Junior Resource Monthly July 2021

PREMIUM CONTENT FOR PAID MEMBERS ONLY

by Gerardo Del Real

by Gerardo Del RealIn This Issue:

Stocks, home prices, incomes (especially for the wealthy), and job openings are all at or near all-time highs.

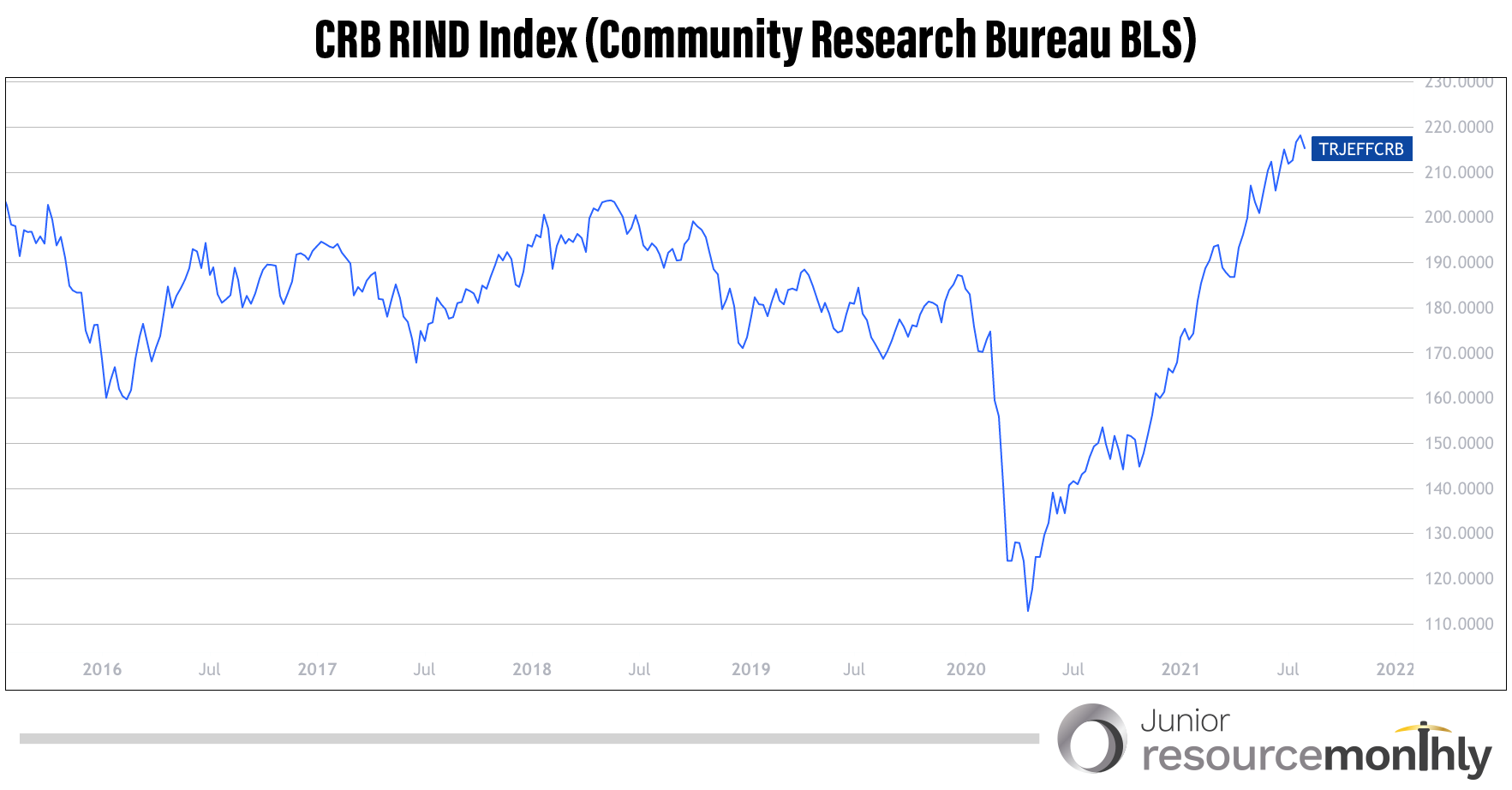

The CRB (commodity index) is at a 10-year high. Next time an armchair economist or a journalist tells you that lumber being down is proof that inflation is transitory make sure to ask if he/she knows what’s in there.

The index includes aluminum, cocoa, coffee, copper, corn, cotton, crude oil, gold, heating oil, lean hogs, live cattle, natural gas, nickel, orange juice, RBOB gasoline, silver, soybeans, sugar, and wheat.

Don’t let the facts get in the way of trying to be right though.

You know what else is higher? Rent. According to Zillow rent in the U.S. is up 1.8% month-over month, 7.1% year-over-year.

Rents have risen 5.1% since March which is the fastest quarterly growth in Zillow’s data, you guessed it, ever.

So while private equity continues to hollow out potential owners and convert them to permanent renters, the Fed continues to aid and abet by suppressing interest rates and making sure everyone knows it will continue to not talk about a different approach until at least 2023.

