Junior Resource Monthly April 2021

PREMIUM CONTENT FOR PAID MEMBERS ONLY

by Gerardo Del Real

by Gerardo Del RealIn This Issue:

Last month I shared with you that commodities and real assets are and will continue to be on an epic run fueled by cheap money, easy credit (for the right profiles), and central banks propping up financial assets as they try to create as much space between inflation where they’re happy to overshoot and deflation, which is a central banker’s worst enemy.

Steel is up 58% ytd

Copper is up 27% ytd (10-year high and going higher)

Corn is up 35% ytd

Soybeans are up 17%

The U.S. has pumped $12.3 trillion of monetary and fiscal stimulus into the economy in the 13 months through March 2021.

The inflation shows and hides itself in many ways. Prices go up at the grocery store or companies keep the price but quietly provide you less paper, coffee, baby food, or soap for the same amount.

Procter & Gamble Operating Chief Jon Moeller, a 33-year company veteran, told the Wall Street Journal that

“This is one of the bigger increases in commodity costs that we’ve seen over the period of time that I’ve been involved with this, which is a fairly long period of time.”

That’s one of the largest consumer products companies in the world, which generates over $75 billion in annual sales.

If you happen to have one of those excellent credit profiles that allows you to take advantage of a mortgage you’ll soon realize that you’re competing with cash buyers who are muscling out non-cash buyers in many markets.

Peter Boockvar, who is an excellent source for all things U.S. macro, recently said that investors in the market looking to buy real estate to rent made up 23% of cash buyers in March.

Meanwhile, gold continues to languish, failing to break through the $1,800 level convincingly. It will.

In the meantime, you and I get to buy companies like Magna Gold (TSX-V: MGR)(OTCQB: MGQLF) at prices that in a few years will have you (not me because I’m buying more) pulling your hair out wondering why you didn’t add more.

The company recently provided 2021 production guidance of 55,000 - 65,000 ounces of gold. More on that in portfolio news, which is what you should be watching in this time of boring gold prices because that’s the most important metric during lulls in price action.

Is the company you own adding value somehow that the market can re-rate when the time comes?

Back to Magna, because it’s a perfect example. Let’s do some simple math. Ignore the excellent pipeline of precious metals exploration projects. Ignore the very real likelihood of the company beating on the production guidance and/or adding more to the reserve base through M&A.

Let’s just look at what revenue from gold sales will look like this year. I estimate production cost at approximately $1,100/oz.

Gold is sitting right near the $1,800 level. $700 in margin per ounce. I’ll take the median number between 55k-65k ounces per year and go with 60k gold ounces produced this year.

That’s roughly US$42 million in profit or US$108 million in gross revenue. Current market cap of Magna Gold in USD is approximately $65 million.

Would it be better for the ego if Magna traded at $3? Sure if you’re into that type of thing. Me?

I want to maximize profits in this cycle so I’m perfectly content to buy more at current levels while the market wakes back up.

Global COVID Cases

While the U.S. is trending in the right direction with access to COVID vaccines becoming more and more available by the day, things are not so rosy elsewhere.

In India, a new COVID-19 surge is raging through the country’s population of 1.3 billion.

Only 1.5% of the country has been fully vaccinated. On Sunday April 26, the country reported approximately 350,000 new cases.

Europe has decided to allow only fully vaccinated Americans to visit this summer.

The surge in India and cautious approach taken by Europe is a clear indicator that an all-out global recovery is closer but not quite here yet.

Despite that, copper, iron ore, and aluminum are all headed to new highs.

Add in potential supply disruptions from Chile and Peru and we have quite the setup.

In Chile, port workers called for a strike after President Sebastian Piñera’s move to block a bill allowing people to make a third round of early withdrawals from their pension funds.

Chile accounts for roughly 25% of the world’s copper supply.

Then there’s Peru.

Peru Exposure & Guidance

Copper continues its upward march towards new all-time highs as the perfect combination of COVID-related supply disruptions, geopolitical tensions, and years of under-investment (coupled with long lead times to bring supply into production) continues to underscore the robust demand from the electrification of everything.

