Junior Resource Monthly June 2021

PREMIUM CONTENT FOR PAID MEMBERS ONLY

by Gerardo Del Real

by Gerardo Del RealIn This Issue:

All assets are going to the moon and the moon is becoming a very busy place. That’s a quote from Sven Henrich and I found it an appropriate description of current monetary policy and its unintended — or intended — consequence.

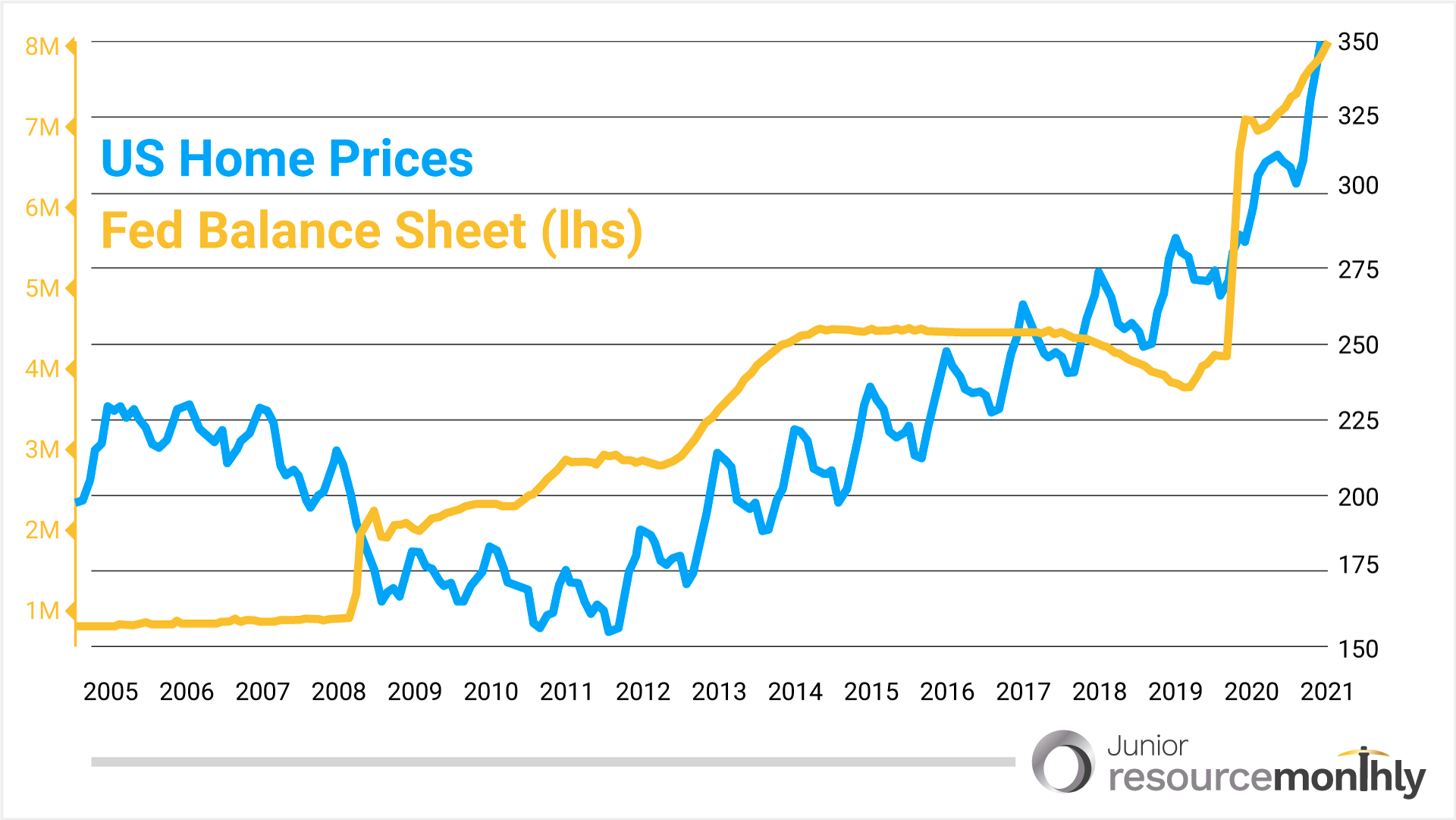

U.S. existing home prices just hit another all-time high and, what a coincidence, so has the Fed balance sheet.

Despite all evidence to the contrary, the Fed continues to insist that inflation is transitory and that Fed policies do not add to inequality.

Here’s a fun fact. Since the lows in March the net worth of the top 10% has increased by nearly $20 trillion. The net worth of the bottom 50% has increased by $0.7 trillion.

Here’s another fun fact. Sales for homes priced over $1 million have increased by 245% over the past year. Sales for homes priced under $100,000 have contracted 11%.

Despite the Fed now admitting that inflation will now last longer than initially anticipated (6-9 months instead of 2-3) gold saw itself take a steep drop to the $1,763 level and has since traded right back near the $1,800 level as reality sets in that the Fed really won’t be doing much of anything other than printing more money and sending more asset classes to the moon.

The May core personal consumption expenditures price index, rose 3.4% from a year ago, the fastest increase since the early 1990s.

The bottom line is the Fed will continue to ignore inflation and insist it is transitory. It may have the cover to do so because companies simply haven’t been able to fill positions.

Why Aren’t People Going Back to Work?

April saw job openings in the U.S. soar to 9.3 million million jobs.

A new record for the most openings added in a month.

That’s also the highest overall number since the Bureau of Labor Statistics started tracking the data in December 2000.

Noticing a lot of new highs recently? Stock market, job openings, record amounts paid for collectibles that include boxes filled with air. Everything is awesome.

Despite the openings, just 6.1 million people returned to work in April, leaving companies scrambling for help and having to readjust compensation packages.

Here in Austin — where we’ve been open for months — one of my favorite restaurants won’t open for another month as they simply can’t find enough staff to cover every shift.

American Airlines recently canceled over 100 flights out of Austin because there wasn’t enough staff to get the planes to and from where they needed to go.

People have pointed to unemployment benefits as a primary reason for the lack of urgency to get back to work.

Others have cited concerns over COVID as many have still not — and may not be — vaccinated.

Whatever the case, unemployment benefits will soon start to expire, employers will soon start requiring people to get back to the office.

We’ll then start getting real employment numbers, real personal savings numbers, and a more accurate reflection of the health of the economy. It should be interesting, to say the least.

In other commodity news, the surge in lithium prices that started in November continues to accelerate. When the lithium price moves it tends to do so in a pretty dramatic fashion (to the downside and upside). Right now we are in an upward price surge that I don’t see any signs of slowing down until at least 2023/2024.

