Junior Resource Monthly May 2021

PREMIUM CONTENT FOR PAID MEMBERS ONLY

by Gerardo Del Real

by Gerardo Del RealIn This Issue:

The gap between haves and have nots continues to widen.

If it’s priced in dollars it’s likely headed higher.

Real estate prices here in Austin continue to balloon, with homes being offered 20-30% above asking price. We are now in the midst of the fastest rise in home price appreciation ever.

As Nick Hodge likes to say, that's a long time.

Who’s buying the homes? Cash-rich buyers or buyers with prime credit scores. As first-time buyers get squeezed out of the real estate space, prime and super-prime credit profiles continue to leverage those credit profiles to pay top dollar for real estate.

Speaking of credit, did you know that student loan debt as a household debt class is now 11%, double what the credit card debt is (5%).

Auto lending is on the rise and accelerating as the same people who used to live in cities continue to flock to the suburbs, which require transportation to move around comfortably.

As a household debt class, auto lending now makes up 9%. The timing couldn't be better as chip shortages have made fewer new cars available, translating into a 50% increase in used auto prices. That’s not a typo.

But don’t worry, J&J are watching inflation and will rein it in at the appropriate time.

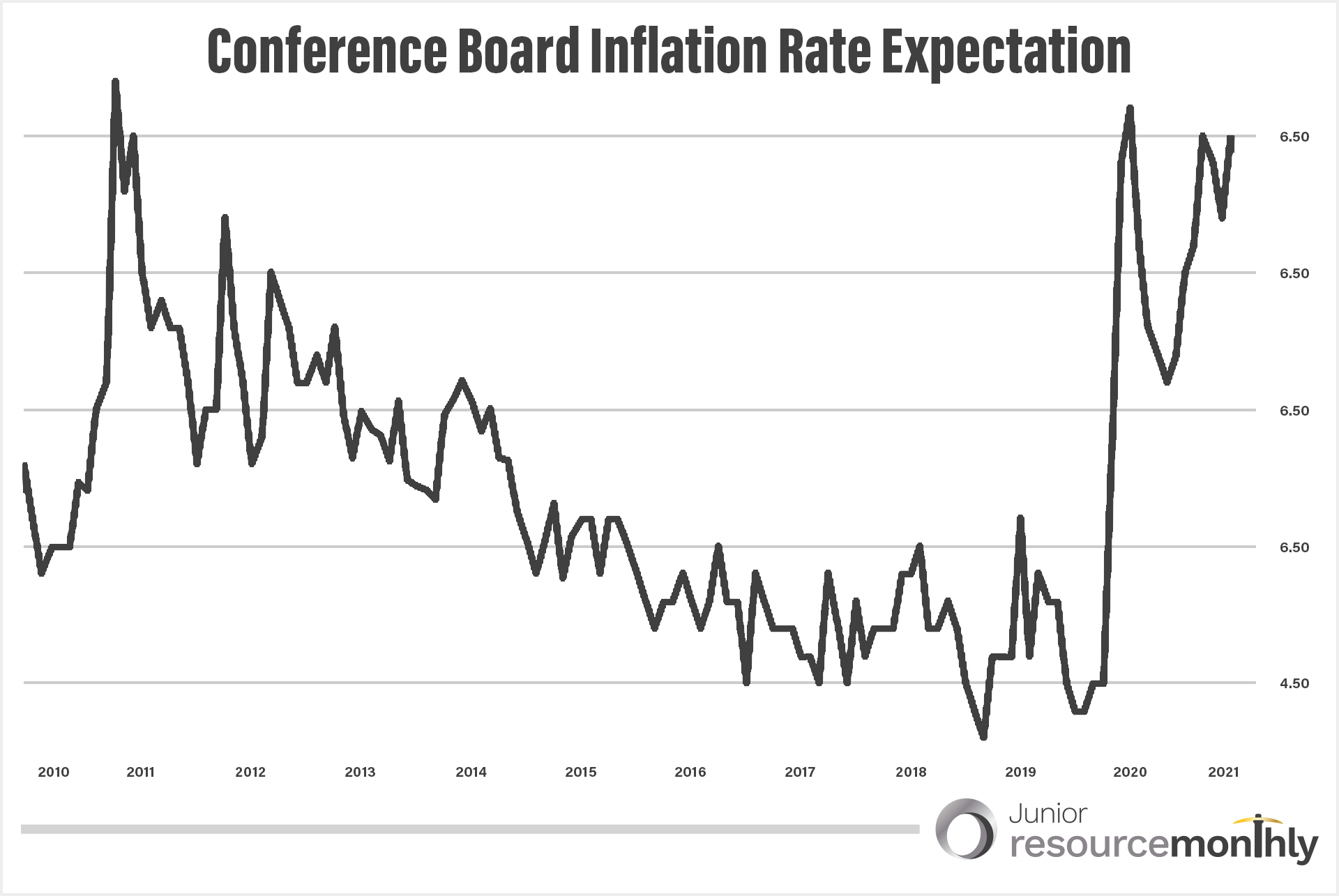

The chart below from the Conference Board Inflation Rate Expectation shows a 10-yr high in inflation expectations (with the exception of June 2020).

COVID cases here in the U.S. continue to decline and consumers are eager to get back to a new normal by doing what we do best, spend.

I’ve made the comparison to the roaring 20s. There’s a good case to be made that we’re also in a period not too dissimilar to the mid-80s.

Not the mid-80s as I experienced it as the son of immigrant parents who didn’t speak a word of english living in Chicago (not the nice part), working hard to try and create a better future.

I mean the “greed is good” 80s. Gordon Gecko-style, baby.

Waiting on the sidelines by choice? In the words of the crypto bros and babes, have fun staying poor.

After months of consolidating, gold and silver are finally starting to look like they want to break out. The correlation between the 10-yr. and the gold price remains intact.

Interest rates go higher, gold goes lower. Interest rates go lower, gold follows along. It’s that simple right now.

It doesn't mean we don’t get one last pullback, but two months of rising prices is encouraging to say the least.

The volatility in the crypto space and mini-crashes in the overall indices is a reminder of the stability gold provides in these uncertain times. Yes it’s down 16% from all-time highs but I don’t worry about waking up to see gold down 40% from the previous day’s close.

It also isn’t hurting gold that real central bank interest rates look like this:

On the silver front, the next month or two could provide some fireworks because there isn’t much resistance between $30-$50.

