Junior Resource Monthly January 2021

PREMIUM CONTENT FOR PAID MEMBERS ONLY

by Gerardo Del Real

by Gerardo Del RealIn This Issue:

Welcome to a New Era (Era of Debt)

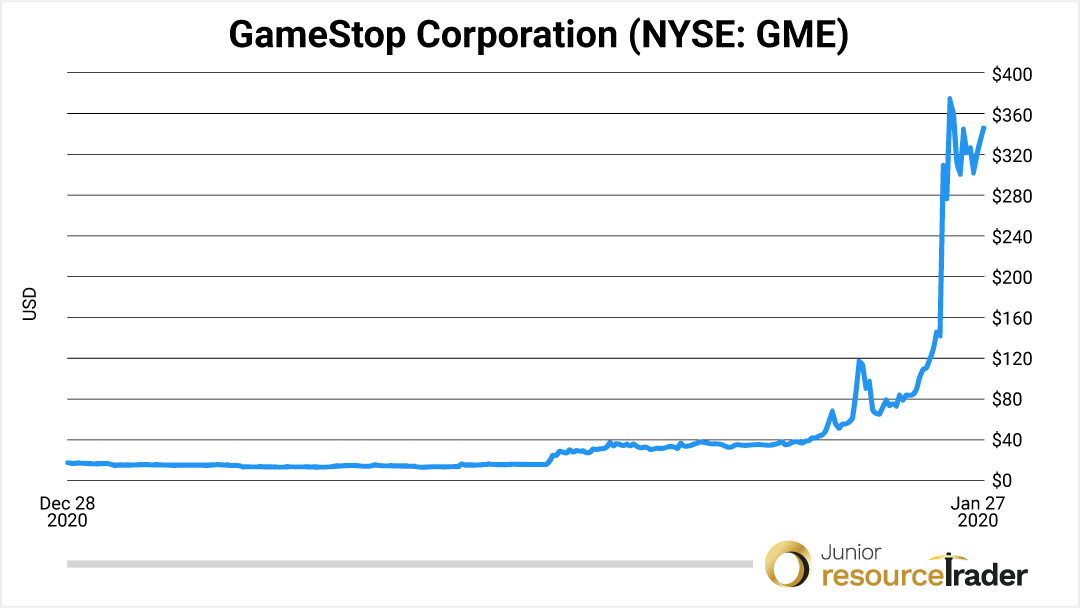

What do you get when Fed driven liquidity, meets Robinhood traders, meets Reddit traders, meets a short position on margin?

GameStop.

The stock is up as much as 80X in the past year.

You could excuse the premise on which the 65% short position was predicated on. It’s a brick and mortar operation that would surely struggle to survive as games continue the transition to digital platforms.

These however are not reasonable times. In the few minutes it took me to put up the GameStop chart and type the words you’re reading the stock as been halted repeatedly over several days and hit a one day high of $420.00.

Previous close was $65.01 and traded at $2.57 in April. Just for kicks here’s a one-month chart of GameStop.

Last month I told you the Roaring 20’s were back and unlike previous cycles we can be confident that the era of cheap cash and debt will last for years.