On the copper front, the recent pullback in the spot price to a still very healthy $4.20/lb is just that, a pullback. Global consumption of copper currently stands at approximately 30 million tonnes.

By the year 2050, Glencore’s CEO believes production will have to double to meet demand.

It’s much easier to allocate capital when you have mega trends behind you.

There’s alot going on so let’s get to portfolio news.

Portfolio News

Despite a healthy pullback in the copper price, several JRM portfolio companies continue to outperform.

Let’s start with Kutcho Copper.

Kutcho Copper (TSXV: KC)(OTC: KCCFF)

On June 15, 2021 Kutcho Copper announced it completed a non-brokered private placement for total gross proceeds of $4.1 million.

Adding to the treasury is a wise move by CEO Vince Sorace and Kutcho but the real news is actually in the second paragraph of the release.

“This financing was led by a strategic investor with proceeds targeting continued advancement of the Kutcho copper-zinc project and for additional initiatives the Company is currently pursuing in order to optimize the value of the project,” stated Vince Sorace, President and CEO of Kutcho Copper Corp. “We expect to provide updates with regards to continued developments around the feasibility study in the near future.”

I’ll speculate that the strategic investor is looking forward to writing a much bigger check that allows Kutcho the flexibility — along with its partner Wheaton Precious Metals — to pursue the financing package required to get the project built.

I also believe the recent financing will allow Kutcho to start testing some of the very prospective targets on the property.

VMS deposits do not tend to occur in isolation. I spoke with CEO Vince Sorace about the financing, where it’s going, the feasibility study, and what’s next.

You can listen to that here.

The stock is near 52-week highs. You’ve had months to buy at much lower prices. The stock is a buy and I’m increasing the buy-up-to price to C$0.60/US$0.50.

Leading Edge Materials (TSX-V: LEM)(OTCQB: LEMIF)

One of the most overlooked — and admittedly frustrating — stocks in the entire portfolio is Leading Edge Materials.

On June 9, 2021, the company announced positive preliminary economic assessment results for its Woxna graphite anode project with US$317/US$248 million pre/post-tax NPV and 42.9%/37.4% pre/post-tax IRR.

On June 21, 2021 the company announced preliminary life cycle assessment results on the Woxna Graphite project demonstrating a potential 90% lower carbon footprint compared with currently dominating Chinese supply alternatives.

Up next is news from the world-class Norra Karr rare earth project. The project is a very consequential rare earth project for Europe if it wishes to act on its stated goals of an independent rare earth supply chain.

The EU Action Plan on Critical Raw Materials wants to work together on identifying critical raw material and rare earths mining, processing, and waste projects that can be operational by 2025.

There are no better options I know of other than Norra Karr.

That’s especially true after last week’s announcement that Volvo's forming a joint venture with a Swedish company (where Norra Karr is) called Northvolt.

Its purpose is to produce more sustainable batteries that will power the next generation of electric Volvos.

The companies will work together to establish a new European battery production facility by 2026 that could have a capacity of up to 50 gigawatt-hours.

I’m a simple guy with a simple question, where will the graphite and rare earths come from?

I caught up with CEO Filip Kozlowski on all the recent developments.

You can and should listen to that by clicking here.

Leading Edge is a buy under the buy-up-to price of C$0.35/US$0.29.

Abacus Mining & Exploration (TSX-V: AME)(OTC: ABCFF)

On June 3, 2021, Abacus Mining announced results from the recently completed three-hole drilling program on the Jersey Valley epithermal gold property.

Short version is the company found smoke but no fire.

The drill bit intercepted similar gold and silver values to historical drilling, with the targets tested further along strike and at slightly greater depth.

The best results were a 12.64 meter interval of 0.053 g/t gold and 0.73 g/t silver, including 1.09 g/t silver over 7.55 meters and 0.19 g/t gold and 3.62 g/t silver over 1.5 meters.

The results are not what I hoped — we always want a discovery — but in line with expectations for a first pass program.

I have higher expectations for the Willow copper-gold project in Nevada where drilling should be starting any day now.

The Company plans to drill four vertical holes, each to a depth of 600 meters. The holes will be approximately 200-300 meter step outs from past drilling by the company in 2018.

Based on work done by Abacus the target is at least 1.5 km x 1.5 km in size, the Willow porphyry remains essentially untested, and the porphyry center has not yet been identified.

The Yerington camp contains four known porphyry copper-molybdenum (Cu-Mo) deposits, and Abacus’s work points to the existence of a fifth porphyry on Willow, the first major discovery in the camp in over 40 years.

All four known copper porphyries are associated with a particular intrusive rock known as the Luhr Hill Granite. The same granite the company intersected in 2017.

There are no known instances of this granite in the camp without an associated porphyry. The company also intersected elevated levels of molybdenum, which is a strong indicator that you are close to a porphyry copper center.

Abacus has the right to earn a 75% ownership interest in the Willow property from another JRM portfolio company, Almadex Minerals.

Almadex MInerals (TSX-V: DEX)(OTC: AAMMF)

Almadex Minerals finally provided the market an update on its severely undervalued exploration and royalty portfolio.

On June 14, 2021, the company provided a thorough update on the litany of activity its portfolio will see over the coming weeks and months.

The company owns a 2.0% NSR royalty on the Elk project, located near Merritt, B.C. owned by Gold Mountain Minerals (TSX-V: GMTN).

On June 8, 2021, Gold Mountain announced that the Ministry of Energy, Mines & Low Carbon Innovation Communications Office had released GMTN’s draft Mine Permit for review.

Once the final Mine Permit is issued, GMTN anticipates beginning its large-scale waste rock mining operations through July and August. This will allow Gold Mountain to mine the high-grade 1300 vein for ore delivery in October to its ore purchase partner, New Gold Inc.

That will allow Almadex to start seeing consistent cash-flow from the Elk project.

Almadex will benefit from drilling at Willow, production from Elk, partner funded drilling at multiple projects across its portfolio, and it also has a royalty on both Ixtaca and El Cobre, each with robust resources already in place and additional exploration upside.

Almadex is a strong buy at current levels.

Another strong buy at current levels and another company with drills turning is Revival Gold.

Revival Gold (TSX-V: RVG)(OTCQX: RVLGF)

On June 3, 2021, Revival announced the commencement of the company’s planned 2021 metallurgical and environmental test work program with SGS Lakefield.

Approximately three tonnes of sample material have been selected and shipped to SGS Lakefield.

Results will be used to establish recovery parameters for a Pre-Feasibility Study (“PFS”), which is scheduled to be completed by Wood.

