Mike Fagan's Precious Portfolio: Special Alert No. 18: Tier-3 Update

Alert No. 18

May 25, 2021

Special Alert: Tier-3 Update

Dear Precious Portfolio subscriber,

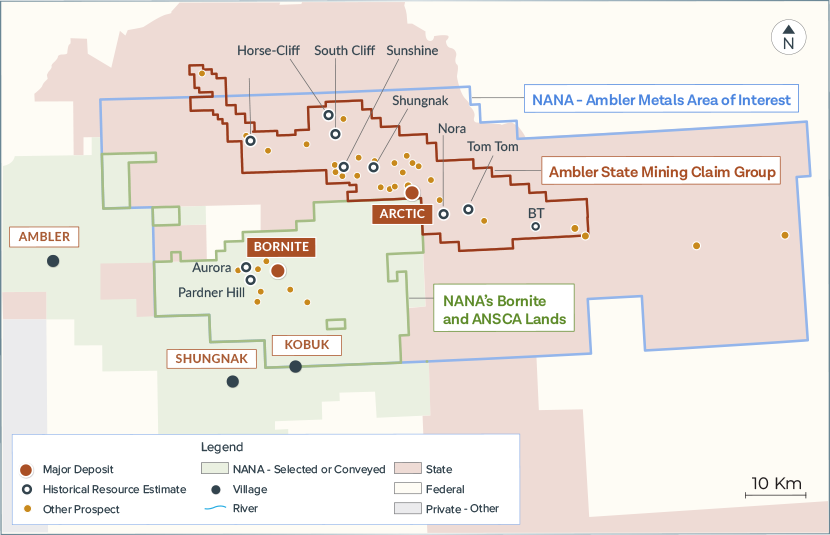

In today’s alert, we’ll be taking a closer look at Trilogy Metals from Tier-3 (Juniors) which has been a top-performer so far this year. The company has released details of its upcoming field season at the Arctic Deposit — one of the highest-grade copper deposits in the world with an average grade of 5% copper equivalent.

Drilling is expected to commence early next month and will focus on both Volcanogenic Massive Sulphide (VMS) and Carbonate-Hosted Copper (CHC) targets as identified by recently-completed airborne geophysics.

Tier-3: Trilogy Metals: (NYSE-A: TMQ)(TSX: TMQ)

