Junior Resource Monthly February 2021

PREMIUM CONTENT FOR PAID MEMBERS ONLY

by Gerardo Del Real

by Gerardo Del RealIn This Issue:

While impatient speculators yawn and shun the gold juniors, producers continue to telegraph (not so subtly, by the way) the path forward.

The path forward is a wave of mergers and acquisitions at significant premiums as producer reserves dwindle, balance sheets swell and dividends increase.

Barrick’s reserves are down 2%, Iamgold’s operating reserves are down 13%. All while Newmont increased its dividend by 38%, now providing a 3.9% yield.

I’m a pretty simple guy, so I’ll ask a pretty simple question. If you run a business — in this case producing gold — and you are making a good living from it and a lack of supply threatens your existence, what do you do?

Simple answer right? You go find more supply.

Only in this case years of slashing exploration budgets — a consequence of serious mismanagement during the last cycle of high gold prices — has decimated the pipeline of quality projects by major and mid-tier producers.

The result is mid-tiers and producers blessed with swollen balance sheets but cursed with a lack of quality projects to develop.

The solution? Use that balance sheet to go buy quality ounces. A wave of mergers and acquisitions (M&A) is coming and it will bring with it significant premiums that will lead to a re-rating of companies with robust projects.

It will also lead to a re-rating higher of companies on to significant discoveries.

It’s already happening in the copper and uranium space.

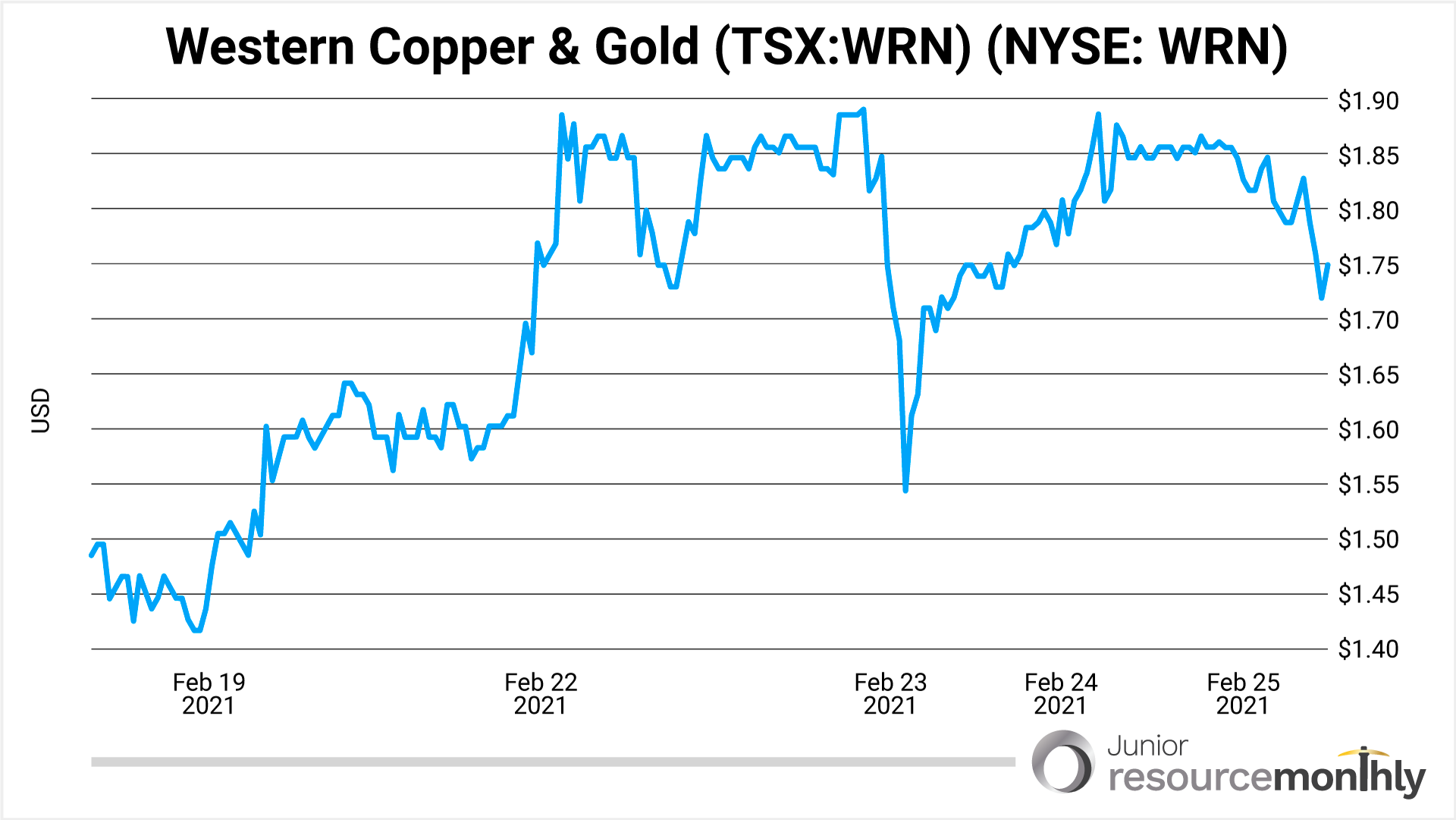

Here’s a 5 day chart of Western Copper & Gold (TSX:WRN) (NYSE: WRN).

Those are 5-year highs, by the way, and while it’s great to be up 60%, both copper and Western Copper & Gold are just getting started.