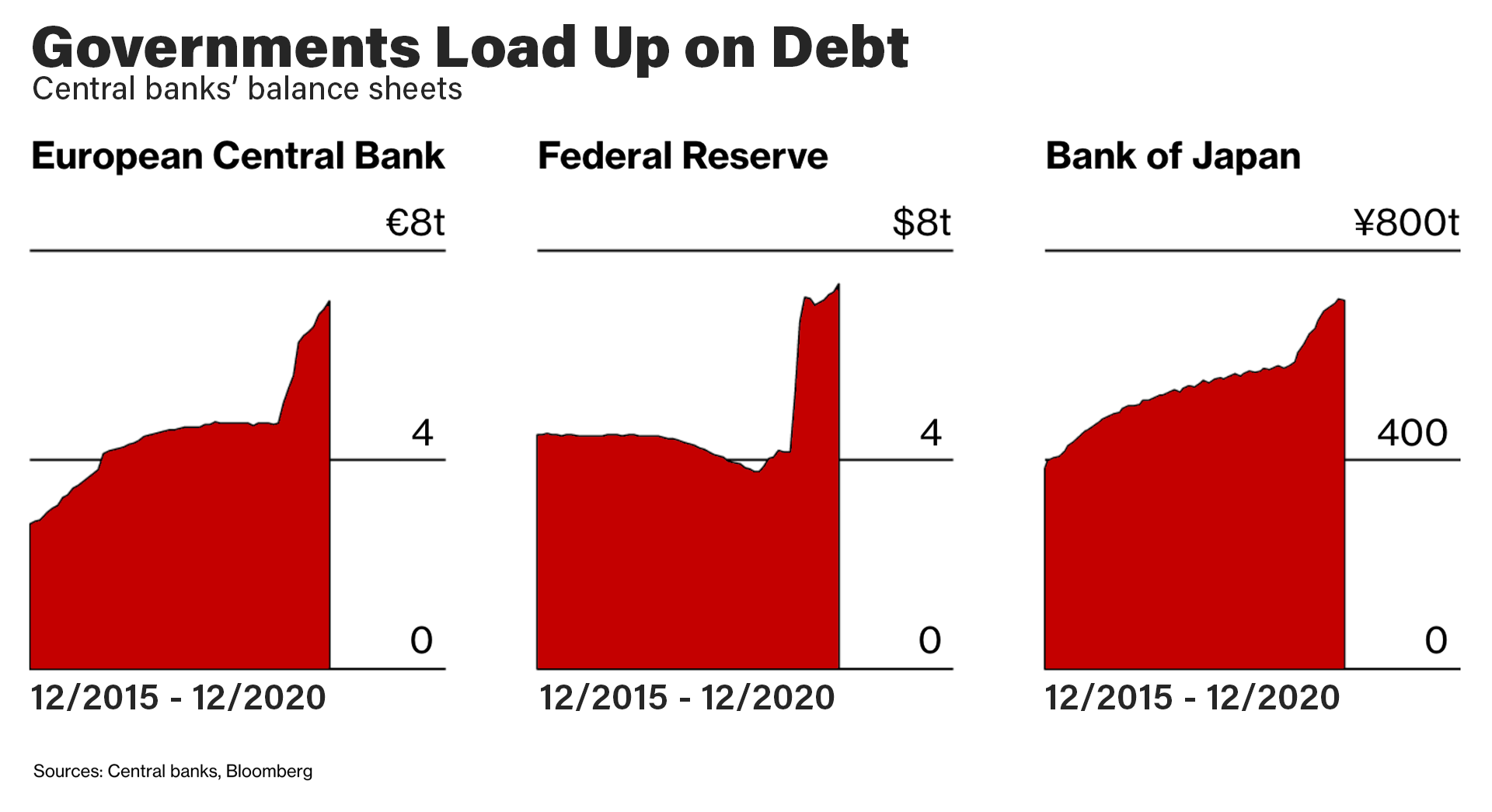

If you are still unclear about the official policy let me spell it out for you. Central banks around the world are making debt the cheapest it’s ever been. The availability of cheap capital — globally — has ignited a rush for yield as capital is looking for the comfiest home.

That rush is and will continue to inflate asset prices of anything that can catch a bid.

Governments have issued over $12 trillion in fiscal stimulus and central banks have partnered with those governments to make sure everything stays awesome.

As of Dec. 31, 2020 there was $17.8 trillion in debt that was trading with a negative yield meaning governments are essentially getting paid to borrow.

Where’s the cash going?

Dividend paying stocks? Check. Cryptocurrencies? Check. You knew that. But how about less cited assets?

A Mickey Mantle baseball card recently sold for a record $5.2 million this month. That same card sold for $2.8 million in 2018.

