June 2021 Foundational Profits

June 2021 Issue

by Nick Hodge

» Portfolio Creation & Allocation

» Inflation Still On

» Uranium

» Silver

» Updated Guidance

» Portfolio News

» Cannabis Consolidation (New Recommendation)

Before we get into the markets, I wanted to spend a few minutes on portfolio creation and allocation.

This is an equity (stock) newsletter.

A balanced portfolio will include fixed income (bonds), currencies (dollar, gold), equities (stocks), and commodities (copper, coffee, etc.).

While this letter may write about bonds and bond yields and currencies, they will rarely be a part of the portfolio. If they are included, it will be via a fund that tracks the performance of whatever instruments we’re trying to track.

Commodities will be covered and will also be purchased via a fund that tracks their performance.

The sentiment of the recommendations on these asset classes can and should be used as positioning tools for your investments. My signaling bullish on oil, for example, might prompt you to see what your weighting to the energy fund is in your 401(k).

It might also mean I recommend not only an oil fund, but also individual stocks within that sector. They will usually be large and liquid and trade on a major exchange.

In other letters, I focus on smaller speculations and private deals. You can see all our publications here.

Any questions on any of that, feel free to write in to customerservice@digestpublishing.com, and I’ll do my best to address them in an issue.

Into the markets…

Inflation Still On, Stocks Still at Records

Last month, amid a selloff in the stock market (S&P 500), I told you that the bull market would continue and laid out some reasons why:

-

Volatility (VIX) was still below previous selloffs and didn’t look like it was breaking out.

-

Corporate earnings were strong

-

And bond yields, though they had paused a bit, would continue to rise (inflate)

Bond yields rising means bond prices are falling. And when money comes out of bonds… it goes into other asset classes… like currencies, equities, and commodities.

When that money flows into other assets — like gold and stocks and copper and cryptos — it inflates their prices.

And that’s where we are now, with record prices in many assets.

How can it be that we saw record stock prices for years as bond prices were strong and yields low… without those record prices manifesting in commodities until now?

For that, you have to ask the man behind the curtain to whom you’re supposed to pay no attention.

My guess would be that inflation spilling over into cryptos and shitcoins and real estate and commodities is another domino to fall on the road to the wizard being revealed.

Owning the things that are inflating fastest is the key to winning this game.

So far this year that has been energy, financials, real estate, and materials.

| Sector |

YTD Performance |

| Energy |

44.78% |

| Financials |

29.23% |

| Real Estate |

23.17% |

| Materials |

19.34% |

| Industrials |

17.71% |

| Communication Services |

17.18% |

| Health Care |

7.67% |

| Information Technology |

7.16% |

| Consumer Staples |

5.04% |

| Consumer Discretionary |

4.85% |

| Utilities |

3.75% |

Those are all sectors of the S&P. But through that lense, it isn’t hard to see why:

- You’re paying more at the pump

-

The housing market is crazy

-

Cryptos (which are both commodities and financial-related) are going nuts

-

And commodities (materials) like copper are hitting records.

My and your “portfolio” is alive. It’s not just stocks. It sure as hell isn’t just cryptos.

It’s my house and acreage. It’s my businesses. It’s my life insurance. It’s my private placements. It’s the accounts I manage on my own. It’s my managed account. It’s the annuity I set up for my parents. It’s the college funds for my kids. And it’s the trust that protects it all from familial and governmental tomfoolery.

The market — currency, bond, and commodity prices — affects all of that and the decision-making process that goes into it.

That’s why it’s hard for me to say you should have xx% of your portfolio in this or that asset class or sector or stock.

But it’s also why I love “the market”.

Because I can tell you to buy energy stocks because oil is inflating six months before you have to force small talk with your friends about high gas prices.

Bring ‘em on, baby! I’ll pay them with my Exxon dividends.

Being plugged into this every single day is also why I can tune out a lot of the noise and call bullshit on contrived government and media narratives like “transitory inflation”.

I don’t even have to entertain the concept, because I’m too busy harnessing real and present inflation in my account.