Addiction to easy money and double talk is not just a U.S. phenomenon. The ECB recently explained to everyone that it now has a “new symmetric inflation target.” I can’t make this stuff up because I don’t have to, the masters of the universe do it for me.

In a statement following its policy meeting, the Governing Council said it expects “key ECB interest rates to remain at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realized progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilizing at 2% over the medium term.” The ECB said this “may also imply a transitory period in which inflation is moderately above target.”

I’m not the only one calling BS.

Lord Forsyth of Drumlean, Chair of the Economic Affairs Committee, recently said:

“The Bank of England has become addicted to quantitative easing. It appears to be its answer to all the country’s economic problems and by the end of 2021, the Bank will own an eye-watering £875bn of Government bonds and £20bn in corporate bonds.

“The scale and persistence of QE—now equivalent to 40% of GDP—requires significant scrutiny and accountability. However, the Bank has faced few questions until now. Going forward, the Bank must be more transparent, justify the use of QE and show its working. The Bank needs to explain how it will curb inflation if it is more than just short term. It also needs to do more to mitigate widening wealth inequalities that have resulted from rising asset prices caused by QE.

“We took evidence from a wide range of prominent monetary policy experts and practitioners from around the world. These included former central bankers from the Fed, the ECB and the Bank of Japan. We found that central banks all over the world face comparable risks (emphasis mine).

“QE is a serious danger to the long-term health of the public finances. A clear plan on how QE will be unwound is necessary, and this plan must be made public.”

Read those last two paragraphs again. Remove the word finances in the last one. It should read “QE is a serious danger to the long-term health of the public.”

You can and should read the entire report by clicking here.

It lays out the hypocrisy and danger of current policy around the world. Central bankers are trapped and think if they make up enough words and call the same thing a different name you and I won’t notice.

Gold is starting — just starting — to sense the end game won’t be a pretty one. Governments already know, which is why Janet Yellen is suddenly very receptive to the adoption of stablecoin rules.

A group of U.S. regulators plans to issue recommendations in the coming months for fixing any regulatory gaps around stablecoins, the Treasury Department recently said in a statement.

Quite the about-face from the same group that once mocked cryptos.

The move away from fiat currencies in their current construct is playing out in real time before our eyes.