Of ten card sales of over $900,000, eight of those have happened in the past 12 months.

The first vintage issue of Batman recently sold for more than $2.2 million at auction, breaking the record for the highest amount ever paid for a Batman comic book.

Real estate? Check that box as well.

Where I live, just outside of Austin, Texas, homes are selling for above full price with many receiving dozens of offers within days.

I purchased a second home last year that required some work. A little over a year that home has nearly doubled in price. I’m not telling you that to brag I’m trying to highlight that we are in the midst of a transfer of wealth unlike any I’ve seen in my lifetime.

U.S. home prices jumped this past November at the fastest pace in six years.

So why isn’t gold performing the way many expected it to and why aren’t our metals stocks performing better?

Quick answer for gold is it doesn’t like the real interest rates rising. Despite record low rates and despite the nearly $18 trillion in negative yielding debt, real interest rates have been rising the past several months hence the consolidation in the gold price.

Over the past two decades there is a -0.9 correlation between the gold price and real interest rates.

The 10 year recently hit a nine-month high and frankly I’m surprised gold has held up as well as it has considering it’s competing with record highs in cryptocurrencies, home prices in low tax states, art, pot stocks and baseball cards.

Don’t be surprised if gold pulls back to the $1,790 level. Don’t be surprised if the dollar — which appears to have bottomed for now — perks up a bit for the next quarter.

The consolidation will be short-lived for the same reasons that cash is swooshing around all over the place; The Fed.

The Federal Reserve will start implementing its yield curve control policy framework and force rates back down.

The holy trinity of easy money — Yellen, Powell and Biden — will soon get to work providing fiscal and monetary support while forcing rates down.

You should use this opportunity and do exactly what I’m doing which is rounding out your portfolio by adding to quality and even more speculative names.

You won’t be able to add Nevada Sunrise Gold (TSX-V: NEV) (OTC: NVSGF) at C$0.03 but you can initiate or add to your position at C$0.115 today.

The company will likely raise money soon and if it does I will be participating.

There’s 40 holes remaining in the labs and I suspect that a discovery or two will light a fire to Nevada Sunrise Gold’s share price.

Several other companies are reporting phenomenal results while the market shrugs. That’s good because that’s not going to last.

If you’re a new subscriber or a subscriber that followed Nick and I over from the previous incarnation of our services, let me welcome you on board and thank you for your patience as we finalize the premium site that will allow for log in, portfolio tracking and the same features you were accustomed to.

The next few months you can expect the Fed to continue to intervene in the markets. Expect volatility, meaning exaggerated movements higher and lower in the markets that will make for a lot of noise.

The single most important indicator you should be watching for is discussion and implementation of yield curve control.

That’s the next green light for gold and the catalyst that will send gold to new all-time highs and get the portfolio to the point where I look smart as everyday feels like Christmas and our stocks go much higher.

In the meantime there is a lot of quality work being done that isn’t being rewarded by the market. It will be.

On to portfolio news.

Portfolio News

Revival Gold (TSX-V: RVG) (OTCQB: RVLGF)

On January 25, 2021 one of the most undervalued speculations in the resource space announced results from the final seven drill holes from the company’s 2020 drilling program on the Haidee zone at the past-producing Beartrack-Arnett gold project.

The results — while not blockbuster high-grade numbers — achieved the very important goal of upgrading and expanding the resource. All the holes intersected near surface oxidized mineralization.

Highlights included:

0.55 g/t gold over 16.7 meters in AC20-054D

0.53 g/t gold over 20.5 meters and 0.25 g/t gold over 31.7 meters in AC20-066D

0.61 g/t gold over 18.6 meters in AC20-067D

0.56 g/t gold over 22.6 meters, 0.79 g/t gold over 14.5 meters and 0.69 g/t gold over 16.3 meters.