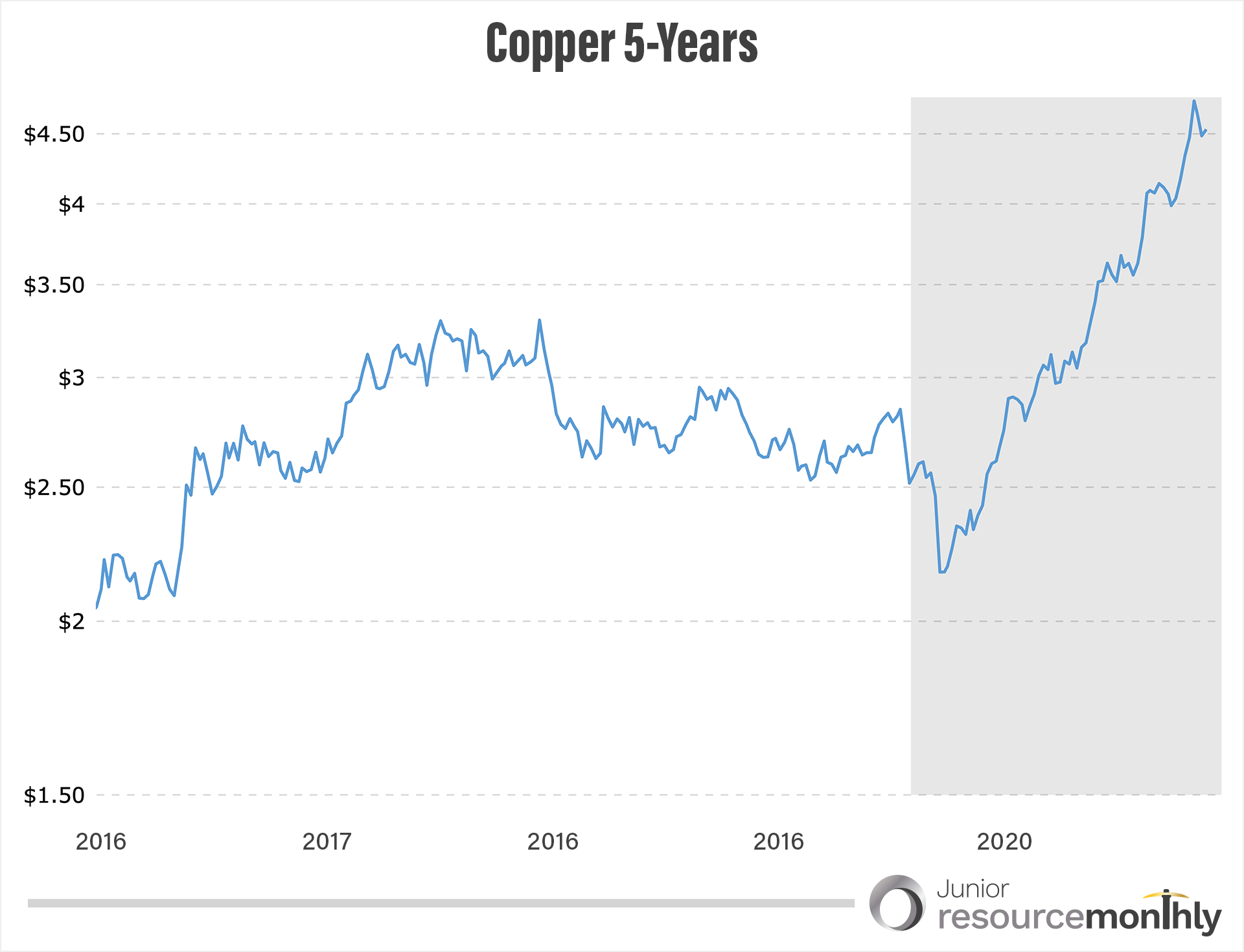

And for anyone worried about the recent pullback in the copper price some perspective is important. First off it’s pulled back from all-time highs, which is healthy.

The demand part of the supply/demand equation is in our favor and not slowing down anytime soon.

Consider this, according to Benchmark Minerals there are now 211 total gigafactories. Of those, 156 are in China, 22 in Europe, and 12 in the U.S.

Those factories are producing batteries that require large amounts of copper.

It’s why the International Energy Agency (IEA) is recommending Western governments stockpile critical battery metals.