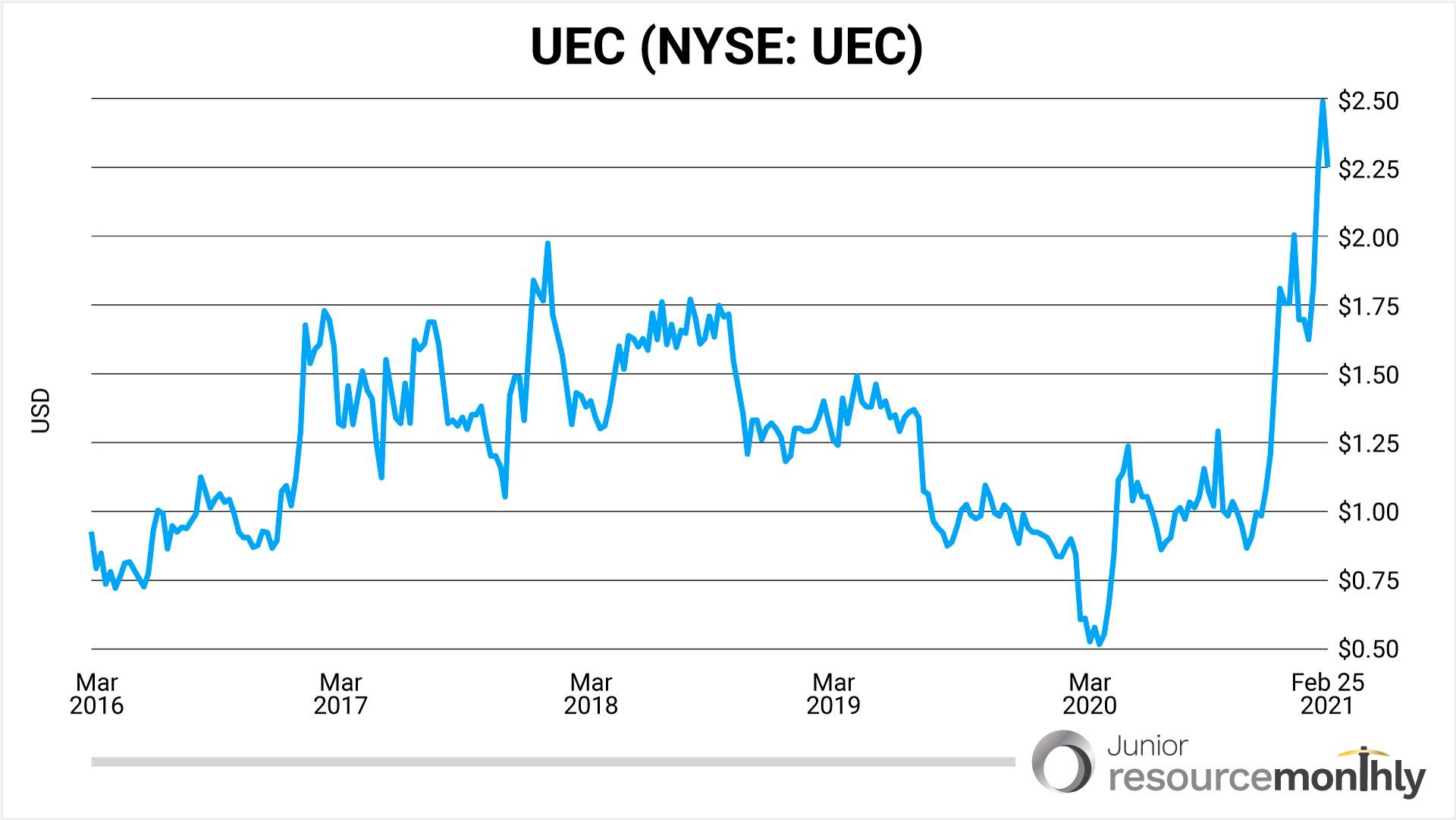

Here’s a 5-year chart of UEC (NYSE: UEC), which we’re up 70% on with the bulk of the move higher coming in the past month.

If you’re a new subscriber you should also note the volume increase during the move higher.

During "boring" periods in the market — like the one we’re experiencing in the gold space right now — a 40-50% move lower on light volume is common.

Those moves lower are gifts if you’re patient and know what you’re buying. Hype and a trend will send prices higher in the short-term, quality companies with quality assets will ensure that those gains are not a round trip.

Which brings me to the critical metals space.

Critical Metals Surge

I’ve written at length (here and here) about the recent energy grid failure here in Texas, and if you listened to the most recent Bizarro World episode I’ve made my feelings pretty clear about the whole debacle.

The failure of one of the country’s most prosperous state’s energy grid is going to make it tough to oppose a multi-trillion dollar infrastructure package being proposed by the new administration here in the U.S.

Infrastructure that the past month made clear is necessary. We can all disagree on the most productive way to pay for it but that’s another discussion for another day, and I’d rather focus on how we can make money from it.

Nickel is at its highest since 2014, tin has risen sixteen weeks in a row, platinum is this year’s top performing precious metal, copper is seeing its highest price in nearly a decade and headed to new all-time highs.

I rarely agree with Goldman Sachs but they are right when they warn of a historic copper shortage:

These trends point towards a high risk of scarcity conditions over the coming months. In this context, the fundamental outlook for copper remains extremely bullish with no evidence that current price levels are yet stimulating softening effects to reverse both spot and forward fundamental tightening trends. We continue to forecast the largest deficit in 10 years in 2021 (327kt), followed by an open-ended phase of deficits as peak copper supply (2023/24) and a record 10-year supply gap on the horizon. To reflect the rising probability of scarcity pricing our new 3/6/12M copper targets increase to $9,200/$9,800/$10,500/t (from $8,500/9,000/10,000/t previously). We consider below the key bullish increments for copper supporting the revision higher in price targets.

I couldn’t agree more, and the forecast may turn out to be a modest one.

