Mike Fagan's Precious Portfolio: Special Alert No. 16: Tier-2 Portfolio Update

Alert No. 16

April 27, 2021

Special Alert: Tier-2 Portfolio Update

Dear Precious Portfolio subscriber,

In today’s alert, I’ll be providing a brief portfolio update on our Tier-2 (Mid-Tiers) positions.

- Alamos Gold: (NYSE: AGI)(TSX: AGI) → BUY

-

Dundee Precious Metals: (OTC: DPMLF)(TSX: DPM) → BUY

-

SilverCrest Metals: (NYSE-A: SILV)(TSX: SIL) → BUY

-

Hecla Mining: (NYSE: HL) → HOLD

-

B2Gold: (NYSE-A: BTG)(TSX: BTO) → HOLD

-

Torex Gold: (OTC: TORXF)(TSX: TXG) → HOLD

-

Pan American Silver: (NASDAQ: PAAS)(TSX: PAAS) → HOLD

Our Tier-2 positions are up significantly over the last few weeks due primarily to the current rebound in the commodity pricing for both gold and silver, which we expect to continue over the next several business quarters.

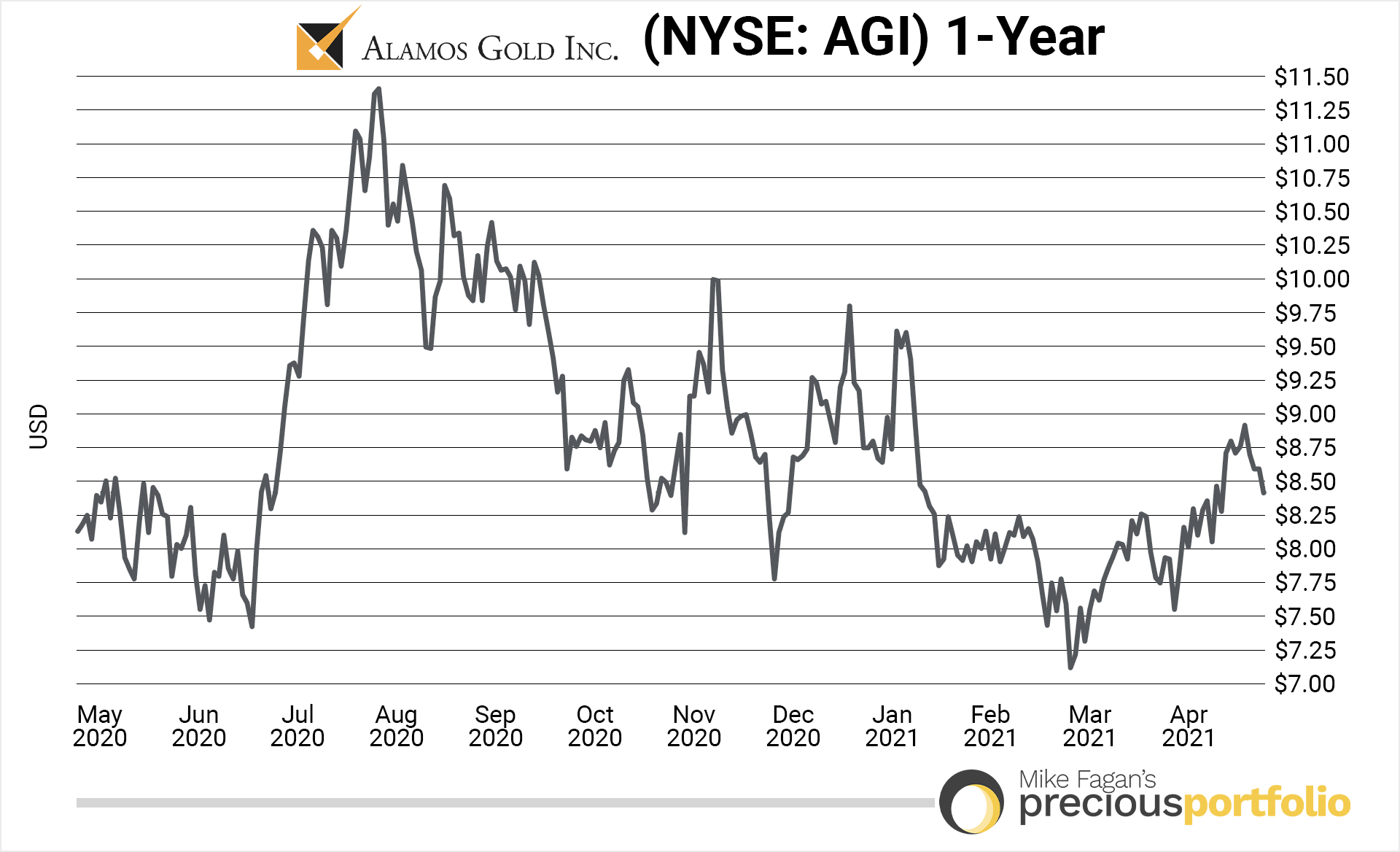

Tier-2: Alamos Gold: (NYSE: AGI)(TSX: AGI)

We began our active coverage of Alamos Gold — a Canadian-based gold producer with diversified production from three operating mines in North America — in October of last year with a buy-up-to price of US$9.25 per share.

AGI is currently trading at approximately US$8.50 per share, or 8% below our buy-up-to price.

Alamos reports Global Proven and Probable Mineral Reserves totaling 9.9 million ounces of gold as of December 31, 2020 — a slight increase from 9.7 million ounces at the end of 2019. The numbers reflect increases at the company’s Canadian operations [Island Gold, Young-Davidson, and Lynn Lake] which more than offset mining depletion of 555,000 ounces in 2020.

In Turkey, the company is engaged in a legal dispute with the Turkish government over the pending renewal of mining licenses on the Kirazli Gold Project. Alamos president & CEO, John A. McCluskey, stated in part, “We are hopeful that the arbitration process will bring about the engagement that we have sought from the Turkish state, and lead to an equitable resolution to this impasse.”

Elsewhere, exploration is continuing at the company’s Mulatos mine project in Sonora, Mexico. And gold production is expected to commence in the second half of 2022 at the neighboring La Yaqui Grande project.