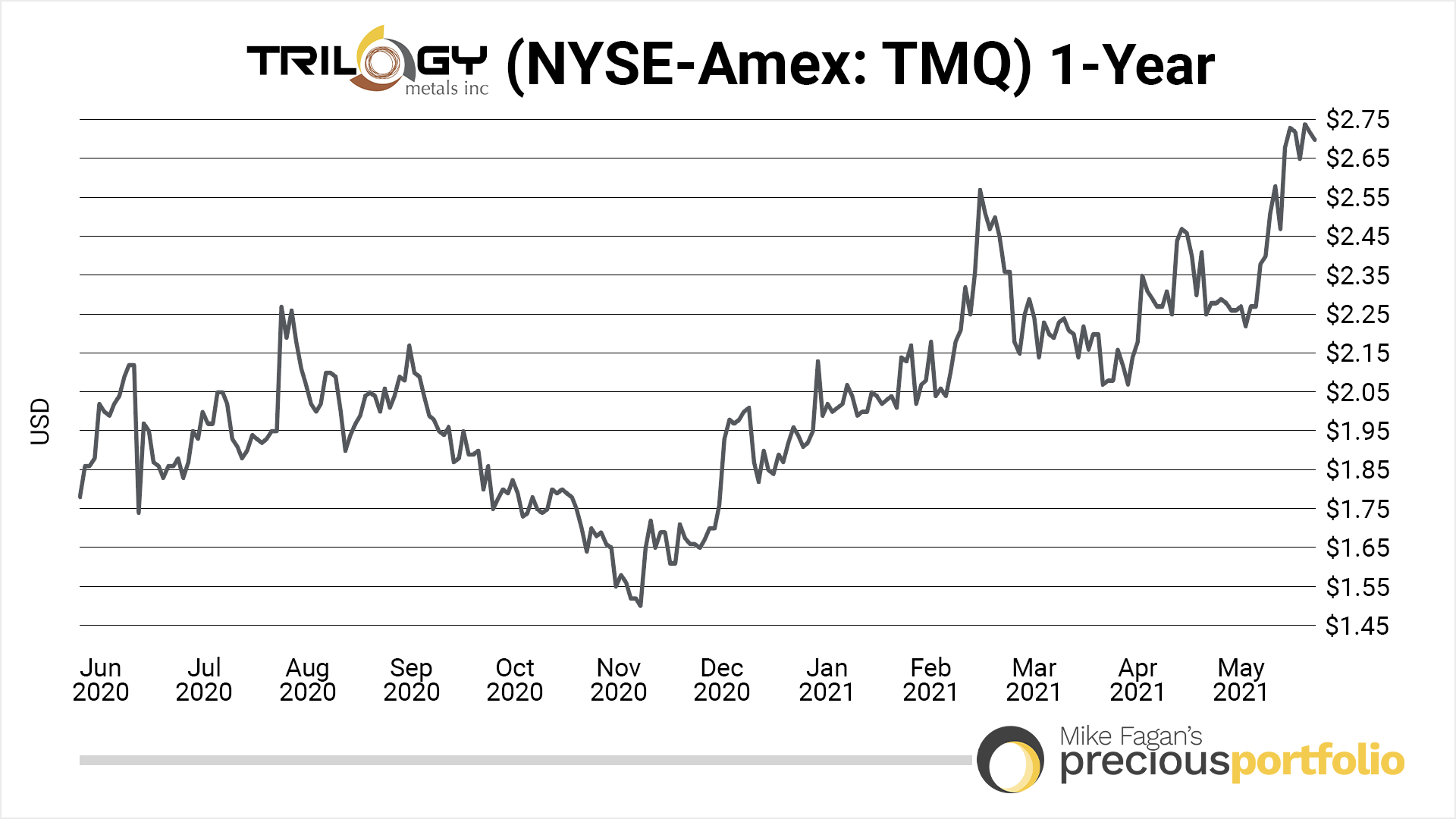

We began our active coverage of Trilogy Metals — which is advancing the feasibility-stage Arctic copper-dominant deposit with South32 in the Ambler Mining District of Alaska — in October of last year with a buy-up-to price of US$1.70 per share.

TMQ is currently trading at approximately US$2.65 per share, or 55% above our original buy-up-to price.

Exploration efforts to-date have focused on the Arctic VMS deposit and the Bornite CHC deposit. Both deposits are located within a large land package spanning approximately 426,000 acres (665 sq mi) in northwestern Alaska.

The 2021 field program (~US$27 million) — slated for approximately 14,600 meters of diamond drilling (2 to 3 rigs) starting in early-June — will focus on the Arctic VMS deposit and is being fully funded by Ambler Metals.

Primary objectives include:

- Priority 1 – The Arctic Project. This will entail additional infill drilling to further improve the confidence of the mineral resources. In addition, there will be further metallurgical and targeted drilling to allow the partners to further de-risk the Arctic Project;

-

Priority 2A – Near Arctic (Arctic Hub) exploration with the goal of discovering nearby copper-rich satellite deposits within a 3-5 km radius of the Arctic deposit; and

-

Priority 2B – District exploration for both VMS deposits in the Ambler Belt and CHC deposits in the Cosmos Hills and the Ambler Lowlands.

Trilogy CEO, Tony Giardini, commented, “I am extremely excited given that we will soon be opening camp with the expectation that we will commence drilling by early June, with the first assay results expected to be available in the fall. The proposed exploration program will be one of the biggest programs in the history of the Ambler Mining District and we have expectations that this program will eventually add to our mineral inventory within this emerging world-class mining district. While we will not be drilling at the Bornite Project this year, we believe in the potential of this project and plan to resume drilling there soon.”

The Trilogy / South32 joint venture is seeking to develop Alaska’s Ambler Mining District into a premier North American copper producer.

Already, Trilogy’s 2020 Feasibility Study for the Arctic project outlines the potential technical and economic viability of establishing a conventional open-pit copper-zinc-lead-silver-gold mine and mill complex for a 10,000 tonne per day operation.

The project comes in at a base case Pre-tax NPV (8% discount rate) of approximately US$1.5 billion and an IRR of 30.8% based on a 12-year mine life and estimated payback period of 3 years.

Average annual payable production is projected to be more than 155 million pounds of copper, 192 million pounds of zinc, 32 million pounds of lead, 32,000 ounces of gold, and 3.4 million ounces of silver for LOM (Life of Mine).

There’s potential to extend the Arctic deposit’s projected mine life from 12 to 20 years. And to that end, part of the drilling focus will be on converting a portion of the Arctic resources from the indicated category to the measured category.

From a stock speculation standpoint, Trilogy is setting up nicely for a steady stream of news flow over the next several months, which will include assay results from multiple high-priority targets.

