Mike Fagan's Precious Portfolio: Special Alert No. 17: Tier-3 Portfolio Update

Alert No. 17

May 11, 2021

Special Alert: Tier-3 Portfolio Update

Dear Precious Portfolio subscriber,

In today’s alert, I’ll be providing a brief portfolio update on our Tier-3 (Juniors) positions.

- Trilogy Metals: (NYSE-A: TMQ)(TSX: TMQ) → HOLD

-

Bluestone Resources: (TSX-V: BSR)(OTC: BBSRF) → BUY

-

Clean Air Metals: (TSX-V: AIR)(OTC: CLRMF) → HOLD

-

Vox Royalty: (TSX-V: VOX)(OTC: VOXCF) → HOLD

-

Chakana Copper: (TSX-V: PERU)(OTC: CHKKF) → BUY

-

Loncor Resources: (TSX: LN)(OTC: LONCF) → HOLD

-

American Pacific Mining: (CSE: USGD)(OTC: USGDF) → BUY

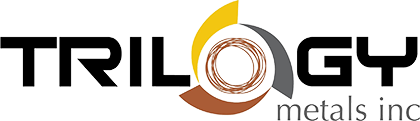

Tier-3: Trilogy Metals: (NYSE-A: TMQ)(TSX: TMQ)

We began our active coverage of Trilogy Metals — which is advancing the feasibility-stage Arctic copper-dominant deposit with South32 in the Ambler Mining District of Alaska — in October of last year with a buy-up-to price of US$1.70 per share.

TMQ is currently trading at approximately US$2.49 per share, or 46% above our original buy-up-to price.

While the stock has performed reasonably well of late, Trilogy’s ability to outperform the copper market going forward will hinge on news flow, which is expected to ramp up significantly as compared to its COVID-impacted 2020 field season.

The company will be issuing an update on this year’s US$27 million field season, and I expect the drills (2-3 rigs) to be turning before July 2021. Drilling will initially focus on upgrading and de-risking the Arctic deposit, which hosts 43 million tonnes grading 2.24% copper with lead, silver, and gold credits.

The company’s joint venture partner, South32, is funding the program and is keen on extending the Arctic deposit’s mine life from 12 to 20 years wherein it will begin testing the exploration upside of the northwest-trending Ambler Mining Belt which hosts several VMS prospects.

Recently, the Alaska Industrial Development and Export Authority (AIDEA) confirmed a US$13 million budget — to be funded by AIDEA (US$6.5 million) and Ambler Metals (US$6.5 million) — to build the much-anticipated 211-mile-long Ambler Access Road from the Dalton Highway to the Ambler Mining District.

AIDEA also signed a land access agreement with Doyon — a Native corporation and one of the largest private landholders in Alaska — to conduct feasibility and permitting activities to advance the construction. The purpose of the road is to allow the development of mining projects in the Ambler District by providing them access to markets.

With drilling scheduled to commence in a couple of months, and with copper trading at 10-year highs above US$4.50 per pound, there’s still plenty of upside potential here and we’ll continue to hold.

Our original write-up on Trilogy Metals is available here.

Recommended action: Hold open Trilogy Metals positions.

