May 2021 Foundational Profits

May 2021 Issue

by Nick Hodge

» Volatility, Earnings, & Rates

» Recommendation Recap: Intel & Oil

» New Recommendations & Golden Guidance

» Uranium

» Cannabis

» SunRun

In the simplest terms, the bull market in nearly everything is still on.

Stocks remain near record highs, and that looks like it will continue.

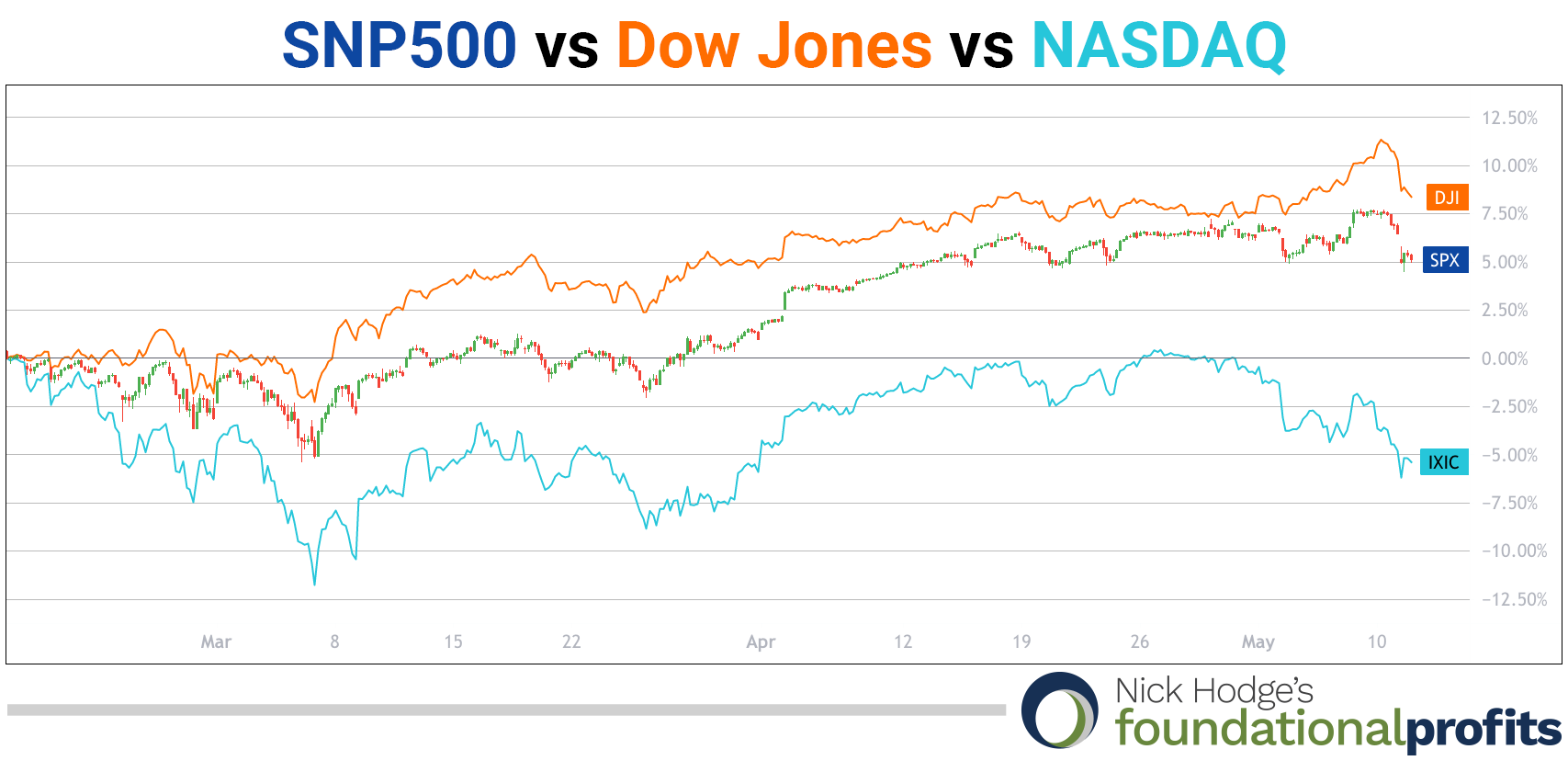

The NASDAQ continues to be the weakest link of the three major U.S. indexes — continuing a divergence I was bold enough to point out to you at the beginning of last month’s issue.