“To follow-up on last year’s successful PEA, this test work will provide critical technical input for the next steps in assessing the potential restart of heap leach gold production from existing infrastructure at Beartrack-Arnett,” said Hugh Agro, President & CEO. “We are at an exciting stage of the project definition as this metallurgical testwork, together with Revival Gold’s 2021 drilling plans, will set the foundation for a mineral resource update in early 2022, a PFS and potentially, a decision to proceed with the first phase restart of gold production at Beartrack-Arnett in late 2022.”

Revival is drilling, has over 3 million gold ounces, excellent exploration upside, and the attention of several mid-tiers.

Shares of Revival Gold are a steal at current levels.

Ethos Gold Corp. (TSXV: ECC)(OTCQB: ETHOF)

I’ve told you for months that Ethos Gold was positioned to have one of the better and most active second halves of any junior in the space. That was 75% ago.

The market is finally starting to catch up.

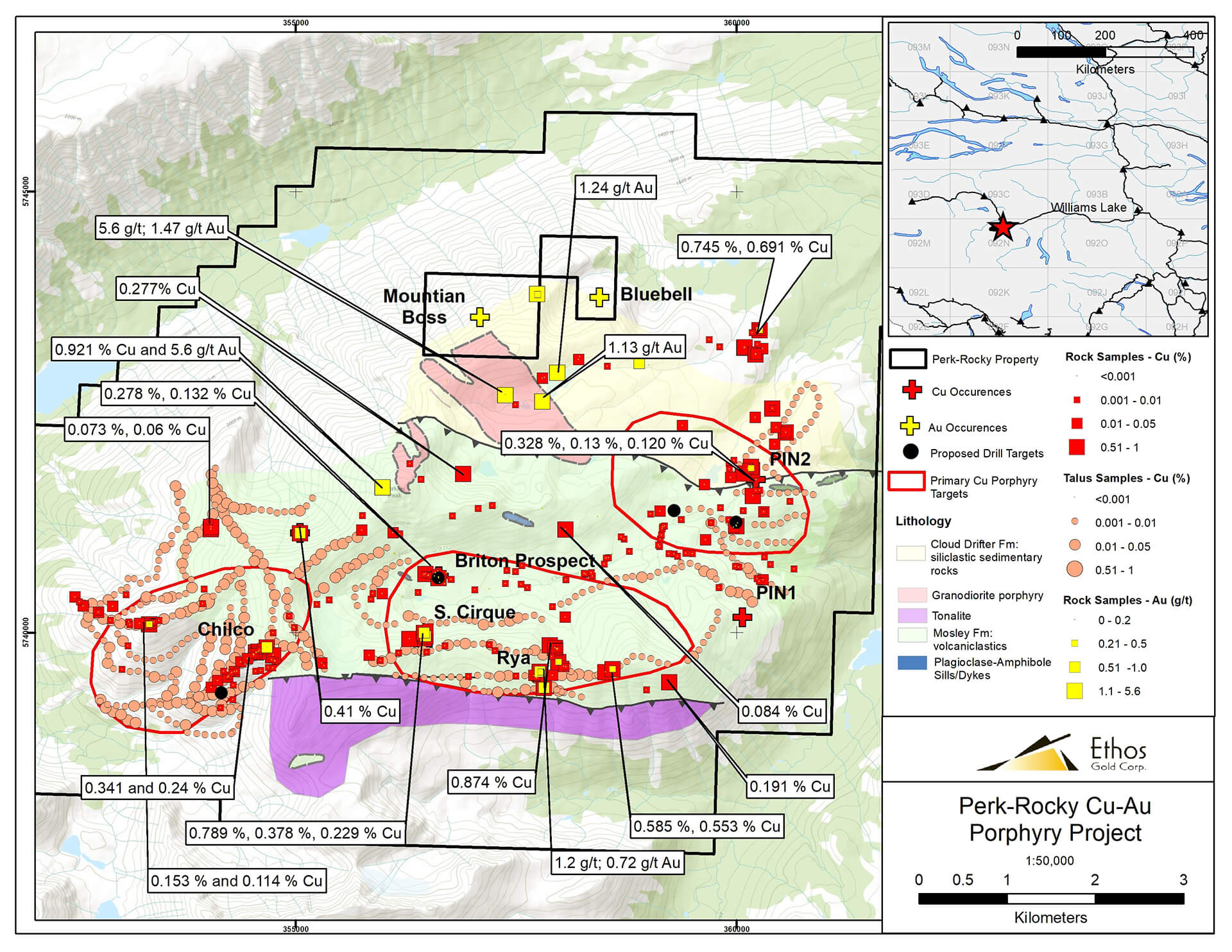

On June 2, 2021, Ethos announced the commencement of the company's first drilling program at the Perk-Rocky Copper-Gold Porphyry Project.

Perk-Rocky (100% earn-in) is a large copper-gold porphyry target located in BC within a major copper deposit trend including Highland Valley (Teck), New Afton (New Gold Inc.), Yalakom (Barrick), and New Prosperity (Taseko Mines Ltd.).

The 100% earn-in is important because a discovery there will send Ethos much higher.

Perk-Rocky is one of the few remaining road-accessible, metal-endowed magmatic-hydrothermal systems in British Columbia that has never been drill tested.

The project exhibits extensive copper-gold mineralization over an 8km x 5km area with indications of multiple porphyry centers on the property.

The technical team is one of the best in the space and is led by Rob Carpenter, who has several significant discoveries under his belt.

Alex Heath, CFA., President and CEO stated, “Perk-Rocky represents one of the best undrilled copper-gold porphyry targets in BC. Our technical team has identified multiple potential porphyry centers, which will be the initial targets in this maiden drilling campaign. We are excited to begin drilling and moving Perk-Rocky forward.”

Dr. Alan Wainwright, technical advisor to Ethos, added, “Porphyry deposits often occur in clusters and we have evaluated the rocks with robust field and analytical campaigns in order to vector to the priority target areas. We look forward to drill testing for porphyry copper centers driving the extensive alteration footprint at Perk-Rocky.”

Exploration is always high risk/high reward but in the case of Perk-Rocky I believe them and can’t wait for assays.

I spoke with new CEO Alex Heath about Perk-Rocky. You can listen to that here.

