Elif is a Chartered Professional Accountant with over 20 years of experience in finance, treasury and strategic management in the Québec gold mining industry.

Prior to her current role, she was Vice President Finance and Chief Financial Officer of Osisko Gold Royalties since its creation in June 2014. In that capacity, she was responsible for leading the efforts to list Osisko on the New York Stock Exchange and played a key role in acquisitions of over C$1.5 billion in stream and royalty interests as well as equity and debt financings of over C$1 billion.

The team in place has the experience, background and network to take Nomad from the current C$598 million market to a multi-billion dollar company.

Share Structure

Nomad has approximately 564.5 million shares outstanding, and 597.3 million fully outstanding.

Shares currently trade at ~C$1.06/US$0.86 per share giving Nomad a market cap of approximately C$598 million, and C$632 million fully diluted.

Major shareholders — and important partners — include Orion Finance, which owns approximately 70.2% of Nomad shares.

The company has approximately $20 million in cash and an undrawn $75 million revolving credit facility. A credit facility it is keen to use to acquire new royalties.

In addition the company pays a royalty sector-leading C$0.02 dividend on every Nomad share. That works out to a yield of 1.8%.

So you get paid while the company executes its business model.

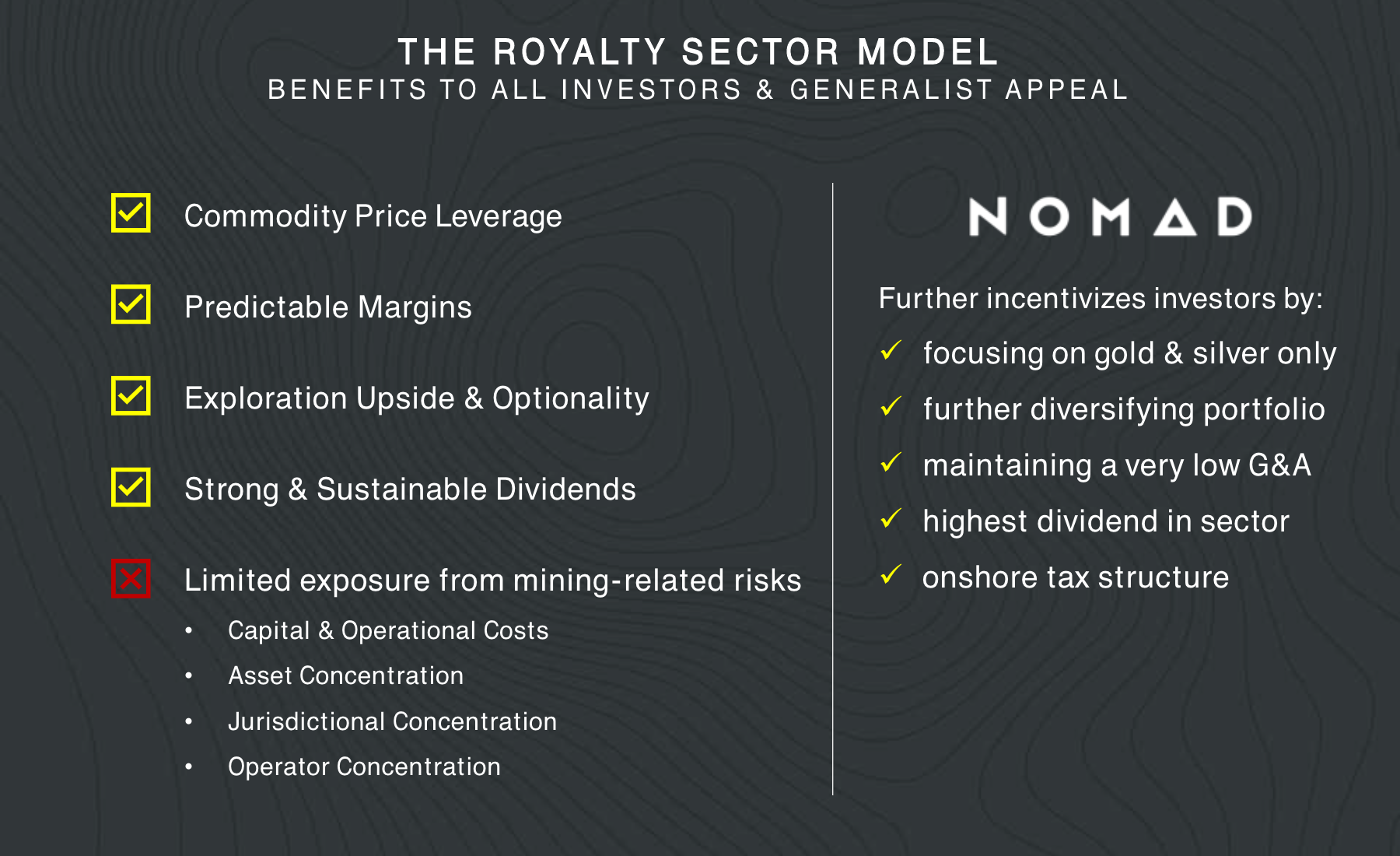

Nomad Business Model

A model that is low-risk and provides immediate cash flow from six cash flowing assets. This cash flow is low cost and high margin.