The reasons the bull market in stocks is set to continue are multifaceted.

You have a reopening underway. You have record amounts of stimulus working their way through the system. You have corporate earnings picking up. And you have a Fed that just keeps on easing.

Everyone knows it can’t last forever. But no one knows when the next cycle will start.

Here are the tea leaves I’m looking at.

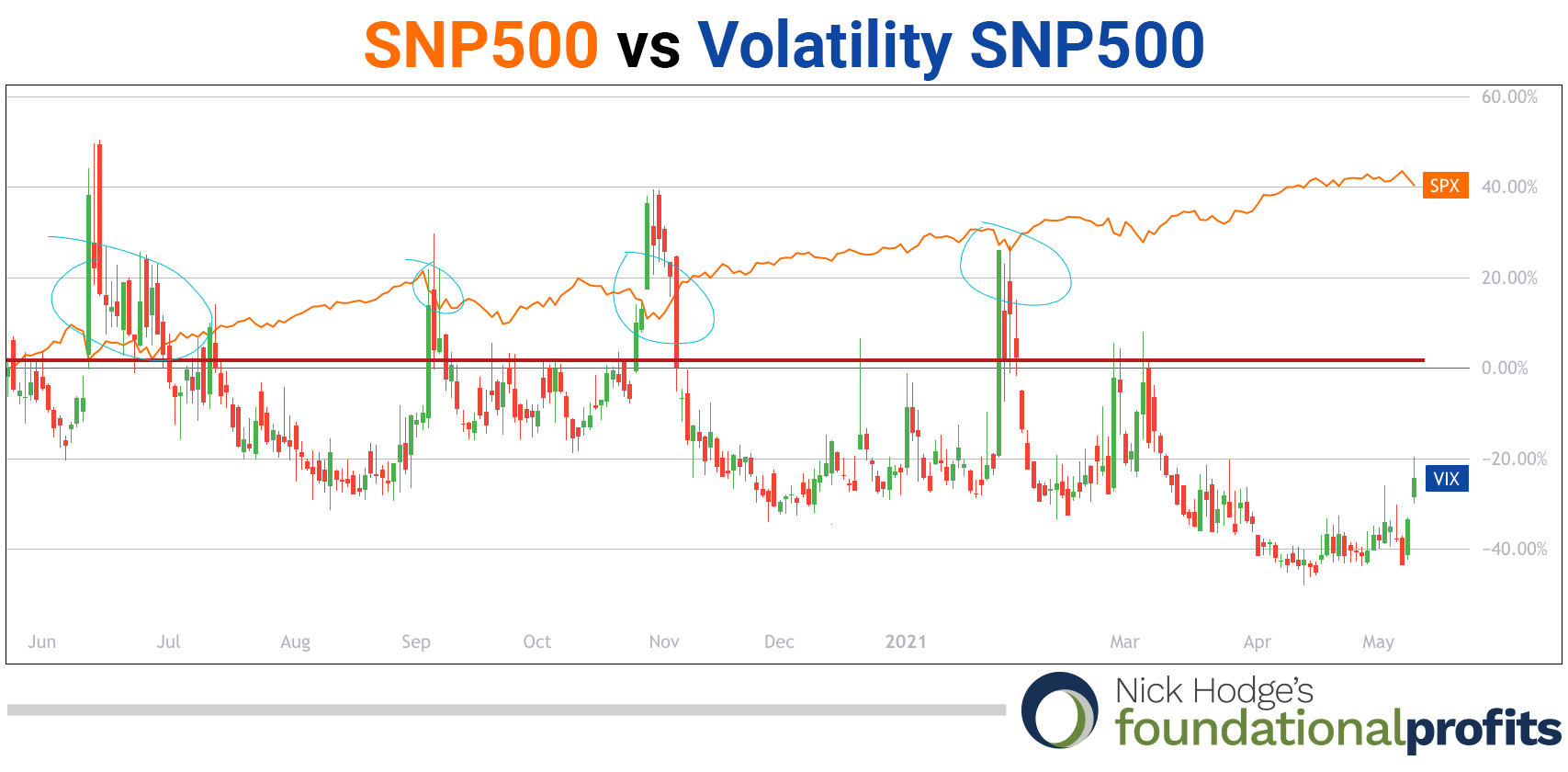

First, the volatility index (VIX). This is the “fear gauge” of the S&P 500. And the fear is nowhere near the levels we saw leading into other selloffs over the past year.