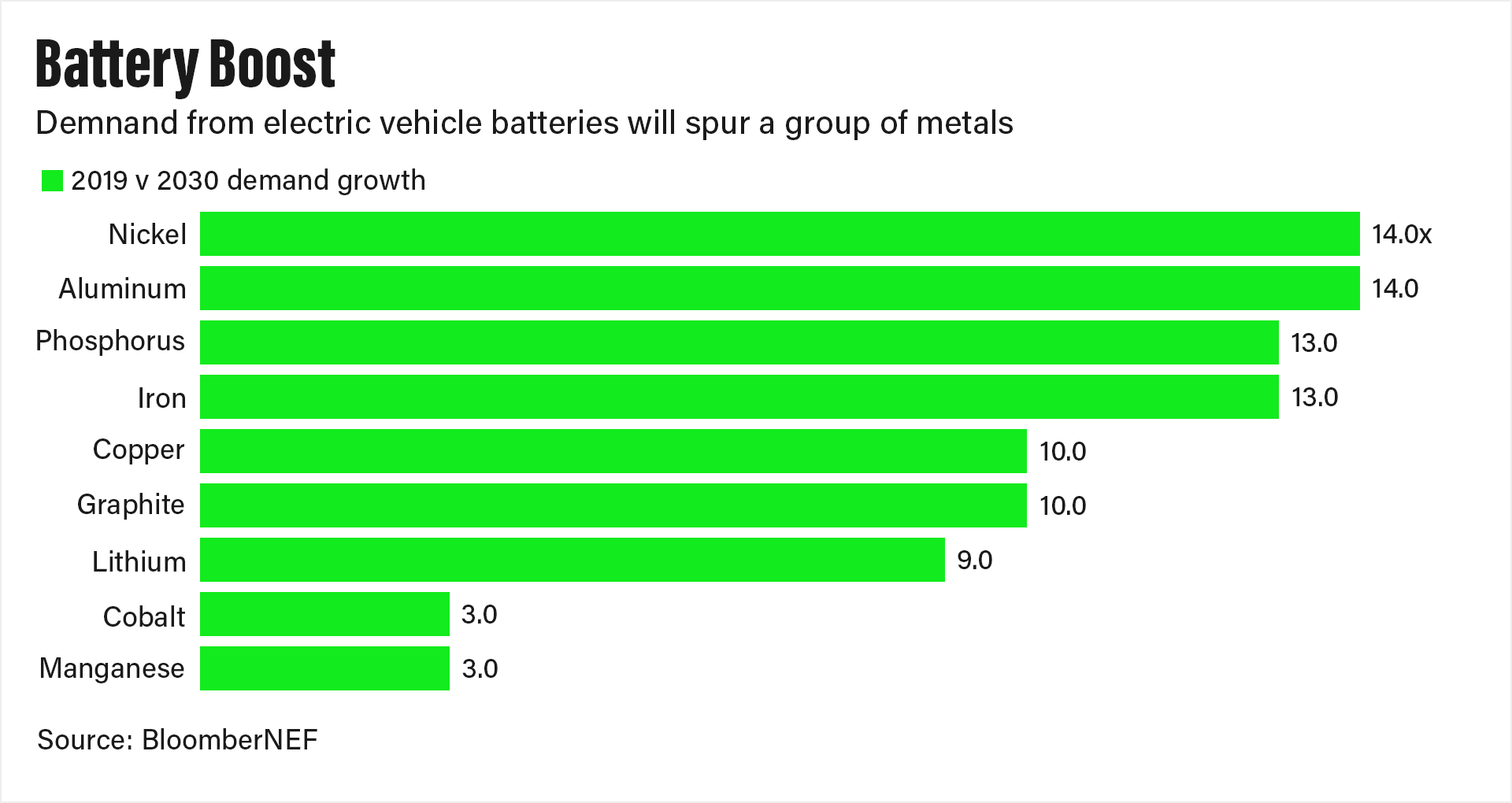

The demand projections from BloombergNEF are eye popping.

The IEA is correct in highlighting the geopolitical risks that come with sourcing these metals from unstable or unfriendly countries.

I touched on election uncertainty in Peru last month. We will have more clarity in less than three weeks about the near-term future as it relates to mining in Peru.

I wrote about the election surprise in Chile recently. You can view that here.

The #1 copper producer (Chile) and #2 (Peru) will not cease being top copper producers but changes are afoot globally that won’t make it any cheaper to mine a metal with decades of projected demand.

Kinsley Mountain Site Visit

Which brings me to my recent site visit at the Kinsley Mountain gold project 80% owned and operated by New Placer Dome Gold (TSX-V: NGLD)(OTC: NPDCF) and 20% owned by JRM portfolio company Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF).

Jurisdiction and infrastructure are always important if you’re speculating on a project with the hopes of seeing it bought out or built one day.

On both fronts it doesn’t get much better than Nevada. The drive in and out of the project was the easiest I’ve made.

I flew out of Austin early in the morning and arrived at Salt Lake City, rented a car, and made the hour-and-a-half drive across state lines to Nevada.

Here’s a view of the road. It was like this throughout.

I crossed the state line, which was very apparent by the casinos and restaurants that dotted the other side, drove 30 minutes, and met with Alex Wallis (New Placer Dome Gold geologist), who was gracious throughout.

The last time I was in Nevada visiting a project I was greeted by sharp rocks that led to a flat tire an hour in. This time around it only took 10 minutes after arriving at Kinsley to flatten a tire.

Twenty minutes later we were off to see three main areas of interest on this trip: The past producing Main Pit North, the Secret Spot, and, of course, the Western Flank Zone which in past campaigns delivered some phenomenal results. More on that in a bit.

Three new gold discoveries were confirmed at Kinsley during the 2020 drill season: at Secret Spot, Western Flank Extension, and the Main Pit North oxide targets, hence my interest as that is where follow-up drilling will focus.

Here’s a view of the Main pit.

The high-grade near-surface oxide gold success at the Main Pit is easy to understand when you’re seeing it in person.

Most of the high conviction targets are under cover and require reconnaissance work that should’ve included trenching, geophysics, and more time on the ground prior to drilling.

In fairness to New Placer Dome Gold the company had a choice last year. Refine the targets but miss out on the 2020 drilling season or hire the drillers that were available and select targets on the information it had.

That led to some great numbers and discoveries in certain areas (the three I mentioned) but also led to a hit rate that should have — and likely would have — been higher if the work had been completed and interpreted prior to drilling.

The mineralization at the Main Pit is the easiest to follow as you can visually see the mineralization, which makes chasing it easier.

A main focus of the next drilling program, given the high grades and near-surface oxide mineralization encountered at the Main Pit, should be adding ounces near the pit and once geophysics and some trenching is done, trying to connect — or prove it doesn’t — the Secret Spot and Western Flank, which are 1.5 kilometers from each other.

Secret Canyon shale gold (sulphide) intercepted within KMD20-006 represents the highest-grade interval to date at Secret Spot with high-grade gold mineralization similar in tenor to the Western Flank Zone (seen here).

Recently, multiple chargeability anomalies have been identified at the high-grade Western Flank Zone and Shale Saddle target (which is also very prospective and a favorite among the geos but missed in the 2020 program) that warrant expansion of the IP geophysical grid and follow-up drill testing.

The 2020 IP/Resistivity survey the company just processed shows the Western Flank is clearly open for extension laterally in undrilled ground.

Max Sali, CEO and founder of New Placer Dome, recently commented, “With the release of the 2020 IP/resistivity survey results we are extremely pleased to have identified a new gold vectoring tool that has potential to contribute to new discoveries within the Kinsley Mountain Gold Project. During 2021, we look forward to expanded geophysical surveys and drilling to build on multiple new discoveries made during 2020 and increase the current indicated and inferred resource at the Western Flank Zone, Main Pit North Oxide and Secret Spot targets.”

(Exposed mineralization at Secret Spot).

I look forward to that program and a more targeted approach.

Let’s get to portfolio news because there’s a lot to get to.

Portfolio News

Let’s start with Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF). You already know what I’m going to tell you, the stock is a screaming buy on the Kinsley potential alone and the most recent bit of news underscores that point.

On May 10, 2021, Nevada Sunrise announced that it has entered into a binding letter of intent with Cypress Development Corp. of Vancouver, BC, Canada (TSXV: CYP)(OTCQB: CYDVF).

I’ve always said the bit of success I’ve had has come from luck, hard work, and asking simple questions. In the case of Nevada Sunrise Gold and the strategic water rights it owns, I’ve always argued that the water rights alone justify a value of $3-$4 million.

Why? Because all the hype in the world won’t mine lithium alone. No one else in the basin has available water rights and there are several parties that need those water rights for those projects to ever work.