Chinese demand is part of why the copper price is surging, but copper isn’t the only metal China is hoarding. China once again set its sights on weaponizing its rare earth dominance in a game of political chess that has led to a surge in prices and a rush to expedite a domestic supply of the critical metals.

Earlier this month The Financial Post reported that China is exploring whether it can hurt U.S. and European defense contractors by limiting supplies of rare-earth minerals that are critical to the industry.

China accounts for 80% of rare-earth imports into the U.S. The Biden administration is continuing a Trump administration policy exploring ways to develop a domestic rare earth supply.

The United States is now again part of the Paris agreement and recent announcement to move the entire fleet of federal vehicles to electric underscores how mainstream EV’s are becoming.

Benchmark Lithium estimates that battery demand in Europe is set to increase at an annualized rate of 40.1% between 2020 and 2025.

In 2020, China mined 140,000 tons of rare earths. The United States came in second with an output of 38,000 tons, and Burma was third with 30,000 tons.

Outside of recycling, there are no quick fixes to the problem which makes for a compelling investment theme that is anchored by a shortage of real options.

One excellent way to play the critical metals space is Leading Edge Materials (TSX-V: LEM)(OTCQB: LEMIF).

On to portfolio news.

Portfolio News

Leading Edge Materials (TSX-V: LEM)(OTCQB: LEMIF) has tripled since it raised $3.5 million at C$0.11 last year, but should be trading in dollars not cents.

I suspect the C$0.20 warrants issued in that financing are part of the reason the stock isn’t closer to a dollar.

The company recently commissioned SRK Consulting (UK) Limited to produce a preliminary economic assessment study on the Norra Karr heavy rare earth element project, to include the additional potential of by-product revenues and associated reduced environmental footprint.

This coincides with The European Commission’s announcement of an Action Plan on critical raw materials aimed at developing resilient value chains for European Union industrial ecosystems, reducing dependency on primary critical raw materials, strengthening domestic sourcing of raw materials in the EU, diversifying sourcing from third countries and removing distortions to international trade.

The Action Plan included the establishment of a European Raw Materials Alliance to address raw material challenges along industrial ecosystems, provide tailored solutions to industry needs, unlock regulatory bottlenecks and create an investment channel for raw materials projects.

Leading Edge has joined ERMA with both the Norra Karr HREE and Woxna Graphite projects.

Zenito Limited, a UK based engineering consultancy, and a range of sub-consultants, have been commissioned to produce a Preliminary Economic Assessment study on the Woxna Graphite project.

The PEA will for the first time include previously developed downstream processes utilizing thermal purification that could enable Woxna Graphite to produce a range of ultra-high purity natural graphite products suitable for the lithium-ion battery market.

Leading Edge has a market cap of approximately C$53 million and is right at our buy up to price. Get that done.

Nomad Royalty (TSX: NSR)(OTCQX: NSRXF)

Another bargain that should be a part of your portfolio is Nomad Royalty.

On February 18,Nomad reported 2020 annual and Q4 results.

Here are some highlights from the release:

-

The company had fourth quarter revenue of $6.8 million.

-

Gold equivalent ounces sold of 3,587 for Q4 2020 (3,084 for Q4 2019) and 14,870 for the year 2020 (12,233 for 2019).

-

Cash operating margin came in at an excellent 86% for Q4 2020 (96% for Q4 2019) and 90% for the year 2020 (96% for 2019).

The company ended 2020 with $22.5 million in cash.

On February 22, the company announced a quarterly dividend of CAD $0.005 per common share, payable on April 15, 2021 to Nomad's shareholders of record as of the close of business on March 31, 2021.

Vincent Metcalfe, CEO and Chair of the Board of Directors of Nomad, stated, "Nomad had a strong fourth quarter with revenue of $6.8 million as the portfolio continued to demonstrate its strength and reliability. As for the year 2020, Nomad was successful in launching and establishing a strong platform, while executing on the business plan of becoming a significant player in the sector. For 2021, Nomad expects organic portfolio growth which will allow it to continue to generate strong free cash flow while reinvesting in new opportunities that will support further growth and returns to shareholders."

There are lots of new subscribers and I can’t stress enough how great your timing is.

Nomad presents compelling value at these levels and is under the buy up to price.

Perpetua Resources (TSX: PPTA)(NASDAQ: PPTA) — formerly Midas Gold (TSX: MAX)(OTC: MDRPF) — has done what it’s always done, which is trade in line with the gold price.

When gold goes higher, Perpetua goes higher, and vice versa.

I’ve had several of you write in concerned about the price action and wondering if there have been hiccups in the permitting process or something wrong behind the scenes.

Quite opposite, permitting remains on track and the recent price action is an opportunity for new subscribers to initiate a position. For those of you looking for a liquid gold play with leverage to higher gold prices, Perpetua presents a compelling speculation.

I spoke with CEO Laurel Sayer on the name change, permitting progress and how an environmentalist became CEO of a mining company. You can listen to that here.

Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF)

Nevada Sunrise had its momentum reversed by the pullback in gold and the delays with the assay labs. Those delays allowed me to do what I’m advising you to do, take advantage of the delays and pullback to add to your position.

I now expect the next set of assays within the next 7-10 days and have been advised that we should expect approximately 18 holes.

In the meantime the company recently announced that it has staked additional claims at its two lithium brine projects in Nevada.

The company owns 100% interests in the Gemini Lithium Project ) and the Jackson Wash Lithium Project, both located in the Lida Valley basin in Esmeralda County, Nevada.

A total of 40 claims totaling approximately 800 acres (194.25 hectares) were staked in February 2021 to expand the boundaries of Gemini and Jackson Wash.