Second is corporate earnings. Factset reported on May 10 that:

As of today, the blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings growth rate for the S&P 500 for the first quarter is 49.4%, which is more than double the estimated earnings growth rate of 23.8% at the end of the first quarter (March 31). If 49.4% is the actual growth rate for the first quarter, it will mark the highest year-over-year earnings growth rate reported by the index since Q1 2010 (55.4%).

Third, bond rates are still rising. Yes, they have gone sideways for two months. But the current trend is still higher.

Those higher rates can also be called “inflation” — a word that you’ve been hearing a lot more lately.

It’s what has driven not just rates higher, but prices for nearly everything from corn to cryptocurrencies. Indeed, copper has hit all-time record highs and you know at least one person with a Dogecoin story.

Everything except gold, of course, which hit record prices last summer but has “melted” since then under the heat of rising bond rates.

“Melted” in quotes because, given full context, gold is still historically high.

It has simply been out-inflated by everything else for the past few months.

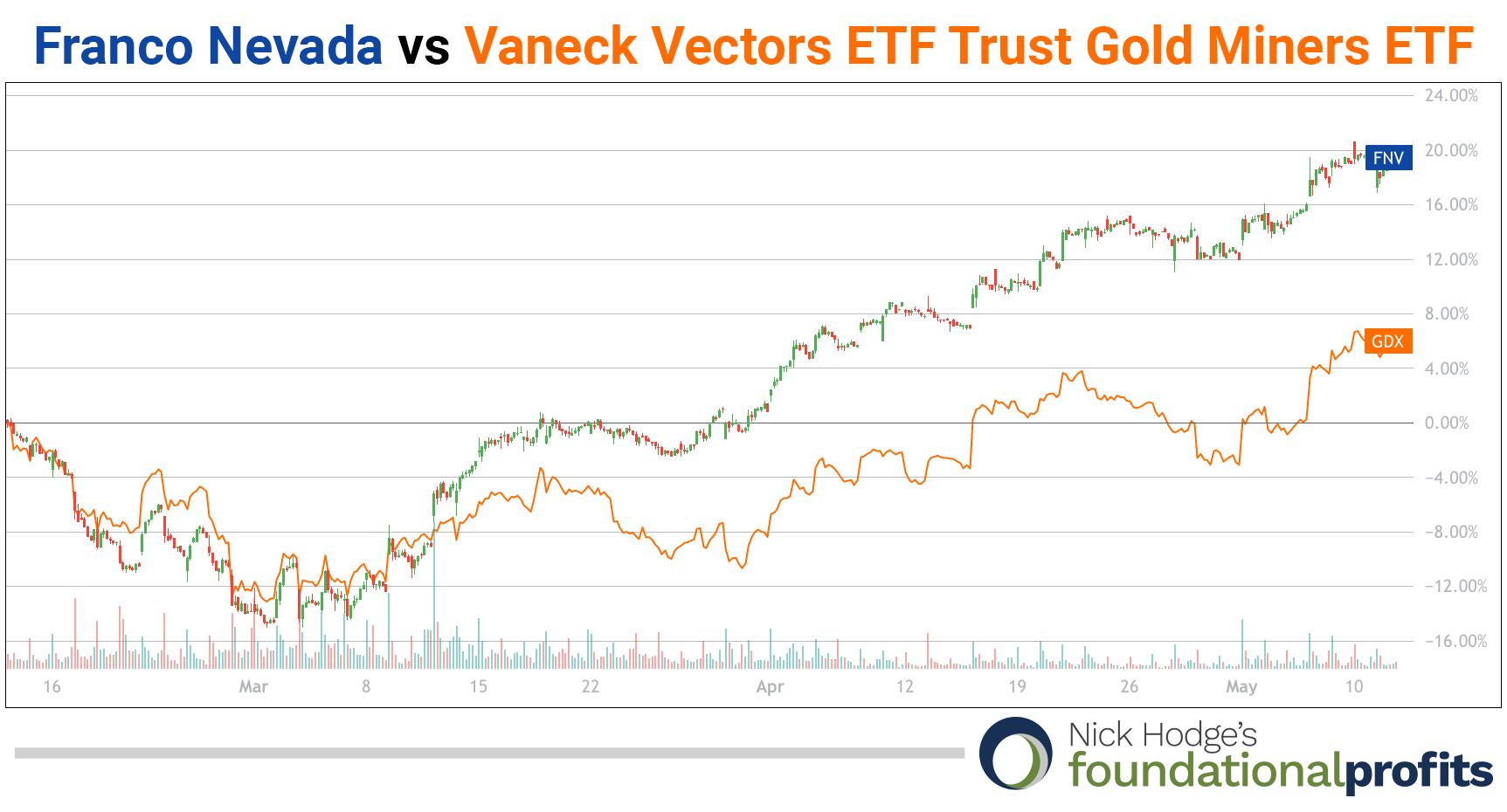

With gold — and silver, don’t forget — prices still historically high… they are driving the earnings of the companies that produce it. And their stocks are starting to be rewarded because of this fundamental truth, even though it goes against the current narrative of gold being “boring.”

That’s the backdrop for the recent actions I’ve recommended… and for some new actions I’ll recommend today.

Let’s get caught up.

Recommendation Recap

Since the last issue, I sent out an interim update with guidance to:

Buy Intel (NASDAQ: INTC) below US$56.75. It’s been sold down hard over the past month. Oversold, in my opinion, with the chart saying it should smooth out in the low US$50s. Materials have been one of the best-performing sectors of late, and that includes semiconductors. Intel is one of the largest holdings for many of the ETFs in that sector. It also yields over 2.4%.