“Revival Gold exceeded expectations for the 2020 drilling program at Haidee. With complete results from all thirty drill holes now in hand, we can see that the footprint of near-surface oxide gold mineralization has indeed grown. The program further reveals additional stacked mineralized structures extending up dip to the north-east. Haidee remains open in all directions and offers the potential to significantly increase the mine life and reduce the expected strip ratio for the planned first phase heap leach operation at Beartrack-Arnett. Further Beartrack-Arnett drill results from additional zones are expected next month. Meanwhile, preparations have begun to resume resource expansion drilling in the spring,” said President and CEO Hugh Agro.

The consistent grade and continuity bodes well for adding quality ounces in a potential heap leach re-start which the company is considering.

The focus now turns to drill results from other zones at Beartrack-Arnett and the company is already making preparations for a follow-up program in the spring.

I spoke with CEO Hugh Agro about the results and the value proposition that Revival presents.

You can listen to that here.

Revival Gold is well under the buy up to price and an absolute bargain at these levels.

K2 Gold (TSX-V: KTO) (OTCQB: KTGDF)

While Revival continues to hit solid grades and widths, K2 Gold seems to be on to an exciting high-grade, near-surface oxide gold discovery in California.

Yes California.

On January 25, 2021 K2 announced assays for the final five reverse circulation holes drilled at the Dragonfly zone, located within its 100% owned Mojave property in Southern California.

Hole DF20-004 intersected 30.5 meters of 7.2 g/t gold from surface, including 15.2 meters of 11.1 g/t gold.

The apathy in the junior resource space was on full display as the market simply shrugged off the results. The stock actually went down that day.

One hole at site DF1 (holes DF20-004) and all four holes at site DF2 (DF20-005 through 008) were successful in intersecting gold mineralization but were terminated prior to target depth due to difficult drilling conditions resulting from the highly fractured and silicified nature of the rocks.

Let me be clear. The four holes that “missed” didn’t reach the target depth before being abandoned due to difficult conditions.

There is no reason to believe that the holes would not have returned more of the same.

In total the drill program at Mojave comprised 17 reverse circulation holes (2,540-meters of chip samples) from two zones, the 8 holes now reported from Dragonfly plus an additional 9 holes at the Newmont zone located 2 km apart from Dragonfly on the same structural trend.

Assay results from the nine holes drilled at the Newmont are pending.

It should be noted that when I spoke with CEO Stephen Swatton he was clear in stating that the difficult drilling conditions he encountered while drilling at Dragonfly were not encountered at Newmont.

Stephen Swatton, President and CEO of K2 commented, "The second set of drill results from our flagship Mojave project continues to highlight the potential for near surface high-grade oxide gold resource definition. Despite being unable to reach the target depths from the second platform due to difficult drilling conditions, significant gold intercepts were encountered demonstrating the robust nature of the mineralized horizon; this is very encouraging news. We look forward to receiving the outstanding assay results from the remaining nine drill holes at the Newmont target, two kilometers south of Dragonfly.”

I spoke with Stephen about the results and permitting in the Biden era for a project in California which is perceived to be a tough go on the permitting front.

You can and should listen to that here.

Millrock Resources (TSX-V: MRO) (OTCQB: MLRKF)

One company that has not had luck with the drill bit thus far is Millrock Resources.