On that note, Nick Hodge and I recently presented at the Money, Metals, & Mining Virtual Expo about the electrification of everything and how we’re playing it. You can watch that here.

That’s the good news. The not-so-good news in the short-term — but news that presents an opportunity for patient traders amongst you — comes out of Peru where the elections that were meant to provide clarity earlier this month did the exact opposite.

I’m no expert in Peruvian politics so I’ll give you the very stripped-down version.

A far-left candidate, Pedro Castillo, who has voiced the possibility of nationalizing natural resource assets (not good for mining), and a far-right candidate who is the daughter of former and disgraced President Fujimori (and who is very pro-business) are headed for a runoff in June that will determine the direction of the country.

Castillo was very vocal in voicing his support for mining and his support for the rule of law.

The fear of nationalization is the reason for recent weakness in Hannan Metals (TSX-V: HAN)(OTC: HANNF) and Chakana (TSX-V: PERU)(OTC: CHKKF) despite copper running higher.

Anyone who tells you they know how it plays out is lying to you.

Let’s take the worst-case scenario for my Peru exposure (Regulus and Chakana) in the portfolio. Palamina (TSX-V: PA)(PTC: PLMNF) is also in Peru but has been inactive publicly though behind the scenes it continues to get its drilling permit for the most prospective of its gold projects.

If the far-left candidate wins and does an about-face on nationalization it will start with producers. Producers that can provide immediate revenue to the state.

Will that have an effect on financial assets with Peru exposure? Of course. That’s the risk of holding.

A risk I’m personally willing to take because of the already depressed share prices (relative to value) of both Hanann (TSX-V: PERU)(OTC: HANNF) and Chakana (TSX-V: PERU)(OTC: CHKKF).

Both companies are cashed up. Both have well-funded partners with a vested interest — and influence in the region — in seeing these projects advance and both have multiple catalysts that make each stock a bargain despite political risk.

Lots going on. Let’s get to portfolio news.

Portfolio News

Let’s start with Magna, which I led with.

Magna Gold (TSX-V: MGR)(OTC: MGLQF)

On April 13, 2021, Magna announced Q1 operating results and updated progress on its ramp up of the San Francisco mine in Sonora, Mexico.

The company expects the mine will return to full-scale commercial production by June 2021. Gold and silver production during the three months ended March 31, 2021 was 9,785 ounces and 8,093 ounces, respectively. Compared to the three months ended December 31, 2020, this represents an increase of 31% and 76% to gold and silver production, respectively.

Magna also reported higher head grades (28% higher) and remedied a neglected plant and equipment which, according to Magna (and I believe CEO Arturo Bonillas), had not received proper maintenance by the prior operator for an extended period of time.

Mr. Arturo Bonillas, president & CEO of Magna, commented:

“We are extremely proud of our progress at San Francisco – our team has made considerable progress during ramp-up and we are well on our way to establishing San Francisco as a stable free cash flow generator. The evident turnaround of the San Francisco Mine, considered by many as an impossible task one year ago, shows our team's resourcefulness and commitment to executing our mission to become a profitable precious metal producer. In addition to achieving commercial production at San Francisco in the coming months, we will remain focused on realizing further operational efficiencies, expanding mineral reserves and resources and seeking growth opportunities externally and within our significant pipeline of projects.”

We should also expect an update to the ongoing drill program.

The bottom line is Arturo and the team have executed brilliantly. I can’t make you buy Magna but I can tell you I will make sure to remind those of you who don’t when the stock is trading at $2, then $3, then $5.

Magna is under the buy-up-to price and a strong buy at these levels.

Mawson Gold (TSX-V: MAW)(OTC: MWSNF)

Every month Mawson does exactly what I look for in portfolio companies experiencing a pullback in a boring market. It adds value.

On April 12, 2021, Mawson announced the thickest mineralized zone found at Rajapalot — in Finland — to date.

Fifteen diamond drill holes were reported as part of the company's 76-hole, 19,422-meter 2020/21 drill program at the company's 100%-owned Rajapalot project.

Drill hole PAL0259 — a new discovery at an area called the Hut prospect — intersected 70.3 meters @ 0.9 g/t Au, 828 ppm Co, 1.6 g/t AuEq from 95.8 meters.