Buy the SPDR Oil & Gas Exploration and Production ETF (NYSE: XOP) below US$83.00. Oil is re-inflating. We played it with the XLE fund starting last November. We can drill down a bit on the sector with this fund during the pullback that has developed in the fund while oil goes higher. Energy has been the absolute best performing sector of the S&P over the past month, three months, and six months. We profited from it previously with the XLE fund. And now we’re staying with the trend, but drilling down on the smaller companies like Hess, EOG, and Devon Energy in search of a bit more torque. You get yield here, too, with the fund currently yielding 1.58%.

New Recommendations & Golden Guidance

Sell Alamos Gold (NYSE: AGI)above US$8.50. Turkey has failed to grant the company routine renewal of its mining licenses there, and Alamos is seeking a US$1 billion investment treaty claim. While a development and not a producing asset, it’s enough for me to walk away from the position, especially because we’re up more than double digits. We have plenty of other quality gold exposure.

Sell Artemis Gold (TSX-V: ARTG)(OTC: ARGTF) above C$6.13. That’s the entry price. I simply think we have better immediate-term upside elsewhere in the precious metals space now that Artemis is embarking on a large financing package.

That leaves us with six positions in the gold and silver space.

| Company |

Buy Under |

| Franco-Nevada Corp. (NYSE: FNV) |

US$130.00 |

| GoldMining Inc. (TSX: GOLD)(NYSE: GLDG) |

C$2.50 |

| Hecla Mining (NYSE: HL) |

US$6.00 |

| MAG Silver (NYSE: MAG) |

US$11.00 |

| Perpetua Resources (NASDAQ: PPTA) |

C$10.00 |

| Sibanye Stillwater (NYSE: SBSW) |

US$8.50 |

Some key callouts there…

I was telling you to buy Franco-Nevada (NYSE: FNV) in the March Issue because it was under our buy-under price of US$130.00 and was delivering record earnings. It is now well above that price as it has continued to deliver solid earnings, and is beginning to lead quality gold stocks higher like I mentioned in the introduction of this letter. Franco is making the GDX look sloppy over the past six months for example. I hope you own it.