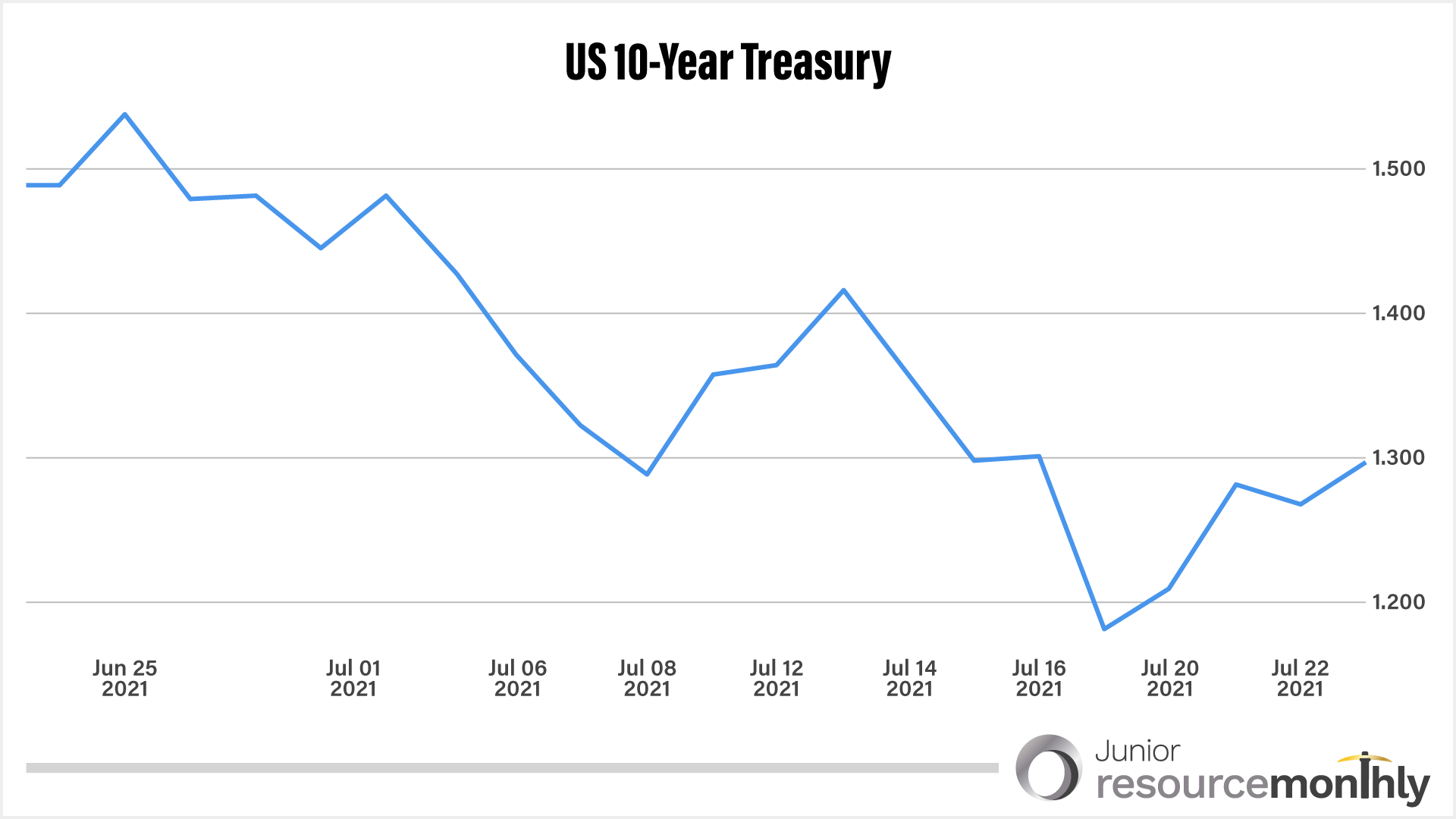

The 10-year and real rates also realize a reset is afoot.

The next quarter could be a pivotal one for gold and by default the related equities.

The consolidation that started last August has lasted longer than most estimated.

It’s now summer time and despite a surge in COVID cases and hospitalizations (especially among the unvaccinated) people are out and the seasonal summer doldrums are here, meaning mostly sideways to lower share prices.

Which means we have another month or two to buy things at steeply discounted prices.

Peru & What’s Next

For companies with exposure to Peru (Hannan, Palamina and Chakana), the sell-off was accelerated by the recent presidential election.

That sell-off should also be nearing its end as it is becoming more and more clear — as I thought it would months ago — that the rural teacher and very left-leaning Pedro Castillo is aware of the limits imposed on him by a divided congress.

It’s also becoming more clear that fears of resource nationalization — which were stoked by the now thrice-defeated Keiko Fujimori, who lost by just 44,000 votes — are not going to play out the way many feared.

Instead, Castillo has called for unity in the country and has made clear that though his administration will look to use revenues from the mining sector to improve public services, including education and health, it will not be through nationalization or force.

It’ll likely be from increased royalties on revenue that though higher, will not force producers or explorers out of the country.

The official handover of power will occur on July 28th (days before you read this).

We will soon know who will make up his administration and that will provide a clear signal to the markets as to the direction of economic policy.

Hannan, Chakana, and Palamina will all have active field/exploration programs.

In the case of Chakana I expect a steady stream of assays leading up to a resource estimate later this year.

Palamina will be drilling within weeks and Hannan continues to add value on its basin-scale land package in Peru.

Let’s jump into portfolio news and start with the laggards in the portfolio.

Portfolio News

Perpetua Resources (NASDAQ: PPTA)(TSX: PPTA)

One of the most frustrating holds in the portfolio is Perpetua (formerly Midas Gold).

It’s frustrating because the asset is world-class. It has a critical metal component — the antimony — that should be helping expedite, not delay, the permitting process and yet here we are with another delay.

On July 1, 2021, Perpetua announced that the United States Forest Service (USFS) is advancing Perpetua Resources’ modified proposed action in the National Environmental Policy Act (NEPA) process and updated the permitting schedule for the Stibnite Gold Project.

The modifications work in stakeholder feedback on the Draft Environmental Impact Statement (DEIS) and are designed to reduce the project footprint and improve environmental outcomes.

Modifications include the elimination of waste rock storage areas, overall reductions in mined material, additional pit backfilling and restoration, and improvements to water quality and water temperature.

That’s all fine and prudent by Perpetua to provide itself a clear path towards permitting but the market clearly didn’t like the updated final decision timeline, which now gets pushed out to Q4 of 2022 and the first half of 2023.

The rocks haven’t changed, the company is still a clear takeout target at many multiples of where it trades today (and I wouldn’t be surprised if someone made a run at it given the recent price performance) but outside of a buyout, it is clear that we’ll likely be able to buy shares of Perpetua at discounted rates until at least the next leg up in the gold price.

Leading Edge Materials (TSX-V: LEM)(OTC: LEMIF)

Another frustrating hold — and one that should start moving soon — is Leading Edge Materials.

Last month the company delivered excellent numbers on its Woxna graphite project, demonstrating a NPV of US$317 million or ten times its current market cap.

This month the company just delivered a PEA for its Norra Karr rare earth project.

The company announced a pre-tax net present value (NPV) of US$1.026 billion, a 30.8% IRR, and a 26-year mine life.

f

Again, the company has a total market cap of just over C$37 million.

Peers in the rare earth space are trading at a 30-40% discount to NPV.