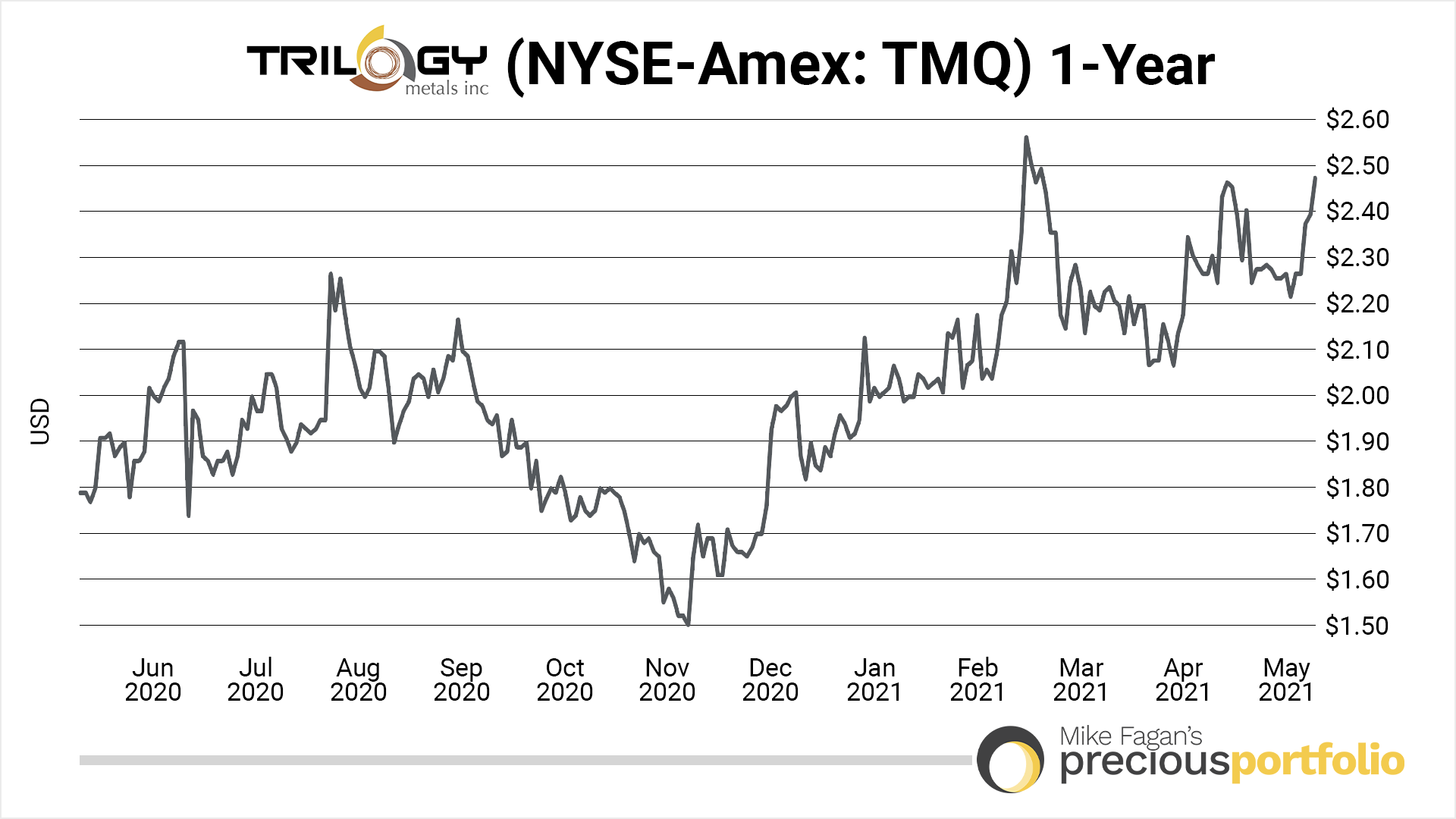

Tier-3: Bluestone Resources: (TSX-V: BSR)(OTC: BBSRF)

We commenced active coverage on Bluestone Resources — which is advancing the Cerro Blanco Gold-Silver Project in southeastern Guatemala — in October of last year with a buy-up-to price of US$1.55 per share.

BBSRF is currently trading at approximately US$1.38 per share, or 11% below our original buy-up-to price.

The company’s change of plan from an underground to an open-pit scenario at Cerro Blanco has been supported by recent drill results including 11.6 g/t gold and 11.7 g/t silver over 28.6 meters from the South zone.

Earlier results from the South zone returned intersections of up to 127 meters grading 3.5 g/t gold from a disseminated gold halo surrounding the veins or high-grade veins cutting through the Salinas unit driving the grade.

CEO, Jack Lundin, commented: "As anticipated, the South zone continues to yield plus-100-metre intervals at over two g/t gold near surface. Combined with the impressive widths of high-grade vein mineralization deeper in the deposit, these unique attributes to Cerro Blanco create an asset capable of producing over 300,000 ounces Au per year. The drill results will be incorporated into an updated resource estimate that will form the basis of our ongoing feasibility study, which is progressing on schedule."

I’m continuing to hold Bluestone as the Cerro Blanco project’s economics are compelling, and the authors of the technical study are highly competent. In addition, the Lundin Group’s success with permitting, financing, and development of the Fruta del Norte gold mine in Ecuador is also a benefit.

If you don’t currently own Bluestone, now is the time to accumulate up to our original buy-up-to price of US$1.55 per share.

You can access our original write-up on Bluestone here.

Recommended action: Bluestone Resources remains a Buy up to US$1.55 per share.