So the May 10, 2021 announcement did not come as a surprise. There are multiple suitors and as a shareholder I’m content that the offer Cypress made is a fair one.

The deal still needs to undergo the due diligence process and both companies — I reached out — were hesitant to comment publicly until the deal is consummated.

The bulk of the deal consists of US$2 million in cash and $850,000 in shares of Cypress which provides the company with upside if Cypress is successful in advancing the project.

$1.3 million of the $2 million in cash will go to attorney fees and payments owed to the underlying vendor of the water rights. The rest will allow the company the flexibility to ride out a drilling campaign at Kinsley and start preparing for a fall drilling campaign at the Coronado VMS copper project also in Nevada.

There are few speculations at this market cap as an attractive risk/reward proposition.

Nevada Sunrise is a buy at current levels.

Fission Uranium (TSX: FCU)(OTCQX: FCUUF).

The company was on its way to 52-week highs when it announced a $30 million financing. A financing which provides a good entry point.

Fission Uranium is developing the high-grade, near-surface Triple R uranium deposit located in the renowned Athabasca Basin uranium district.

PLS hosts the longest mineralized trend in the district and the Triple R is the only existing major, high-grade deposit in the region found at shallow depth.

A pre-feasibility study shows the potential for the Triple R to be among the lowest-operating-cost uranium mines in the world.

That study pegs the after-tax NPV at C$1.56 billion. Current market cap is below C$400 million.

The daily headlines and multiple upcoming catalysts in the space along with the underperformance of Fission shares relative to value make Fission an excellent trade in the uranium space.

For those who want to take a deeper dive, here is the most recent corporate presentation.

Western Copper & Gold (TSX: WRN)(NYSE: WRN)

I’m always early. Early on trends and early on trades which means I’m usually wrong for a while. The good thing for me — and those of you who follow along — is that patience (being wrong) is more often than not rewarded over time.

Western Copper & Gold is a great example.

I started writing about copper years ago (uranium too).

I laid out the infrastructure case, the supply-demand fundamentals at the time, and why copper demand would soar due to the most obvious mega-trend developing at the time, the electrification of everything.

My insight was rewarded by one of the most — if not the most — brutal bear markets in the junior resource space. Especially tough in the base metals names.

Fast forward to 2021 and even Goldman Sachs has come around on the copper thesis.

When I added Western Copper & Gold to the portfolio in July of 2020 the premise was again a simple one. I like copper, I like gold, I like undervalued plays and in the case of Western Copper it also had the added benefit of an NYSE listing which I suspected would serve us well when the institutions started looking around for a liquid vehicle on a major exchange.

Fast forward nine months later, we’re up over 100% and I believe the best days are ahead for Western Copper & Gold. Copper giant Rio Tinto agrees.

On May 17, 2021, Rio Tinto announced a C$25.6 million strategic investment in the company, giving Rio Tinto an 8% stake in the company. The deal also provides a path forward for future investments (and influence) by allowing Rio Tinto the option of appointing one director to the company if the 8% ownership increases to 12.5%.

Shares are also locked up for one year, which signals the investment is the first of many.

Westerrn Copper & Gold is an appetizing take out target for any major with the checkbook to develop a project that requires deep pockets in exchange for a very accretive acquisition.

Chakana Copper Corp. (TSX-V: PERU)(OTCQB: CHKKF)

Few companies are looking more forward to the clarity the June 6 elections in Peru should provide than Chakana Copper.

In the meantime the company keeps hitting with the drill bit and working towards a maiden resource estimate due in October.

On May 25, 2021, Chakana announced results from eleven in-fill holes totaling 2,873.7m from the Huancarama, Paloma East, and Paloma West tourmaline breccia pipe discoveries at its Soledad project, Ancash, Peru.

Highlights from the release are below.

Soledad Project Highlights Include:

- Huancarama East - four holes with high-grade intercepts, including 134.3m of 0.92 g/t Au, 0.86% Cu, and 80.7 g/t Ag (2.15% Cu-eq) from 119.7m depth;

-

Paloma East - five holes with strong grades, including 126.1m of 0.91 g/t Au, 0.20% Cu, and 11.6 g/t Ag (0.89% Cu-eq) starting at surface;

-

Paloma West - two holes with high grades, including 101.0m of 0.53 g/t Au, 1.01% Cu, and 41.5 g/t Ag (1.71% Cu-eq) starting at surface.

David Kelley, president and CEO, commented, "The resource definition drilling portion of our current program is going exceptionally well with excellent results from the three discoveries at Soledad since the resumption of drilling in 2020. Huancarama and Paloma West continue to demonstrate their high-grade nature, and strong grades were also encountered at Paloma East. Mineralization in all three breccia pipes starts at surface and is open at depth. These results are another positive step toward our resource estimate due out later this year that will include multiple breccia pipes. To date, we have only tested 15 out of the 110 total targets on the property."

I spoke with David Kelley earlier this month about the results and the upcoming elections. You can listen to that here.

The stock has pulled back and was already undervalued relative to what I believe the maiden resource will demonstrate let alone what I believe to be on the property.

The company is below the buy-up-to price and presents an excellent entry point/average down point for those of you who are willing to hold it through the Peruvian presidential election.

Palamina Corp. (TSX-V: PA)(OTC: PLMNF)

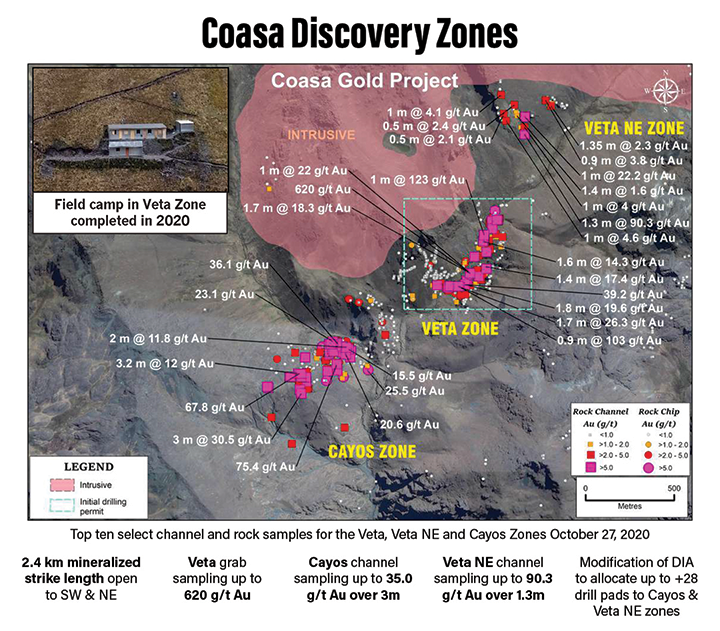

Palamina has been a frustrating hold because of delays in the company securing its drill permit for the Coasa gold project in Peru.