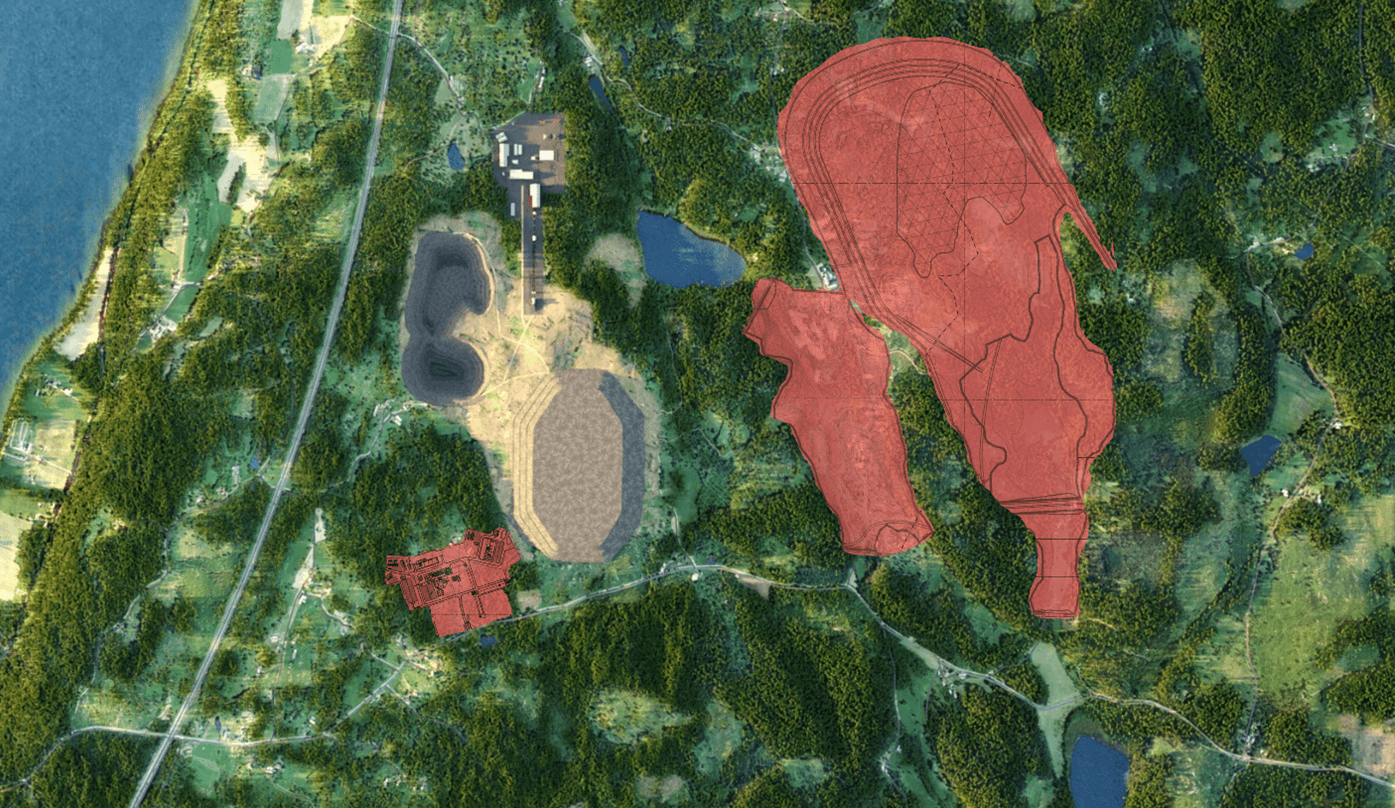

In addition to the excellent economics the PEA demonstrates a project with a much smaller environmental footprint.

The new design substantially reduces land area usage of the project by approximately 80%.

The removal of chemical processing and wet tailings at Norra Karr delivers an overall predicted 51% reduction in water requirements over the life of mine vs the 2015 PFS study. Use of mine dewatering for processing can reduce additional water requirements by almost 100% and lead to the elimination of discharge requirements to local water bodies compared with the 2015 PFS design. =

CEO Filip Kozlowski said:

“I am very excited to share these important PEA results, having more than met the strategic goals we set out to achieve. Norra Karr is a globally recognized significant rare earth project, and the re-evaluated design strengthens the sustainability, economics and resiliency of the project. By moving chemical processing off-site, and significantly improving resource utilization we have shown the opportunity to eliminate the need for a wet tailings storage. Adding further revenue streams improves the resiliency and cost competitiveness of the project relative to current dominant supply of rare earths from China. Norra Karr offers a rare opportunity for the European Commission’s ambitions to develop a sustainable and secure EU based value chain for rare earths and permanent magnets and we now have a much better path ahead of us.”

Leading Edge is significantly lagging its critical metals peers and presents one of the better values in the critical metals space and is a strong buy at current levels.

Magna Gold (TSX-V: MGR)(OTCQB: MGLQF)

Magna Gold continues to execute.

On July 14, 2021, Magna announced record monthly gold production at the San Francisco gold mine in Sonora, Mexico.

The company produced 5,398 ounces in June. Magna also announced the strip ratio for the month of June was 2.9, another record.

Q2 2021 gold production was 11,713 ounces at its San Francisco Mine in Sonora, Mexico. Gold sold during the quarter was 11,777 ounces at an average realized gold price of $1,752 per ounce.

