Modern-Day Gold Rush Serves Up An 800% Gain … Under the Radar Company Positioned to Strike

The gold rush. It conjures up images of grizzled prospectors panning for the yellow metal along mountain streams.

You think of the famous rushes in history: The 1849 rush that earned California its moniker as “The Golden State” and the frenzied Yukon gold rush of the late 1890s.

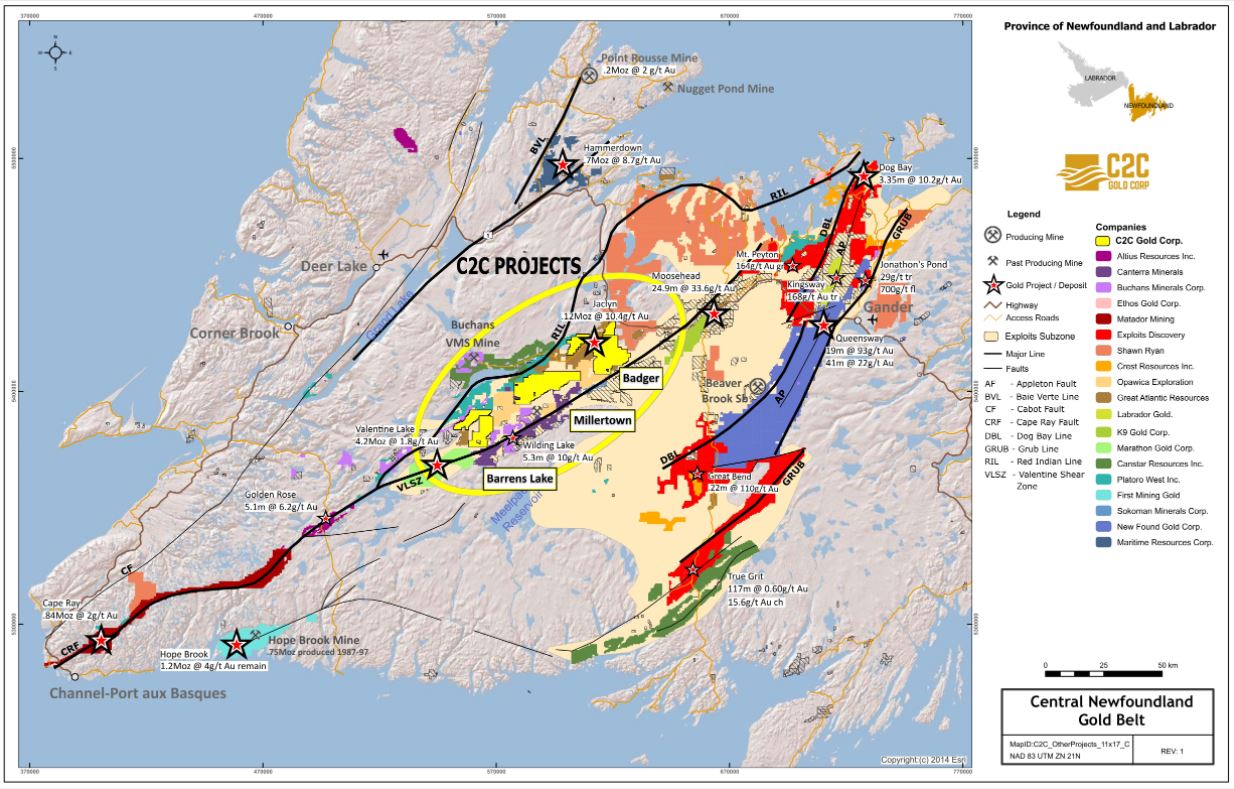

History’s latest gold rush is underway in eastern Canada’s Newfoundland province, with modern-day prospectors working hand-in-hand with gold exploration companies.

One recent gold discovery of 92 grams per metric ton in Newfoundland has already generated up to an 800% gain for one gold company and touched off a land staking frenzy on the island.

And, as you’re about to see, tiny Leocor Gold (OTC: LECRF | CSE: LECR) has leveraged its relationship with storied prospector Shawn Ryan, the man responsible for a “Second Yukon Gold Rush,” to take a stake in a massive land position on prime gold-hunting ground in the province, including some land positioned just 20 miles from major discoveries made this year.