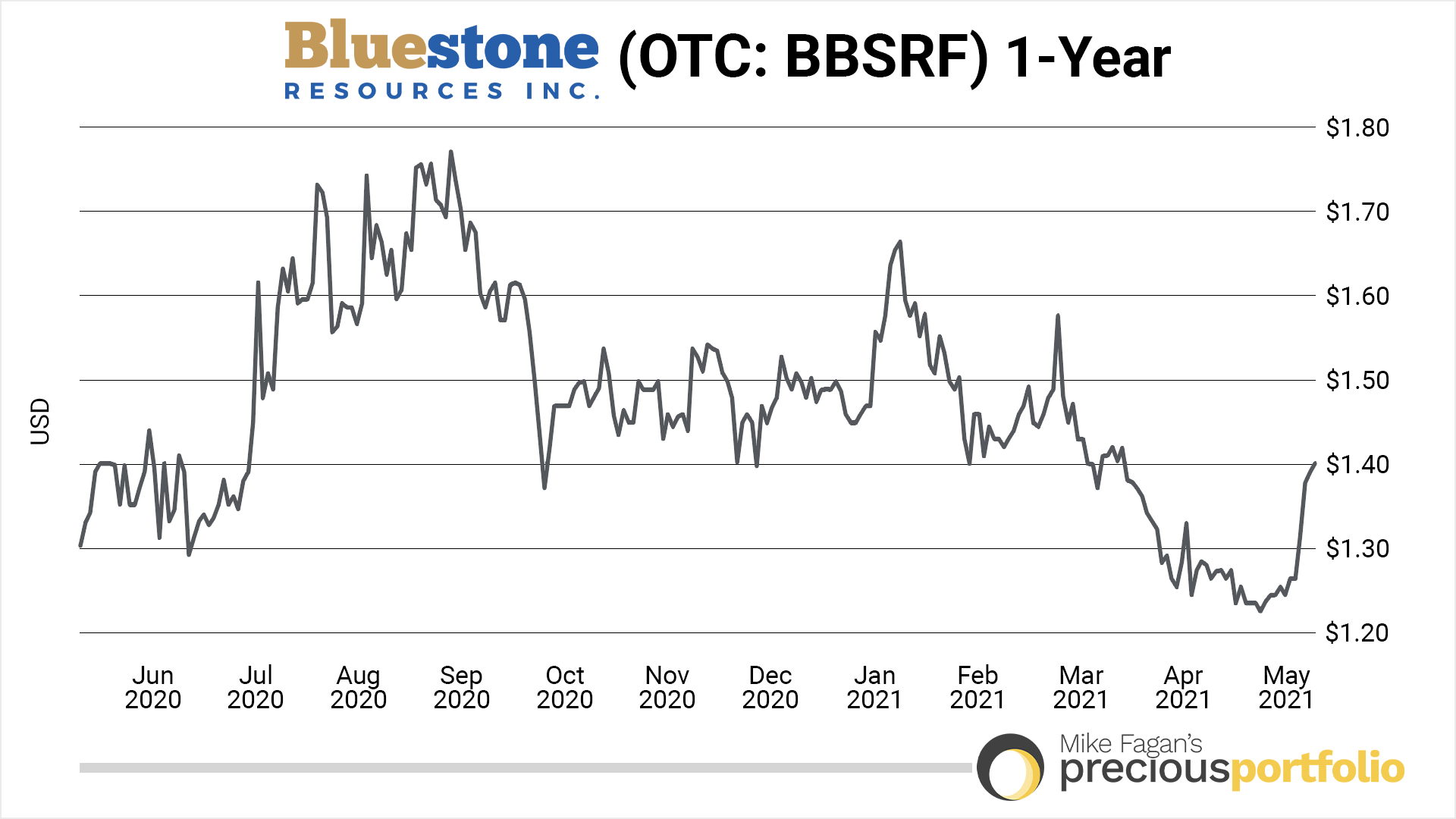

Tier-3: Clean Air Metals: (TSX-V: AIR)(OTC: CLRMF)

We began active coverage of Clean Air Metals — which is advancing the flagship Thunder Bay North PGM (Platinum Group Metals) project located in Ontario, Canada — in November of last year with a buy-up-to price of US$0.24 per share.

CLRMF is currently trading at approximately US$0.30 per share, or 25% above our original buy-up-to price.

Clean Air continues to generate solid results from its 30,000-meter drill program (C$6.6 million) designed to increase the Escape Lake deposit’s tonnage.

Recent results include thin intervals (<1.0 meters) grading up to 20 g/t platinum + palladium (Pt+Pd) with over 7% copper + nickel (Cu+Ni) from a downhole depth of over 340 meters. The thicker intervals (up to 23 meters) returned lower PGM (1.65 g/t Pt+Pd) and base metal (0.57% Cu+Ni) grades from similar downhole depths (330 meters).

Previous results were more encouraging with thick intervals of mineralization (20 to 35 meters) grading up to 2.2 g/t palladium, 1.6 g/t platinum, and higher grade nickel (up to 0.4%) and copper (up to 0.8%) from downhole depths of 200 to 379 meters.

The company has added a third drill rig after increasing its meterage allocation (+15,000 meters) to test six high-priority targets generated by a property-wide geophysical survey.

CEO, Abraham Drost, commented: “The company confirms the high-level similarities of the magma conduit chonolith system and structural and stratigraphic controls on mineralization at Thunder Bay North with the Talnakh complex, one of the world's foremost nickel-copper-PGM mining camps. Based on the recent resource update and discovery of massive sulphides in the Escape Lake deposit with favourable metal ratios and the recent completion of a structural analysis and MT geophysical surveys, we are committing to a substantial ramp-up of our drilling exploration efforts on multiple bull's-eye ultra-low resistivity targets at the base of both the Escape Lake and Current Lake magma conduit deposit systems.”

