Mike Fagan's Precious Portfolio: Special Alert No. 19: Tier-3 Update

Alert No. 19

June 8, 2021

Special Alert: Tier-3 Update

Dear Precious Portfolio subscriber,

In today’s alert, we’ll be taking a closer look at American Pacific Mining from Tier-3 (Juniors).

With copper and gold prices both in solid uptrends thus far in 2021, excitement is brewing with the commencement of drilling at American Pacific’s wholly-owned Madison Copper-Gold Project in Montana.

Tier-3: American Pacific Mining: (CSE: USGD)(OTC: USGDF)

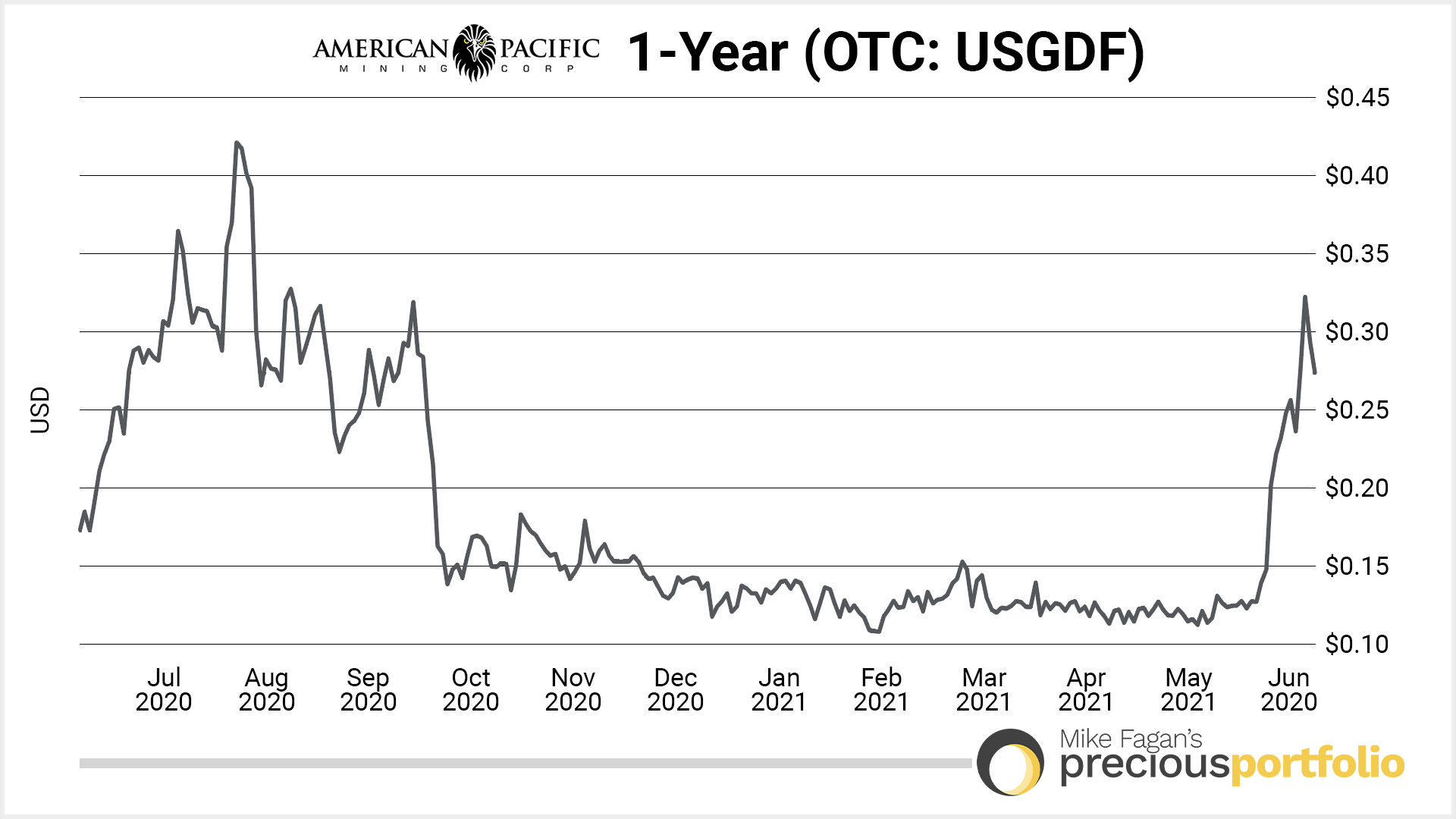

We began our active coverage of American Pacific Mining — which is advancing the Madison Copper-Gold Project in Montana via a joint venture with Rio Tinto/Kennecott — in February of this year with a buy-up-to price of US$0.15 per share.

The drills are now turning on a 4,000-meter diamond drilling program at Madison and average daily trading volume has increased.

With that timing, USGDF shares more than doubled from US$0.12 per share on May 20th to an interim high of US$0.32 per share on June 6th and have since pulled back slightly to around US$0.26 per share — which is approximately 73% above our original buy-up-to price.

Drilling at the Madison Copper-Gold Project

American Pacific’s wholly-owned Madison Project is currently under an earn-in agreement (with an option to JV) whereby Kennecott Exploration Company — part of the Rio Tinto Group — may spend US$30 million to earn up to 70% in the project.