The project is expected to produce an average of 123,000 ounces of gold per year starting in the third quarter of 2022 at all-in sustaining costs (AISC) of $578 per ounce — significantly reducing the Mulatos District AISC from the mid-point of 2021 guidance of $1,085 per ounce.

Alamos Gold pays a quarterly dividend of US$0.025 per common share.

Our original write-up on Alamos Gold is available here.

Recommended action: Alamos Gold remains a Buy at current price levels.

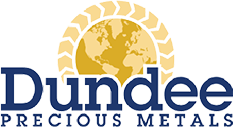

Tier-2: Dundee Precious Metals: (OTC: DPMLF)(TSX: DPM)

We commenced active coverage on Dundee Precious Metals — a Canadian-based miner with current operations in Namibia, Bulgaria, and Serbia — in October of last year with a buy-up-to price of US$8.00 per share.

DPMLF is currently trading at approximately US$7.60 per share, or 5% below our buy-up-to price.

The company’s Ada Tepe open-pit gold mine project in Bulgaria continues to deliver an impressive performance, achieving a new quarterly record for gold production of approximately 33,400 ounces. Ada Tepe is on-track to achieve its previously issued 2021 guidance.

The Chelopech underground copper and gold mine project, also in Bulgaria, produced approximately 36,900 ounces of gold and 7.2 million pounds of copper in Q1 2021, which was slightly lower than forecast due to lower copper grades as well as lower copper and gold recovery performance with certain ore blends. Chelopech remains on-pace to achieve 2021 guidance.

Dundee president & CEO, David Rae, stated via press release: “The first quarter was a solid start to the year, which included a new record for quarterly gold production at Ada Tepe. With the completion of the planned maintenance at the Tsumeb smelter [Namibia], we resumed full operations at the end of March and expect stronger smelter performance for the balance of the year.”

Dundee pays a quarterly dividend of US$0.03 per common share. Q1 2021 operating and financial results are due after market close on May 5, 2021.

You can access our original write-up on Dundee here.

Recommended action: Dundee Precious Metals remains a Buy at current price levels.