With 21,498 ounces of gold produced through the second quarter and achievement of full-scale commercial production on June 1, 2021, the company reiterated full-year gold production guidance of 55,000 to 65,000 ounces.

Arturo Bonillas, president & CEO of Magna Gold, stated:

“The end of Q2 marked a major milestone for the Magna Gold team. We achieved commercial production on schedule and had our highest production total in the month of June. We are seeing production ramp up every day and look to end the year producing ~7,500 oz Au per month. Figure 1 demonstrates just how far we have come as our strip ratio has been brought down to near life of mine averages and our production continues to steeply trend upwards."

"Magna Gold is in a phase of rapid expansion and advancement of our assets. Having said that our commitment to health and safety remains a priority, this evidenced by our unblemished ~3.5M man hours without a lost time incident. We look to continue our dedication to best practices as we are well on our way to become a mid tier producer.”

Arturo has been very clear that he is still on the M&A hunt and the company is also conducting an extensive exploration program on multiple properties.

I spoke with Arturo recently about the impressive turnaround at the San Francisco mine and what to expect in the second half of this year.

You can listen to that by clicking here.

Mawson Gold (TSX-V: MAW)(OTC: MWSNF)

Mawson has sold off the past several months as the combination of a large block of shares being sold into the market — that’s done — and as a direct result of the general apathy that has hovered over the resource space.

It certainly has not been due to lack of exciting results.

On July 13, 2021, Mawson announced drill results from 4 drill holes at the Raja prospect as part of the company's 76-hole, 19,422-meter 2020/21 drill program at the company's 100%-owned Rajapalot gold-cobalt project in Finland.

Highlights included drill hole PAL0297, which intersected 20.7 meters @ 7.4 g/t Au, 111 ppm Co, 7.5 g/t AuEq from 74.0 meters.

It wasn’t a one-off.

Drill hole PAL0295 intersected 15.7 meters @ 3.8 g/t Au, 783 ppm Co, 4.5 g/t AuEq from 74 meters.

Mr. Hudson, chairman and CEO, states:

“To discover such high grades, over broad widths and at such shallow depths is demonstrative of both the untapped potential of this expanding camp scale discovery in Finland, as well as the continued geological understanding being developed by our experienced Finnish project team. These results more than double the grade and thickness of the shallow parts of the Raja prospect and provide further encouragement as we move towards our soon to be announced resource upgrade for Rajapalot.”

That followed news from Australia on July 6, 2021.

Mawson announced three holes with a highlight intercept of 15.3 meters of 2.2 g/t gold and 2.1% antimony at Sunday Creek in Australia.

I spoke with CEO Michael Hudson twice this past month. Both interviews are worth a listen.

You can listen to those here and here.

Mawson is well under its buy-up-to price and is a strong buy at current levels.

Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF)

Short and sweet on Nevada Sunrise Gold because this New Placer Dome Gold interview outlines the most important catalyst for the share price, drilling at its 20%-owned Kinsley Mountain gold project in Nevada.

The other two catalysts — that are taking longer to materialize — are the sale of the water rights (LOI announced in May) to Cypress Development, which I anticipate will be consummated in August and a follow-up drill program at the Coronado copper VMS project in Nevada, which should happen in October/November.

The market is bored, gold is sideways, and the company has been quiet.

That’ll change in a month or two. In the meantime, Nevada Sunrise is a steal at current levels.

Millrock Resources (TSX-V: MRO)(OTCQB: MLRKF)

Millrock has been busy — not that the market cares right now — but it’s clear that what the market wants from Millrock and its joint-venture partner Northern Star Resources is a discovery at the 64North gold project.

On July, 7, 2021, Millrock provided an update on its exploration activities at its Fairbanks and Goodpaster gold district projects in Alaska.

It also announced the Drilling program was recently completed at 64North Gold Project near Pogo Mine, Goodpaster District. Quartz veins were reported. I’ll wait for the assays to come in before getting too excited as we’ve seen pretty rocks that didn’t have the grade or widths to justify excitement in the past.

I spoke with CEO Greg Beischer about the flurry of activity and the share price performance. You can listen to that here.

Millrock is a hold.

Hannan Metals (TSX-V: HAN)(OTC: HANNF)

Another steal at current levels is Hannan Metals, which continues to advance its massive basin-scale copper-silver and now gold projects.

On June 30, 2021, the company announced the commencement of a large-scale 2,782-line kilometre ("line km") LiDAR survey over 64,500 hectares of the San Martin JOGMEC JV sediment-hosted copper-silver project in Peru.

Hannan is advancing the San Martin Cu-Ag project by the utilization of LiDAR, one of the newest remote sensing technologies on the market.

The survey is a first in Peru to utilize LiDAR for geological mapping, fieldwork targeting along with drilling and logistics planning.

The groundbreaking survey will allow mapping of geology and structure, and hence, in combination with geological and geochemical field observations, define geological controls on copper-silver mineralization.