"The discovery of lithium-bearing brines can present a small footprint, environmentally-friendly method of lithium production in Nevada," said Warren Stanyer, President and CEO of Nevada Sunrise. "Our Lida Valley properties are underexplored, and the increased land position from our recent staking covers what we believe are our best lithium brine target areas for future drilling."

In addition to the 20% interest in Kinsley Mountain, the right to earn inot 100% of the Coronado VMS copper project (also in Nevada) the company also owns an 80.09 acre/feet/year water right, a prerequisite for the exploration and development of lithium brine projects in Nevada.

With lithium heating up, I suspect that the water rights will once again become attractive for companies in the basin looking to develop their respective lithium projects.

A lot of shots on goal for a company with a market cap of approximately C$11 million, which is why I recently participated in the most recent financing in hopes of writing future checks at much higher prices.

A new discovery at Kinsley will ensure that happens sooner rather than later.

Mawson Gold (TSX: MAW)(OTC: MWSNF)

Mawson is very representative of the sentiment in the gold space.

All Mawson has done this past month is find more gold in Australia, de-risk its flagship Rajapalot gold-cobalt project in Finland, and mobilize a total of five drill rigs across multiple jurisdictions.

The market has rewarded Mawson by selling Mawson stock down some 35% in the past month.

With assays pending from both Australia and Finland, I expect that downward trend to reverse soon.

On February 11, Mawson announced assay results from five further drill holes (MDDSC006-10) from the 100%-owned Sunday Creek project in the Victorian Goldfields of Australia.

Highlights from the release:

-

Diamond drillhole MDDSC0010 intersected 7.0 metres @ 6.0 g/t gold from 72.4 metres including 2.0 metres @ 18.5 g/t gold from 73.9 metres and 3.4 metres @ 9.7 g/t gold from 97.9 metres including 0.3 metres @ 72.9 g/t gold from 101.0 metres

-

Diamond drillhole MDDSC008, drilled 60 metres above MDDSC010, intersected 2.1 metres @ 7.6 g/t gold, 1.7% antimony from 67.7 metres including 0.7 metres @ 21.5 g/t gold and 5.0 % antimony from 73.9 metres and 0.2 metres @ 8.0 g/t gold, 3.9 % antimony from 95.0 metres.

-

Diamond drillhole MDDSC007, drilled 60 metres to the SW of MDDSC010, intersected a broad 20 metre lower grade zone from 76.2 metres, that included 5.8 metres @ 2.2 g/t gold, 0.4 % antimony from 76.2 metres including 0.4 metres @ 22.3 g/t gold and 3.2 % antimony from 78.6 metres.

-

Diamond drillhole MDDSC007, drilled 60 metres to the SW of MDDSC010, intersected a broad 20 metre lower grade zone from 76.2 metres, that included 5.8 metres @ 2.2 g/t gold, 0.4 % antimony from 76.2 metres including 0.4 metres @ 22.3 g/t gold and 3.2 % antimony from 78.6 metres.

Michael Hudson, CEO, commented on the results: "Sunday Creek continues to deliver with our first results from the Gladys mine area. Encouraging the deepest hole, MDDSC010, reported here contains the best result reported to date from Gladys, and is reflective of drilling now testing below historic mined areas. Mawson has now drilled strong gold results from three individual sheeted vein structures: Apollo, Central and now Gladys. All areas remain open towards depth. Additionally, significant strike potential remains untested over 500 metres between and below historic mines, before we consider stepping out into the 11 kilometre historic mine trend."

Mawson has now completed twelve drill holes with one hole in progress and one hole abandoned for 1,955.4 meters at the Sunday Creek gold. Drilling continues. Assays from 10 out of the 12 completed holes have been released. Geophysical surveys (3D induced polarization and ground magnetics) have been completed.

I spoke with CEO Michael Hudson about the results in Australia. You can listen to that here.

Mawson followed that news up with news that likely went over a lot of speculators’ heads.

The headline, "Mawson Commences EIA and Land Use Planning for the Rajapalot Gold-Cobalt Project in Finland" doesn’t capture how important this step is to the Rajapalot project.

CEO Michael Hudson said: "The commencement of the EIA and land use planning mechanisms is reflective of the local and regional support that the project receives, for which Mawson is very thankful. The decisions made by the local authorities are a clear indication that we have succeeded in crucial stakeholder engagement and that the project is welcomed in the area. As the project transitions from exploration to advanced studies, Mawson will continue to work in the same transparent and open way to retain the social acceptance of the local people in order to de-risk this strategic gold-cobalt project for the future benefit of all stakeholders."

I reached out to Michael Hudson to go over the milestone.

You can and should listen to that here.

Mawson is under the buy up to price and a strong buy at these levels.