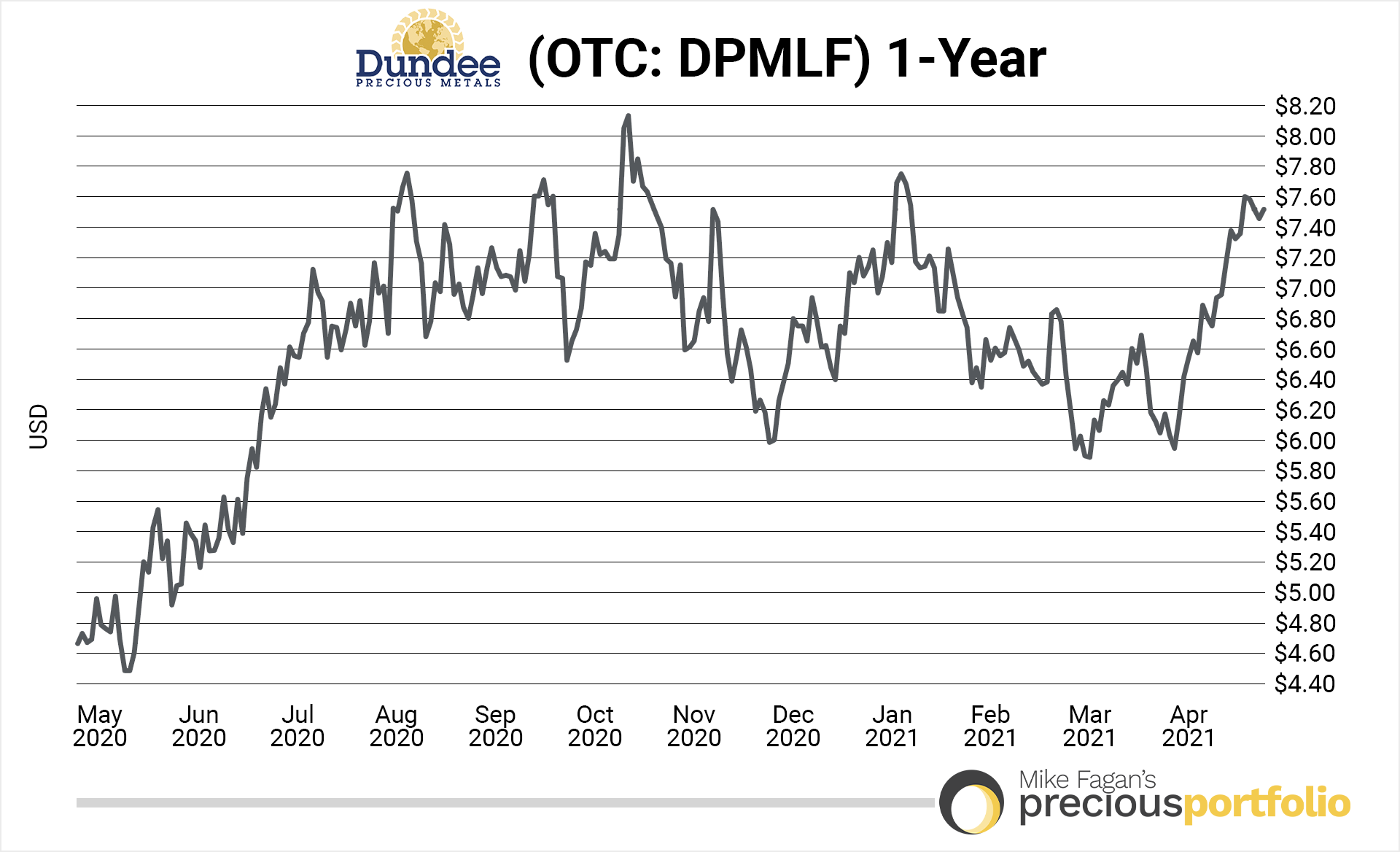

Tier-2: SilverCrest Metals: (NYSE-A: SILV)(TSX: SIL)

We began coverage of SilverCrest Metals — a Canadian-based precious metals exploration company focused on advancing the Las Chispas Silver-Gold project in Sonora, Mexico — in November of last year with a buy-up-to price of US$9.95 per share.

SILV is currently trading at approximately US$9 per share, or 9% below our buy-up-to price.

On February 2, 2021, SilverCrest Metals released a positive Feasibility Study on Las Chispas. Using base case metal prices of $1,500/oz for gold and $19/oz for silver, Las Chispas generates a post-tax NPV of US$486 million with a post-tax IRR of 52% and a one-year payback (8.5-year mine life) at a 1,250 tonne per day throughput.

SilverCrest CEO, N. Eric Fier, stated in part, “We are thrilled to have completed a robust Feasibility Study within five years of drilling the first hole at Las Chispas. The Feasibility Study confirms what we have believed for a while, that Las Chispas is economic as a stand-alone operation … While there is a lot of hard work ahead of us, we look forward to making the shift to production and cash flow which we expect will finance our continued growth.”