At Joki East hole PAL0252 intersected 1.5 meters @ 18.1 g/t Au, 1,696 ppm Co, 19.6 g/t AuEq from 117.1 meters.

Michael Hudson, chairman and CEO, said:

“After an active few months in the field, this is a strong start, delivering both high grades and thick gold-cobalt mineralization on new discoveries close to our already defined resource areas. These results show the potential to substantially grow the Rajapalot resource and we highly anticipate the additional results from 50 drill holes that will be reported from five individual prospect areas over the coming months.”

Rajapalot will become a multimillion-ounce gold project that will be bought by a mid-tier or major. That alone will command a market cap much higher than the current C$65 million.

Which leaves the Australian assets — which I also believe will yield at least one million-ounce gold deposit — being assigned zero value.

I’m aware a large shareholder has been liquidating a position and that, coupled with the gold consolidation, has led to current prices.

I spoke with Michael Hudson about the new discovery, success with the drill bit, and the many catalysts. You can listen to that here.

Hannan Metals (TSX-V:HAN)(OTC PINK: HANNF)

Quiet month news-wise from Hannan though teams are back in the field after a pause due to COVID-related restrictions.

I did however manage to speak with technical advisor Quinton Hennigh, who was very clear about the basin-scale potential with Hannan.

You can and should listen to that by clicking here.