Covid and politics led to the delays. In fairness to the company it stayed active and put itself in position to take advantage of those permits once in hand.

On May 10, 2021, Palamina announced it has received its Authorization to Initiate Exploration Activities (“AIEA”) permit to commence drilling on its Coasa Gold Project in Peru.

In December of 2019, Palamina received its Declaración de Impacto Ambiental permit ("DIA"), which allows for up to 40 drill pads in the Veta Zone at Coasa. Palamina has spent over US$ 2M on exploration at Coasa including a heli-borne geophysical survey, structural, and geological mapping surveys and extensive surface sampling campaigns. Palamina has also constructed drill pads and an exploration field camp in the Veta zone.

“Palamina can now proceed with its maiden drill program at Coasa.” stated Andrew Thomson, president of Palamina, “The Company will conduct an initial 2,600 metre drill program to test eight mineralized gold structures in the Veta gold discovery zone. Palamina is one of a few pure gold junior exploration companies in Peru drill permitted with numerous orogenic gold target zones.”

Palamina has 45.3 million shares outstanding, 54 million fully-diluted. Shares trade at C$0.25 /US$0.21, giving Palamina a market cap of approximately C$11.3/US$9 million.

The company will need to raise money soon and will have no problems doing so.

Palamina participates in five gold projects in southeastern Peru in the Puno Orogenic Gold Belt (POGB).

Coasa is up first and Andrew Thomson believes it alone has the potential for a million-ounce-plus deposit.

Palamina is under the buy-up-to price and is a buy.

Hannan Metals (TSX-V: HAN)(OTC: HANNF)

A quiet month for Hannan though it did announce the initiation of baseline studies and permitting to undertake advanced exploration work, including diamond drilling, at its 100%-owned Tabalosos Copper-Silver Prospect at the San Martin Joint Venture Project in Peru.

Baseline studies for the DIA will take approximately three months to be completed and will involve up to 12 specialist consultants during May and June undertaking socio-economic and environmental baseline studies, environmental monitoring, archaeological investigations, community workshops, and liaison activities. Final DIA and other approvals are anticipated during early 2022.

That’s when I believe the real fireworks will start for Hannan as people realize the potential for multiple discoveries that comes with controlling an entire basin.

Michael Hudson, CEO, states, "Our detailed work over the last months finding high-grade copper and silver outcrop discoveries at Tabalosos has allowed for the next key step of permitting initial drill programs. We are very appreciative of the support shown by the local people in the area to allow this work to proceed, and will continue to work in an open and transparent manner for the benefit of all stakeholders."

Hannan is a buy under the buy-up-to price.