Click here for our feature-length report on SilverCrest Metals.

You can also access our original SilverCrest write-up here.

Recommended action: SilverCrest remains a Buy at current price levels.

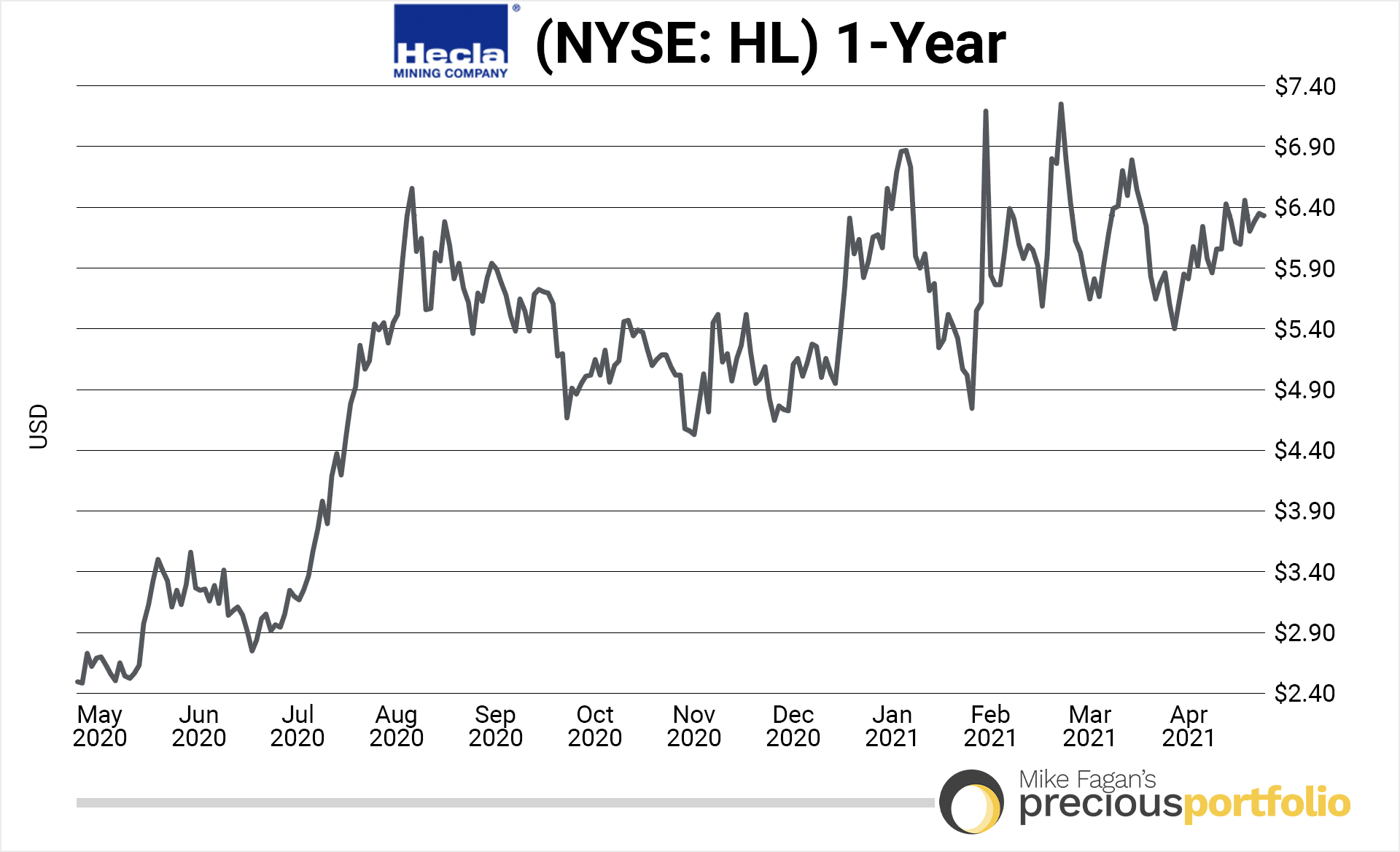

Tier-2: Hecla Mining: (NYSE: HL)

We commenced active coverage of Hecla Mining — the largest silver producer in the United States — in December of last year with a buy-up-to price of US$5.40 per share.

HL is currently trading at approximately US$6.50 per share, or 20% above our original buy-up-to price.