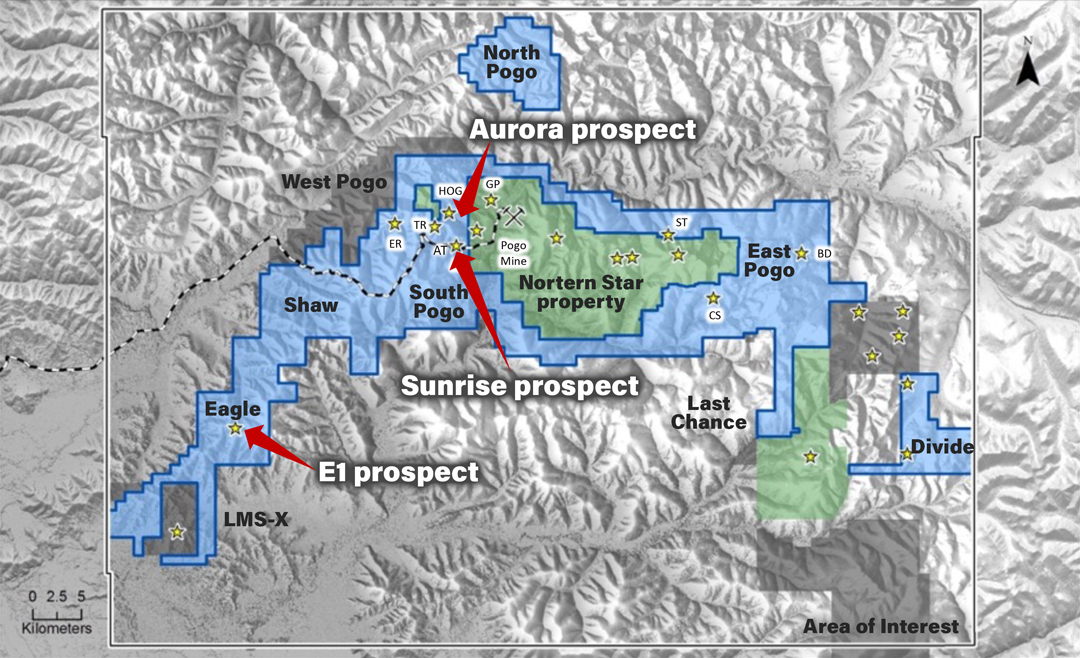

On January 18, 2021 Millrock announced assays from drilling and surface rock samples from the West Pogo and Eagle blocks at the 64North project in Alaska.

The project is a joint-venture with partner Resolution Minerals which is earning into the project.

Two holes which followed up encouraging quartz veining failed to return any significant mineralization.

The project is large, Millrock’s partner is patient and understands the prize — if discovered — is big one which is why it has decided to commit another in 2021 $5 million to continue its earn-in.

Millrock has pivoted to new targets and sampling returned 93.0 meters of 0.29 grams per tonne and 27.0 meters of 0.53 g/t gold with a maximum 1.0 meter interval of 1.89 g/t gold from continuous rock sampling in a road cut leading to the adjacent Aurora prospect area.

Drilling will resume in March. I’ve been patient with Millrock and I’m not selling into a quiet market but Millrock will need to find something this spring if it’s going to stay in the portfolio.

In other Millrock news on January 12, 2021 Millrock announced that it has sold its Treasure Creek, Ester Dome, and Liberty Bell projects to Alaska-domiciled subsidiary companies of Felix Gold for a future share payment, US$210,000 in cash, and retained royalties.

Felix Gold will have the right to secure 100% ownership in the projects in accordance with the underlying option agreements.

Felix Gold is planning to undertake an initial public offering and listing on the Australian Securities Exchange in 2021. Upon successful listing and ASX approval, Millrock will vest with a circa 10% share ownership of Felix Gold (dependent on the final capital raising amount).

I spoke with CEO Greg Beischer about the transaction. You can listen to that here.

Millrock is a hold as it’ll be a few months before drilling resumes.

Magna Gold Corp. (TSX-V: MGR) (OTCQB: MGLQF)

If you are a subscriber to either of my paid services and do not own Magna Gold — and are not initiating a position at these levels —you should unsubscribe.

Magna is permitted, producing, expanding, cash flow positive, exploring and on the M&A hunt. It doesn’t get much better than that for a junior with a market cap of approximately C$91 million.

On January 26, 2021 Magna provided a letter to shareholders providing an update to shareholders. The update laid out what the company achieved in 2020 and what it plans to achieve in 2021.

That includes a full ramp up of production — heavily wighted to the second half — to produce 66,267 gold ounces.

Just for kicks multiply 66,267 times $600 which is the margin the company anticipates capturing for each gold ounce sold in 2021.