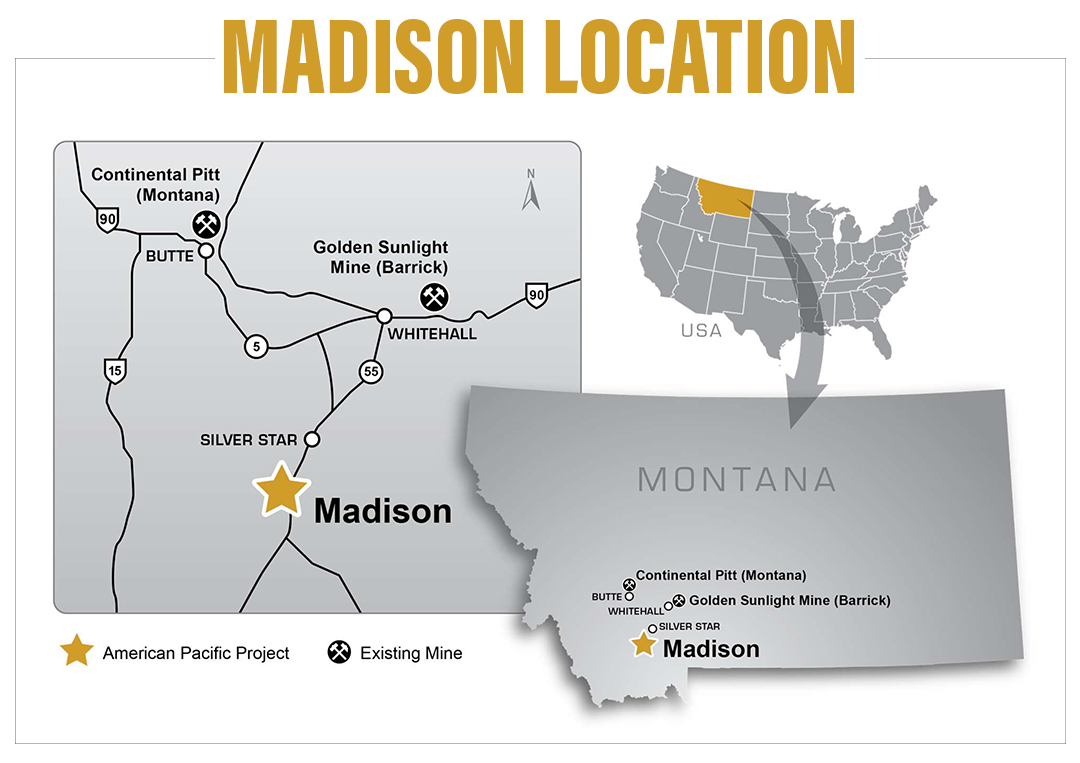

The project is located in the heart of Montana’s prolific copper-gold belt only 38km southeast of the world-renowned Butte Mining District. Recent interpretations have identified multiple priority target areas believed to be associated with large-scale porphyry mineralization at-depth and located within a well-mineralized, two-mile-long geological trend.

The JV has permits in-hand to drill up to 31 core holes and 50 RC holes as the program seeks to extend Madison’s five known jasperoid zones and its three massive sulphide zones. Additionally, the drilling will attempt to extend the project’s skarn mineralization.

American Pacific president, Eric Saderholm, commented, “American Pacific is pleased to announce the 2021 exploration program at the Madison Project has entered the drilling phase with the arrival and set-up of the first core drill rig. This is the third year of exploration on the property by Rio Tinto/Kennecott Exploration. Numerous targets are planned to be drill-tested based on many factors including geophysical surveys, the success of historic drilling, mapping, modeling and newly encountered surface geologic interpretations and expressions. This will be a dynamic exploration season at Madison.”

Rock sample from Madison Copper-Gold Project — Montana, USA

Those who currently own American Pacific Mining — which, again, has moved up from our original buy-up-to price of US$0.15 per share to currently around US$0.26 per share — may want to consider taking partial gains off-the-table at current price levels to lock in some profits.

With a deep-pocketed partner in Kennecott spending up to US$30 million to probe Madison’s district-scale copper-gold potential in a strong market for both metals, American Pacific remains a compelling bet on discovery and resource growth by way of the drill in 2021.

And for that reason, I am continuing to hold as the drills get underway at Madison.

You can access our original American Pacific Mining write-up here.

Recommended action: Hold open American Pacific Mining positions.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio

Mike Fagan has mining in his blood. As a teenager he staked countless gold and silver properties in Nevada alongside his dad Brian Fagan, who created the Prospect Generator model that’s still widely used today in the resource space. One of those staking projects was put into production by a major Canadian mining company — a truly rare and profitable experience. That background uniquely qualifies him as a mining stock speculator. One of the most well-known names in the business, Mike is now putting that experience to use for the benefit of Resource Stock Digest, Hard Asset Digest, and Mike Fagan's Precious Portfolio readers.

Previous Alerts

Alert No. 1 | Alert No. 2 | Alert No. 3 | Alert No. 4 | Alert No. 5 | Alert No. 6 | Alert No. 7 | Alert No. 8 | Alert No. 9 | Alert No. 10 | Alert No. 11 | Alert No. 12 | Alert No. 13 | Alert No. 14 | Alert No. 15 | Alert No. 16 | Alert No. 17 | Alert No. 18