I’m continuing to hold Clean Air Metals for the results of the systematic testing it is carrying out at Escape Lake and the upgrading of Current Lake’s Inferred resource to the Indicated category (10,000 meters, C$2.2 million).

You can access our original Clean Air Metals write-up here.

Recommended action: Hold open Clean Air Metals positions.

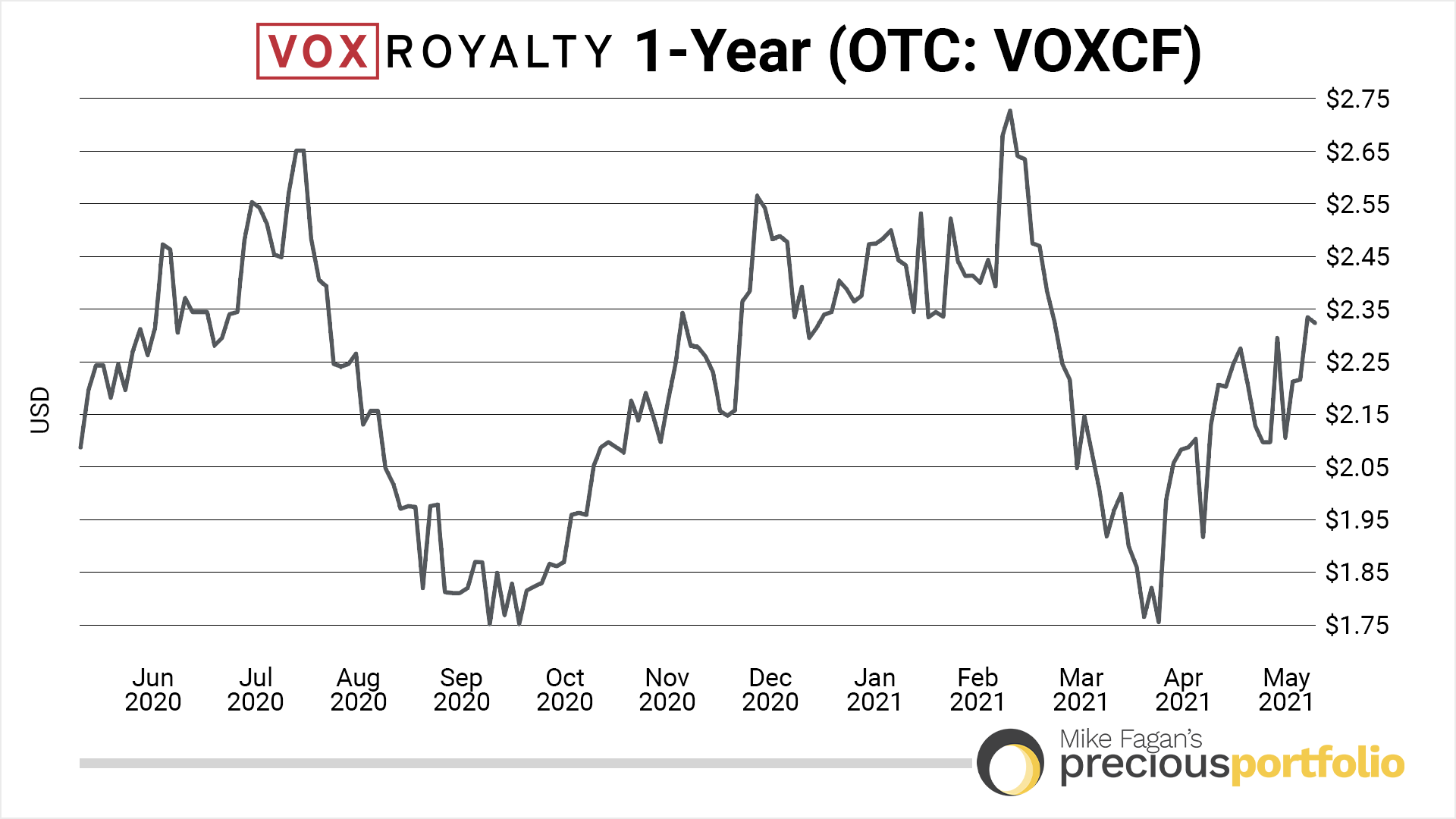

Tier-3: Vox Royalty: (TSX-V: VOX)(OTC: VOXCF)

We commenced active coverage of Vox Royalty — a newly-listed, small-cap precious metals royalty and streaming company — in January of this year with a buy-up-to price of US$2.30 per share.

VOXCF is currently trading at approximately US$2.33 per share, or slightly above our original buy-up-to price.

Vox reported record revenues in Q1 of C$668,600 — all derived from royalties — and expects seven of its royalties to be revenue generating by the end of the current calendar year.

Some of these royalties are small; nevertheless, we should see Vox’s top-line revenue surpass C$2 million this year based on management’s estimates with further growth next year from its current portfolio of royalties.