If you can find another company with free cash flow near US$40 million and a US$ market cap of approximately US$74 million please send it in.

Take a second, read through the letter then go buy Magna Gold which is well under the buy up to price.

Midas Gold Corp. (TSX: MAX) (OTCQX: MDRPF)

Midas Gold — now under the stewardship of Laurel Sayer —continues two march towards a permit expected in 2021.

On January 15, 2021 it announced that after three years of extensive discussions, federal agencies have authorized and directed the company to perform agreed immediate clean up actions to address contaminated legacy conditions within Idaho's abandoned Stibnite mining district that are negatively impacting water quality.

Keep in mind that Midas did not cause the problems on site, it’s just going to clean it up and restore it.

The sources of contamination to be addressed by the agreement are decades old and largely stem from tungsten and antimony mining during World War II and the Korean War, long before Midas Gold started planning for redevelopment of the site.

The company also announced it had approved a 10-1 share consolidation in connection with a planned U.S. listing on the Nasdaq Stock Market.

I’m going to get ahead of myself a bit and speculate that Midas wouldn’t be getting federal approval to start clean up if the merits of its permit was in question.

I’m also going to get ahead of myself and imagine the day that Midas is listed on the bubbly Nasdaq exchange while gold is hitting all-time highs and the company is granted its permit.

"For decades, ground and surface water at Stibnite have suffered from elevated levels of arsenic and antimony," said Laurel Sayer, CEO of Midas Gold Corp. and Midas Gold Idaho. "Yet, because the problems stem from historic mining activity, there are no responsible parties left to address the issues at hand. While we did not cause the problems impacting water quality today, we have always been clear on our intentions to be a part of the solution. We know redevelopment of the Stibnite Mining District for mining activity must include restoration of legacy features. So, when we saw the need to address sources of water contamination more quickly at Stibnite, we knew we had to offer our help.”

I’ve been in touch with management and will be bringing you an interview with new CEO Laurel Sayer.

The recent pullback from bored junior resource investors and spectators that believe the Biden administration may have a negative effect on the permitting process should be bought.

Like Magna Gold if you don’t already own a position in Midas Gold the recent pullback is a great entry point. Shares are below the buy up to price for the first time in a long time.

Use the weakness to your advantage. For those of you that are managing money and looking for a liquid gold pay with a world-class asset that has bipartisan support to be permitted and will soon be on a big exchange, Midas is your play.

Mawson Gold (TSX: MAW) (OTC: MWSNF)

Mawson continues its incredible hit rate in Australia.

On January 5, 2021 the company announced assay results from two further drill holes (MDDSC004-05) from the 100%-owned Sunday Creek project in the Victorian Goldfields of Australia.

Diamond drill hole MDDSC005 intersected 4.2 meters @ 3.4 g/t gold from 88.0 meters and 11.5 meters @ 3.3 g/t gold from 123.7 meters including 0.1 meters @ 52.6 g/t gold from 123.7 meters, 0.3 meters @ 17.9 g/t gold from 128.2 meters and 0.3 meters @ 45.1 g/t gold from 133.5 meters.

Fifteen holes (MDDRE001-015) for 2,774.8 meters have also been drilled at the Redcastle Project. First results will be released shortly.

The Phase 1 drill program at Redcastle was completed immediately prior to Christmas and the drill rig will move to the Doctors Gully prospect in the Whroo Goldfield.

Mr. Hudson, Chairman and CEO, states, "We continue to drill strong gold mineralization across a multiple stacked vein system at our 100%-owned Sunday Creek epizonal gold project. Diamond drill hole MDDSC005, reported here, intersected 4.2 meters @ 3.2 g/t gold from 88.0 meters and 11.8 meters @ 3.1 g/t gold from 123.7 meters, adjacent to and beneath the historic Apollo mine where the old miners left significant gold that was considered too low grade during the late 1800s and early 1900s, leaving immediate follow up drill targets. Our results continue to provide more evidence of a widespread multi-event, gold-rich system. We look forward to continuing to trace the extensions of the 40 meter wide zone to depth and along strike as one of the many target areas left to drill and extend at Sunday Creek."

