July 2021 Foundational Profits

July 2021 Issue

by Nick Hodge

» Fun with Inflation

» Action Recap

» A Note on Gold

» New Macro Guidance & Positioning

» Buy a Couple Thousand Second Homes

» Golden Updates

This is going to be a fun issue.

Like most things in life, investing is more fun when you’re having success. And we’ve been having quite a bit of it.

We’re in the midst of asset inflation, if you haven’t noticed.

And we’ve been turning that inflation on its head — stuffing our accounts with it instead of worrying about it, arguing about it, or, worse… being oblivious to it.

The clear example is energy.

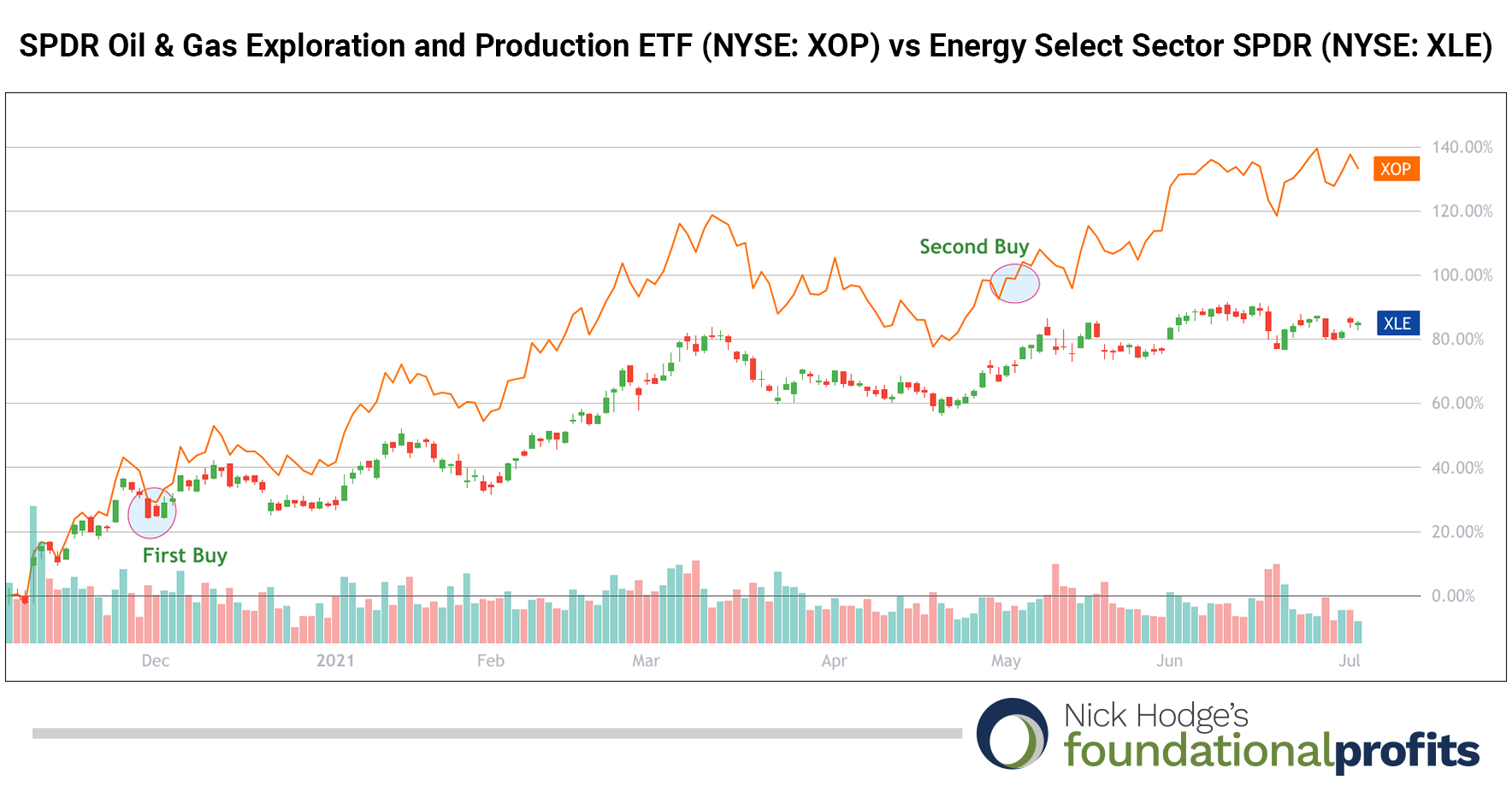

I’ve seen the talking heads blaming high gas prices on summer driving. Meanwhile, we’ve been using inflating oil prices to the benefit of our account since last November, first banking 40% on the Energy Select Sector SPDR Fund in three months and then rotating into the SPDR Oil & Gas Exploration and Production ETF (NYSE: XOP) in May, which we’re still in and sitting up some 17% in two months.