It will also supply a detailed topographic ground model to facilitate efficient fieldwork to map key outcrops and access in the thick jungle terrain, provide targeted ground access, and support environmental monitoring and precise drill collar location planning.

Michael Hudson, CEO, states:

“Up to now, LiDAR has been used primarily for mapping vegetation canopy and for topographic controls. Sensor technology and ability to process and interpret the vast cloud point datasets means that the technology can now be applied to mineral exploration in these highly vegetated and challenging terrains for the first time. This is truly a game changer for exploration in these areas and Hannan, along with HSA, is pleased to be leading the application of this technology in Peru.”

I spoke with CEO Michael Hudson about the game-changing technology and the progress in Peru.

You can listen to that here.

Aguila American Gold Ltd (TSX-V: AGL)(OTC: AGLAF)

Aguila had been very quiet and we now know why. It was busy putting together a deal for another prospective property. This time a copper one.

On July 15, 2021, Aguila announced it has acquired 100% ownership through staking, the Cora copper project, located in Pinal County, Arizona.

The Cora project lies 75km NNE of Tucson, within the heart of the southern Arizona copper belt.

The project is 100% owned by Aguila, secured by 46 granted BLM lode mining claims covering a total of 3.84 sq km.

Original exploration company records held by the Geological Survey of Arizona indicate past drilling at Cora intersected oxide copper mineralization over widths in excess of 100m, beneath shallow alluvial cover, over an area of at least 1km by 1km.

Pinal County is a prolific copper producing region and is host to several large, world-class copper mines and deposits including Ray, San Manuel, Silver Bell, Mission, Resolution, and Miami (1.6 Bt @ 0.63% Cu).

“The newly staked Cora project represents an exciting first step for Aguila into copper exploration in the Western US,” commented Mark Saxon, president & CEO of Aguila American Gold.

“We have been progressively and patiently assessing projects, and Cora stands out as a significant copper prospect in one of the world's premier copper producing regions. The timing could not be better, as secure global copper supplies are tightening, coinciding with strong demand growth as a result of a global infrastructure, electrification and renewable energy boom. We look forward to applying modern exploration techniques to this under-explored district.”

Timing is excellent with copper back at $4.40/lb and poised to head higher.

I caught up with CEO Mark Saxon about the recent acquisition and what comes next.

You can listen to that here.

Aguila has a tiny market cap of approximately C$5 million, has an excellent share structure, and makes an excellent speculation at these levels.

Nomad Royalties (TSX: NSR)(OTCQX: NSRXF)

Several of you have written in regarding Nomad and right on cue the company provided a pretty comprehensive update earlier this month.

The company realized preliminary revenues of $4.6 million and $14.2 million for the three- and six-month periods ended June 30, 2021 resulting in preliminary cash operating margin of $4.0 million and $11.9 million.

Nomad was keen to highlight the announcements by Barrick Gold Corporation regarding the progression and potential initial production timeline at Robertson.

Nomad expects initial production during the fourth quarter of 2024 subject to permitting.

In addition, Artemis Gold Inc. and Troilus Gold Corp. raised in excess of C$580 million to further advance the Blackwater project in British Columbia, and the Troilus gold project in Québec.

Nomad has done a great job of positioning itself for the next leg up in the gold price. Share price performance has been flat. That’ll change once gold comes back in favor.

Nomad is a buy at current levels.

Abacus Mining & Exploration (TSX-V: AME)(OTC: ABCFF)

Drilling is finally underway at the Willow porphyry copper property in the Yerington copper camp, southeast of Reno, Nevada.

The company plans to drill four vertical holes, each to a depth of 600 meters. The holes will be approximate 200-300 meter step outs from past drilling by the company in 2018.

Based on past work done by Abacus the target is at least 1.5 km by 1.5 km in size.

Abacus completed geological, geochemical, and geophysical work on Willow beginning in 2017 and then undertook a short core drilling program.

This drilling identified the Luhr Hill Granite on Willow with copper values in the 0.1% to 0.2% Cu range along with elevated Mo. This was a key new discovery, as there are no known instances of this granite in the camp without an associated porphyry.

The target is essentially identical to the two largest porphyry deposits in the Yerington camp, namely the past-producing Yerington mine and the undeveloped Ann Mason deposit.

Abacus has the right to earn a 75% ownership interest in the Willow property from Almadex and of course also holds a 20% ownership interest in the Ajax copper-gold porphyry project, located near Kamloops, British Columbia.

A project which suffered a permitting denial a few years back but now appears to be gaining traction as several important local stakeholders seem engaged and interested in supporting the project.

The 20% ownership of 2.7 billion pounds of copper, 2.6 million gold ounces, and 5.3 million ounces of silver is enough in its own right to justify Abacus trading in dollars not cents.

A discovery at Willow would accelerate that.

Abacus is a buy at current levels.

Kutcho Copper (TSX-V: KCC)(OTCQX: KCCFF)

Speaking of trading in dollars not cents, Kutcho seems well on its way there. After hitting a 52-week low — and telling you how great the Kutcho asset was — Kutcho is now at 52-week highs and poised to head higher alongside copper.