Vox CEO, Kyle Floyd, stated: “Record quarterly revenue for Q1 represents the start of Vox's anticipated revenue growth through 2023 as numerous royalty assets are expected to commence production. The Company's preliminary quarterly revenue is in line with previously announced 2021 full-year revenue guidance of C$1.7M to C$2.5M. Vox's organic revenue growth is a product of the Company's stated strategy of acquiring high quality, attractively priced royalties many of which are near term production opportunities. Vox held one producing royalty in May 2020 and anticipates finishing 2021 with seven producing assets based on its current portfolio of 50 royalties.”

Junior royalty firms, as a group, have been a bit flat the last few months as the sheer number of them has grown, which is increasing competition between them for a limited universe of potential royalty acquisitions.

Yet, I fully expect Vox to differentiate itself from some of the other players by way of its large portfolio of gold royalty holdings in western Australia, its aggressive acquisition approach, and its impressive marketing strategy.

For those reasons, Vox Royalty continues to be rated as a hold.

You can access our special report on the royalty and prospect generator models featuring Vox Royalty here.

And our original write-up on Vox Royalty is available here.

Recommended action: Hold open Vox Royalty positions.

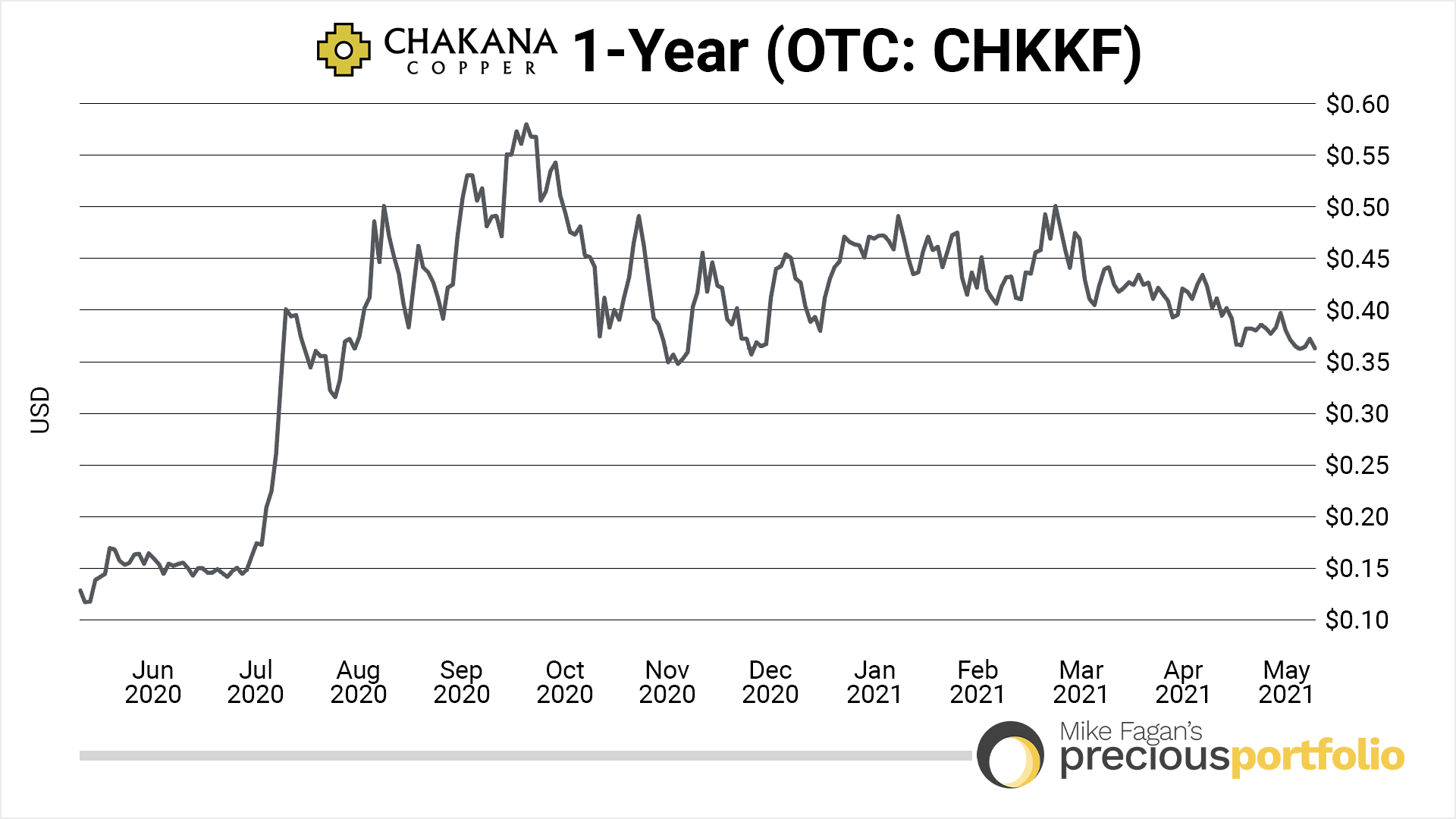

Tier-3: Chakana Copper: (TSX-V: PERU)(OTC: CHKKF)

We began our active coverage of Chakana Copper — which is advancing the flagship Soledad copper-gold-silver project in Peru — in January of this year with a buy-up-to price of US$0.47 per share.