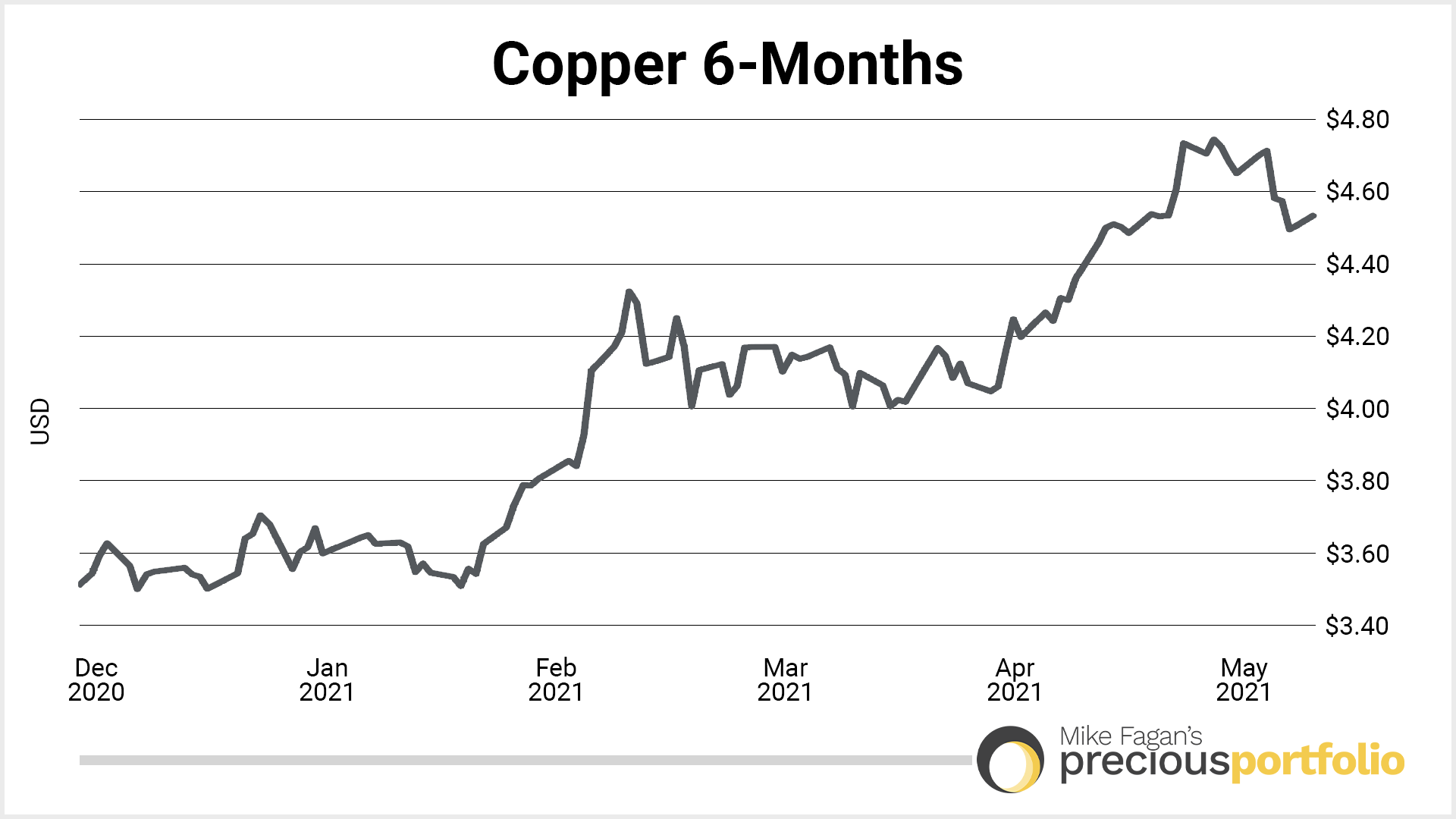

And copper’s strength — currently trading north of US$4.50 per pound for the first time in over a decade — is yet another positive component.

Those who currently own Trilogy Metals — which, again, has moved up from our original buy-up-to price of US$1.70 per share to currently around US$2.65 per share — may want to consider taking partial gains off-the-table at current price levels to lock in some profits.

Remember, the drills are the ultimate truth-machine meaning there’s always a bit of mystery as to what gifts Mother Nature will ultimately yield.

I’m currently holding for what’s shaping up to be a very exciting 2021 field program with the potential for significant resource expansion and new discoveries.

In that respect, Trilogy is quite representative of the junior resource sector as a whole. Always understand that the juniors — because they are typically still in that “proving stage” prior to actual metals production and revenue generation — generally carry a higher risk factor than the mid-tiers and majors.

Yet, the juniors — because of the excitement they can oftentimes generate in making new discoveries through drilling — also offer the highest potential reward and can quickly elevate to prime takeover status when Mother Nature does indeed prove generous.

It’ll be exciting to see what the truth-machines reveal at the Arctic Deposit with 14,600 meters of drilling planned for this summer’s program, and it certainly won’t hurt having copper at decade highs above US$4.50 per pound.

Our original write-up on Trilogy Metals is available here.

Recommended action: Hold open Trilogy Metals positions.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio

Mike Fagan has mining in his blood. As a teenager he staked countless gold and silver properties in Nevada alongside his dad Brian Fagan, who created the Prospect Generator model that’s still widely used today in the resource space. One of those staking projects was put into production by a major Canadian mining company — a truly rare and profitable experience. That background uniquely qualifies him as a mining stock speculator. One of the most well-known names in the business, Mike is now putting that experience to use for the benefit of Resource Stock Digest, Hard Asset Digest, and Mike Fagan's Precious Portfolio readers.

Previous Alerts

Alert No. 1 | Alert No. 2 | Alert No. 3 | Alert No. 4 | Alert No. 5 | Alert No. 6 | Alert No. 7 | Alert No. 8 | Alert No. 9 | Alert No. 10 | Alert No. 11 | Alert No. 12 | Alert No. 13 | Alert No. 14 | Alert No. 15 | Alert No. 16 | Alert No. 17