Are you prepared for your lights to suddenly go out? How about your air conditioning? Your internet?

It’s smart to start preparing now — because rolling blackouts have become more and more common for millions of Americans. And they’re getting worse over time.

Nearly a million Californians lost power in August of 2020 as a record-breaking heatwave stretched the Golden State’s poorly-planned power supplies past their limits. And in last February of 2021 over 3 million Texans were forced to brave arctic weather without power due to outsized demand and intermittency issues among the state’s natural gas power plants.

If that wasn’t bad enough, according to energy economists, this is only the beginning of America’s electricity crisis. It’s all the result of an outdated grid that is woefully unprepared for an increasingly-chaotic set of weather conditions and electrical demand patterns.

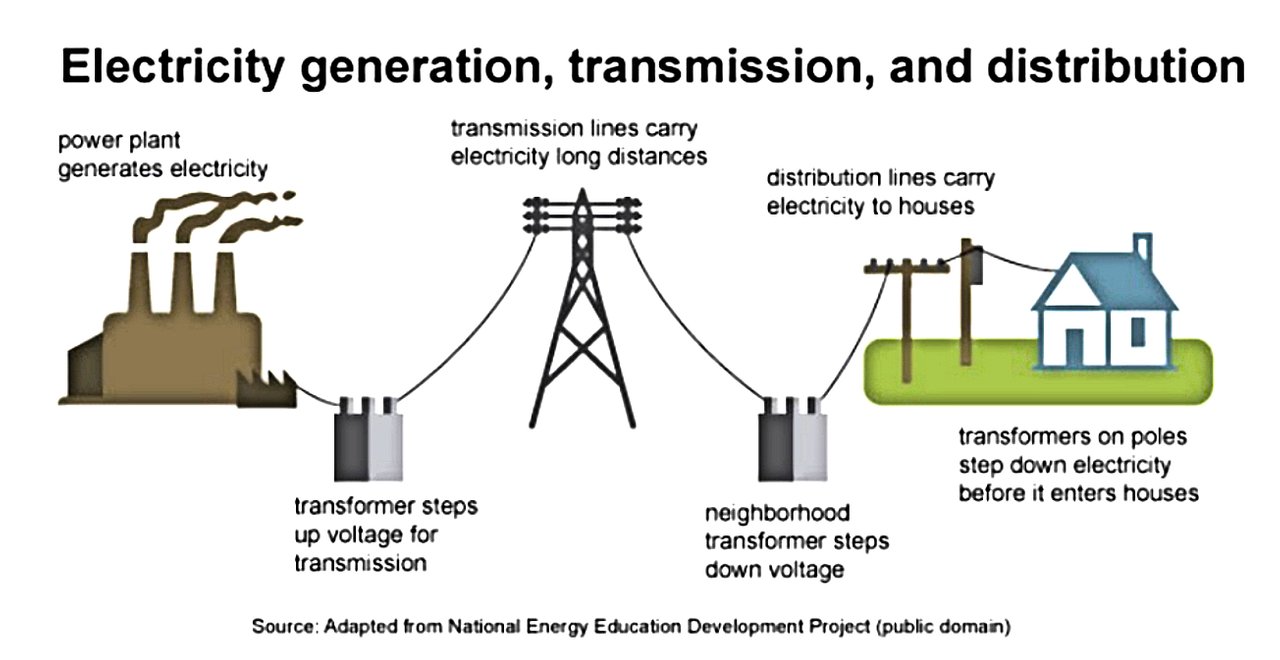

The “grid,” in this context, refers to the traditional model of electricity generation and distribution — in which large, centralized power plants are responsible for the entire power supply in a given region.

Power plants do their best to change their capacity in real-time in response to changes in demand — but they’re large industrial facilities that can’t easily start and stop on a dime.

Recently, however, engineers have started to experiment with a different model of electricity generation and distribution — one which could put an end to rolling blackouts, even in times of erratic demand and chaotic conditions. It’s called distributed energy — and it’s one of the most underhyped investment opportunities of the 2020s.

What Is Distributed Energy?

Distributed energy sources — also known as virtual power plants — are decentralized networks of grid-connected small power generators like wind turbines and rooftop solar installations, storage units like household and commercial battery systems, and “demand response” consumers who are willing to voluntarily reduce their power usage during periods of surging demand.

By combining these small assets — which are often built into homes and businesses — distributed energy planners can supply electricity to the grid and adjust output in response to changing conditions much more nimbly than a large power plant can.

And since distributed energy consumers participate in the grid themselves — producing and storing much of their own energy in their homes and workplaces — they often end up paying a lower price than conventional electrical utilities charge.

In other words, virtual power plants serve all the functions of traditional power plants, but better and cheaper — and without the need for a physical power plant facility.

And these aren’t just theoretical advantages. Although a very new technology, virtual power plants already have a record of rescuing the grid during extraordinary situations that traditional power distribution models can’t handle.

They saved California from further blackouts in late 2020, and the Biden administration is proposing them as a way to prevent more blackouts in the future.

I’m very supportive of microgrids, of these small modular nuclear reactors, of the ability to have distributed energy resources, community-based solar attached to a microgrid.

Those solutions are very exciting and could be, and certainly should be, part of the national system. We should be incentivizing communities to think about that so that they are not so dependent on, you know, poles with wires atop that were constructed 70 years ago.

-Energy Secretary Jennifer Granholm, speaking to the Washington Post

Why The Smart Money Is Betting On Virtual Power Plants

Distributed energy investments have already shown significant momentum around the world. Market research firm Fortune Business Insights projects that the space will grow at a 27.2% compound annualized growth rate (CAGR) through 2027, with especially strong growth forecasted in Europe, North America, and Asia.