Permitting, building, and operating a mine is difficult work. Risky work where management and shareholders alike share in the risks. It can often take a decade or more to get a mine into production… if it can even get a permit.

With the royalty model, shareholders benefit from the exposure to higher metals prices and predictable margins.

And in this case, a dividend and the leverage of jurisdictional diversification, which is critical given the increasing geopolitical risk miners face.

Nomad focuses exclusively on gold and silver streams.

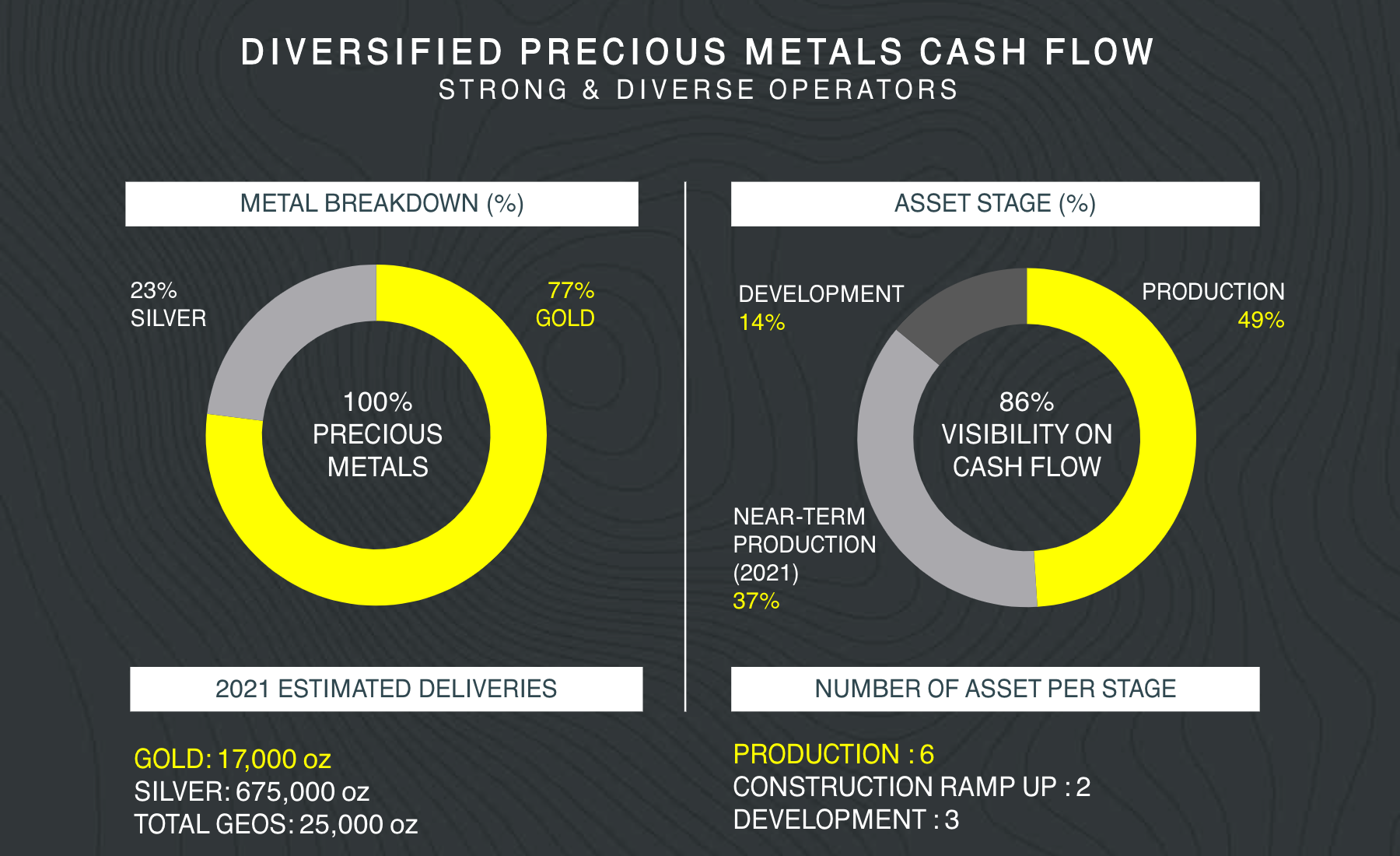

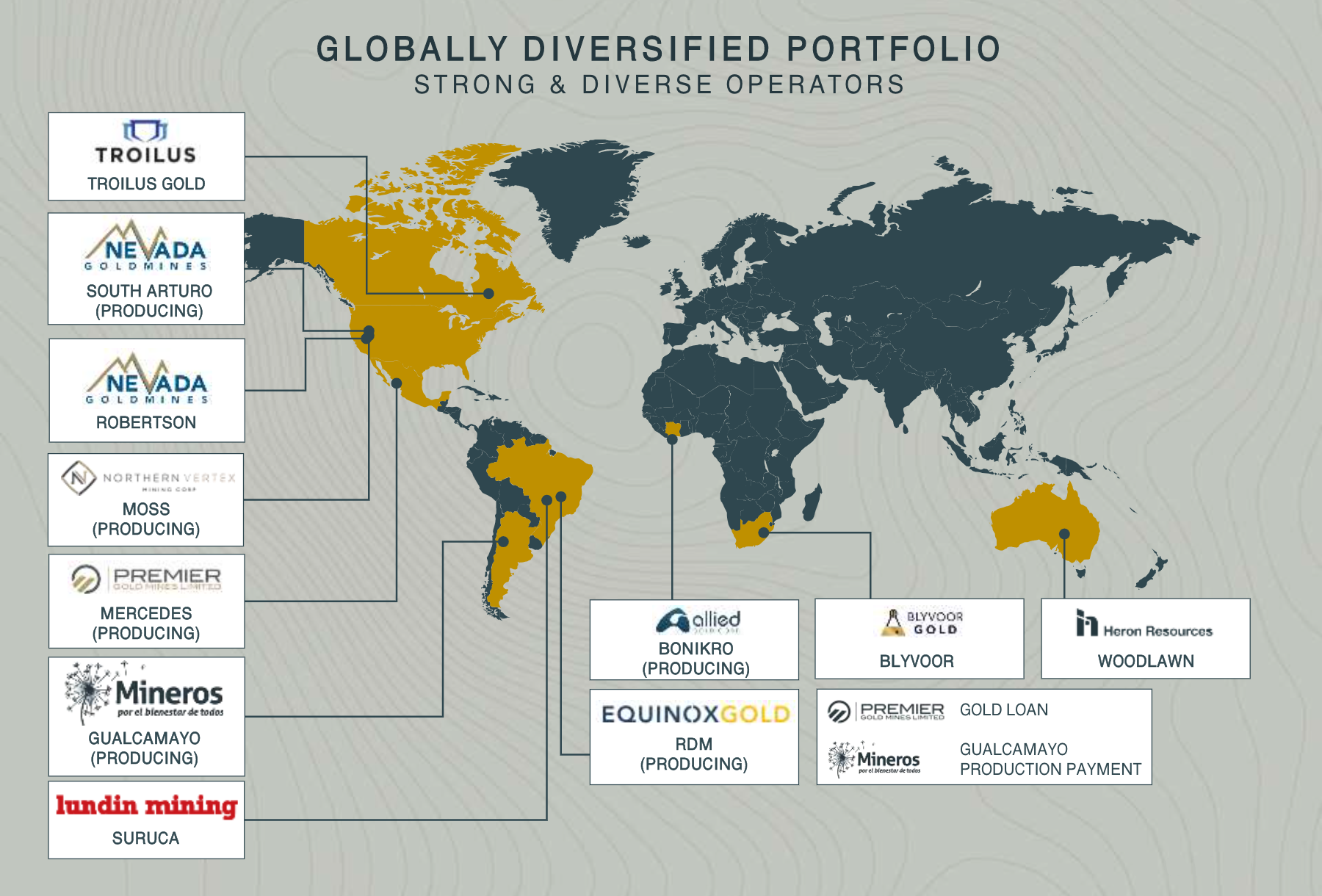

The current portfolio — one that will grow rapidly in 2021— consists of six producing gold and silver streams. With another two scheduled to come online in 2021. And three others in development.

Around 77% of Nomad’s revenue is generated from gold royalties with the other 23% coming from silver.

Recent financials show a cash operating margin of 86%.

Geographically, revenue was sourced 48% from the Americas, 50% from Africa and 2% from Australia.

The revenue stream includes the recently acquired gold-silver royalty on the Robertson gold project which is part of the Cortez and Pipeline mine complex in Nevada.

The royalty from the top gold mining operator in the world, Nevada Gold Mines — a joint venture of Barrick and Newmont — has an inferred resource of 2.7 million gold ounces.

The acquisition fits with the Nomad model, which if the company executes as is anticipated will lead to a significant re-rating in share price.

Nomad is already paying a 1.8% dividend. The peer average is 0.67%.

The company boasts a 17.8X cash flow while better-known peers and staples in the royalty sector like Franco Nevada enjoy a multiple of 28.1X.

Ditto for share price relative to net asset value — where Nomad has a 1.0X multiple while the peer average is 1.76X.

All those metrics show significant value using today’s cash flow and metals prices.

I, of course, expect the company to aggressively add to its portfolio.

And I expect new all-time high gold prices in 2021.

Shares of Nomad Royalty Company are undervalued using today’s metrics.

If I’m right about the growth and the increase in precious metals prices... it won’t be long before the market catches on and drives shares many multiples higher. .

Beat them to it.

Become the royalty of gold today.

Nomad Royalty Company (TSX: NSR)(OTC: NSRXF) is a strong buy up to C$1.10/US$0.93.