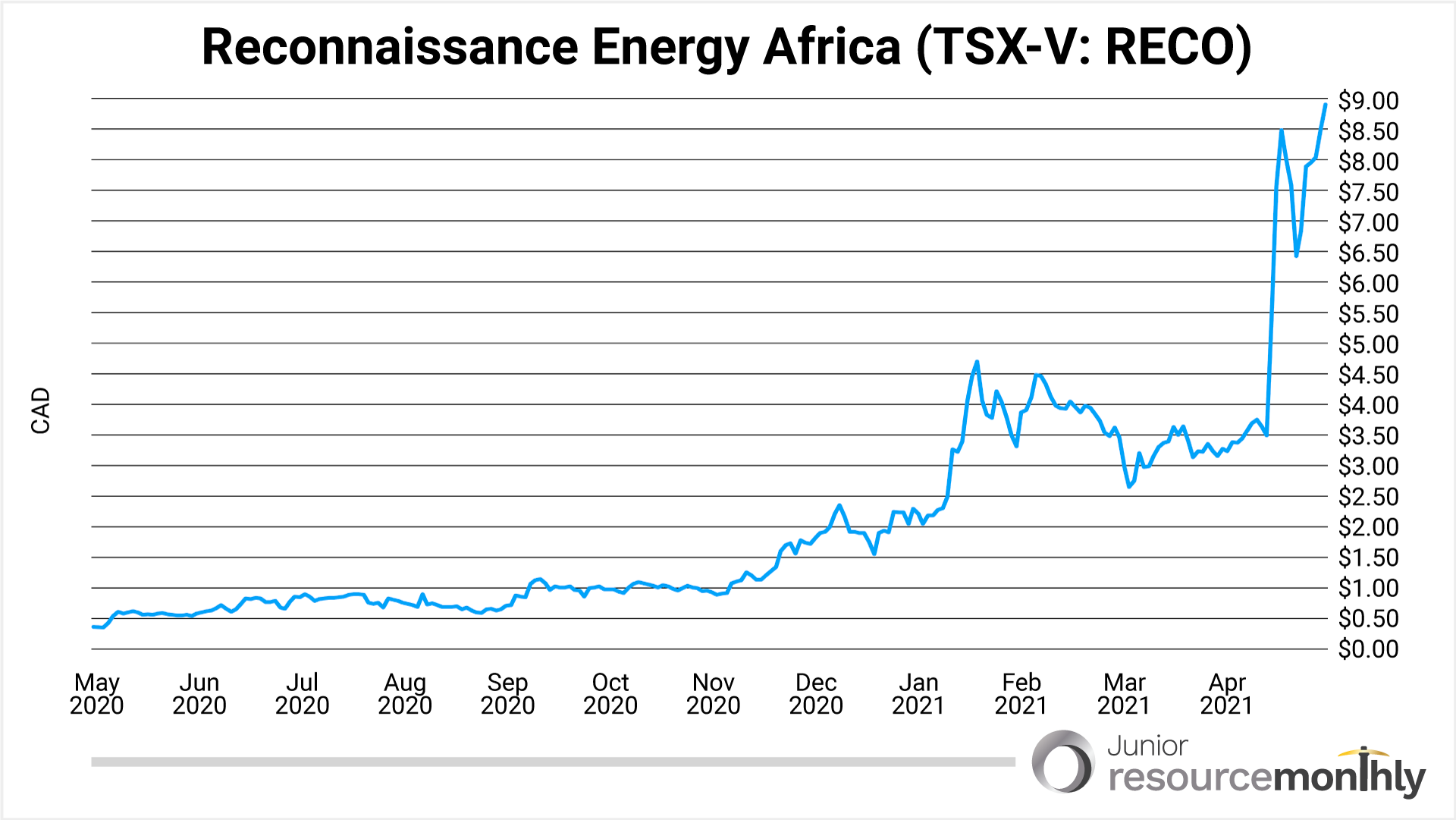

There is an analog in the oil & gas space which reminds me a lot of Hannan and underscores the upside when you are exploring an entire basin. That analog is a company called Reconnaissance Energy Africa (TSX-V: RECO).

The chart below shows what happens when a discovery is made and you control an entire basin, which is prospective for discoveries.

Hannan has already discovered high-grade copper outcrops all throughout the land package. There’s also silver and gold all over the place. The market wants clarity out of Peru and a drill bit to confirm the outcrop discoveries.

It’s boring until it’s not. Hannan is a strong buy below the buy-up-to price, which it’s currently trading near.

Uranium Energy Corp. (NYSE: UEC)

UEC is a perfect example of letting the share price action catch up to the trend. The trend — a uranium bull market — has been clear to anyone who can connect dots.

Despite that, uranium stocks — kind of like most gold stocks right now — were shunned, despised, pick a word. A position that was down over 60% last year is now up over triple digits and just getting going.

A word on that. Please use the buy-up-to prices for guidance. When the sector runs it does so quickly and though it’s easier to buy when no one cares, few of you actually do.

So if you’re building a uranium portfolio make sure you’re not buying at the top end of a run. Everything pulls back.

Back to UEC.

The company did what good companies do, which is use tough markets to your advantage. In the case of UEC it now has over $110 million in cash, equity, and inventory holdings as of early April and is back focused on its Burke Hollow ISR project in South Texas with the completion of 40 development holes.

Drilling will continue with additional resource delineation test holes, followed by installation of approximately 45 additional exterior monitoring wells to accommodate the trend extensions, complementing the 76 monitor wells previously installed.

UEC also controls the Reno Creek project, which is the largest permitted, pre-construction ISR uranium project in the U.S. I mention it because Azarga Uranium (TSX-V: AZZ)(OTC: AZZUF) controls the highest-grade ISR project in the U.S. and I believe that the surge in UEC’s share price could lead to UEC buying the fully permitted Dewey Burdock project.

UEC has had a good run. If you don’t own it, be patient.

The company is a buy under the buy-up-to price.

Fission Uranium (TSX-V: FCU)(OTCQX: FCUUF)

Fission has had itself a very good run this year and is back drilling its high-grade Triple R deposit at its PLS project, in the Athabasca Basin region of Saskatchewan, Canada.

On April 7, 2021, Fission announced results from the first of its 2021 drill programs on the R780E zone.

Twenty holes were completed in 7,147.8 meters.

All 20 holes hit wide mineralization in multiple stacked intervals, with 13 intercepting significant intervals of >10,000 cps radioactivity.

These recently completed holes have the potential to increase the Indicated category resource which may positively impact the planned feasibility study.

Ross McElroy, CEO for Fission, commented:

“This is the first of our 2021 drill programs and I'm very pleased to report that we have met, and in numerous instances exceeded, our expectations on width and strength of mineralization in all 20 holes. We continue to make strong progress towards feasibility, and these results will be instrumental in delivering a key part of our deposit growth strategy.”