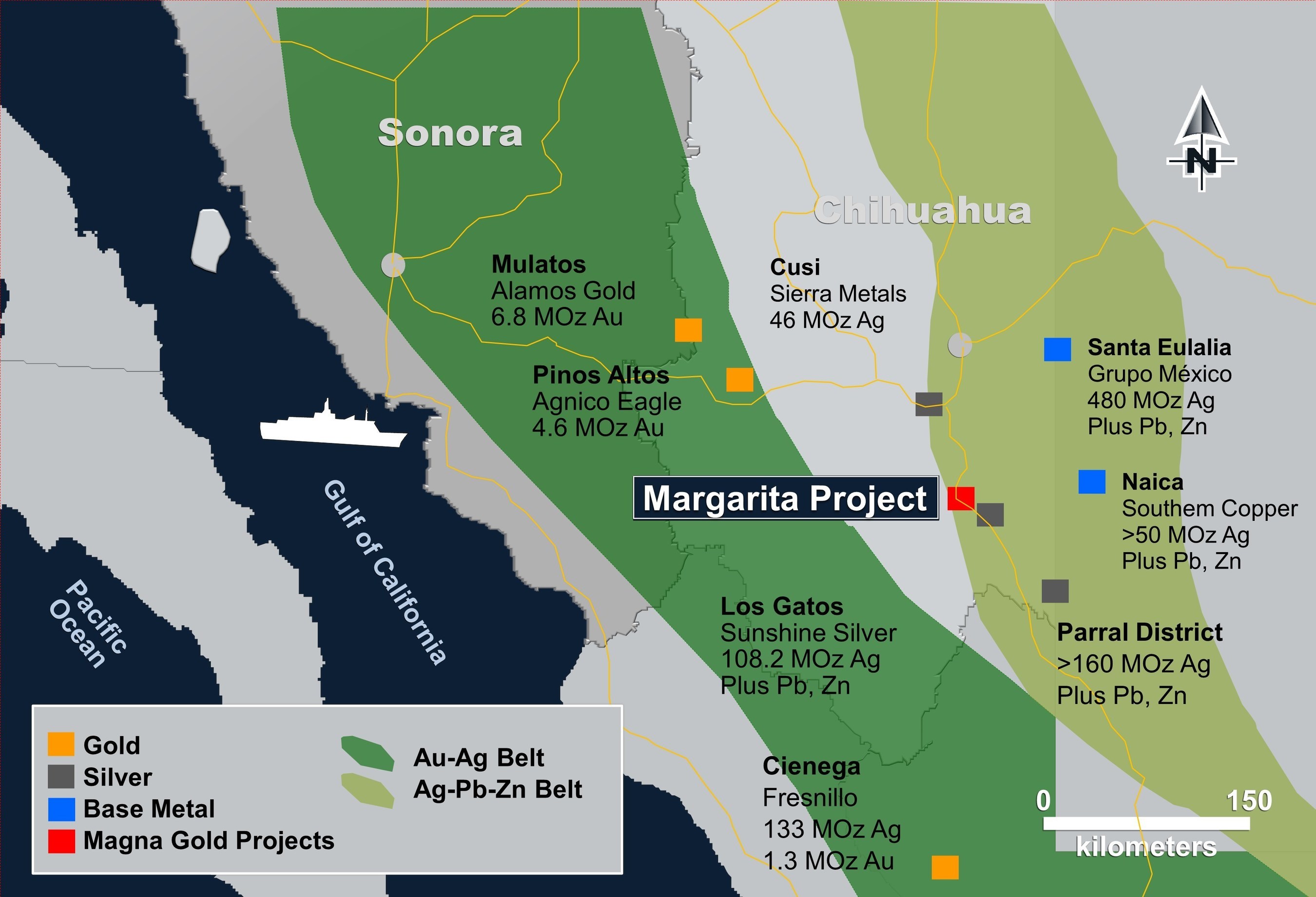

Magna Gold (TSXV: MGR)(OTCQB: MGLQF)

Magna continues to execute, the market continues to yawn and my contrarian heart continues to smile as the opportunity to add at these levels is delightful.

On February 4, Magna announced that exploration activities have commenced on the 100% owned Margarita Silver Project located in Chihuahua State, Mexico.

Magna has started to process 5,097 meters of HQ drill core from 35 drill holes that were acquired in the acquisition of Margarita.

Magna plans to re-log drill core, re-sample and sample vein and vein extensions, and compile sections and long sections based on drilling from 2018 and 2019 in an effort to further understand the mineral potential across the property.

Arturo Bonillas, President and CEO of Magna stated, "Magna has a promising portfolio of silver projects in Mexico and an ambitious exploration program planned for the year. We expect good results from Margarita, as well as our other properties, and we look forward to reporting the results over the course of 2021. In addition to a continued successful ramp-up at San Francisco and establishing a stable base on gold production, we believe there is a significant amount of value that can be surfaced across our silver portfolio."

I believe the value in the silver portfolio will be unlocked via a spinout of the silver portfolio (Magna Silver) creating a quality silver exploration play.

Field work at Margarita is scheduled to commence in Q1, which will be used to plan a drill campaign that will commence by Q3 2021.

In addition to Margarita, Magna is planning work programs on the La Pima and Los Muertos properties.

Exposure to exploration, development, and production. Gold and silver.

That’s what Magna provides. Every single subscriber to this service should own Magna.