Investors are starting to run to the safety of gold, as rampant inflation caused by massive supply chain disruptions and a lack of Fed action continues to plague the economy with the problems worsening every day. It’s a repeat of the 1979-1981 boom that saw gold prices skyrocket more than 200% at its peak…and the 2008-2011 boom, when gold prices increased by 87%.

Gold mining operations saw major increases during these times as well. Newmont Corporation (NYSE: NEM) saw a 67% increase from 1980-1981 and a 98% increase between 2008 and 2011. Barrick Gold (NYSE: AU) saw an increase of over 108% from 2008 to 2011.

At current trading levels, Leocor Gold (OTC: LECRF | CSE: LECR) gives you a way to leverage the current strong environment for gold to the hilt and possibly protect your hard-earned nest egg in the process.

Historical and recent drilling successes show why Leocor Gold is positioned for success in the newest Newfoundland Gold Rush.

This could be my next big winner…

Allow me to introduce myself. My name is Nick Hodge.

I made my first million by investing in a biotech company called ImmunoPrecise Antibodies [OTC: IPATF | TSX-V: IPA]. That stock would eventually soar 6,860% and allow me to quit my day job, move my family into private estate and pursue my passion for investing full time.

That passion led me to publish my monthly investment newsletter, Foundational Profits, which has helped subscribers generate life-changing wealth by being early into stories exactly like the one I see developing with Leocor Gold.

I’m not necessarily predicting a 6,860% profit like I had with ImmunoPrecise, but I do think investors who invest in Leocor Gold (OTC: LECRF | CSE: LECR) will likely be very glad they did.

“Eureka” Moment Sets Off Newfoundland Land Grab

The story of the Newfoundland gold rush, and thus Leocor Gold’s story, began in earnest in 2019.

That’s when then-private company New Found Gold drilled an eye-popping hole on its Queensway project’s Keats zone. That discovery sparked a frenzy of claim-staking and exploration in Newfoundland.

It’s easy to see why. That hole generated 19.0 metres of 92.2 grams per metric ton of gold.

That’s almost 3.3 ounces of gold per metric ton.

If you applied the current $1,800 gold price to this slice of rock cut by New Found’s drill bit, it would be worth around $6,000 per metric ton!

New Found would go on to list as public company in August 2020.

After initially trading as low as C$1.50 in mid-September 2020, subsequent drill results would see its share price soar to C$13.50 by June 2021.

That’s an 800% gain in just 10 months, a performance that makes the company one of the gold sector’s biggest winners this year.

New Found Gold’s Keats gold discovery set off a claim-staking rush in the Newfoundland.

Follow-up drilling would send the company’s share price soaring as much as 800%.

After the first wave of staking at Keats, consistently amazing drill results from this area have persuaded explorers to snap up practically every square inch of prospective ground in Newfoundland.

Legendary Prospector Who Spawned the “Second Yukon Gold Rush”

Thinks Newfoundland Could Be Even Bigger

Shawn Ryan has been a key player in many of those land deals. It was Ryan’s dogged prospecting work that kicked off a “Second Yukon Gold Rush” in the late 2000s and early 2010s.

In the early and middle 2000s, at a time when the Yukon has lost some of its luster as a gold mining destination, Ryan spent several years taking a systematic approach to looking for gold in the territory.

He had a theory that, by using “fast-and-dirty” exploration techniques, he could quickly assess the gold-hosting potential of the ground underneath and hone in on the sources of the river and stream-bound gold that set off the original Yukon Gold Rush more than a century earlier.

To say that that theory proved successful would be an understatement.

He would eventually sell ground staked based on his work to then-tiny Underworld Resources, which would go on to estimate 1.4 million ounces of gold (worth over US$2.4 billion at today’s gold prices) on the White Gold project.

That discovery resulted in industry heavyweight Kinross acquiring Underworld in 2010 for C$140 million.

But Ryan wasn’t done. He also staked the ground that became the Coffee project.

Kaminak Gold would go to estimate more than 3 million ounces of gold (worth over US$5.2 billion at today’s prices) at Coffee before Goldcorp (now Newmont) bought the company in 2016 for C$520 million.

Those discoveries and the resulting land grab have made Ryan a millionaire many times over.

They also earned him the Prospector & Developers Association of Canada’s Prospector of the Year Award in 2011.

But Ryan hasn’t rested on his laurels.

Instead, he’s been intimately involved in the current Newfoundland gold rush.

In fact, he helped New Found Gold vector in on the ground that became its Keats discovery.

And he has used some of the same early-stage prospecting techniques he honed in the Yukon to stake large land positions in Newfoundland.