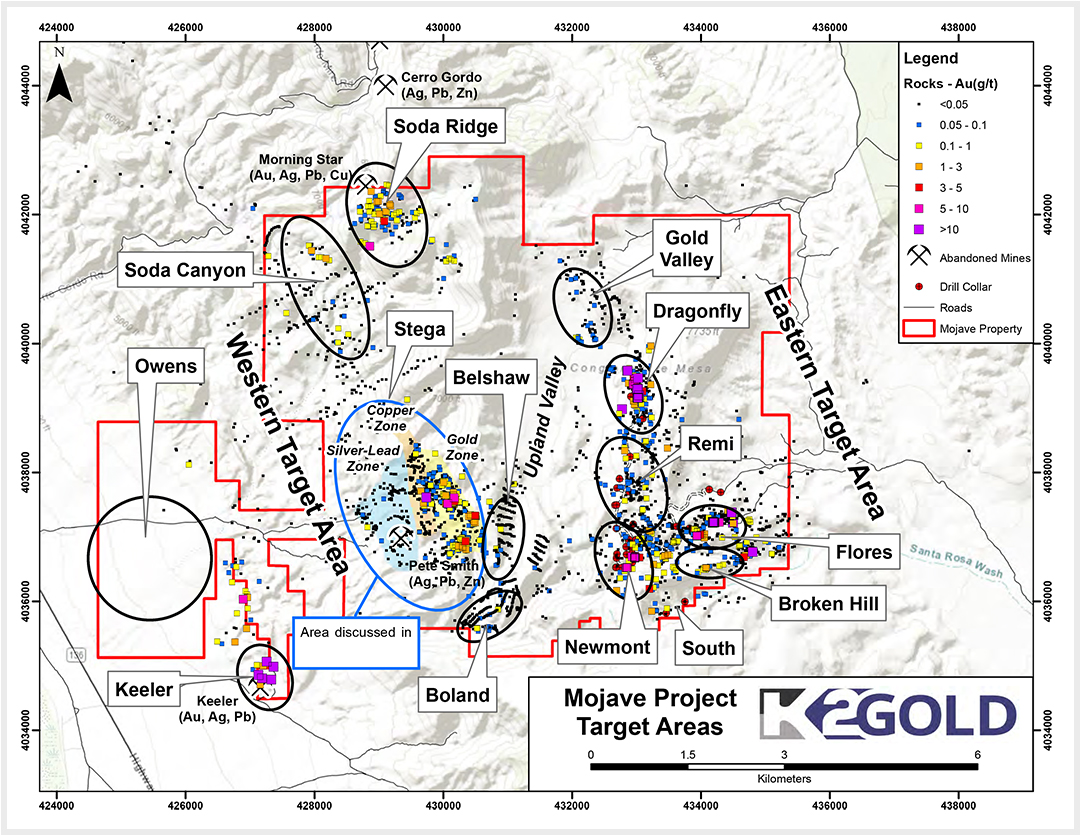

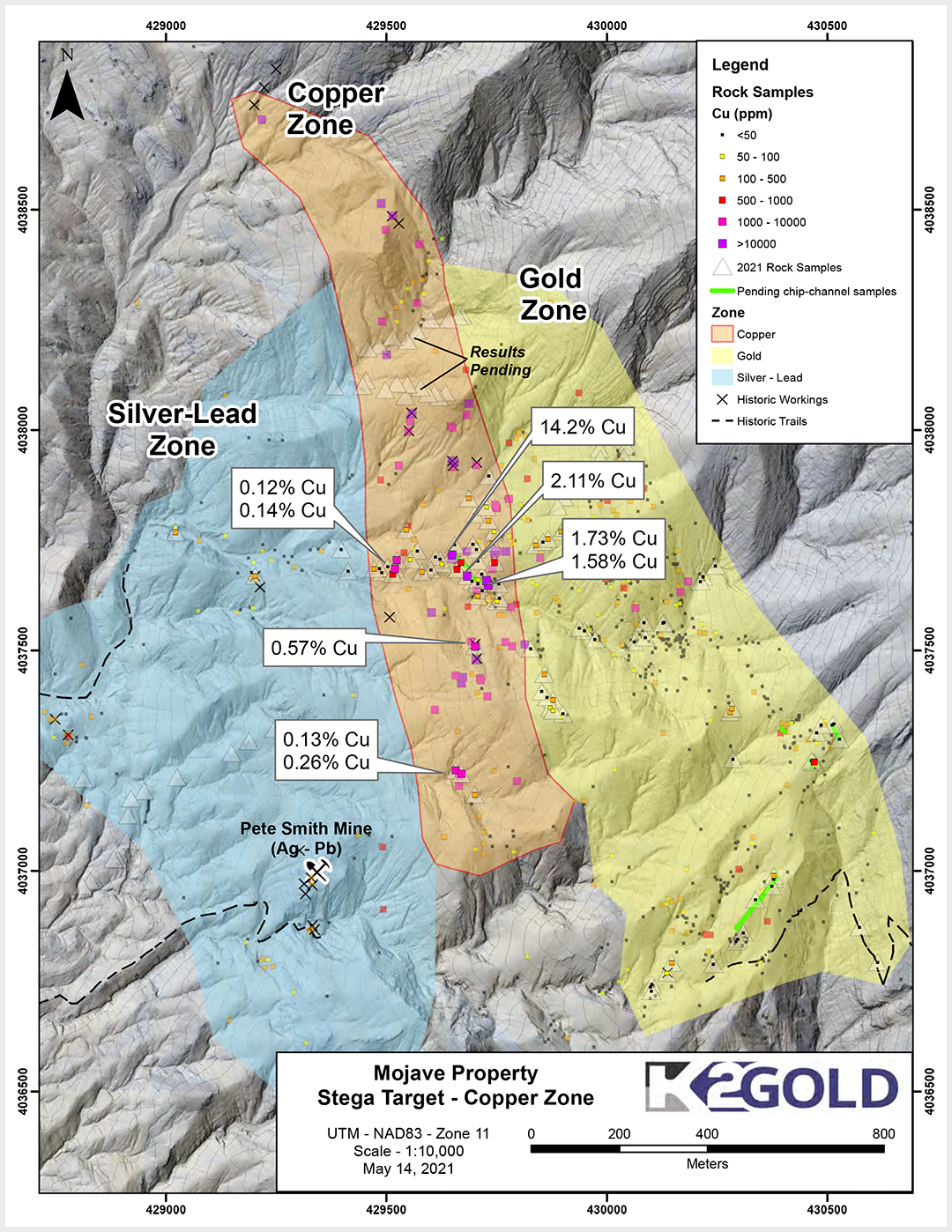

K2 GOLD (TSX-V: KTO)(OTC: KTGDF), with its Mojave project, was already an incredibly attractive gold speculation based just on the gold potential and abundance of quality targets.

That was before the recent announcement that K2 had discovered a significant zone of copper mineralization at the Stega target on the western side of the Company's Mojave project in Southern California.

K2 samples returned up to 14.2% copper with mineralization associated with locally anomalous gold and silver. The Stega Copper Zone is up to 250m in width, 1.8km in length, and is open to the N-NW.

I expect the drilling permit to be in hand by Q3-Q4 and then I expect everyone will regret not buying K2 at these levels.

I spoke with the VP of Exploration about the new copper discovery and the multiple gold targets at the Mojave gold project.

Patient speculators should be accumulating K2 Gold (TSX-V: KTO)(OTC: KTGDF) shares at these levels by placing a limit order in anticipation of drilling the gold and copper targets later this year.

I spoke with VP Exploration Jodie Gibson about the new discovery and the high-grade oxide gold potential at Mojave.

You can listen to that here.

The stock has a 52-week high of C$0.96. Shares currently trade at C$0.36/US$0.30, giving the company a paltry market cap of C$23 million.

Around $7 million of that market cap is backed by cash. Cash it will use to drill the better targets in this emerging gold, silver, copper, and base metals district.

K2 is a buy under the buy-up-to price.

Nomad Royalty (TSX: NSR)(OTC: NSRXF)

Nomad shares are up some 20% over the past month and just getting started.

In the interim, it's busy setting the table.

On May 10, 2021, the company announced Q1 results.

Results that included record revenues of C$9.7 million, gross profit of $2.9 million, cash operating margins of 82%, and a cash position as of March 25, 2021 of $25.3 million.

The company also completed the acquisition of the second tranche of the Blackwater Gold Royalty.

Vincent Metcalfe, CEO and chair of the Board of Directors of Nomad stated, "Our portfolio delivered a strong first quarter of gold and silver production and represents a great start to the year. Our focus ahead is on maintaining this positive momentum by delivering on our stated goal of delivering value through further deployment of capital in new opportunities across the globe, which coupled with the strong organic growth of our current portfolio will allow Nomad to continue to generate strong free cash flow and support further growth and returns to shareholders."

Nomad followed that up with news on May 13, 2021 that it has acquired a copper cash flowing royalty on the Caserones mine in Chile. Casarones is a new mine with long reserve life and significant exploration potential, located on a large land package of ~17,000 hectares with potential for future expansions.

The royalty consists of an effective 0.28% net smelter return royalty on the tenements comprising the Caserones mine, located on a land package of ~17,000 hectares.

I spoke with Nomad CEO Vincent Metcalfe about the business model, activity, and what to expect for the rest of the year. You can listen to that here.

Nomad is a buy under the buy-up-to price. It’s been there for a bit. That might not last.

Azucar Minerals (TSX-V: AMZ)(OTCQX: AXDDF)

Azucar Minerals is no longer dormant.

After what seemed like an eternity (due to COVID), a drill is once again turning at the El Cobre project in Veracruz, Mexico.

On May 18, 2021, Azucar announced that it has commenced a focused drill program at the El Cobre porphyry copper-gold project in Veracruz State, Mexico.

The project is an exciting one because the El Cobre project covers a 5 km trend of porphyry copper-gold associated alteration and mineralisation along which five separate zones have now been identified and explored in past drilling campaigns.