I’m keeping the buy-up-to price at C$0.45 for now though that may change.

Keeping with the uranium theme, takeout target Azarga Uranium had good news recently.

Azarga Uranium (TSX:AZZ)(OTCQB:AZZUF)

On March 30, 2021, Azarga reminded the market it’s far from a one-trick pony. That pony being the high-grade ISR Dewey Burdock project which I believe will be taken out.

The news last month, which didn’t make the cutoff for publishing, was a 128% increase in Measured & Indicated resources for the Gas HIlls uranium project in Wyoming.

Blake Steele, Azarga Uranium's president and CEO, stated:

“We are extremely pleased with the results of our Gas Hills Project resource update. The scale and confidence of our ISR amenable Gas Hills Project resource estimate has established it as a significant deposit in the USA. We have conducted numerous hydrology studies on our Gas Hills Project, and they have all confirmed that the resources located below the water table are ideally suited to ISR mining techniques.”

He went on to say, “The Gas Hills region is a prolific uranium district with approximately 100 million pounds of past production. Industry leader, Cameco Corporation, owns a permitted ISR uranium project within this district. We look forward to completing a preliminary economic assessment for our Gas Hills Project and evaluating its potential as a standalone deposit as well as a significant satellite deposit to the Company's flagship Dewey Burdock Project. Utilization of planned infrastructure at our Dewey Burdock Project also has the potential to considerably reduce the capital cost profile of our Gas Hills Project.”

Azarga is right at the buy-up-to price. Get that done.

Orocobre (TSX-V: ORL)(OTC: OROCF)

Orocobre has hit all-time highs — and it’s up over 60% in the portfolio after being down by the same percentage last year — on news that Orocobre and Galaxy Lithium have agreed to merge in a $4 billion blockbuster of a deal that creates a top 5 lithium entity.

The merger consolidates the combined group’s position in Argentina, which I long called for, though admittedly it took longer than I thought.

The merger will result in a new name. Orocobre is a buy. I’m raising the buy-up-to price to C5.00/$3.80.

Probe Metals (TSX-V: PRB)(OTCQB: PROBF)

Despite the apathy in the gold space Probe is just 20% off its 52-week highs.

The company remains a clear takeout target. Not only does Probe keep hitting with the drill bit, it’s also busy identifying new gold-copper targets and de-risking the project by advancing the metallurgy.

On March 30, 2021, Probe provided an update for its 2021 exploration program on the Detour Quebec Project located immediately adjacent to the Detour Lake Mine, Ontario.

In 2020, regional-scale airborne geophysical and surface geochemical surveys were completed across the entire 90-kilometre strike length of the Project, representing the first district-scale exploration programs to have been carried out over the 777-square kilometer property.

Four areas have been selected for the first phase of follow-up exploration, which is designed to generate drill targets for the 2021 drilling program. That program is expected to consist of approximately 20,000 meters.

David Palmer, president and CEO of Probe, states:

“Our Detour exploration has performed exceedingly well with dozens of new gold anomalies identified across the entire 90-kilometre strike length of the property. We have already started our follow-up exploration programs, which are targeting high-grade gold mineralization associated with the Lower Detour Deformation Zone, which hosts the high-grade 58N and 75N gold zones south of the Detour Gold Mine, as well as high-grade gold mineralization south, along structure, of the high-grade Tabasco/Fenelon gold deposits on a neighbouring property, and expect to start an aggressive drill program once results are received. Being situated between two very high-profile mining and exploration projects, we are highly encouraged with our results to date and look forward to unlocking value for our shareholders from this prolific and very active gold belt.”

That news was followed up by news on April 20, 2021 that metallurgical testing has demonstrated above 50% gravity recoverable gold and 95% overall gold recovery on most deposits.

Importantly, all deposits are amenable to treatment in a single processing facility.

The next major catalyst is an updated resource estimate that is expected in Q2-2021 and a PEA, which is expected in Q3-2021.