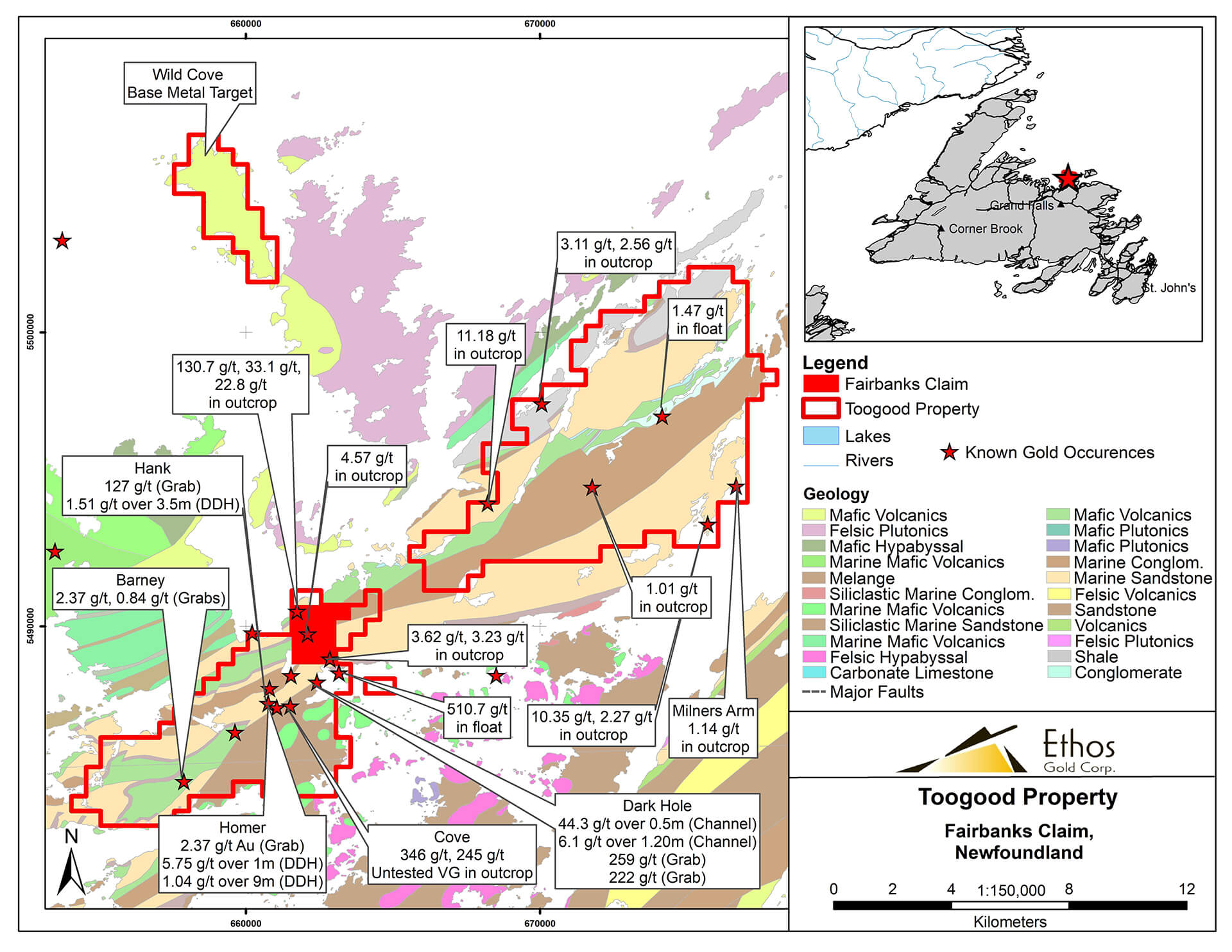

It’s important to note that Ethos has put together five district-scale gold projects and one of the most underappreciated aspects of its portfolio is its 118-square-kilometer land package in Newfoundland.

On June 16, 2021, the company announced it added 3.25 square km to its land position at the Toogood Project.

The Toogood Project covers 28 km x 8 km of prospective geology hosting numerous gold occurrences on New World Island. Both coarse and fine gold mineralization are present in quartz and sulfide veining and stockwork fracturing of conglomerates and sandstones.

At least nine occurrences with visible gold in bedrock over a structural corridor of more than 5 km occur on the southwest section of the property adjacent to the Fairbanks claim.

Alex Heath, CFA., President and CEO, stated, “The addition of the Fairbanks claim is strategic, as it not only increases our overall land position at our Toogood project, but also provides Ethos with a contiguous land position near an area with numerous outcrops of visible gold within quartz veins. It also comes at an opportune time, as we finalize our exploration plans for our inaugural field season in Newfoundland.”

Toogood will be next to see the drill bit.

I also spoke with CEO Alex Heath about the Toogood project and news it has engaged Goldspot Discoveries and its AI exploration technology to develop and refine targets at the Toogood Project.

The same Goldspot that did the same thing with New Found Gold which has had one of the best runs this year on the back of spectacular results in Newfoundland.

You can listen to that interview here.

I’m increasing the buy-up-to price to C$0.30/US$0.25, though all but newer subscribers should've already bought shares at lower prices.