On July 7, 2021, Kutcho announced it has agreed to buy back the royalty held by Sumac Mines (now Sumitomo Metal Mining Canada) and terminate Sumac’s Right of First Refusal to purchase concentrates.

The total purchase price of the buyback is US$3.2 million with an initial $1 million already paid.

A second payment of $500k will be made on or before October 5, 2021 and a final payment of $1.7 million will be paid on or before December 31, 2021.

Kutcho Copper president and CEO, Vince Sorace, commented:

“We view the buyback as a highly accretive transaction to the Company which will provide an economic benefit to the Kutcho project that will be reflected in the upcoming feasibility study. In addition, termination of the Sumac ROFR gives the Company full flexibility to engage freely in strategic discussions with respect to offtake and offtake financing arrangements. This will provide a more competitive environment for concentrate offtake terms given that offtake for 100% of the concentrate is now available for negotiation.”

I suspect by the time you read this we will have seen numbers from the upcoming feasibility study.

Numbers I expect to take Kutcho to trading in dollars not cents.

Ethos Gold (TSX-V: ECC)(OTCQB: ETHOF)

Add Ethos to the list of companies that with a bit of luck with the drill bit will soon trade in dollars not cents.

Don’t just take my word for it. The company has attracted the attention of billionaire Eric Sprott. On July 26, 2021, the company announced Mr. Sprott bought 2 million units consisting of one share at C$0.32 and a half warrant good for two years at C$0.45.

The company intends to use the gross proceeds from the sale of units for exploration activities on the Toogood Project, on New World Island, Newfoundland.

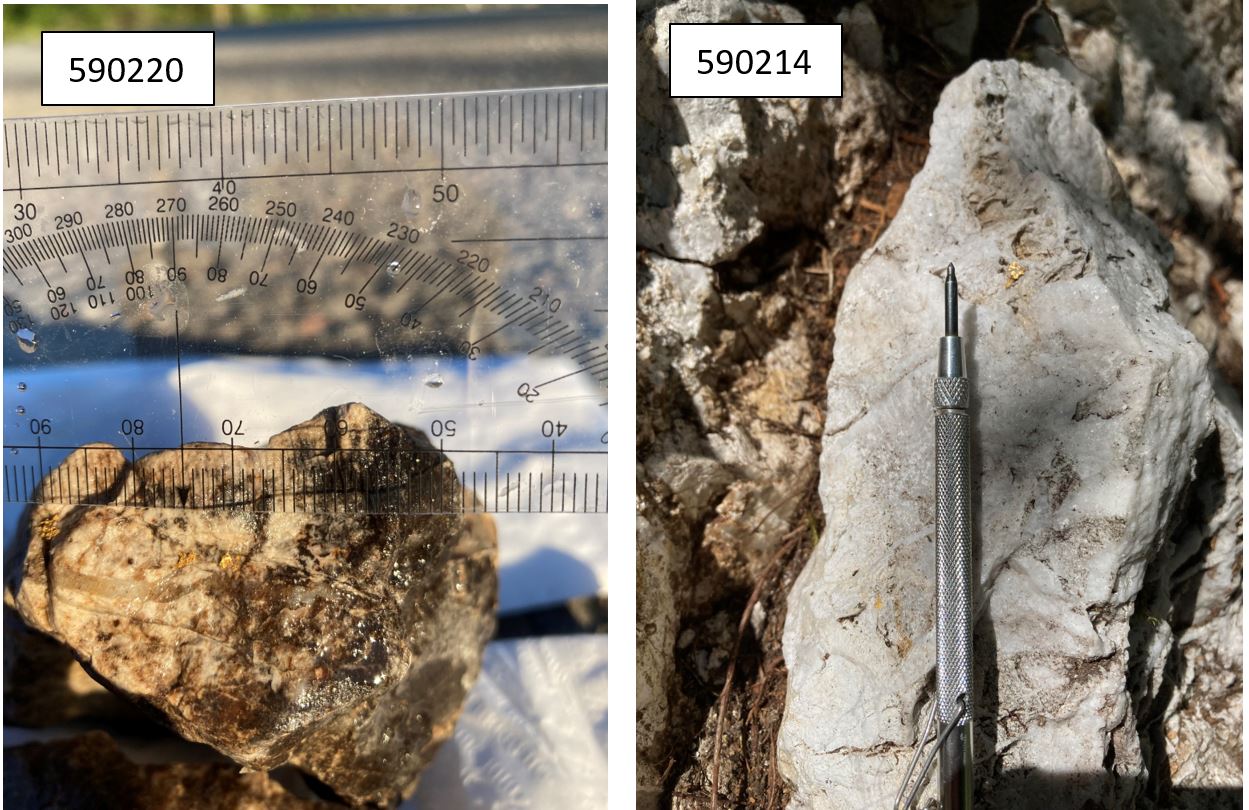

The same Toogood project that on July 21, 2021 yielded 572.9 g/t gold in sampling of previously untested outcrops.

Three visible gold samples were assayed by metallic screen returning 572.87 g/t Au, 493.91 g/t Au, and 22.28 g/t Au respectively.