The company released Q1 2021 results on April 8. Highlights include:

- Silver production of 3.5 million ounces, an increase of 7%, due to growing Lucky Friday production.

-

Gold production of 52,004, a decrease of 12% because of reducing less profitable production.

-

Zinc and lead production increased 25% and 82%, respectively, due to Lucky Friday production.

-

Silver equivalent production of 9.3 million ounces or gold equivalent production of 135,946 ounces.

-

Quarter-end cash position exceeds $135 million.

Hecla president & CEO, Phillips S. Baker, Jr., commented via press release, “Greens Creek, Lucky Friday and Casa Berardi all had strong operating performance which combined with current silver prices enabled us to close the quarter with more than $135 million in cash. This is our fourth consecutive quarter of increasing cash balances, all attributable to free cash flow generation.”

On February 16, 2021, the company declared a quarterly cash dividend of $0.00875 per share of common stock, consisting of $0.00375 per share for the minimum dividend component and $0.005 per share for the silver-linked dividend component.

Our original write-up on Hecla Mining is right here.

Recommended action: Hold open Hecla positions.

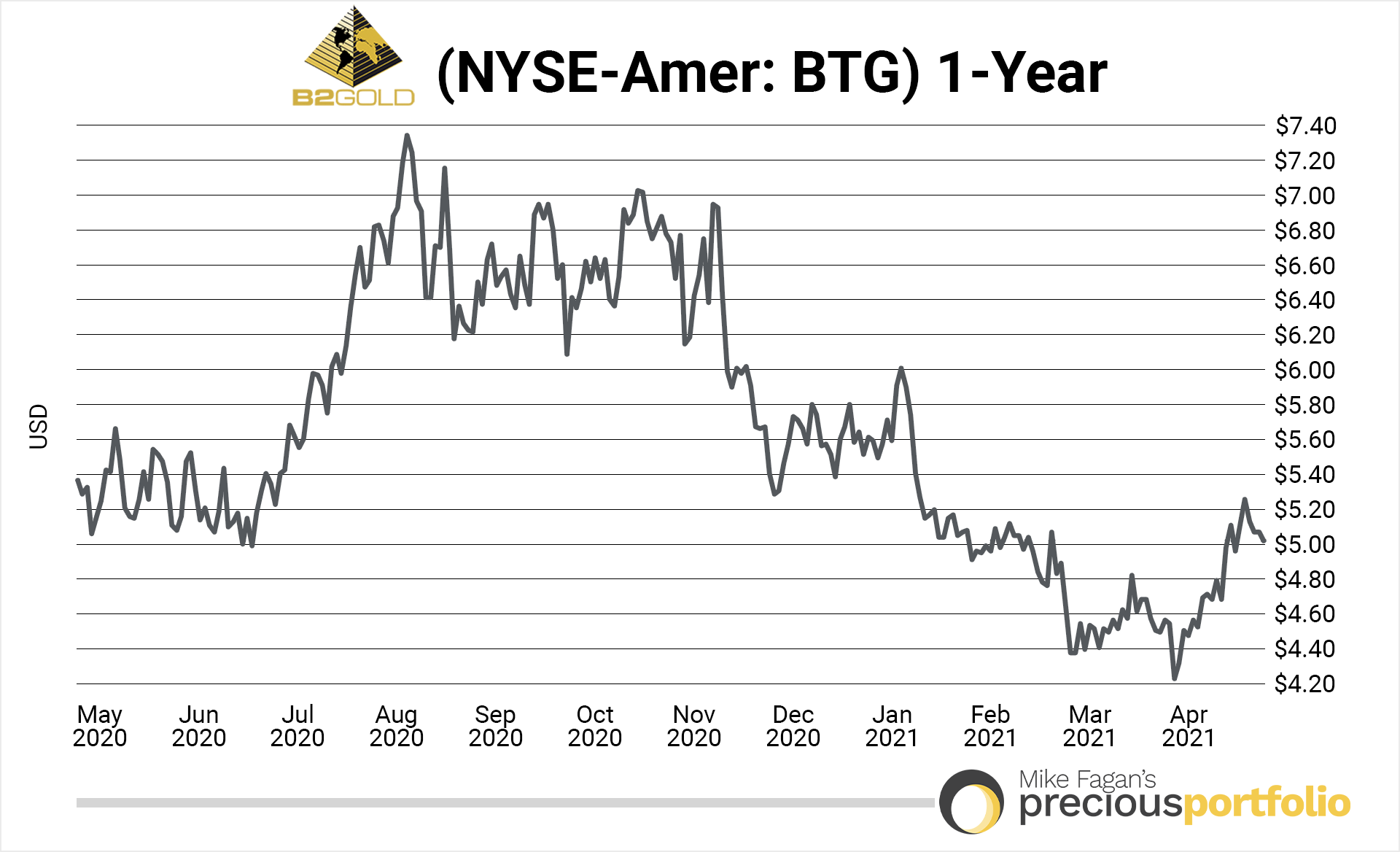

Tier-2: B2Gold: (NYSE-A: BTG)(TSX: BTO)

We began our active coverage of B2Gold — a Canadian-based gold producer with three operating gold mines in Mali, Namibia, and the Philippines — last month with a buy-up-to price of US$4.57 per share.

BTG is currently trading at approximately US$5 per share, or 8% above our original buy-up-to price.

On April 15, 2021, the company released first quarter results highlighted by:

- Total gold production of 220,644 ounces and consolidated gold production of 205,643 ounces from the company's three operating mines; 9% (17,291 ounces) above budget.

-

Consolidated gold revenue of $362 million on sales of 202,330 ounces at an average price of $1,791 per ounce.

-

Following the successful completion of the Fekola mill expansion to 7.5 million tonnes per annum in September 2020, Fekola's mill throughput came in at a quarterly record of 2.07 million tonnes in the first quarter of 2021; 9% above budget and 19% higher than the first quarter of 2020.

For full-year 2021, B2Gold remains well-positioned for continued strong operational and financial performance with total gold production guidance of between 970,000 - 1,030,000 ounces with total consolidated forecast cash operating costs of between $500 - $540 per ounce and total consolidated AISC of between $870 - $910 per ounce.

Based on current assumptions, including a gold price of $1,800 per ounce, B2Gold expects to generate cash flows from operating activities of approximately $630 million for the full year 2021.

B2Gold pays a quarterly dividend of US$0.04 per common share.

You can access our original write-up on B2Gold here.

Recommended action: Hold open B2Gold positions.