Uranium

Last month, I recommended buying the Global X Uranium ETF (NYSE: URA) below US$21.00. That opportunity came on May 25 at US$20.98 and is now logged in the portfolio. It remains a buy under US$21.00 but now trades above that price. So keep a limit order set if you want in.

The sector continues to heat up. Spot prices are back over $31.00 per pound.

TerraPower, backed by Bill Gates, announced this month that it’s building a next-generation nuclear reactor in Wyoming along with the Berkshire Hathaway-owned PacifiCorp. It had Wyoming Senator John Barrasso singing the praises of the state’s uranium mining industry.

China continues its ambitious nuclear buildout, with 17 nuclear plants under construction. China General Nuclear Power Group recently forged a deal with Kazatomprom to build the Ulba Nuclear Fuel Plant, giving China a 49% stake in the plant for $435 million, and guaranteeing that CGNPC will purchase 49% of the plant’s production annually. Kazatomprom is Kazakhstan’s national atomic agency and the largest producer of uranium in the world.

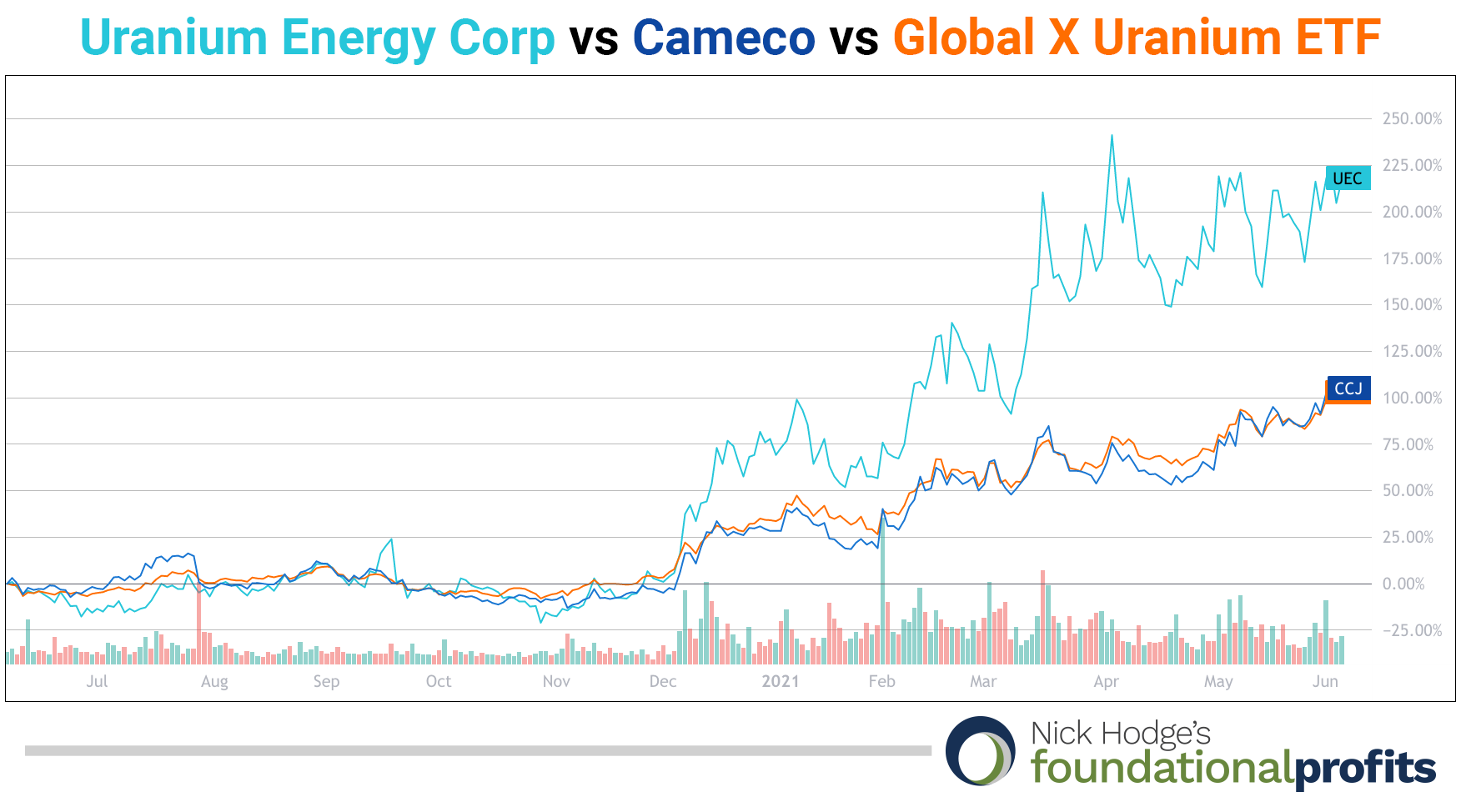

The uranium sector typically moves as a group. You can see from our three holdings that uranium stocks really started to move in late December last year.

With the ETF, you now own many of the top names in the sector, including Cameco (NYSE: CCJ) and Uranium Energy Corp (NYSE: UEC), which are our two other uranium holdings.

And with that, my long-term plan continues to come into place. We don’t need three uranium companies in a 20-company portfolio. Our holding in URA will deliver all the gains we need in a continued bull market.

The current buy-under price on Cameco is US$11.00. The current buy under on Uranium Energy Corp. (NYSE: UEC) is US$1.63.

Both of those stocks were below their respective buy-under prices since this letter was (re)created in October 2020. And both of them are up at least 100% from my original entry price — both of which predated October 2020.

So to continue positioning in larger companies and to protect profits I am selling both in this letter.

Sell Cameco (NYSE: CCJ) above US$21.00 for up to 143% profits since the original recommendation.

Sell Uranium Energy Corp. (NYSE: UEC) above US$3.30 for up to 102% profits since the original recommendation.

I am still bullish on uranium and uranium stocks. This is a good place to take some profits and rotate.