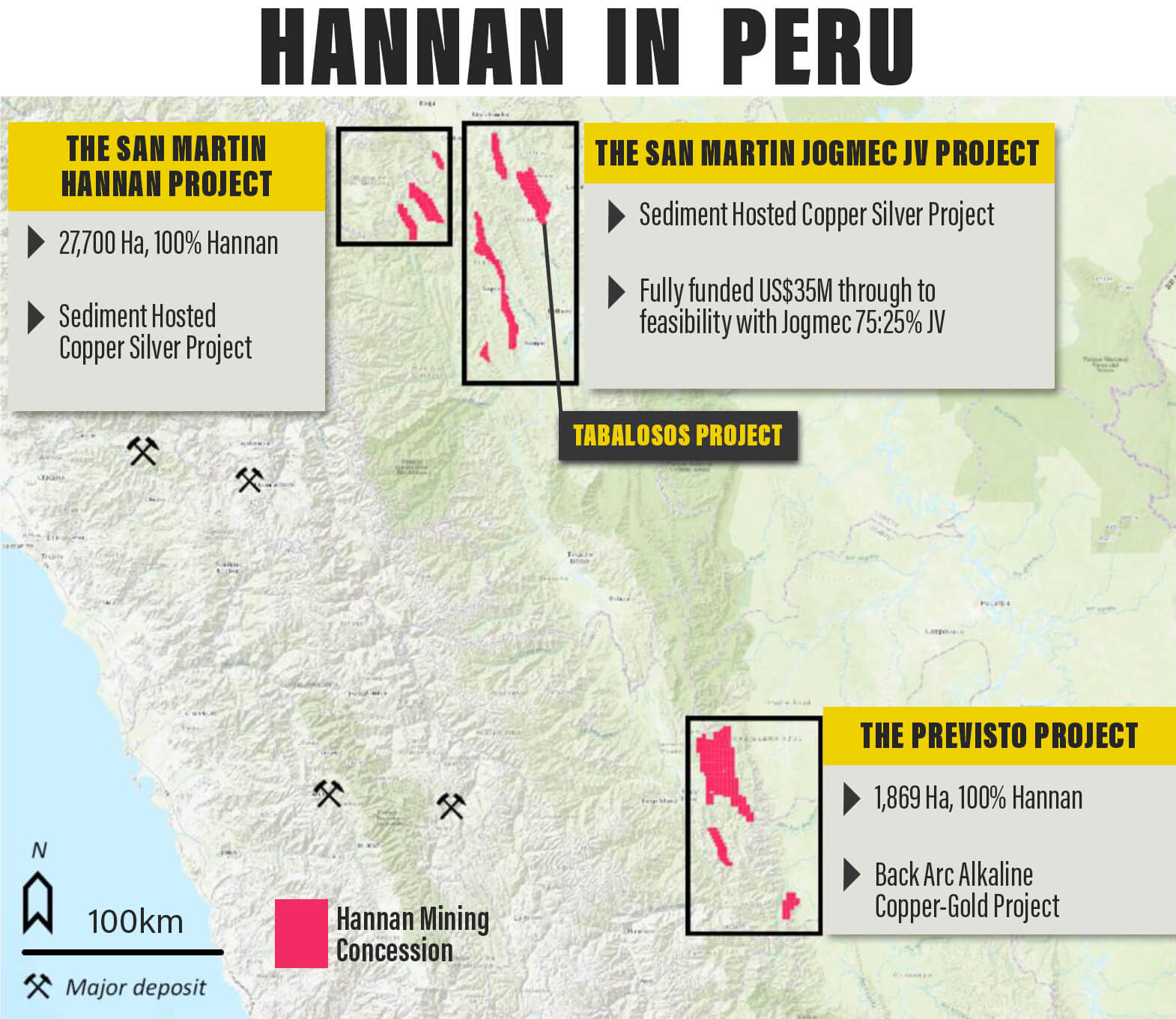

Hannan Metals (TSX-V: HAN)(OTC: HANNF)

Hannan Metals had some news on June 17, 2021 that I don’t believe the market fully appreciates. Like I told you about Kutcho when it traded at the C$0.20 level, it will.

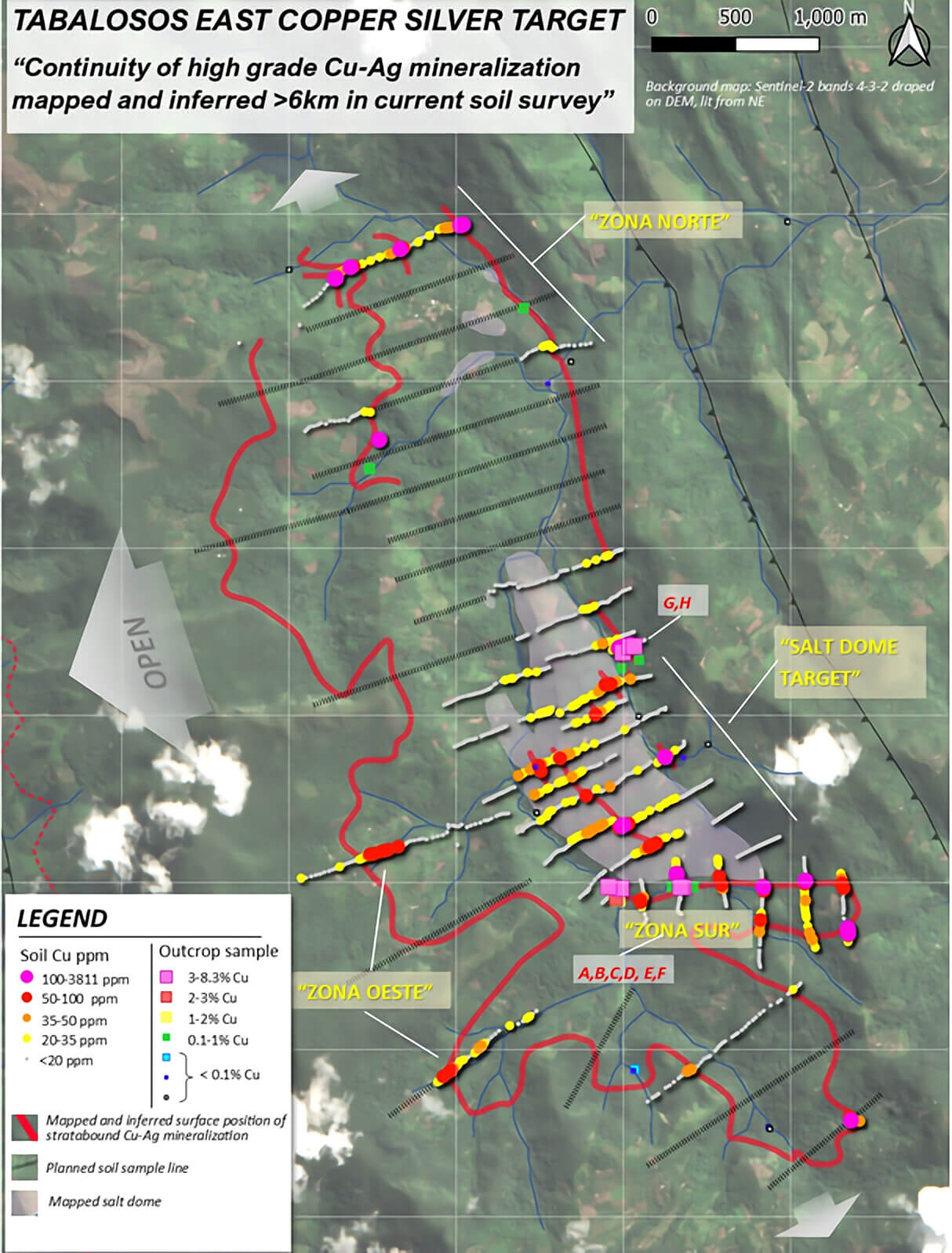

Hannan reported results from a soil geochemical sampling program from the Tabalosos East prospect within the San Martin JOGMEC JV sediment-hosted copper-silver project in Peru.

Scale, continuity, and grade have always been the three boxes Hannan needed to check in order to really be on to what could be a company maker/makers.