Here’s what Ryan has to say about this latest gold rush: “If I was 25 years younger and I found Newfoundland first instead of the Yukon, I’d be in Newfoundland.”

Could Leocor Gold (OTC: LECRF | CSE: LECR) Be Newfoundland’s Next Big Winner? Ryan Thinks So…

Ryan’s large (and early) stake in the Yukon allowed him to play “kingmaker” with companies like Underworld and Kaminak.

Now he’s following the same model in Newfoundland.

By optioning more than 144,000 hectares of prime gold-hunting ground to Leocor Gold (OTC: LECRF | CSE: LECR), he’s tapped this under-the-radar company as one of his potential winners in this latest gold rush.

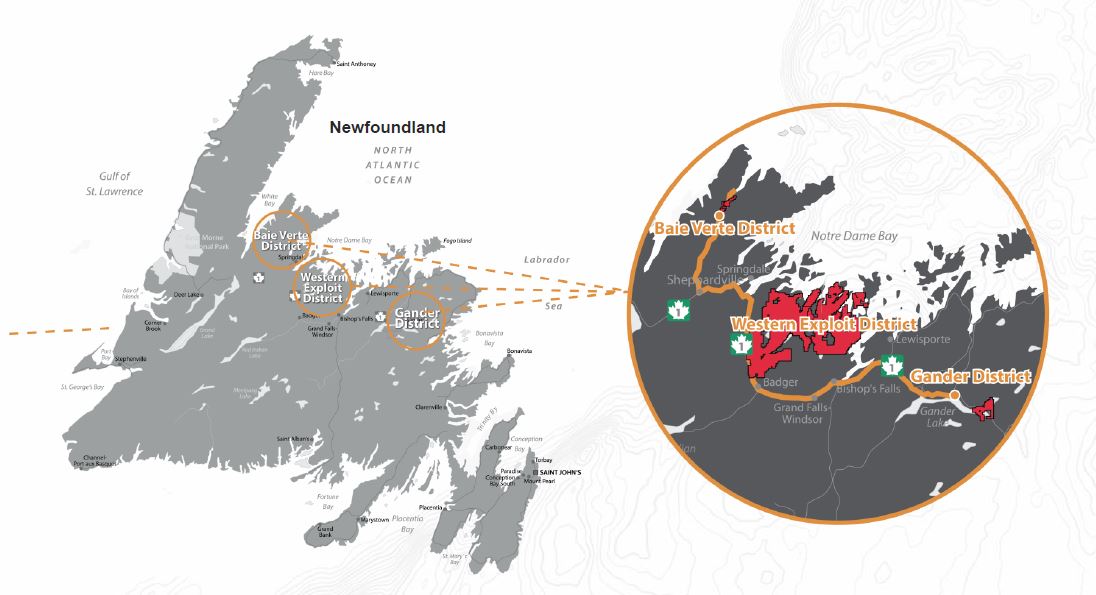

Leocor’s Western Exploit District gives it a massive land package on trend with some of the major, gold-hosting geological structures that run through the province.

Better still, Ryan’s early exploration work on the project has identified a key exploration marker of gold in the district.

They’re called “gabbros,” and they’ve long been associated with gold showings in the area.

Between his own ground-truthing efforts and the extensive work that the provincial government has poured into mapping the area, he’s identified multiple gold targets on this district-scale property.

Thanks to those distinctive gabbros, Leocor Gold (OTC: LECRF | CSE: LECR) now has a big head start on which targets to drill first.

Combined with its target-rich properties in the Baie Verte District and the Gander District, the company controls 590 square miles of some of the higher potential gold ground in Newfoundland.

This puts Leocor Gold (OTC: LECRF | CSE: LECR) in a great position to make that next “Keats-like” discovery in the province.

Three Paths to Profits

Will Leocor (OTC: LECRF | CSE: LECR) match New Found’s amazing 800% price run?

Time will tell of course, but with three paths to profits, the company is set up for success.

Path #1: Make a gold discovery. Given Leocor’s commanding land position in Newfoundland and the abundance of targets it can pursue with drilling, a major gold discovery would almost certainly send the company’s share price soaring.

Path #2: Get an “area play” bump. Along with the claim-staking frenzy in Newfoundland over the past couple of years have come millions of dollars of financing to fund drilling in the area.

With all that activity, the odds go up that someone, somewhere, will hit the same kind of high-grade gold that New Found hit at Keats.