CHKKF is currently trading at approximately US$0.36 per share, or 23% below our original buy-up-to price.

Chakana recently announced drill results from Soledad comprising 8 holes at the Huancarama target totaling 1,500 meters and 5 holes from the Paloma East target totaling 1,450 meters.

Highlights include:

- 0.63 g/t gold, 0.54% copper, and 55.7 g/t silver (or 1.43% copper equivalent “CuEq”) over 125 meters; including

-

2.29 g/t gold, 1.27% copper, and 248 g/t silver (or 4.89% CuEq) over 15 meters at Huancarama; and

-

0.42 g/t gold, 0.33% copper, and 11.7 g/t silver (or 0.70% CuEq) over 164 meters at Paloma East.

CEO, David Kelley, commented, “It is great to see these strong results from both new exploration drilling and definition drilling. At Huancarama East, we are clearly defining a sizable zone of copper-gold-silver mineralization that should feature prominently in our resource estimation plans. At Huancarama West, the exploration drilling continues to define shapes and continuity, while Paloma East has impressive significant near-surface mineralization and long runs of mineralization, including 163.9m of 0.42 g/t Au, 0.33% Cu, and 11.7 g/t Ag from surface in tourmaline breccia that is open at depth. The drill program continues to run smoothly with effective COVID protocols in place.”

The Soledad project consists of high-grade gold-copper-silver mineralization hosted in tourmaline breccia pipes; a total of 45,061 metres of drilling has been completed to-date testing 10 of 23 confirmed pipes.

The most recent batch of results is part of the company’s fully funded 2021 drill program of 26,000 meters (2 rigs), which will be integral to the company’s forthcoming maiden resource slated for release later this year.

Based on the current strength in copper and the company’s commitment to building an economically viable resource at Soledad, Chakana Copper holds robust potential upside from current price levels.

Continue to accumulate up to our original buy-up-to price of US$0.47 per share.

You can access my colleague Gerardo Del Real’s recent interview with Chakana CEO David Kelley here.

And my original write-up on Chakana Copper is available here.

Recommended action: Chakana Copper remains a Buy up to US$0.47 per share.

Tier-3: Loncor Resources: (TSX: LN)(OTC: LONCF)