The new results define a 100 m by 40 m gold zone, which remains open in all directions.

Alex Heath, CFA., president and CEO stated:

“These first outstanding high-grade gold results from our initial sampling program demonstrate the potential for a significant discovery at Toogood. We are very encouraged by the continuity of the gold bearing structures at this early stage in the exploration program and look forward to defining targets for drilling in the coming months.”

Keep in mind that drilling is already ongoing at the Perk-Rocky Copper-Gold Porphyry project in B.C.

Like Kutcho, it took a bit for Ethos to find its legs and get going.

This time last year Ethos touched a 52-week low of C$0.14. The stock just hit a 52-week high of C$0.44.

You’ve had plenty of time to buy it. The company is a buy but only up to the current and increased buy-up-to price of C$0.35/US$0.27.

Gold Bull Resources (TSX-V: GBRC)(OTC: GBRCF)

Gold Bull — which continues to pursue accretive M&A that will help get it to its publicly stated goal of a five-million-gold-ounce resource base — announced assay results from resource extension drill holes at the North Hill and Silica Ridge Prospects within its 100%-owned Sandman Project in Nevada.

The company recently commenced a Phase 2 5000m Reverse Circulation (RC) drill program of which 2126 m (6975 ft) for 12 holes has been completed.

Two mineralization styles and targets exist at Sandman, broad lower grade, shallow oxidized mineralization, and narrow high-grade gold mineralization.

Drill hole SA-0024 at Silica Ridge intersected 19.8 metres @ 0.67 g/t gold from 111.3 meters.

Drill hole SA-0027 at North Hill intersected three mineralized intervals. 19.8 meters @0.6g/t gold from 4.6 meters, 15.2 meters @0.39 g/t gold, and 21.3 meters @0.44 g/t gold from 51.8 meters.

Assays are pending and should be announced by the time you read this or shortly thereafter.

I spoke with Gold Bull CEO Cherie Leeden about the results, current drilling, news flow, and the M&A pursuit.

You can listen to that here.

Fission Uranium (TSX: FCU)(OTCQX: FCUUF)

After the recent — albeit brief — pullback in the uranium equities, Fission is back in the news with assays from its winter 2021 program.

The resource expansion drill program has confirmed high-grade mineralization.

All 20 holes returned wide intercepts in multiple stacked intervals in each hole, with 15 holes hitting high-grade intervals.

The program targeted areas of inferred category mineralization with the goal of upgrading to indicated category for inclusion in the upcoming feasibility study.

The highlight hole was hole PLS21-602 (line 915E), which intersected 69.5 meters of total composite uranium mineralization in multiple stacked intervals, including intervals such as 4.5m @ 18.63% U 3 O 8 in 14.5m @ 6.11% U 3 O 8.

Ross McElroy, president and CEO for Fission, commented:

“These successful, robust drill results are a strong validation of our growth strategy for the deposit. Specifically, they have the potential to expand the size and quality of the resource from the R780E zone to be used in our upcoming feasibility study.”

The uranium bull market along with the feasibility study are the next major catalysts for Fission. The stock is a strong buy.

Closing Thoughts

The summer doldrums have a way of lulling people to sleep, making for missed opportunities that only seem obvious with the benefit of hindsight.

If you’ve followed my work you know I’m a die-hard Cubs fan.

Without getting into too many details, three weeks before the All-Star break the Cubs were in first place, looked ready to spend money and bring in valuable pieces, and poised to make another World Series run.

Then we lost 11 of 13 games, dropped to fourth place, and with the trade deadline about to pass it looks like we’re sellers of talent not buyers.

Things turn quickly. It’s the same in the junior resource space.

Chakana, Almadex, Palamina, Hannan, Leading Edge, Revival, Nomad, Mawson, Gold Bull, and K2 Gold will all have a very strong close to the year. You should be adding those names while no one pays attention.

Ethos, Kutcho, Probe, Western Copper & Gold, Orocobre, and all the uranium names all have significant tailwinds that will send those companies to new all-time highs.

Nevada Sunrise, Abacus, and Millrock will require a bit of luck with the drill bit and a better market but I see a better market in the cards in the next few months.

Though those companies tend to be higher risk/higher reward, alot of the risk has been mitigated by the paltry market caps each commands right now relative to the shots on goal for a significant win.

Keep an eye on your inbox as I have some shuffling in the portfolio to get to. Expect that in the next month or two.

Let's get it!

Gerardo Del Real

Gerardo Del Real

Editor, Junior Resource Monthly

For the past decade, Gerardo Del Real has worked behind-the-scenes providing research, due diligence and advice to large institutional players, fund managers, newsletter writers and some of the most active high net worth investors in the resource space. Now, he is bringing his extensive experience to the public through Resource Stock Digest, Junior Resource Monthly, and Junior Resource Trader. For more about Gerardo, check out his editor page.

*Follow Gerardo on Twitter.

Make sure you never miss an update or issue from Junior Resource Monthly by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Junior Resource Monthly, Copyright © 2021, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Junior Resource Monthly does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.