Yves Dessureault, COO of Probe, states:

“These results are a very important milestone for the Val-d’Or East project. We have gone from a concept of multiple deposits feeding a central mill to actually demonstrating it with the metallurgical test work results. All deposits have the same type of response in Gravity and Leaching. The Gravity Recoverable Gold is coarse to very coarse and we have been able to model most of the resource with a single grade-recovery curve/equation, with potential for future enhancements. Lower strip ratios, less costly waste rock storage, more efficient milling and reduced infrastructure costs are just a few of the benefits we are seeing in the development work, and all should contribute to a more robust bottom line for the project. In my experience, it would be difficult to find a mineral resource that was easier to process than what we have at Val-d’Or East.”

It’ll be interesting to see if Probe makes it that far.

Probe is a buy under the buy-up-to price.

Millrock Resources (TSX-V: MRO)(OTCQB: MLRKF)

Millrock is back doing what it does best which is explore for discoveries and option projects to partners willing to put up their own capital to fund exploration in exchange for a majority interest in the project.

On April 13, 2021, Millrock reported additional acquisitions in Fairbanks, Alaska.

Millrock has signed an option to purchase a 100% interest in the former producing Grant Mine near Fairbanks, Alaska. The Grant Mine is a high-grade vein deposit with expansion potential.

Indicated and Inferred Resources have been estimated at 340,800 ounces of gold. True to form, it immediately allowed partner Felix Gold an option to the project in exchange for a royalty interest for Millrock.

Ditto for the GST claim blocks.

Millrock signed a letter of intent to enter a lease agreement with option to purchase a 100% interest concerning the GST claim blocks with Fairbanks Exploration, Inc.

The claims cover favorable geological structures adjacent to Freegold’s Golden Summit project northeast of Fairbanks, near Kinross’ Fort Knox gold mine. Felix Gold may be assigned the lease and purchase option in exchange for a royalty interest.

That news was followed by an update on the major catalyst for Millrock share price appreciation, the 64North gold project.

Millrock partner Resolution Minerals has completed a rotary air blast drilling program at the Sunrise prospect, West Pogo block, 64North gold project, Alaska.

Drilling targeted intrusion-hosted disseminated gold mineralization exposed in a road cut located approximately four kilometers southwest of the Pogo Mine operated by Northern Star Resource Ltd. Results from drilling are expected in May.

Drilling has thus far disappointed but that can change in a hurry with a discovery hole, which is what makes the juniors so attractive to people like me who are fully aware of the risks and willing to allocate capital to see it play out.

Resolution has earned a 30% interest in the 64North gold project, and is on track to increase its ownership to 42% with recently completed and upcoming drill programs. Millrock receives cash and Resolution share payments in accordance with the option agreement made between Millrock and Resolution in late 2019.

I spoke with CEO Greg Beischer about the new deals and drilling at 64North. You can listen to that here.

Millrock is a buy under the buy-up-to price for patient speculators. For shares to surge higher the company needs a discovery, a better gold market, or both.

Nomad Royalty (TSX-V: NSR)(OTCQX: NSRXF)

Nomad has started catching a bit of a bid up from its C$0.93 lows recently and is back flirting with the C$1.10 level.

Buy it now or buy it later at higher prices. The company continues to do everything I like to see in a royalty company.

Industry-leading dividend, skin in the game through insider ownership, low G&A, and most importantly making money in a sideways market.

Shares are such a bargain, management has decided to start buying them after the April, 27, 2021 announcement that it intended to commence a normal course issuer bid to purchase for cancellation of up to 15.5 million shares.

The move is a prudent one and follows news from April 14, 2021 reporting record deliveries in Q1 and the first delivery from the Blyvoor gold stream.

The company realized preliminary revenues of $9.7 million for the three-month period ended March 31, 2021, resulting in a preliminary cash operating margin of $7.9 million.

Nomad owns a 10% gold stream on the Blyvoor Gold Mine on the first 160k ounces of gold production within a calendar year, and 5% on any additional gold production within the same calendar year.

Following the delivery of 300k ounces of gold to Nomad under the agreement, the stream percentage converts to 0.5% on the first 100k ounces of production within a calendar year until gold production reaches 10.32 million ounces at the Blyvoor Gold Mine.

Nomad will make ongoing payments of $572 for each ounce of gold delivered under the stream agreement.