It’s lazy to wait until June or July and say, “Look at those high gas prices because of summer driving season.”

That’s what average investors do and say. Perhaps that’s why financial television is so popular.

You, of course, know better.

We saw the energy inflation coming literally a half a year ahead of time and got positioned in the sector in multiple ways. So rather than complaining about gas prices in July, we’ve been profiting from them for the past eight months with great exposure to what turned into the best-performing sector of the first half of the year.

And it hasn’t been only from oil and gas.

In last month’s issue, I advised selling Cameco (NYSE: CCJ) above $21.00 to lock in 154% uranium gains in less than two years. That turned out to be precisely the right call, as Cameco started heading lower two days after the issue came out.

And SunRun (NASDAQ: RUN) has been moving higher as well, moving up from $40 to $57 over the past month. It remains a buy under $58.00.

Here is a recap of the rest of the actions from last month before we get into more macro positioning and this month’s portfolio news.

June 2021 Action Recap

Here are the actions I recommended taking last month and the results since then:

| Recommended Action |

Result |

| Sell Cameco at $21.00. |

Sold at $21.08. |

| Sell Uranium Energy Corp at $3.30. |

Did not reach target price. |

| Re-buy half position in Mag Silver below $21.00. |

Re-buy half position in Mag Silver below $21.00. |

| Re-buy half position in Ivanhoe Mines below C$8.75. |

Bought at C$8.64. |

| Buy Innovative Industrial Properties below $180.00. |

Did not reach target price. |

Uranium Energy Corp (NYSE: UEC) remains a sell above $3.30. Keep a limit order set.

Innovative Industrial Properties (NYSE: IIPR) did not dip to my recommended buy-under price of $180.00. This is a company that owns properties and provides real estate capital for the cannabis industry. It only got as low as $183 before moving higher and is now at $200. We will not chase at that price and IIPR is no longer a recommended buy. This is a great example of how to set rules and follow them, not chase, and not get emotional. We didn’t get our price, so we moved on.

And there is plenty to move on to…

Last month I also increased the buy-under prices on:

MP Materials (NYSE: MP) to US$28. It didn’t get there. But it could dip back that low if it fails to break out at $40, which it’s pushing up against now. It remains a buy under $28.

Rio Tinto (NYSE: RIO) to $88. It has pulled back below that price as copper prices saw a bit of softness last month. Copper remains at historically elevated prices. I bought a little bit of Rio for the IRA at these prices because of the 5% yield.

Sibanye Stillwater (NYSE: SBSW) to $18.75. Sibanye, a global top three platinum group metals producer and top ten gold producer, is offering what I’d consider to be a great long-term buying opportunity at this price.

A Note On Gold

Gold, which I didn’t even mention in the first 700 words of this issue, is down some 8% for the year, trading below $1,800.

This is a pause — or consolidation — in a bull cycle.

The talking heads don’t understand that like they don’t understand gas prices.

Talk of gold’s failure to hedge inflation properly is inaccurate and overdone.