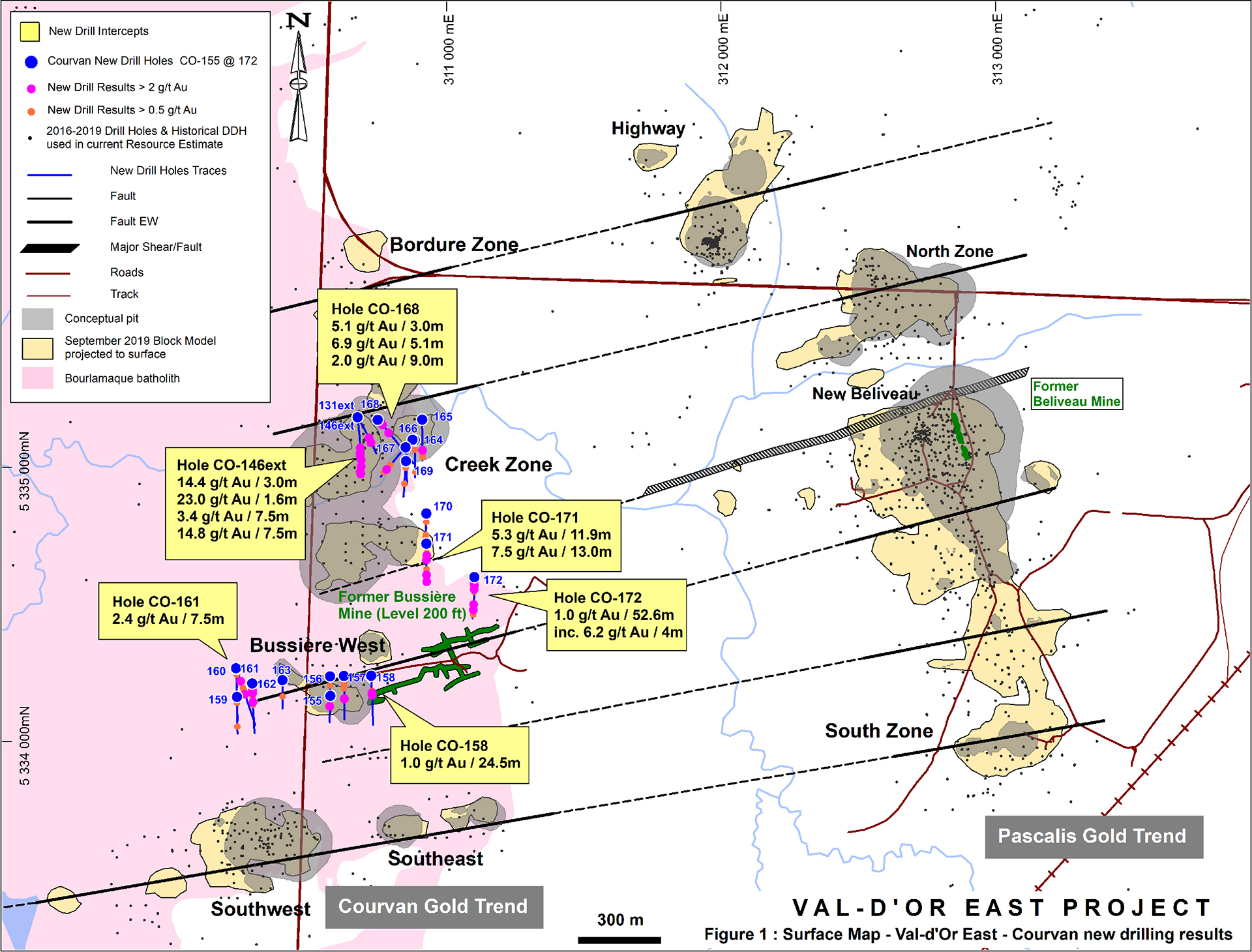

Probe Metals (TSX-V: PRB)(OTCQB: PROBF)

I believe Probe Metals is on a short list of companies that will be bought out in 2021.

Until that happens, Probe will continue to add value via the drill bit.

On February 1, Probe announced additional results from the 2020 drill program on its 100% owned Val-d’Or East Courvan property.

Results from the last 20 holes, including two extension holes, of the 2020 exploration and expansion drill program continued to show new high-grade gold discoveries along the Courvan Gold Trend near the surface and at depth.

Results from this drilling returned some of the best intervals to-date from the Courvan property, including 14.8 g/t Au over 7.5 metres in hole CO-146 and 7.5 g/t Au over 13 metres in hole CO-171. The 2021 winter drill program at Courvan is focused on both resource expansion and infill drilling to convert inferred and indicated resources.

David Palmer, President and CEO of Probe, states, "2020 was an exceptional year for the Val-d’Or East Project and resulted in numerous discoveries that indicate areas of better grade, better thickness and better continuity across all deposits. It was also a year where we continued to gain a much better understanding of these deposits that will lead to increased confidence in the ounces we are generating. The drill results we released today for Courvan are some of the best we have seen for this project and speak to the tremendous exploration potential of Val-d’Or East, however, as we continue exploration in 2021, one of our key goals is to advance the project towards development, with a focus on improving the quality of ounces that will form the basis of our PEA. 2021 should be an exciting year for the project, and the Company, as we advance our project and interest grows in the Val-d’Or area."

Probe has over three million gold ounces, a strong balance sheet and excellent exploration upside in a great jurisdiction.

All the boxes that I would want to check if I was looking to expand my reserve base. Probe is a buy up to C$1.50/US$1.22.

Western Copper and Gold Corporation (TSX: WRN)(NYSE: WRN)

Western Copper & Gold was the subject of a lot of emails for a few months from subscribers wondering if the company was still worth owning. Those emails were from bored speculators that discounted where copper was headed and that the NYSE listing would generate institutional interest as funds looked for copper exposure.

What a difference a month makes. We’re now up 80% with the bulk of the move happening in the past month.

On February 2, the company announced assay results from the 2020 exploration diamond drilling program at its wholly owned Casino Project located in the Yukon Territory, Canada.

The exploration program consisted of 12,008 m of diamond drilling in 49 holes.

There were four major drilling targets the "Gold Zone", a zone of higher-grade gold values along the southern and western margins of the Casino deposit; step-out drilling at the "Northern Porphyry Zone"; drilling in the "Casino West Zone" west of the Gold Zone; and a new target in the "Ana Zone" located 2 km west of the Casino West Zone within the Canadian Creek claim block acquired in 2019.

A full table of all drill results from the release can be found here.

"Casino is a significant copper-gold project and these drill results continue to improve it. The 2020 drill program extended the mineralization at the Northern Porphyry discovered in 2019 and confirmed the importance of the higher-grade deposit core," said Paul West-Sells, President and CEO. "The deposit core has significantly higher grades than the rest of the deposit and they persist from a few metres below the surface to greater than 200 m depth over a sizable area. The significance of these attributes will be clearly shown in the updated PEA, which we expect to release during Q2."

The PEA is the next major catalyst. Western Copper & Gold is a buy up to C$1.75/US$1.45.

Gold Bull Resources (TSX-V: GBRC)(OTC: BLSSF)

Gold Bull CEO has a mission to grow the resource base from the current 500k or so gold ounces to five million by year-end. That’s not a typo. And because I believe her the stock made its way into the JRM portfolio.