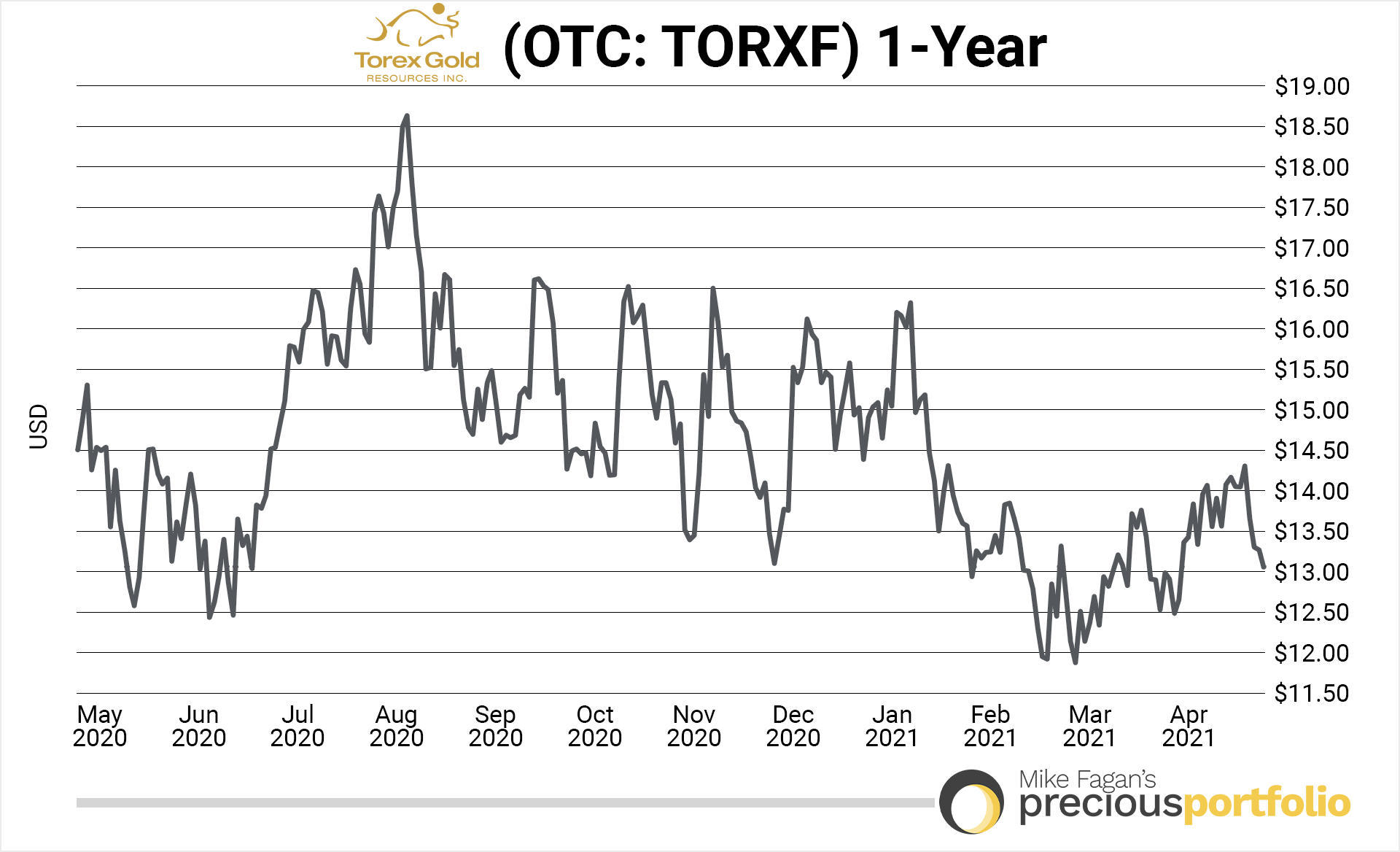

Tier-2: Torex Gold: (OTC: TORXF)(TSX: TXG)

We commenced active coverage of Torex Gold — a Canadian-based gold producer focused on its 100%-owned Morelos Gold Property in Guerrero, Mexico — last month with a buy-up-to price of US$12.85 per share.

TORXF is currently trading at approximately US$13 per share, slightly above our original buy-up-to price.

On April 8, 2021, Torex announced Q1 2021 gold production from Morelos of 129,500 ounces — the company’s highest first quarter of production on record. During the quarter, Torex sold 129,010 ounces of gold at an average realized price of $1,775 per ounce.

In February 2021, Torex announced full-year 2020 gold production of approximately 430,500 ounces at AISC of US$924 per ounce along with record net income of US$109.0 million, or US$1.27 per share on a basic basis, and US$1.25 per share on a diluted basis. Free cash flow came in at US$168.1 million.

With the strong start to the year, Torex is well-positioned to achieve full-year production guidance of 430,000 - 470,000 ounces of gold in 2021.

The company will release its Q1 financial and operational results before the market open on May 13, 2021.

Our original Torex Gold write-up is available here.

Recommended action: Hold open Torex Gold positions.