And if that happens, it will draw a whole new wave of investors into Newfoundland stories, likely boosting the shares of Leocor Gold (OTC: LECRF | CSE: LECR) and every other company with projects in the region.

Path #3: Benefit from a run on gold. The rampant inflation that has us all paying more for groceries, gas, real estate (and seemingly everything else) is like rocket fuel for gold prices.

In a classic “rising tide lifts all boats” scenario, higher gold prices could lift the valuations of the whole gold sector.

In fact, if history is any guide, the junior equities like Leocor won’t just benefit from rising gold prices, they will actually provide significant leverage on them.

Any way you look at it, Leocor Gold makes for a compelling bet on the Newfoundland Gold Rush and a gold bull market.

Claim your FREE Special Report “How To Profit from the First Gold Rush of the 21st Century”

I’ve only scratched the surface of the potential I see in Leocor.

That’s why I’ve put together a new special report that reveals additional details on why I think Leocor Gold (OTC: LECRF | CSE: LECR) has a great chance to be one of the Newfoundland gold rush’s big winners.

“How to Profit from the First Gold Rush of the 21st Century” lays out the substantial profits that Leocor Gold could offer investors as the Newfoundland story evolves, and it’s free when you agree to a no-risk, discount subscription of my Foundational Profits newsletter.

Foundational Profits helps subscribers make money by spotting hot trends before the rest of the market catches wind of them.

Some of its biggest winners include …

- 245% on 3D printing company Organovo

- 397% on Chinese automaker BYD Auto

- 610% on Idaho gold-silver explorer Integra Resources

- 2,574% on Papua New Guinea gold miner K92 Mining.

Foundational Profits picks like these are the direct result of the connections, experience and investing acumen that I use to hone in on the next big winners in mining, green energy, cannabis and cryptocurrencies.

A No-Risk Investment, Backed by an Iron-Clad Guarantee

Your no-risk subscription to Foundational Profits comes with 12 monthly issues, plus:

Flash Alerts — Urgent updates when needed for news-based buy/sell information.

Research Reports — You’ll receive a detailed analysis of every stock I recommend, packed with the information explaining my thinking. You’ll also receive quarterly reports that delve into important market trends and events.

Exclusive Interviews — I have the ear of many executives and thought leaders across several industries. And I bring my talks with them directly to you in candid interviews.

Your 1-year subscription is just $199 — a small price to pay for investment advice that has consistently delivered money-multiplying returns for my subscribers.

And, if you subscribe in the next 10 days, you can take advantage of my Half-Price Subscription Offer to Foundational Profits and pay just $99 for the full year.

Not only will you get my “How to Profit from the First Gold Rush of the 21st Century” report on Leocor Gold, you’ll also get a FREE copy of these special reports:

- Get Ready for the Turbulent 20s! The “Turbulent 20s” will be a time of unprecedented chaos. This Special Report will prepare you for the crazy economy that’s about to unfold. — It’s a $20 value, and it’s yours FREE!

- The Amazon of Energy: Earn 60x Your Money on the Digital Power Revolution. This proprietary Special Report reveals the name of a drastically undervalued company that is re-writing the rules of how energy is created, stored, managed and distributed. — A $20 value, yours FREE!

- Cannabis 2.0. The 10 largest cannabis firms in the U.S. are expected to generate $5.5 billion in sales next year, up from $3.3 billion this year. This report outlines the best way to invest in the re-ignition of the cannabis sector. — Another $20 value, yours FREE!

- Kings of the DRIP – Dividends are the best way to protect your wealth with recurring income. Here you’ll find the top income names on the street and how to compound your gains when you own them long-term. — A $20 value, yours FREE!

The Best Guarantee in the Publishing Industry: You must be satisfied with your subscription to Foundational Profits. That’s why we offer our industry leading “Money Back Double Guarantee.”

Guarantee #1: If you’re not fully satisfied with the picks and analysis you’ll find in the pages of Foundational Profits, you may cancel your subscription at any time within the first 6 months and receive a full refund.

Guarantee #2: In the unlikely event you decide to cancel, you may keep all issues you receive, as well as my Special Report, free of charge.

If you want to maximize your profits in fast-moving markets like the gold sector, you want to do your due diligence and then you want to act.

I encourage you to do exactly that with Leocor Gold by reading through the “How to Profit from the First Gold Rush of the 21st Century” special report you’ll receive immediately, when you subscribe today to Foundational Profits.