GoldMining (NYSE: GLDG)(TSX: GOLD) would be on my shopping list if I were looking for a way into gold that hasn’t started to move higher over the past two months, and also where there is some fundamental misunderstanding of value. GoldMining currently has a market cap of US$242 million. It recently spun out royalties on some of its assets into a company called Gold Royalty, which now has a market cap of US$194 million. Two things:

- GoldMining owns 48% of Gold Royalty, or US$97 million, which is over 40% of GoldMining’s current market cap.

- If royalties alone on GoldMining’s assets can support a near-US$200 million valuation, it tells me the assets themselves should be valued (re-rated) higher. Either that, or both have to come way down.

But history says that isn’t likely. GoldMining has outperformed gold over the past 10 years, 5 years, and year. And it has substantially outperformed, i.e. provided leverage, in times when the gold price was rising.

We have been buying GoldMining below C$2.50. Because GoldMining now has an NYSE listing, I’m going to start listing it in U.S. dollar terms. It is now a buy under US$2.00.

Perpetua Resources (NASDAQ: PPTA)(TSX: PPTA) — formerly Midas Gold — is fast approaching a permitting decision. It is expected in Q3. It could always be delayed, but the can has already been kicked several times. The posturing of the company and the government look good heading into it. The stock has risen right to our buy-under price of C$10.00. With the NASDAQ listing in place, I will also start covering Perpetua Resources in U.S. dollar terms. It is a buy under US$8.25.