And indeed, distributed energy policy is already changing in the U.S. In fact, it started changing significantly several months before Biden was even elected.

In September 2020, the Federal Energy Regulatory Commission (FERC) issued Order No. 2222 — a change which removes regulatory barriers to virtual power plants by requiring grid operators to accept power from them — and to pay them at the same rate as traditional power plants.

The order has been compared by energy economists to the 1993 computer networking regulatory changes that allowed private companies to use the previously-public-sector-only NSFNet telecommunications infrastructure, creating the modern commercial internet.

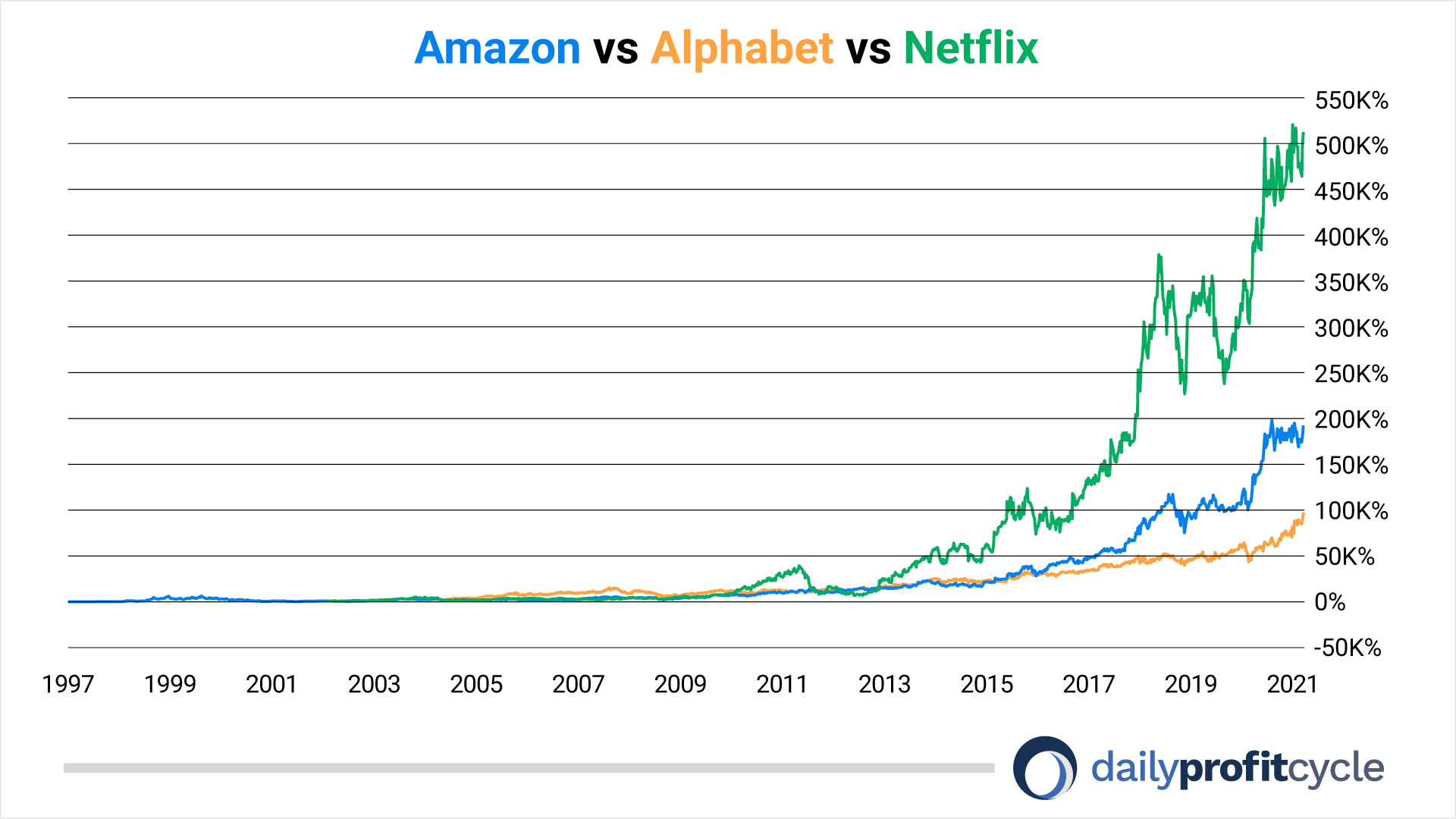

In the aftermath of those 1993 NSF changes, several entrepreneurs launched startups with the then-experimental idea of selling goods and services on the newly-opened network. Today, we call a few of those startups Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG), and Netflix (NASDAQ: NFLX).

As you can see — and as you probably knew already — all three companies have handed investors five-digit returns since the ‘90s.

Investors today have a similar opportunity to invest in distributed energy upstarts that are among the first companies to profit from America’s newly-opened energy network.

Our research team has profiled four companies that could be the Amazons, Googles, Netflixes, or eBays of energy in our latest free report, “Virtual Power Plants: Profit While Preventing More Texas Blackouts With Four Distributed Energy Stocks.”

Inside, you’ll find:

-

A fast-growing startup whose focus on distributed energy has already made early investors fortunes — and could make today’s investors even bigger fortunes;

-

A dividend-paying bluechip that has been at the forefront of the virtual power plant revolution for years;

-

The most distributed-energy-focused utility company in America, which has rewarded shareholders with a balance of growth and income;

-

And an undervalued power technology company whose products are essential to the distributed energy revolution.

Simply enter your email to receive this completely free report. You’ll also receive a free subscription to our premium investment news and education letter, Daily Profit Cycle.