I still own large positions in several uranium companies. Most of the companies in the sector are too small to cover in this letter. I have smaller uranium speculations in Family Office Advantage.

And Gerardo covers the sector as well in Junior Resource Monthly.

Silver

Silver remains bullish and has added $4.00 since April to trade at $28.00 this month.

It has been range-bound for the past 10 months or so but has turned increasingly bullish over the past two months. Breaking out north of $30 could send it to near-record prices or higher.

But even at current prices, silver stocks are attractive.

And like uranium, there aren’t a lot of pure plays in silver.

We own:

Hecla Mining (NYSE: HL), the largest silver producer in North America. We’ve been buying it since July 2020 with a buy under of US$6.00. So far, we’ve been up as much as 131%. It was below its buy under as recently as May 2021 — last month! — so I’m not going to raise it just yet.

MAG Silver (NYSE: MAG), which we bought in February 2020 at US$10.15 and sold half of during the “Silver Squeeze” of early 2021 at US$21.04 for 107% profits. I want to buy that half back below where we previously sold it. MAG Silver is now a buy under US$21.00.

Let’s do the math on a hypothetical $1,000 investment in MAG following these recommendations:

- Buy 98 shares at $10.15 for $994.70.

-

Sell 49 shares at $21.04 for $1,030.96.

-

You’ve now been paid $36.26 to own 49 shares.

-

Buy 49 shares at $21.00 for $1,029.

-

Leaving you with your original 98 share position at a net cost of $992.74, or $10.13 per share.

-

You’re now up 100% on a newly full position.

Do this often enough and then with larger sums… and you might just be able to move on to the next level of speculating on smaller companies for higher returns.

Updated Guidance

With commodities still in a bull market, I want to take the opportunity to do what we just did with MAG Silver on another company:

Ivanhoe Mines (TSX: IVN)(OTC: IVPAF). We sold half this position back in February for 280%. Copper remains strong and Ivanhoe is now in production with Kamoa. Insiders were buying in May at an average price of C$8.61. I’m recommending buying back that half position below C$8.75. I won’t take you through the math like I did with MAG Silver, above, but following my guidance on Ivanhoe over the past few years would’ve gotten you paid multiple times. Our blended entry price on the new full position is C$2.72.