On February 2, the company announced that the mineral resource at the Sandman project in Nevada had grown by 60% to 494,000 ounces.

The resource grew 60% without a single hole being drilled.

Gold Bull CEO, Cherie Leeden, commented:

"This resource estimate incorporated the additional drilling that has been completed at the project since the 2007 resource estimate which totalled 309,000 ounces. Since acquiring the project from Newmont in December 2020, it is a fantastic outcome to have grown our resource base to 494,000 ounces of gold (comprised of 433,000 ounces of Indicated plus 61,000 ounces of Inferred) before we even commence our drill program."

The resource consists of 21.8Mt @ 0.7g/t gold, comprising of:

-

Indicated Resource of 18,550kt @ 0.73g/t gold for 433,000 ounces of gold and Inferred Resource of 3,246kt @ 0.58g/t gold for 61,000 ounces of gold.

In addition to the excellent grade it’s important to note that the bulk of the mineralization occurs at shallow depths of less than 100 meters.

Drilling at Sandman has now commenced and I look forward to results from the initial program.

I spoke with CEO Cherie Leeden about the aggressive plans for 2021 and beyond.

You can listen to that here.

Gold Bull is right under the buy up to price. It won’t last long.

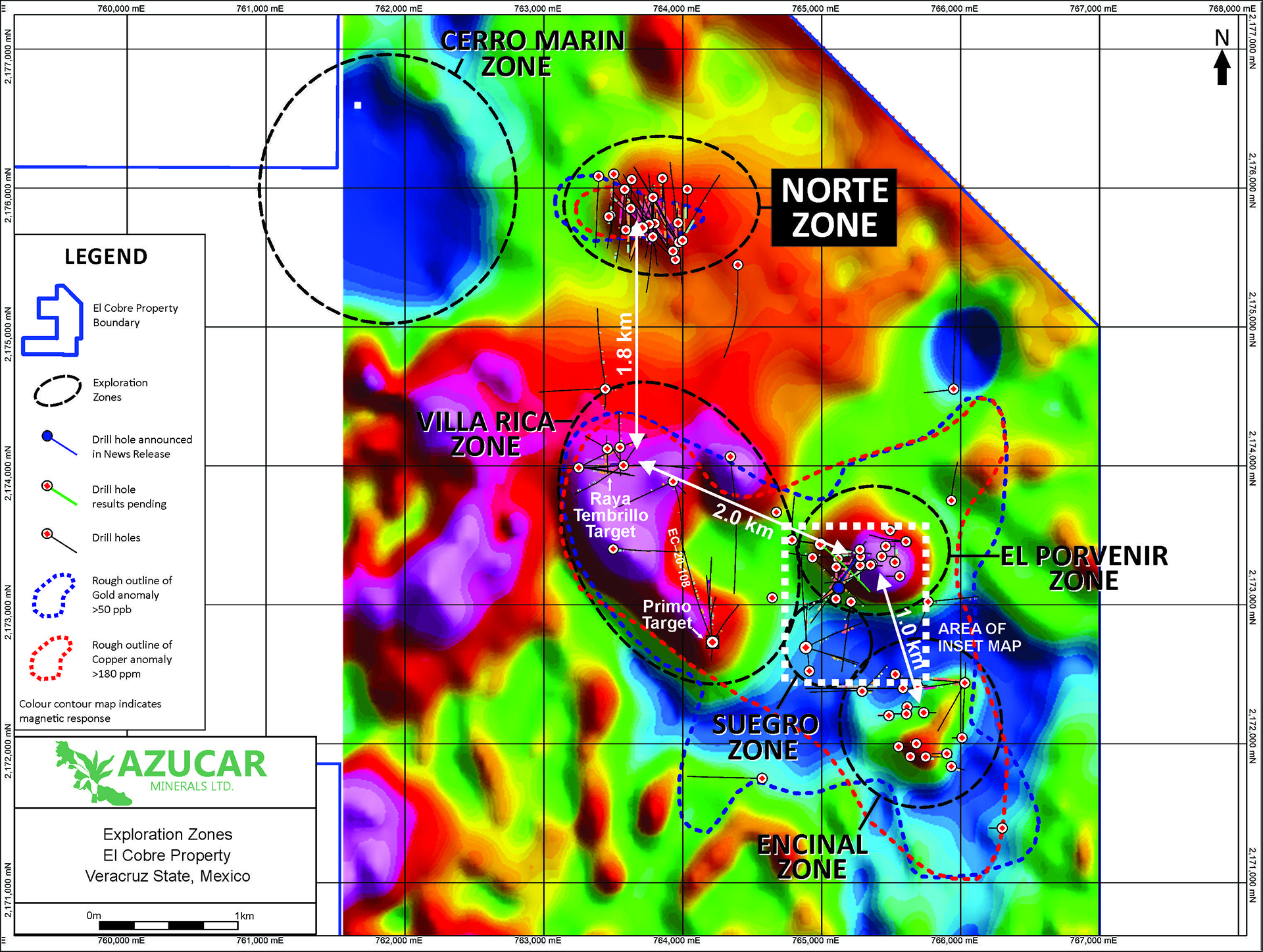

Azucar Minerals (TSX-V: AMZ)(OTCQX: AXDDF)

After several Covid-related delays Azucar finally has a drill turning at its El Cobre copper-gold project in Veracruz, Mexico.

On February 4, 2021, Azucar announced results from recent drilling at El Cobre.

Results were decent, not great, and included 65.50 metres of 0.39 g/t Au and 0.22% Cu.

Drilling planned for the Porvenir Zone has been completed and future drilling on the project will be planned based on a geologic review currently underway and the receipt of outstanding assay results.