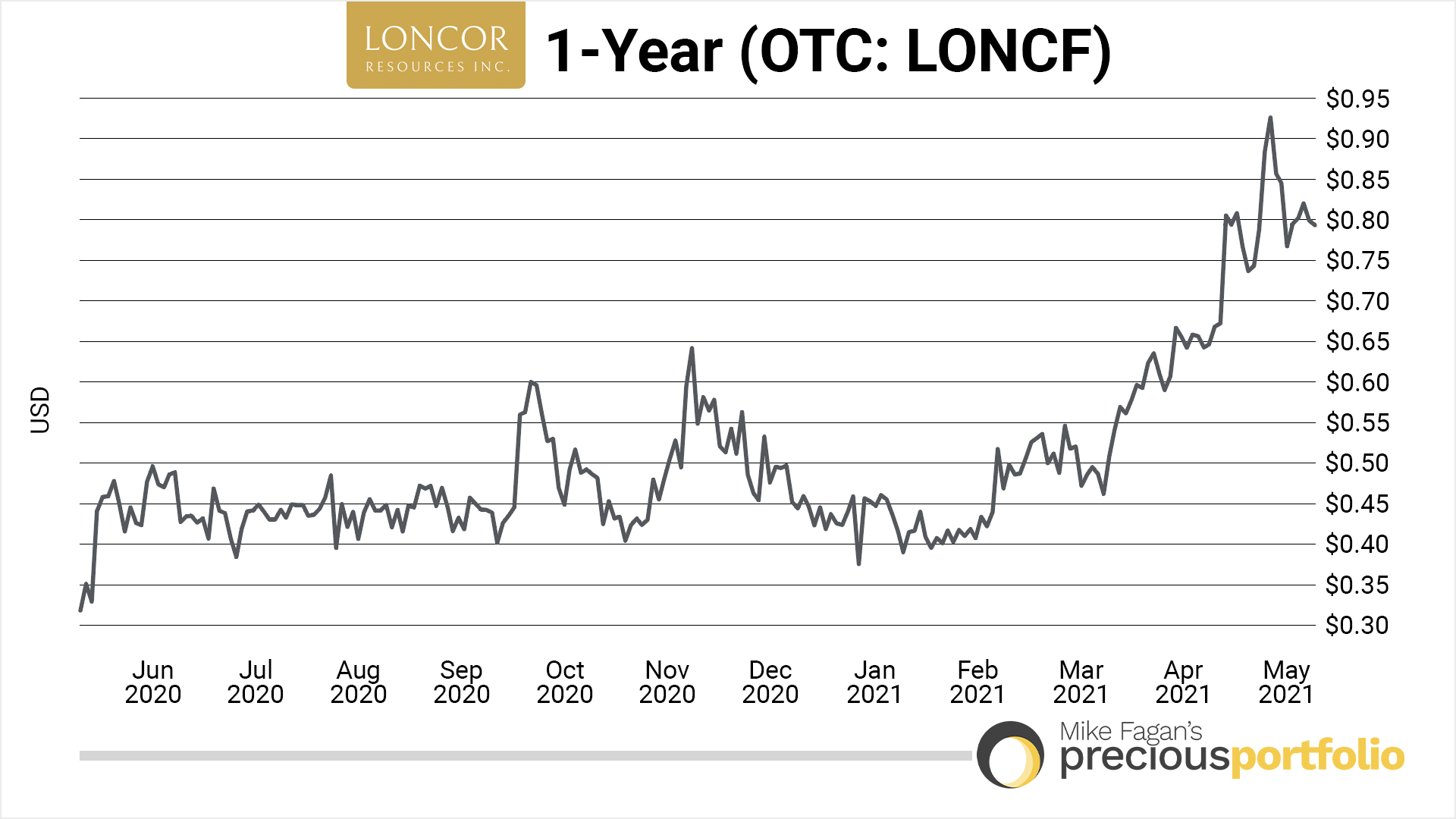

We commenced active coverage of Loncor Resources — which is focused on gold projects within the emerging Ngayu Greenstone Belt in the Democratic Republic of the Congo — in February of this year with a buy-up-to price of US$0.45 per share.

LONCF is currently trading at approximately US$0.79 per share, or 75% above our original buy-up-to price.

The primary reason for our Loncor recommendation was the company’s established resource of 2.19 million ounces grading 2.35 g/t gold at the Adumbi deposit in its ~85%-owned Imbo project plus upside potential.

Loncor’s recently announced 44% increase (+960,000 oz) to 3.15 million ounces with little change in the grade (2.37 vs. 2.35 g/t Au) is a very positive development. The company is continuing to drill at Adumbi with assay results expected over the coming weeks.

Loncor also plans to deliver a PEA of the entire Imbo project — including Adumbi and two satellite deposits (Kitenge and Mazanko) located about 4 kilometers away — though additional drilling may be needed on these targets to increase their current resources.

Loncor president, Peter Cowley, commented: “This major increase in mineral resources within a $1,500 (U.S.) pit shell to 3.15 million ounces of gold is an important milestone in demonstrating the potential economic viability of the Adumbi deposit. Sensitivities show this mineral resource within the pit shell is robust and not markedly sensitive to changes in the gold price. Gold mineralization is open at depth below the pit shell where drilling is continuing with the objective of outlining underground resources. Drilling at Adumbi also demonstrates that grade is increasing at depth, which bodes well for a significant underground resource to be outlined. Going forward, once drilling has been completed in Q2 2021, we will embark on a preliminary economic assessment (PEA) to determine the potential economic viability of Adumbi.”

These positive developments, plus the active JV with Barrick Gold, are the reasons why the stock is up and why we’re continuing to hold.

Our original Loncor write-up is available here.

Recommended action: Hold open Loncor Resources positions.