And I want to raise the buy under on three others:

MP Materials (NYSE: MP). I’m raising the buy-under price on MP Materials to US$28.00.

Rio Tinto (NYSE: RIO). I’m raising the buy-under price on Rio Tinto to US$88.00.

Sibanye Stillwater (NYSE: SBSW). I’m raising the buy under to US$18.75.

Portfolio News

GoldMining (NYSE: GLDG) has put out an updated resource on its Sao Jorge project in Brazil that includes:

14.27 million tonnes Indicated grading 1.55 grams per tonne (g/t) gold for 710,000 oz/Au

17.58 million tonnes Inferred grading 1.27 g/t gold for 720,000 oz/Au

The company will now move forward with a preliminary economic assessment (PEA) on the project, as it has also done with Yellowknife in Canada and La Mina in Colombia. The company now has some 30 million gold equivalent ounces across all its projects, and has plans for fully-funded drill programs as well. GoldMining (NYSE: GLDG) remains a buy under US$2.00.

Perpetua Resources (NASDAQ: PPTA) announced it will be included in the Russell 2000 and Russell 3000 Indexes effective June 28. The Russell 3000 is a cap-weighted index that measures the performance of the 3,000 largest U.S. stocks. The Russell 2000 is the smallest 2,000 stocks in the Russell 3000 Index. Many funds track the performance of these indexes or are benchmarked to them, so a company being included in the index for the first time means institutional buying to come. We continue to buy it below US$8.25 ahead of a permitting decision that is due out next quarter.

Sunrun (NASDAQ: RUN) announced it is partnering with Ford to serve as the preferred installer for Ford Intelligent Backup Power, which will be a feature of the all-electric F-150 Lightning. With the installation of the Charge Station Pro, the truck can serve as a home backup energy source. This is yet another component of the virtual power plants you’re seeing being created in real-time. Each of those truck buyers will also be offered the opportunity to install a solar and battery system on their home. Sunrun remains a buy under US$58.00.

(Sunrun will be the preferred installer for Ford’s Charge Station Pro)

Cannabis Consolidation

Not only have cannabis stocks consolidated over the past three months, the industry itself is starting to consolidate as well.

Readers of my Family Office Advantage were the beneficiaries of Trulieve taking out Harvest Health last month to the tune of 100% after just a six-month hold time.

In this letter, we’re up 23% on the AdvisorShares Pure US Cannabis ETF (NYSE: MSOS) in about the same time.

That really is as easy a comparison as I can give you between the two pubs. This one will target sectors with larger companies and funds. Family Office Advantage speculates on smaller companies within the sectors I’m bullish on.

I’m bullish on cannabis and mushrooms.

And Harvest was just one in a dizzying string of recent tie-ups.

Hexo has taken out Redecan and Zenabis and 48 North. Curaleaf has taken out Los Sueños. Canopy Growth took out Supreme Cannabis.

This is the next iteration of the cannabis market playing out before your eyes, with the larger players trying to buy U.S. market share… which is why we’re in the U.S. cannabis ETF.

One of its holdings is Innovative Industrial Properties (NYSE: IIPR), which longtime cannabis investors will know as a company that owns properties and provides real estate capital for the cannabis industry.

It’s gone from $90 to over $220 in the past year, but has now pulled back and consolidated — along with the rest of the industry — to ~$180 over the past few months. And that’s where I want to start adding it to this portfolio.

Buy Innovative Industrial Properties on pullbacks below $180.00. Not only do I expect it to continue capitalizing on the U.S. cannabis market as it opens up, but also the mushroom market as it begins to gain traction.

Wrap Up

We have several open positions that I’ll be looking to fill if and when I see sector rotations.

You’ll notice I’ve divided the portfolio into two categories:

- Funds / Currencies / Commodities

-

Equities

In the spirit of keeping this more “foundational”, I will look to place a couple more in the first group there.

For now, I’m very pleased with the current portfolio given the current market.

Stick to the buy-under prices.

And I’ll be in touch if anything major happens over the next month.

Call it like you see it,

Nick Hodge

Nick Hodge

Editor, Foundational Profits