astronauts went to the moon and back using hydrogen power — specifically, a hydrogen fuel cell that used the gas to generate all the electricity and water the crews needed. Hydrogen power is cheap, safe, reliable, and completely clean. The only problem is that the production of the gas itself tends to be quite dirty.

More than 90% of the hydrogen produced for industrial use today is a byproduct of natural gas processing — and that process releases nine parts of carbon dioxide for every one part of hydrogen gas produced.

Governments and energy companies are starting to realize that we can’t stop climate change without hydrogen — or with dirty hydrogen. That’s why they’ve started to promote green hydrogen — hydrogen produced through carbon-neutral methods like electrolysis (the use of electricity and chemical catalysts to separate water into hydrogen and oxygen gas).

Grand View Research estimates that investments in green hydrogen will see a compound annual growth rate (CAGR) of 14.24% through 2027, and it’s easy to see why. National and supernational governments are starting to aggressively promote the technology…

President Biden mentioned subsidizing green hydrogen on his campaign website. The European Union has a plan to increase the number of electrolyzers 24-fold by 2024. And the UN is implementing a maritime fuel rule change that should turbocharge hydrogen demand in the years ahead…

How to Invest in Green Hydrogen

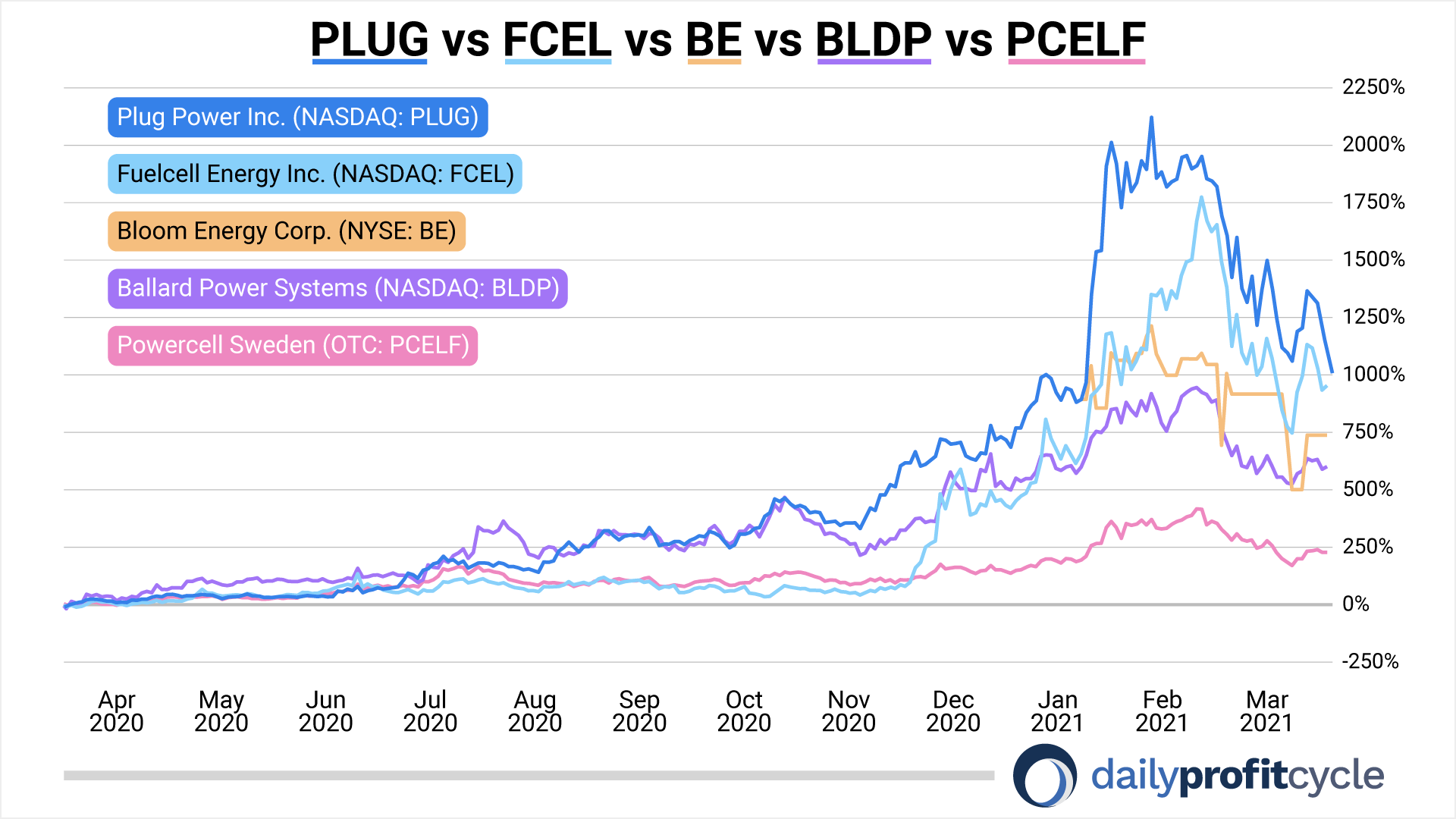

Upstarts with lots of media attention, like Bloom Energy (NYSE: BE), FuelCell Energy (NASDAQ: FCEL), and Plug Power (NASDAQ: PLUG) have made some investors fortunes in the last year — but as you can see below, they’ve also lost some investors fortunes in recent months.

If you’re looking for a more reliable strategy — one that can both protect and grow your capital, generating income as well as capital gains — then consider investing in green hydrogen producers.

These chemical engineering firms tend to be more entrenched and have wider competitive moats than the upstarts — and as a result, they often pay big dividends.

Our research team has profiled the three best-connected green hydrogen producers in its latest free report, Clean Energy Dividends: Three Pioneering Green Hydrogen Stocks Generating Income And Profits.

Inside, you’ll find:

- A multinational gas producer that is building big green hydrogen plants around the world;

- An American chemical engineering firm that is powering Europe’s hydrogen revolution, and;

- A scrappy upstart whose new hydrogen electrolyzer design could upend the energy industry forever…

Simply enter your email to receive this completely free report. You’ll also receive a free subscription to our investment news and education letter, Daily Profit Cycle.