I spoke with CEO Michael Hudson about the latest high-grade results from Australia. You can listen to that here.

Expect an active year of results from multiple projects. The market doesn’t care right now but it will.

Mawson is a buy at these levels.

Uranium Energy Corp (NYSE: UEC)

UEC President & CEO Amir Adnani knows how to maximize returns in a bull market and has positioned UEC and its shareholders well for the coming run.

On January 26, 2021 UEC announced the restart of wellfield development and resource* delineation drilling at the company's Burke Hollow in-situ recovery ("ISR") uranium project close to my neck of the woods in South Texas.

The restart coincides with UEC's plans to participate in supplying the U.S. Uranium Reserve ("UR") as outlined in the Nuclear Fuel Working Group report published by the U.S. Department of Energy ("DOE"). The UR is designed as a 10-year, $1.5 billion program to purchase newly mined U.S. origin uranium.

The following quotes are from the release and though lengthy, they articulate why everyone should be bullish on the clean metals under the Biden administration.

UEC Chairman and former U.S. Energy Secretary, Spencer Abraham, stated, "U.S. energy policies and bi-partisan legislative initiatives in 2020 have laid the foundation for domestic nuclear fuel to supply America's largest source of carbon-free energy and support strategic defense priorities. By restoring the domestic nuclear fuel supply chain, with its high standards in the areas of health, safety and environment, the U.S. will reduce over-dependence on foreign sources while supporting the generation of significant baseload, carbon-free energy from American nuclear power plants.”

Secretary Abraham continued, "Initial funding of $75 million to establish the U.S. Uranium Reserve was approved in the FY 2021 bipartisan omnibus spending bill and the DOE has begun the process of developing a plan on how to implement the program. This is expected to be a competitive bid process, focused on existing fully permitted and low-cost projects.”

Amir Adnani, President and CEO, added, "UEC is positioned as the leader in U.S. low-cost, environmentally friendly and fully permitted ISR projects. Burke Hollow's initial production area is amongst the largest uranium ISR wellfields ever developed in the 45-year history of uranium mining in South Texas. It's a key building block in our production readiness portfolio which includes the largest U.S. resource base of fully permitted ISR projects in Texas and Wyoming. The low-impact ISR method of uranium recovery being developed at Burke Hollow is the most environmentally friendly way to mine uranium which is now responsible for approximately 50% of global production.”

It is not a coincidence that critical metals stocks are all near or above the buy up to price after years of languishing and underperforming everything else. That time has passed.

The company plans to drill at least 30 exploration and delineation holes to further define the five mineralized fronts.

Burke Hollow has received all four of its major permits required for uranium extraction from the Texas Commission on Environmental Quality and the Environmental Protection Agency.

You’ve had a lot of time to buy the stocks that provide exposure to the transition to clean energy.

Use the buy up to price and be patient but get positioned because when uranium and critical metals juniors really get going these prices will seem like a gift.