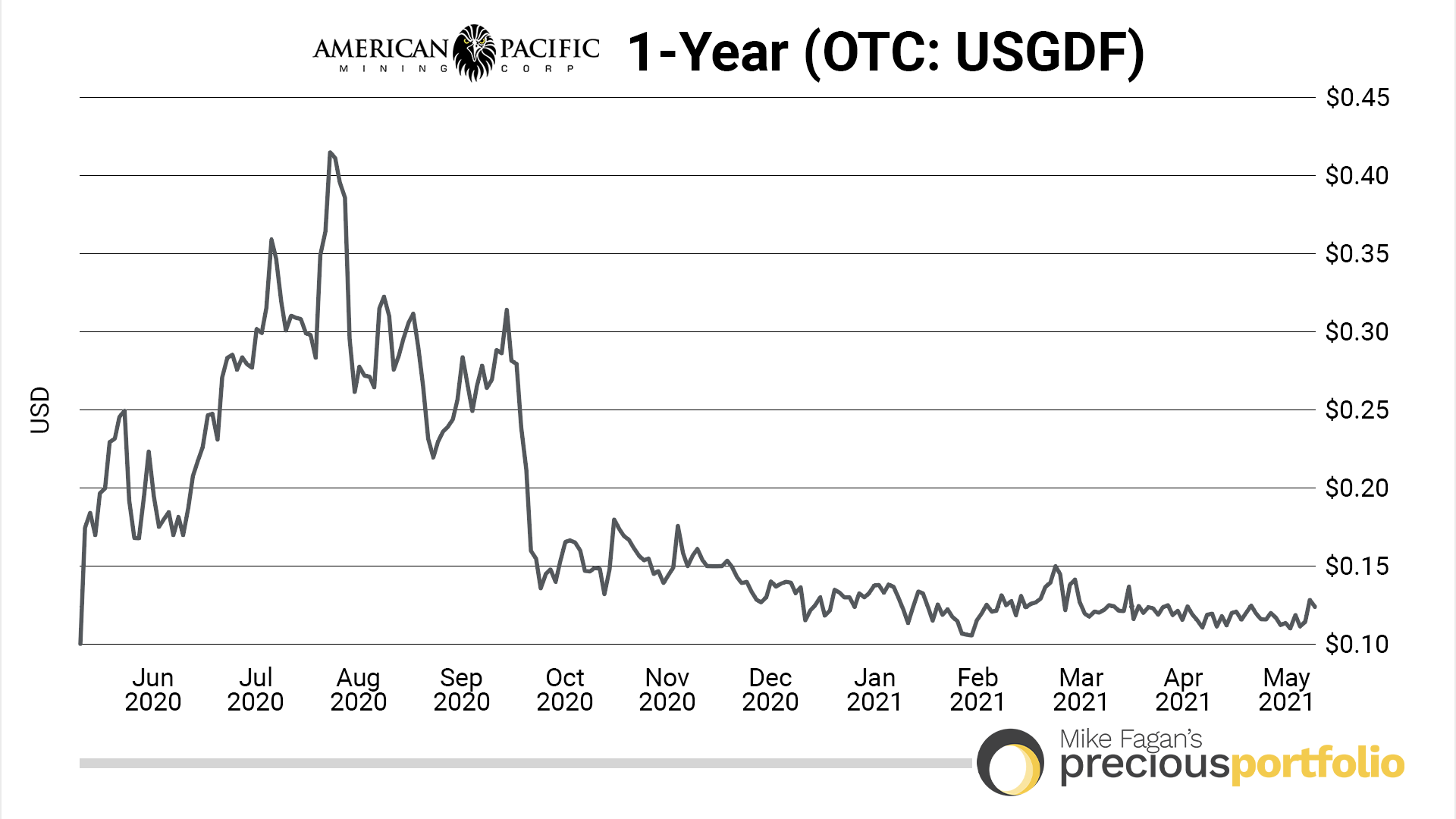

Tier-3: American Pacific Mining: (CSE: USGD)(OTC: USGDF)

We began our active coverage of American Pacific Mining — which is advancing the Madison Copper-Gold Project in Montana via a joint venture with Rio Tinto/Kennecott — in February of this year with a buy-up-to price of US$0.15 per share.

USGDF is currently trading at approximately US$0.12 per share, or 20% below our original buy-up-to price.

American Pacific has laid out its 2021 joint exploration program with Kennecott for the Madison project. The program will include both diamond and RC drilling along with rock and soil sampling and a MAG survey.

The JV has permits in hand to drill up to 31 core holes and 50 RC holes as the program seeks to extend Madison’s five known jasperoid zones and its three massive sulphide zones. Additionally, the drilling will attempt to extend the project’s skarn mineralization.

American Pacific president, Eric Saderholm, commented, “American Pacific is looking forward to the extensive and multi-faceted 2021 exploration program at Madison. We anticipate further definition and extension of the skarn, jasperoid and massive sulphide mineralization from the drilling program. Road construction and detailed mapping should expose hidden mineralization and additional geophysical work will further refine target generation.”

With a deep-pocketed JV partner in Kennecott (a division of Rio Tinto) helping to probe Madison’s district-scale potential, American Pacific remains a compelling bet on discovery and resource growth here in 2021.

Continue to accumulate up to our original buy-up-to price of US$0.15 per share.

You can access our original American Pacific Mining write-up here.

Recommended action: American Pacific Mining remains a Buy up to US$0.15 per share.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio

Mike Fagan has mining in his blood. As a teenager he staked countless gold and silver properties in Nevada alongside his dad Brian Fagan, who created the Prospect Generator model that’s still widely used today in the resource space. One of those staking projects was put into production by a major Canadian mining company — a truly rare and profitable experience. That background uniquely qualifies him as a mining stock speculator. One of the most well-known names in the business, Mike is now putting that experience to use for the benefit of Resource Stock Digest, Hard Asset Digest, and Mike Fagan's Precious Portfolio readers.

Previous Alerts

Alert No. 1 | Alert No. 2 | Alert No. 3 | Alert No. 4 | Alert No. 5 | Alert No. 6 | Alert No. 7 | Alert No. 8 | Alert No. 9 | Alert No. 10 | Alert No. 11 | Alert No. 12 | Alert No. 13 | Alert No. 14 | Alert No. 15 | Alert No. 16