Overview of soil sampling at Tabalosos East. Approximately 50% of the survey is completed to date. The correlation between known sites of Cu-Ag mineralization and soil anomalies is excellent. Key results from outcrop sampling: A: 1.8m @ 3.7% Cu and 42 g/t Ag* incl. 1.2m @ 5.4% Cu and 62 g/t Ag / B: 2.2m @ 2.4% Cu and 29 g/t Ag inclu. 0.7m @ 5.9% Cu and 70 g/t Ag / C: 4m @ 7.2% Cu and 163 g/t Ag* / D: 0.4m @ 6.3% Cu and 152 g/t Ag* / E: 1.1m @ 1/6% Cu and 28 g/t Ag / F: 0.5m @ 2.0% Cu and 35 g/t Ag /. G: 2m @ 4.9% Cu and 62 g/t / H: 1.3m @ 1.5% Cu and 18 g/t Ag. * Partially sampled.

The release demonstrated scale and continuity of copper-silver mineralization over 18 kilometers of combined strike, within a 6 kilometer x 2 kilometer area. That's a massive area.

The soil survey confirms continuity of previously reported high-grade copper mineralization at Tabalosos East which included outcrop mineralization of up to 2.0m @ 4.9% copper and 62 g/t silver.

It is estimated that ⟨1% of the bedrock outcrops.

A total of 1,211 soil samples have been taken with approximately 50% of the survey completed. Sampling will be ongoing for another two months.

Michael Hudson, CEO, states, “These results demonstrate the scale of the Company's multi-kilometre long copper-silver anomalies at the Tabalosos East prospect and coincide with, and expand upon, areas of known mineralization in outcrop. Encouragingly, these data confirm the continuity of mineralization at the same stratigraphic position and outline 18 kilometres of subcropping mineralization at Tabalosos East. Our sediment-hosted San Martin copper-silver project continues to develop into a major copper-silver system of scale for Peru.”

Keep in mind that this release only covers the portion of the San Martin project that JOCMEC can earn up to 75% of in exchange for US$35 million in total expenditures.

I say the projects could be company makers because the entire basin is ripe for exploration.

The San Martin JOGMEC JV Project

- Fully funded Option and Joint Venture Agreement with Japan Oil, Gas and Metals National Corporation (“JOGMEC”). JOGMEC has the option to earn up to a 755 beneficial interest in the San Martin Project by spending up to US$35,000,000 to deliver to the joint venture (“JV”) a feasibility study. 87 mineral concessions for a total of 660 sp kms.

-

On a basin scale, the project exhibits district wide mineralization hosted in reduced sedimentary rocks covering at least 120 kilometers of strike and 50 kilometers.

The San Martin Hannan Project

- Sediment hosted copper silver project (same as the JOGMEC JV project) but 100% owned by Hannan.

The Previsto Project

- Back arc alkaline porphyry project. Initial results have outlined well defined targets with copper and gold mineralization in boulders and coincident sediment anomalies.

-

100% owned by Hannan.

I spoke with CEO Michael Hudson about the recent results and why they are a technical game changer.

You can and should listen to that here.

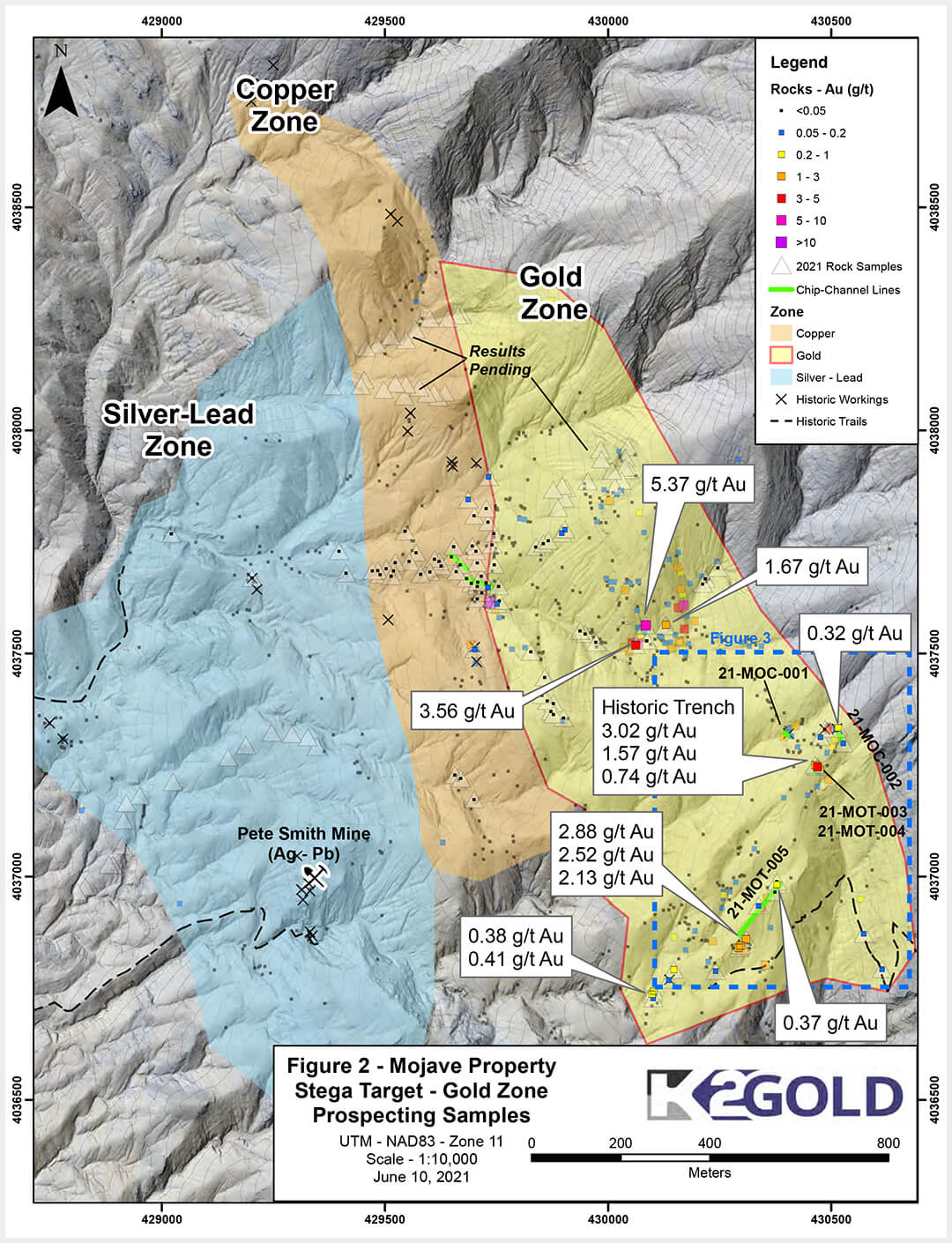

K2 Gold (TSX-V: KTO)(OTCQB: KTGDF) is a great opportunity at these levels and will be back on everyone’s radar with an aggressive drill program once it receives its drill permit in Q3/Q4.