Uranium

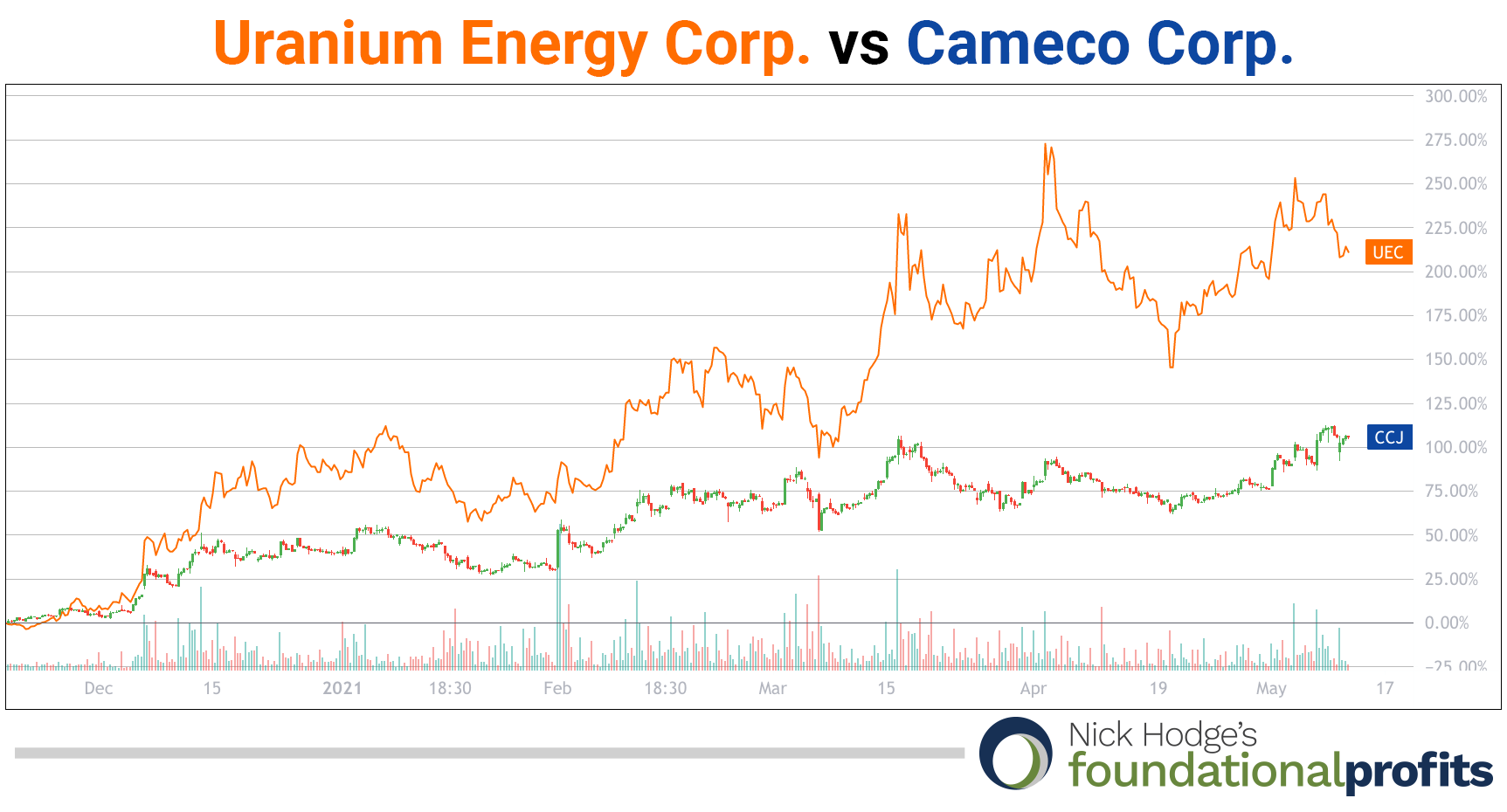

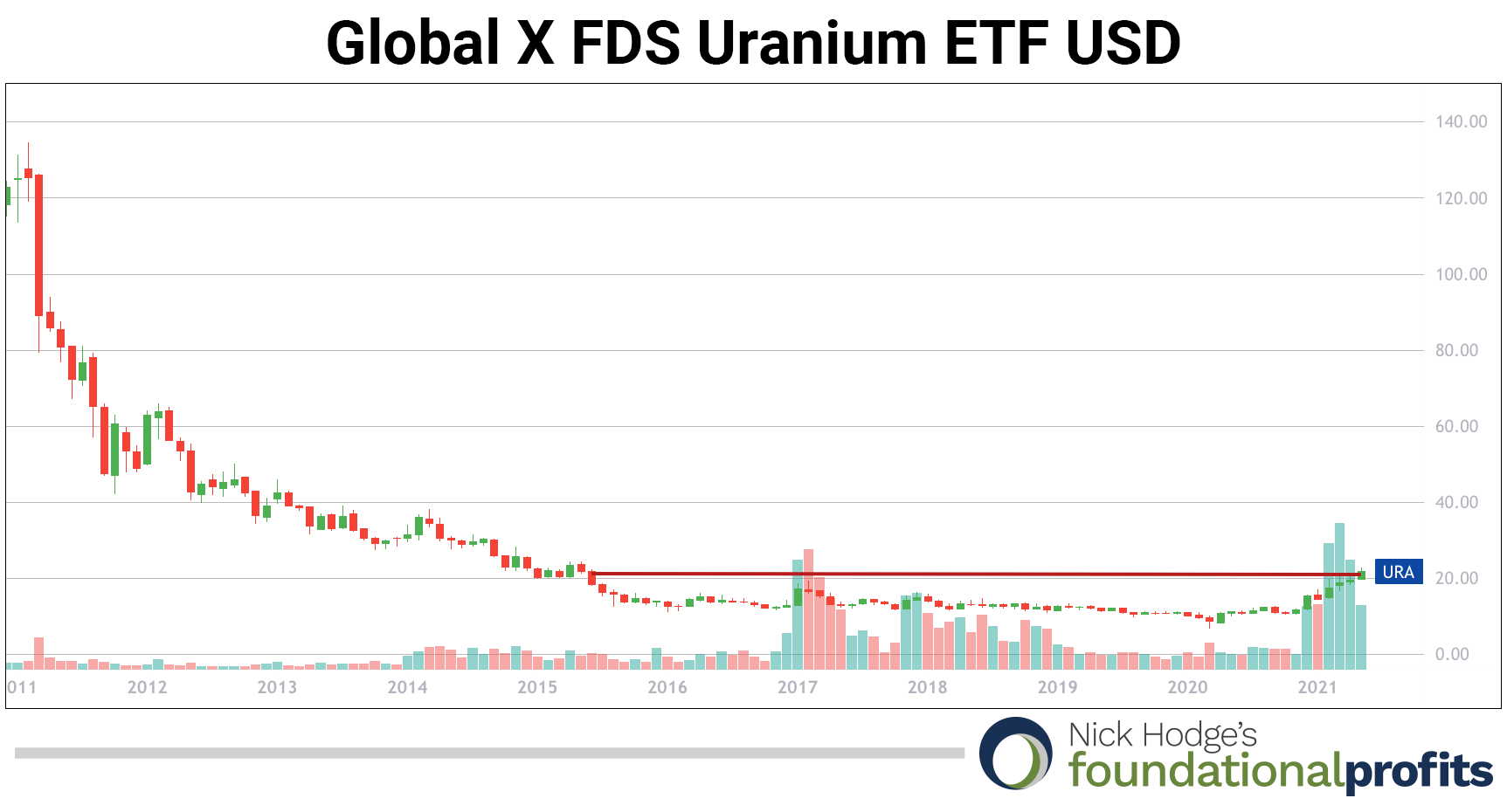

You could’ve bought both our uranium holdings below their buy-under prices last November and December. And I was saying as much in both those monthly issues.

Flash forward six months and Cameco (NYSE: CCJ) and Uranium Energy (NYSE: UEC) have doubled and tripled, respectively.

The move in the uranium equities has now surpassed all the previous “headfakes” of the past five years in both price and volume.

Japan is restarting its reactors. Uranium is being looked to as a clean source of electricity. The U.S. and many other countries are building new reactors. The U.S. government is incentivizing the life extensions of nuclear plants.

I believe it is time to start scaling into the sector in a more meaningful way if you haven’t already.

There are very few quality names in the sector. And the most explosive gains come from stocks that are too small for this letter.

For our purposes — a more solid foundation — I’m adding the Global X Uranium ETF (NYSE: URA) to the portfolio. It is a buy on pullbacks under US$21.00.

For smaller uranium recommendations you’ll have to check out my Family Office Advantage or Gerardo’s Junior Resource Monthly.

Cannabis

Cannabis stocks are looking like they are in a “buy the dip” moment.

As I’ve explained to you, the cannabis market is changing and new leaders are emerging. The new leaders are the companies with U.S. exposure whereas the old leaders were Canadian-focused companies.

This is what I’ve been calling “Cannabis 2.0”.

I recognized this early and started recommending the AdvisorShares Pure US Cannabis ETF (NYSE: MSOS) back in December.

We got a good initial lift, followed by a consolidation that’s been happening since February.

That consolidation could be approaching an end, with a new breakout for the sector to follow.

Mergers and acquisitions are now happening as the bigger companies start jockeying for U.S. market share.