One zone, the Norte Zone alone has an indicated resource of 1.2 Moz AuEq (47.2 million tonnes grading 0.49 g/t Au, 0.21% Cu 1.4 g/t Ag) and an inferred resource of 1.4 Moz AuEq (64.2 million tonnes grading 0.42 g/t Au, 0.18% Cu and 1.3 g/t Ag).

The focus for the current drill program in 2021 will be in the Pedregal, Villa Rica, and Encinal Zones of the property. Initially one hole is planned for each area.

The Pedregal target is one of two prominent magnetic anomalies located north of the Norte Zone, neither of which has been drilled in the past. The Pedregal target is about 1.0 kilometer north of the Norte Zone.

I spoke with Azucar CEO Morgan Poliquin about the drill program and the resource in place.

You can listen to that here.

Ethos Gold (TSX-V: ECC)(OTCQB: ETHOF)

Ethos Gold has been on a shopping and financing spree the first two quarters of the year. With treasury topped off and multiple district-scale projects under its control, Ethos is finally in position to start testing some of these projects in what I believe will lead to an exciting second half of the year.

On May 20, 2021, Ethos appointed Alex Heath as new CEO. Craig Roberts will transition into the Chairman role.

Financings and corporate shuffle aside, Ethos will start by drill testing the fully-permitted Perk-Rocky copper-gold porphyry project in June.

That will be followed by a succession of drill programs that will provide significant newsflow for the remainder of the year.

Ethos has a current market cap of C$25 million. A discovery, or multiple discoveries, of merit will lead to a rapid re-rating of that market cap.

For those of you looking for exposure to a quality exploration play that will test multiple properties and is led by an accomplished technical team, Ethos checks all the boxes.

Shares are under the buy-up-to price. Get that done.

Gold Bull Resources (TSX-V: GBRC)(OTC: GBRCF)

On May 3, 2021, Gold Bull announced that visible gold has been observed in Reverse Circulation (RC) drill chips from two holes (SA-0016 from 105.2 m to 106.7 m (345’ to 350’) and SA-0018 from 53.3 m to 54.9 m (175’ to 180’)) at the North Hill South Prospect, located within its 100%-owned Sandman Project, Nevada.

I hesitate to buy on news like this but I’d rather have the visible gold than not.

We should know soon if that visible gold translates to good intercepts as assays are expected imminently.

I will buy on CEO Cherie Leeden’s ambitious and aggressive (fan of both) publicly stated goal of a 5-million-ounce gold resource by year-end.

I spoke with Cherie about the visible gold and the 5-million-ounce target. You can listen to that here.

Gold Bull has a C$25 million market cap. In the gold bull market that will make new all-time highs, Gold Bull’s market cap won’t be $25 million. If the company gets close to 5 million gold ounces by year-end the market cap will be in the triple digits.

Gold Bull is under the buy-up-to price and a buy at current levels.

Skyharbour Resources Ltd. (TSX-V: SYH )(OTCQB: SYHBF )

Skyharbour Resources continues to position itself well to take full advantage of what will be a historic bull market.

On May 10, 2021, Skyharbour announced that mobilization has begun for its 2021 diamond drilling program at its flagship 35,705-hectare Moore Uranium Project.

The company has now completed a 9 km Small Moving Loop EM (SML-EM) geophysical program to refine additional drill targets and has begun mobilization of drilling equipment for a subsequent minimum 3,500-metre diamond drilling program consisting of at least 7-8 drill holes.

This fully funded and permitted program will focus on following up on existing unconformity and basement-hosted targets along the high-grade Maverick structural corridor as well as newly defined targets at the Grid Nineteen area.

Jordan Trimble, president and CEO of Skyharbour Resources, states, “With the geophysical results now in hand and final drill targets picked, we are excited to embark on another aggressive drill program at Moore. We have been very pleased with the results to date at the Maverick East Zone and believe we have just scratched the surface in our endeavour to delineate high grade zones of mineralization at depth in the underlying basement rocks. The uranium mineralization identified during previous drill programs illustrates the strong discovery potential at Moore and recent geophysical programs and geological modeling have enabled the Company to develop new regional drill targets in areas such as Grid Nineteen. Skyharbour is well funded with over CAD $9 million in cash and stock to continue advancing its flagship Moore Project. The uranium market has shown notable signs of recovery with increasing equity valuations and improving sentiment, and this recovery appears to be accelerating.”

I spoke with Jordan Trimble — one of the most informed voices in the uranium space — about Skyharbour and the young uranium bull.

You can listen to that here.

Skyharbour is a buy under the buy-up-to price.

Perpetua Resources (NASDAQ: PPTA)(TSX: PPTA)

Perpetua (formerly Midas Gold) has a 52-week high of C$20.20/US$15.50 and is currently trading 50% below those levels as the company moves closer to obtaining its mining permit for its world-class gold-antimony Stibnite project.

The gold resource, grade, exploration upside is world-class but many often overlook the antimony aspect of the project.

On May 3, 2021, the company reminded the market about the strategic significance when it announced a collaboration agreement with United States Antimony Corporation (NYSE: UAMY) to study the potential for processing the Stibnite Gold Project’s antimony concentrate at USAC’s processing facilities.

Perpetua Resources is in the process of permitting America’s only mined source of antimony. It is estimated the Stibnite Gold Project has the potential to supply approximately 35% of American antimony demand in the first six years of production.

The Agreement outlines a plan for the Company to send samples of Stibnite’s antimony concentrate to the facilities owned by USAC to study the viability of entering into a long-term partnership to secure the domestic sourcing of the critical mineral antimony.

The Stibnite Gold Project, along with USAC’s domestic processing abilities, presents an opportunity to re-establish the American supply chain of this critical mineral. China, Russia, and Tajikistan control the overwhelming majority of the world’s antimony, supplying more than 90% of the global production.

I’ve highlighted the strategic importance of the antimony for years and remain convinced that the antimony will benefit Perpetua’s permit decision.

Shares have pulled back. Perpetua (Midas) is a core company in the portfolio, meaning it’s one that should be in everyone’s portfolio, especially at current levels.

I expect a favorable permitting decision (what could go wrong? (Remember Almaden and Abacus) in Q3/Q4. If that’s the case, shares will be much, much higher.

Speaking of critical metals, let’s talk about Leading Edge Materials.

Leading Edge Materials (TSX-V: LEM)(OTCQB: LEMIF)

On May 5, 2021, the company announced that its mining lease application had been denied.