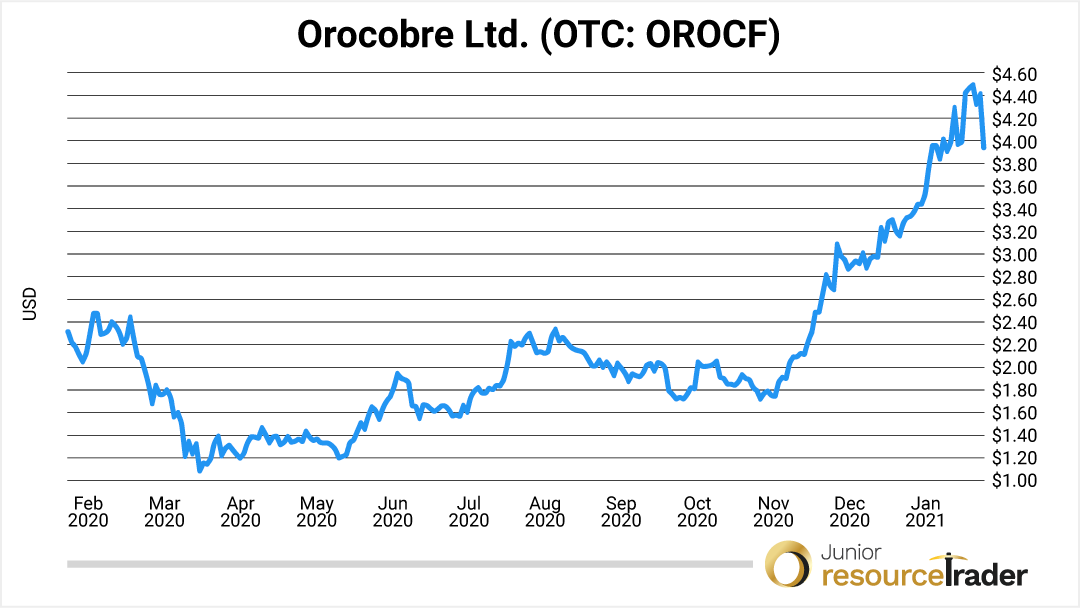

Shares of Orocobre -- which were inherited when it bought out Advantage Lithium — are up fourfold from 52-week lows (there’s a reason I held the shares instead of taking the tax loss.)

While I’m still not selling I'm focused on making sure I communicate the next four fold winner in the critical metals space.

The Leading Edge Materials (TSX-V: LEM) (OTC: LEMIF) is a great candidate as it has one of the only real rare earth assets in Europe. It also has the Woxna graphite mine and pending PEA’s for each of those projects.

Projects that are in high demand from a region desperate for an independent critical metals supply chain.

Kutcho Copper (TSX-V: KC) (OTC: KCCFF) which has performed well recently should be in your portfolio as I anticipate a busy 2021 that reminds the market how valuable its flagship copper-zinc project is.

Except a feasibility study and exploration drilling this year.

I highlighted several other names last month (Abacus, Azucar, Ethos and Palamina among others) and why they are in the portfolio.

Covid-related permit, assay and drilling delays have resulted in depressed share prices in many quality names which is presenting an opportunity that we will likely not see again for years.

Pick your commodity, pick your risk tolerance, if you have a question write-in because now is the time for due diligence and being aggressive.

Closing Thoughts

In the real world 2020 ended somberly and 2021 picked up where it left off.

Surging Covid-19 cases, millions unemployed, 90 million estimated to fall below the extreme poverty line worldwide.

Here in the U.S. 2020 brought the sharpest rise in the U.S. poverty rate since the 1960’s with over 8 million people now considered poor.

Food inflation due to shortages and lockdowns affecting supply chains is accelerating a potential food crisis in Europe amongst others.

Bond market volatility remains low while the VIX used to measure volatility has remained perky to say the least.

But hey, reddit traders are making money, the Fed will be watching to make sure financial markets are functioning smoothly and soon we’ll know just how much stimulus is headed our way.

What could possibly go wrong?

Keep an eye on your inbox.

Let's get it!

Gerardo Del Real

Gerardo Del Real

Editor, Junior Resource Monthly

For the past decade, Gerardo Del Real has worked behind-the-scenes providing research, due diligence and advice to large institutional players, fund managers, newsletter writers and some of the most active high net worth investors in the resource space. Now, he is bringing his extensive experience to the public through Resource Stock Digest, Junior Resource Monthly, and Junior Resource Trader. For more about Gerardo, check out his editor page.

*Follow Gerardo on Twitter.

Make sure you never miss an update or issue from Junior Resource Monthly by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Junior Resource Monthly, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Junior Resource Monthly does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.