In the meantime, it’s using its time efficiently and finding more gold — and now copper — all over.

On June 14, 2021, the company announced that it has successfully expanded the gold mineralization footprint at the Stega Target on the western side of the Company's Mojave project in Southern California.

Recent sampling expands the gold zone at the Stega target to an area of 800m x 1,800m.

There’s gold, and now copper targets all over the property. You will not be able to buy K2 at these prices for long like Ethos, like Kutcho a few months ago.

K2 is well below the buy-up-to price. Use the weakness to your advantage.

Mawson Gold (TSX:MAW)(OTC PINK:MWSNF)

Mawson has quietly been working through an institutional holder bleeding shares and while the pullback hasn’t been fun — though some of that is also due to the consolidation in the gold price — the good news is that liquidation should be near its end.

Meanwhile Mawson is busy drilling and advancing multiple gold projects in both Australia and Finland.

On June 21, 2021, Mawson announced co-funding of battery metal geometallurgical support by Business Finland for €397k (CAD$590k) as part of a 50% co-funding of €795k (CAD$1.2M) for the Finland-based Circular Ecosystem of Battery Metals ("BATCircle2.0").

BATCircle2.0 is funded by Business Finland in cooperation with Mawson Oy (Mawson's 100%-owned Finnish subsidiary), the Geological Survey of Finland (GTK), and Aalto University.

The work will help highlight how important the cobalt aspect is to the Rajapalot gold-cobalt project. Not just for its economic contribution but for its strategic value. Value Mawson will be able to continue to benefit from and leverage during the permitting phase of what will one day become a mine.

Mr. Hudson, Chairman and CEO, states, “We are again thankful that Business Finland has chosen to continue to support Mawson in our pursuit to become a significant Finnish (and European) raw material battery-metal supplier from our 100%-owned Rajapalot project, which is already 7th largest European cobalt resource.”

Expect drill results from Mawson soon.

Mawson is a buy-up-to C$0.38/US$0.32.

Gold Bull Resources (TSX-V: GBRC)(OTC: GBRCF)

Gold Bull surged earlier this month but ended the month right where it started in the low C$0.40s.

The company has a good problem on its hands. On June 1, 2021, the company announced a re-assay results of RC drill samples from the high-grade gold intersections at North Hill and Abel Knoll using the metallic screen fire assay method.

Intersection in SA-0004 with assays determined by metallic screen fire averages 19.76 g/t Au from 41.1 m to 54.9 m, versus 10.95 g/t Au previously reported from conventional 30 g fire assay.

That’s a substantial variation — luckily — to the upside.

The substantial variation in gold values between metallic screen fire and conventional fire assay observed in other samples from the high-grade zone in SA-0001 raises a strong possibility of under-reporting gold values and has led to the company making changes to sample preparation and assay method protocols currently being implemented, along with re-assaying to identify zones where gold grade may be underestimated and under-reported.

Gold Bull CEO Cherie Leeden commented,

“After observing visible gold in RC chips, and reviewing the repeatability of some field duplicate samples, it became apparent that the Company needed to investigate our laboratory technique. By improving the quality of our laboratory technique to suit our coarse gold geology at Sandman, we have an opportunity to include mineralization in the mineral resource estimate that might otherwise have be excluded, while also improving the accuracy of data used in the mineral resource estimate. The re-analysis with this different lab technique is indicating a significant increase in gold values in most samples which leads me to believe some of the coarse-grained gold may have been getting missed in our original laboratory technique. Additional re-assaying is currently underway to rectify this, and we will report the new results to the market as we receive them.”

Good news is I expect the re-assay results to prove positive.

I reached out to CEO Cherie Leeden about the variation, the delay, and of course the march towards five million ounces by year-end.

You can listen to that here.

Gold Bull is a buy and has once again pulled back below the buy-up-to price of C$0.52/US$0.43. You know what to do.

Probe Metals Inc. (TSX-V: PRB)(OTCQB: PROBF)

Probe, which in my mind remains a clear takeout target, added another reason why it will likely be bought out when it announced an updated resource estimate for its Val-d’Or East project located near Val-d’Or, Quebec.

The updated resource shows a 16% increase in total ounces, 2.68 million ounces in pit constrained resource and 1.30 million ounces in underground resource, a 105% increase in overall M&I ounces.

Monique and Pascalis gold deposits will form the cornerstone of the upcoming Preliminary Economic Assessment (“PEA”), representing 77% of the pit-constrained mineral resource estimate.

This new resource will form the basis of the PEA expected in Q3-2021. Drilling continues at the Val-d’Or East Project, with 50,000 metres of additional drilling in 2021.

David Palmer, President and CEO of Probe, states, “This new resource marks the graduation of Val-d’Or East from an exploration project to a potential mining project with tremendous upside for additional growth. The resource shows a significant improvement from previous estimates not only in size but also in the quality of its ounces. The amount of measured and indicated resource, a project’s best gauge of mineability, has more than doubled, while overall grade has also increased substantially. Monique has been the standout performer this year, showing excellent advances in both resource size and quality with almost all of the ounces identified on the mining lease, while Courvan and Pascalis have seen improvement in quality and grade. This current resource estimate will not only form an excellent base for our upcoming PEA, but will also guide us towards future exploration as we continue to grow and advance this project”.

Adding fuel to my speculation of a takeout is the appointment of Ms. Aleksandra (Sasha) Bukacheva to its board of directors, effective June 7th.

Ms. Bukacheva is a capital markets and finance professional focused on the metals and mining industry. She was most recently an independent director at Battle North Gold Corporation (TSX: BNAU) before it was acquired by Evolution Mining Limited (ASX: EVN).

Timing seems convenient. We’ll see.

Probe is a hold at current prices.

Western Copper & Gold (TSX:WRN)(NYSE: WRN)

Busy days for the WRN team. On June 22, 2021, the company announced the results of its Preliminary Economic Assessment on its wholly-owned Casino copper-gold-molybdenum deposit in the Yukon.

The study considered the project being constructed as an open-pit mine, with a concentrator processing nominally 120,000 tonnes per day and a gold heap leach facility processing nominally 25,000 tonnes per day.

The project demonstrates a $2.3 billion after-tax NPVat (8%) and an after-tax IRR 19.5% .