J. Duane Poliquin, Chairman of Azucar commented, "With the announcement of the initial resource at the Norte target in September last year, our exploration focus is now two-fold; to better understand other near surface zones of mineralisation, such as Porvenir, and to continue our search for additional porphyry centres at the project."

With 2.6 million gold equivalent ounces (part gold, part copper) and excellent exploration upside Azucar’s C$12 million market cap makes the company a strong buy at these levels.

Abacus Mining & Exploration (TSX-V: AME)(OTC: ABCFF)

Another absolute gift and one I’m urging you to buy at these levels is Abacus.

The company is drilling at Jersey Valley in Nevada, will de drilling the Willow copper project (also in Nevada) and owns 20% of the massive Ajax copper-gold project which seems to be gaining traction once again after a permit denial several years ago due to lack of support from one of the First Nations groups involved with the project.

I spoke with the President and CEO about the busy 2021 ahead.

You can and should listen to that here.

Kutcho Copper (TSXV: KC)(OTC: KCCFF)

Like Western Copper & Gold, Kutcho Copper has had itself a great month of February — up over 50%.

The most recent bit of news was the updated resource estimate announced on February 11.

I spoke with CEO Vince Sorace about the updated resource and what to expect in 2021. You can listen to that here.

Ethos Gold (TSXV: ECC)(OTC: ETHOF)

Ethos Gold will be one of the best percent movers in this portfolio this year.

The company has managed to put together nine district scale gold projects and is planning work on multiple projects with drilling expected on the most attractive projects in the second half of this year.

The latest addition was announced on February 16, 2021 — that it has entered into an agreement to purchase a 100% interest in 48 mineral claims covering 2,359 hectares (23.59 km2) contiguous with Ethos' existing land position within the Schefferville Gold District, approximately 85 km northwest of Schefferville, Quebec.

The newly acquired claims host at least seven known historical iron formations hosted gold occurrences with sampling ranging from 2.0 g/t Au to 171.5 g/t Au.

An extensive database covering both the newly acquired claims and significant areas of ground already held by Ethos has also been acquired. This dataset includes geologic mapping, surface sampling, geophysical surveys, and drill results.

The Schefferville Project now comprises a total of 36,808 hectares.

Jo Price, VP Exploration of Ethos said, "With this acquisition Ethos has consolidated a district scale project with significant historic work that has identified at least 53 separate gold occurrences over +20 km of strike. Minimal historic drilling yielded very encouraging intervals of gold mineralization. We are delighted to have been able to consolidate such a large scale area of auriferous iron formation in Quebec with an extensive dataset to facilitate the next phase of exploration. The Ethos technical team has considerable experience and discovery success in exploring iron formation hosted gold in Canada, and this will greatly facilitate our work. We will initiate field work as soon as possible in the spring with the aim of completing an initial drill program later in 2021."

I encourage everyone to go to the Ethos website, get familiar with the projects and then go buy some Ethos stock which is an absolute gift at these levels.

Last but not least Fission Uranium.

Fission Uranium (TSX: FCU)(OTC: FCUUF)

Fission has also had itself an excellent February up over 100% the past thirty days.

On February 1, Fission announced drilling plans for 2021, which include a 43-hole (12,640 m) program at its PLS property — host to the large, high-grade and near surface Triple R deposit — in Saskatchewan, Canada .

The fully funded program aims to increase the Indicated classified resource of the Triple R deposit's R780E zone, and also upgrade to Indicated the large R840W zone, located on land, ~500m west of Patterson Lake.

Fission is planning to advance the PLS project with a feasibility study beginning in 2021 and the success of the planned drill program has the potential to increase the resource used in that study.

Uranium mineralization of the Triple R deposit at PLS occurs within the Patterson Lake Conductive Corridor and has been traced by core drilling over ~3.18 km of east-west strike length in five separated mineralized "zones" which collectively make up the Triple R deposit. From west to east, these zones are: R1515W, R840W, R00E, R780E and R1620E.

The time to buy Fission was when no one was looking and though there is significant upside in all the uranium names, the recent move higher has been an aggressive one which you’re hopefully enjoying.

If you haven’t yet topped off your uranium portfolio, Azarga and Skyharbour are both under the buy up to price and still present compelling value at current prices.

Closing Thoughts

Long issue so I’ll keep it brief.

Like copper and uranium, gold will remain boring until it’s not... and then the gold experts that are currently crypto experts will be out in mass to tell you about $5,000 gold.

Use the consolidation to your advantage. Use the buy up to prices as guidance.

M&A is coming. Companies like Revival and Perpetua (formerly Midas Gold) and Mawson will trade at multiples of today’s prices.

Expect a busy March as delayed assays start coming in from the labs including results from Nevada Sunrise Gold, which I’m eager to see.

For those of you that are new to this service, the core companies in the portfolio are the least risky (within the high-risk junior resource sector) companies and the ones you should own first.

Depending on your risk tolerance you should then own a healthy dose of the exploration plays.

What you buy, what you pay and when you sell is ultimately up to you, but I do advise you use the buy up to prices as guidance to inform that decision.

Stay safe and keep an eye on your inbox.

Let's get it!

Gerardo Del Real

Gerardo Del Real

Editor, Junior Resource Monthly

For the past decade, Gerardo Del Real has worked behind-the-scenes providing research, due diligence and advice to large institutional players, fund managers, newsletter writers and some of the most active high net worth investors in the resource space. Now, he is bringing his extensive experience to the public through Resource Stock Digest, Junior Resource Monthly, and Junior Resource Trader. For more about Gerardo, check out his editor page.

*Follow Gerardo on Twitter.

Make sure you never miss an update or issue from Junior Resource Monthly by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Junior Resource Monthly, Copyright © 2021, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Junior Resource Monthly does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.