The announcement, had anyone read the release in detail, had zero material effect as it was based on a dated (2013) mining plan that Leading Edge has already been busy updating.

The updated technical study will form the basis for the application of a mining lease.

Shares have recovered from the initial sell-off though well off 52-week highs. There are two major catalysts in the near-term that may get shares there.

Economic studies on both Norra Karr and the Woxna graphite project are due within the next month. The European Union needs the rare earths and the graphite that Leading Edge has.

I’ll save you my take. I reached out to CFO Filip Kozlowski, who was gracious enough to take the call at midnight, from a freezing car.

You can and should listen to that by clicking here.

Leading Edge is a buy at current levels.

Millrock Resources Inc. (TSX-V: MRO)(OTCQB: MLRKF)

Smoke but no fire yet. That’s what we’ve seen from the 64North gold project in Alaska.

On May 18, 2021, Millrock announced that thick intervals of intrusion-hosted gold mineralization have been intersected at the Sunrise prospect, 64North gold project.

In total, Resolution drilled 27 holes along a fence 1,400 meters in length. The style of mineralization is similar to that observed at the Fort Knox gold mine operated by Kinross near Fairbanks, Alaska. Drilling detected gold over a 280-meter-wide corridor which is open at depth and to the north and south.

Better intercepts included 36.6 meters at 0.33g/t gold from surface and 74.7 meters at 0.26g/t gold.

Of the 27 holes drilled, nine holes intersected gold mineralization grading above a cut-off grade of 0.1 g/t gold over significant intervals. The drill results indicate a mineralized corridor 280 meters in length.

No beating around the bush, those grades won’t cut it and the JV partners know it.

Resolution is also planning a 2,000-meter reverse circulation helicopter-supported drilling program on the East Pogo Prospect. The drilling is scheduled to commence in early June. High-grade gold mineralization identified last year during surface work is to be targeted.

Millrock is a hold at current levels.

Probe Metals (TSX-V: PRB)(OTCQB: PROBF)

Probe will be bought out at a premium sooner or later. There’s a reason it continues to hover near 52-week highs while most gold juniors wait for the next leg up in the gold space.

On May 4, 2021, Probe announced it continues to intersect high-grade gold at its 100%-owned Val-d’Or East Monique property.

M Zone expansion drilling returned 5.3 g/t Au over 18.7 meters, 4.5 g/t Au over 13.6 meters and 3.8 g/t over 4.0 meters, located 750 meters southeast of the Former Monique open pit mine, between surface and 275 metres vertical depth.

B Zone infill drilling returned 4.8 g/t Au over 19.1 meters, 9.6 g/t Au over 5.7 meters and 2.1 g/t over 8.0 meters, located 700 meters southeast of the Former Monique open pit, between surface and 275 meters vertical depth.

Two drills remain active on the Monique property 30,000-meter drill program. 15,000 meters have been completed to date.

Outside of the company continuing to hit high-grade gold everywhere, the next major catalyst is an updated resource estimate from the 2020 drill program which is expected in Q2-2021.

A PEA is also expected in Q3-2021, providing plenty of newsflow over the coming months.

David Palmer, president and CEO of Probe, states, “Monique has been a standout performer over the past year with continuously improving gold grades, widths and continuity and has become one of the cornerstone assets of the Val-d’Or East project. Thick zones of high-grade gold mineralization, excellent metallurgical recoveries with above average gravity returns are just some of the reasons we have accelerated our work on this property. As we begin to advance the project into development Monique will be a leading contributor to its growth and value.”

We’re up over 50% on Probe. The company is a buy under the buy-up-to price.

Last but not least, one of the better values in the entire gold space right now.

Revival Gold (TSX-V: RVG)(OTC: RVLGF)

On May 25, 2021, Revival announced that drilling has resumed on the high-grade Joss target at the Company’s Beartrack-Arnett Gold Project.

Drilling will focus on continuing to define and expand on the one-kilometer trend of high-grade gold mineralization with underground mining potential.

I spoke with friend, financier, and one of the smartest and connected contrarian voices in the junior space, Jeff Phillips, who went over why he likes Revival.

You can and should read that by clicking here.

I also caught up with Revival CEO Hugh Agro, who has been buying his own stock and now owns approximately 4 million shares at last count.

We talked about the value proposition, the drill program and the opportunity at Revival. You can listen to that by clicking here.

Closing Thoughts

Nearly 6,000 words later I think it’s apparent that JRM companies are busy.

Abacus should have drill results from the Jersey Valley gold project (where my bar is low) and should be drilling the Willow copper-gold property (where my bar is high) within the next month or two.

Mawson Gold — which is a bargain at current levels — which had a quiet month newsflow-wise, should have assays any day now.

Every other company in the portfolio is drilling or will be soon. Which means some won’t work, which will translate into a few sell calls to make room for new names.

The consolidation in the gold space has provided excellent entry points on several companies I’ve had my eye on for some time.

The criteria will be relatively straightforward. I’m looking for companies with an established resource base, aggressive drill programs, and the treasury to execute them.

I’m also looking for companies trading well off 52-week highs.

Gold, copper, and lithium companies are all being looked at.

Until then, while Probe, Western Copper & Gold, and most of the uranium names hover near 2021 highs, companies like Magna Gold, Chakana Copper, Revival Gold, and Nomad remain well off their respective highs and are worthy of new capital.

Though I’ve helped finance several companies recently, I’ve also turned several down because of the value that the companies I mentioned present.

You should be doing the same thing. By year-end we’ll see new highs in the major U.S. indices, gold, etc., and you’ll look back and wonder why you didn’t take advantage of the weakness.

We’re getting closer to launching the premium site (1-2 months) and I can’t thank you enough for your patience as we work hard to get that right.

I am also working on a related venture that I’ll be sharing with you soon.

Go outside, do something nice for someone and yourself, and keep an eye on your inbox.

Let's get it!

Gerardo Del Real

Gerardo Del Real

Editor, Junior Resource Monthly

For the past decade, Gerardo Del Real has worked behind-the-scenes providing research, due diligence and advice to large institutional players, fund managers, newsletter writers and some of the most active high net worth investors in the resource space. Now, he is bringing his extensive experience to the public through Resource Stock Digest, Junior Resource Monthly, and Junior Resource Trader. For more about Gerardo, check out his editor page.

*Follow Gerardo on Twitter.

Make sure you never miss an update or issue from Junior Resource Monthly by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Junior Resource Monthly, Copyright © 2021, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Junior Resource Monthly does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.