The release is worth a read as it provides multiple updates on other streams and royalties.

Another great quarter of execution that’ll translate to high prices when the market turns.

Kutcho Copper Corp. (TSX-V: KC)(OTC: KCCFF)

With copper headed to all-time highs and flirting with $4.50/lb, Kutcho is poised for higher prices.

On March 31, 2021, Kutcho provided a progress update regarding the feasibility study being led by CSA Global Consultants Canada.

The study is due for completion mid-year 2021. That is the next major catalyst outside of rising higher copper prices.

Vince Sorace, president & CEO of Kutcho Copper, said:

“As an underground mining scenario is being thoroughly developed in support of the current feasibility study, options for a combination of alternative mining methodologies for the various deposits are also being evaluated to develop a project that is optimal in terms of economic returns and environmental outcomes and that is sensitive to community objectives. We look forward to the results of this optimization of development strategies and to potentially expanding the benefits of the Kutcho project.”

I spoke with Vince earlier this month. You can listen to that here.

For new subscribers, I’m raising the buy-up-to price to C$0.45 from C$0.40 as I anticipate copper continuing to rise and the better juniors like Kutcho catching more of the market’s attention.

Closing Thoughts

Some closing thoughts on companies with a slow news month and a thought or two on how to construct a portfolio.

Copper and the related juniors are showing life and will continue to go higher.

For those of you who participated in the Abacus Mining financing at C$0.13 you’re up nearly 60% and have a half warrant with every share.

I’m looking forward to sharing new financing opportunities in the near future.

Back to Abacus. For those of you who have yet to establish a position in Abacus I’d get that done sooner rather than later.

Drilling from the Jersey Valley gold project has concluded with assays pending.

You know from Nevada Sunrise and Kinsley that assays in Nevada can take a bit so we’ll see when those results come in.

While I look forward to the Jersey Valley results, I’m really looking forward to drilling at the Willow copper-gold property also in Nevada. Details on that program should be announced soon.

There's also good progress being made on the massive Ajax project, which Abacus has a 20% carried-to-production interest in.

If that project is advanced and permitted Abacus will trade in dollars not cents, which is why I’ve continued to write checks.

I wrote checks at C$0.05, C$0.08, and years ago at C$0.30.

Same for Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF), which presents an excellent speculation at current levels and should have news out before you read this.

The reason I initially bought each of those companies was to see Kinsley and Willow drilled with hopes of Ajax being permitted.

That premise is still in play and if Kinsley and/or Willow disappoint then I’ll pivot. Until the premise is proven wrong I’m buying.

I share this, especially for new subscribers, because when you watch a promotion like the one you saw for Nomad and you hear that the company is a potential 10-bagger (it is in the right market) many of you are disappointed when it doesn’t double immediately and prove your decision to buy correct.

That’s the norm in this space. Nothing happens then the right market comes along and it all happens at once.

This pullback in Chakana, Hannan, Magna, Perpetua, Mawson, and Nomad should be purchased aggressively.

The uranium names should be bought at these levels carefully with buy-up-to prices in mind.

The explorers are the highest-risk/highest-reward of the bunch and should be treated as such, though I admit that my personal portfolio is overweight with the explorers. Those should be included along with core companies that provide you exposure to multiple commodities and preferably multiple jurisdictions.

For every pullback in Chakana you’ll get a Probe near all-time highs.

We’re still hard at work on the premium site and thank you for your patience.

In the meantime, feel free to write in and keep an eye on your inbox.

Let's get it!

Gerardo Del Real

Gerardo Del Real

Editor, Junior Resource Monthly

For the past decade, Gerardo Del Real has worked behind-the-scenes providing research, due diligence and advice to large institutional players, fund managers, newsletter writers and some of the most active high net worth investors in the resource space. Now, he is bringing his extensive experience to the public through Resource Stock Digest, Junior Resource Monthly, and Junior Resource Trader. For more about Gerardo, check out his editor page.

*Follow Gerardo on Twitter.

Make sure you never miss an update or issue from Junior Resource Monthly by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Junior Resource Monthly, Copyright © 2021, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Junior Resource Monthly does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.