A company called Harvest Health, for example, was taken out this week for over C$2 billion.

It is a holding in the MSOS ETF. But if you owned it directly, like readers of my Family Office Advantage did, you were able to easily double your money.

And that’s precisely the difference between Foundational Profits and Family Office Advantage.

Here I give you the sectors that are in favor given current market cycles and trends — and some of the largest most liquid ways to play them.

At Family Office Advantage, I’m seeking out the smaller companies that offer significant leverage within those cycles and trends.

SunRun

We continue to buy SunRun (NASDAQ: RUN) for its “Amazon of Energy” qualities below US$58.00.

It just reported first-quarter results, beating revenue expectations and increasing full-year growth guidance to 25%-30%. According to CEO Lynn Jurich:

“This year is on track to be the best in the company’s history. With an accelerating growth rate and expanding market reach, Sunrun is leading the country to a clean energy future. Now is the time for us to move to a distributed energy system to meet the increased demands placed on our energy system from broad-based adoption of electric vehicles and improve the resiliency of our aging energy system.”

She mentioned virtual power plants by their other name: distributed energy systems.

The stock has been soft along with other tech names and the NASDAQ.

But it remains early in this energy transition.

Call it like you see it,

Nick Hodge

Nick Hodge

Editor, Foundational Profits

View My Foundational Profits Portfolio

Make sure you never miss an update or issue from Nick Hodge's Foundational Profits by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here.

Nick Hodge's Foundational Profits, Copyright © 2021, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Nick Hodge's Foundational Profits does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.