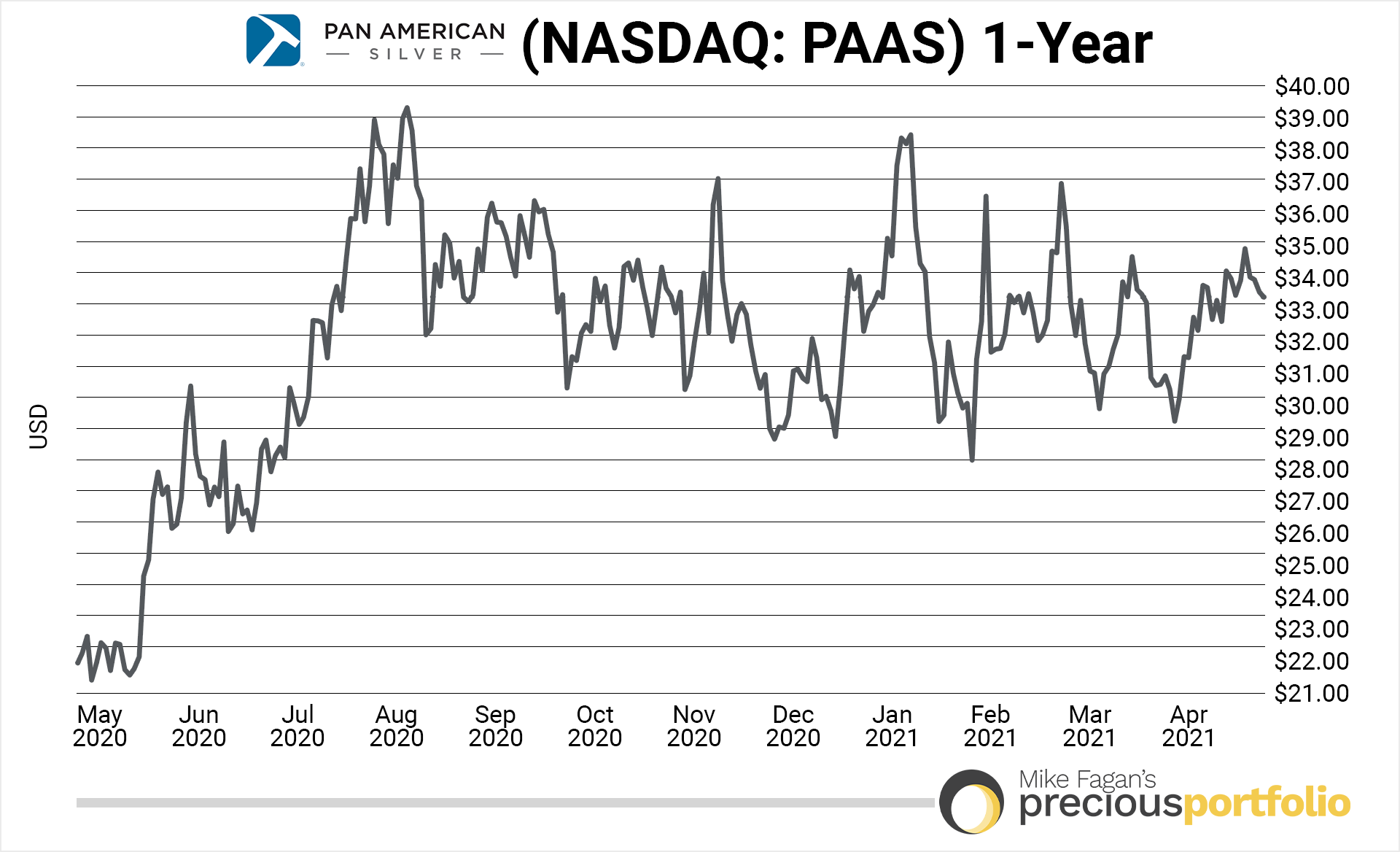

Tier-2: Pan American Silver: (NASDAQ: PAAS)(TSX: PAAS)

We began our active coverage of Canadian-based Pan American Silver — the world's second-largest primary silver producer — last month with a buy-up-to price of US$29.50 per share.

PAAS is currently trading at approximately US$33 per share, or 12% above our original buy-up-to price.

Despite an array of COVID-related challenges across its project base, the company was able to produce record revenues of $403.5 million in Q4 2020 and $1.3 billion for FY 2020 — and record operating cash flow of $170.6 million in Q4 2020 and $462.3 million for FY 2020.

Last year, the company’s total silver production came in at AISC of $11.38 per ounce; silver is currently trading around $26.50 an ounce. Gold production came in at AISC of $1,011 per ounce; gold is currently trading around $1,780 an ounce.

Pan American will release its Q1 results after the market close on May 12, 2021.

You can access our original Pan American Silver write-up here.

Recommended action: Hold open Pan American Silver positions.

Upcoming…

In our next bi-weekly alert, I’ll be providing a brief portfolio update on our Tier-3 (Juniors) positions. As always, use your own best judgment based on your own personal risk tolerance in regard to establishing positions, averaging down, taking profits off the table, et al.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio

Mike Fagan has mining in his blood. As a teenager he staked countless gold and silver properties in Nevada alongside his dad Brian Fagan, who created the Prospect Generator model that’s still widely used today in the resource space. One of those staking projects was put into production by a major Canadian mining company — a truly rare and profitable experience. That background uniquely qualifies him as a mining stock speculator. One of the most well-known names in the business, Mike is now putting that experience to use for the benefit of Resource Stock Digest, Hard Asset Digest, and Mike Fagan's Precious Portfolio readers.

Previous Alerts

Alert No. 1 | Alert No. 2 | Alert No. 3 | Alert No. 4 | Alert No. 5 | Alert No. 6 | Alert No. 7 | Alert No. 8 | Alert No. 9 | Alert No. 10 | Alert No. 11 | Alert No. 12 | Alert No. 13 | Alert No. 14 | Alert No. 15