It assumes base metal prices of $3.35/lb copper, $1,600/oz gold, and $24/oz silver. Fair assumptions on all fronts.

Cashflow is robust and sees $965 million per year over the first four years.

Base case development contemplates a 25-year mine life while an extended two-phase development contemplates a 47-year mine life.

Scale, profitability, and lots of exploration upside. Everything a major likes to see.

“I am extremely pleased with the results from this PEA”, said Paul West-Sells, President & Chief Executive Officer. “This Study reaffirms Casino as one of the very few long-life copper-gold projects with robust economics in a top mining district, the Yukon. We look forward to continuing working with our recent strategic investor, Rio Tinto, First Nations and other stakeholders to advance this project through additional engineering to feasibility.”

On the exploration front on June 24, 2021, the company announced its 2021 exploration and drilling program at Casino.

The program was developed with input from Rio Tinto. The 2021 program will include an exploration diamond drilling phase comprising roughly 5,000 metres in 12 holes.

These will target the peripheral areas of the Casino Deposit as well as several exploration targets within the Canadian Creek property. Drilling on Canadian Creek will specifically target at least three areas having prospective soil geochemical and/or geophysical signatures.

The 2021 program also includes a five-hole, 1,500-metre resource confirmation campaign, targeting the eastern and southern margins of the main deposit.

Input from Rio Tinto along with the $25.6 million strategic investment in May bodes well for the company’s odds of being taken out at a substantial premium.

Shares are a hold for now.

Nomad Royalty (TSX: NSR)(OTCQX: NSRXF)

On June 1, 2021, Nomad announced that it has completed its previously-announced acquisition of an indirect interest in a 0.28% net smelter return royalty on the producing Caserones mine in the Atacama region of Chile.

Nomad also announced the consolidation of its common shares on the basis of one post-consolidation common share for every ten pre-consolidation shares issued and outstanding, which went effective on May 31, 2021. The shares now trade on a consolidated basis on the Toronto Stock Exchange and the OTCQX market on Thursday, June 3, 2021.

Several of you wrote in unhappy about the consolidation. The bottom line is the company’s market cap has 10-bagger potential based on rising metals prices and the execution of its business model which is to continue to purchase accretive royalties and streams. Not on the amount of shares outstanding.

Nothing has changed but the amount of shares (ten times less) and the share price (ten times higher to account for the share consolidation).

I expect the company to continue to use its broad network to secure additional royalties in the gold, silver, and copper space.

When the market turns this will rip higher.

Shares are a buy at current prices.

Quiet month in the uranium space as the expected pullback — though not yet as pronounced as I hoped — has led to a slowdown in newsflow.

Skyharbour Resources (TSX-V: SYH)(OTCQB: SYHBF)

On June 16, 2021, the company announced that it is expanding its current diamond drilling program at its flagship 35,705-hectare Moore Uranium Project.

According to the release:

“The current drilling program at Moore is progressing well and has provided significant encouragement to expand the current 3,500 metres drilling program to a total of 5,000 metres in 12 to 14 holes. This fully funded and permitted program will focus on following-up on existing unconformity and basement-hosted targets along the high grade Maverick structural corridor as well as newly defined targets at the Grid Nineteen area.”

Encouragement in the uranium space tends to mean we found more uranium and think we know where more is.

I asked CEO Jordan Trimble about the “encouragement” as well as his always excellent takes on the uranium space.

You can listen to that here.

Fission Uranium (TSX: FCU)(OTCQX: FCUUF)

On June 10, 2021, Fission announced that it will commence its Feasibility Study (“FS” or the “Study”) for its 100%-owned PLS high-grade uranium project, in the Athabasca Basin region of Saskatchewan, Canada.

The feasibility work will kick-off with Phase 1, consisting of extensive data collection using drilling and other fieldwork. The FS follows the results of the Company’s Pre-Feasibility Study detailing an underground-only mining scenario, which has outlined the potential for PLS to be one of the lowest-operating-cost uranium mines in the world.

Ross McElroy, CEO for Fission, commented, “The commencement of a Feasibility Study is a major milestone for Fission, and also for the emerging uranium district and its local communities in the Western Athabasca Basin of Saskatchewan, Canada. We have several important advantages heading into the Feasibility stage, including a Pre-Feasibility Study showcasing exceptional potential economics and minimal environmental footprint, extensive environmental data from years of baseline studies, and an unparalleled technical team.”

Fission recently took advantage of the recent strength in the uranium space by closing on a C$34.5 million financing completed at C$0.60.

Fission is just above the buy-up-to limit of C$0.55/US$0.47.

Put a bid in and let it come to you.

Uranium’s time in the spotlight is coming. Now is the perfect time to get in before the sector really takes off. You can learn more about why in this new report.

Closing Thoughts

Another busy month of news and activity leading into what will be a very busy second half of the year.

All eyes should be on real rates as moves lower will lead to a higher gold price and vice versa. That’ll correlate until it doesn’t.

Despite the noise, not much has changed. Any talk of tapering or raising rates will be met with a market tantrum that forces a quick about-face by J&J (Janet & Jerome).

Slowly but surely things are getting back to “normal” in this bizarro world. People are out, vaccines are available, vacations are being planned, and conferences are back!

I had a chance to sit down with Brien Lundin who is of course editor of the Gold Newsletter and puts on my favorite conference of the year, the New Orleans Investment Conference.

We talked about gold, the blockbuster lineup he’s putting together and his thoughts on rates, the deficit, and the potential for a monetary reset.

I’ll also be presenting, along with Mr. Nick Hodge in New Orleans this October and encourage those of you who can make it to take advantage of the collection of opinions and voices presenting there.

If you do, make sure to send Nick and I a note and we’ll make sure to make time to say hi.

Here is my conversation with Brien earlier this month.

One last thing. I’m excited to announce that the premium login website we’ve been promising is finally weeks away from going live. Thank you for your patience.

Keep an eye on your inbox.

Let's get it!

Gerardo Del Real

Gerardo Del Real

Editor, Junior Resource Monthly

For the past decade, Gerardo Del Real has worked behind-the-scenes providing research, due diligence and advice to large institutional players, fund managers, newsletter writers and some of the most active high net worth investors in the resource space. Now, he is bringing his extensive experience to the public through Resource Stock Digest, Junior Resource Monthly, and Junior Resource Trader. For more about Gerardo, check out his editor page.

*Follow Gerardo on Twitter.

Make sure you never miss an update or issue from Junior Resource Monthly by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Junior Resource Monthly, Copyright © 2021, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Junior Resource Monthly does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.