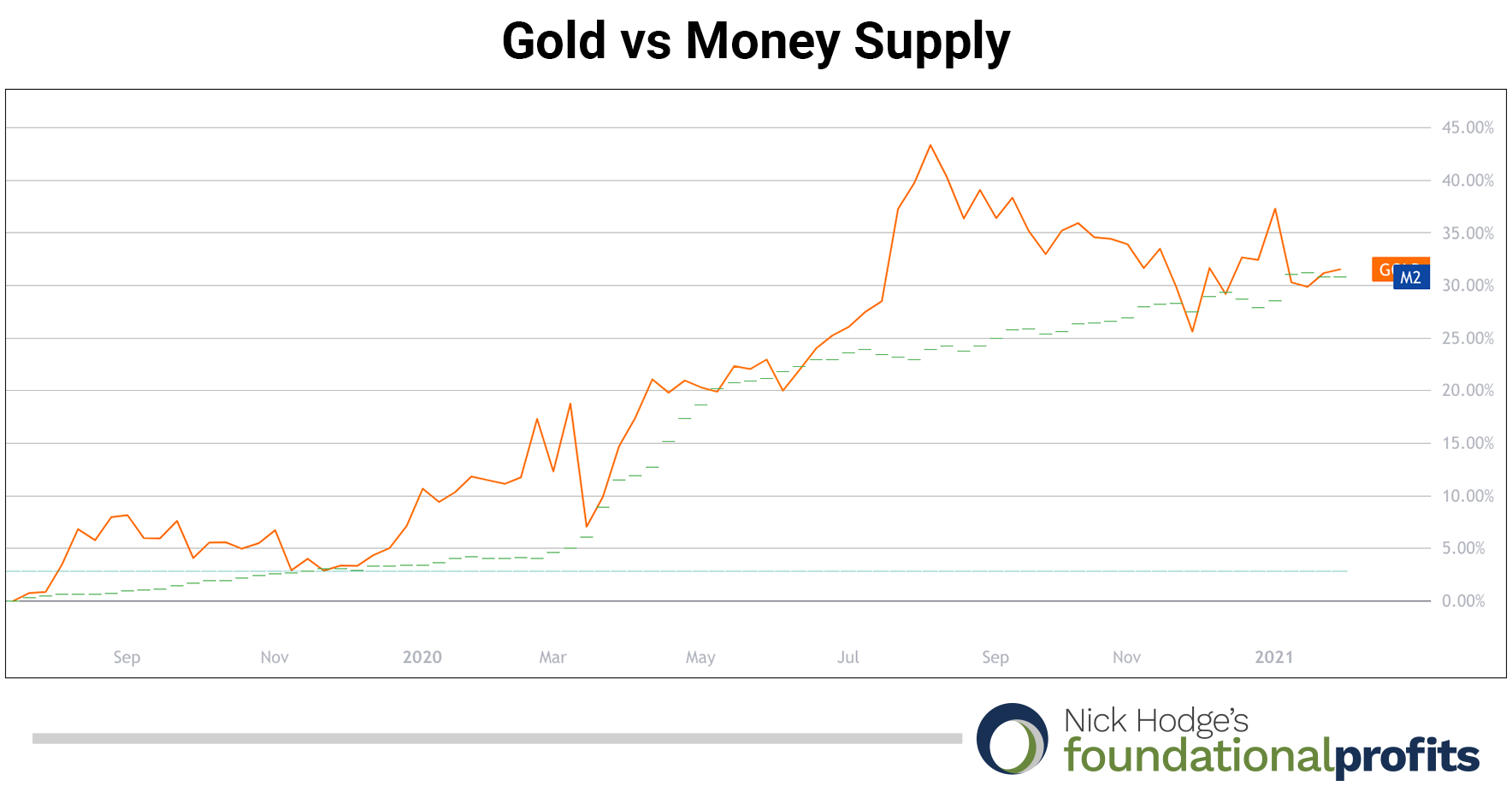

Indeed and in fact, gold prices have kept precise pace with the money supply over the past two years.

It’s just that other things — like oil — have inflated faster.

Good thing we own both.

New Macro Guidance & Positioning

It seems like the S&P 500 has experienced a selloff of some degree in every month this year except April.

Every month the crowd wondered if this “was it” — the end of a bull market in stocks that has now raged on for over a decade.

The worst blow the bull market has been dealt over the past 10 years was the onset of a global pandemic that ended up killing between eight and twelve million people.

That was enough to slow stocks down for two months.

Talk about inflation. The stock gains of the past year are four times the historical average. Valuations by price-to-earnings ratios are near extremes as well.

I would of course remind you that markets can remain irrational far longer than you think.

And I’ve been telling you every month this year during the selloffs when many others were panicking that stocks would head higher still.

My reasoning was simple, and I expressed it concisely last month:

-

Volatility (VIX) is still below previous selloffs and doesn’t look like it’s breaking out.

-

Corporate earnings are strong (coming off forced global lockdowns will do that).

-

Bond yields, though they have paused a bit, would continue to rise (inflate).

All of this is still true.

What’s also true is that growth and inflation have picked up recently. Oil just hit a two-and-a-half-year high in early July.

These numbers are yet to be reflected in the “official” data.

So I think the recent trend of higher stock and commodity prices continues.

And I think the trend of higher real estate prices continues for similar reasons.

Buy a Couple Thousand Second Homes

You’ve probably been watching home prices rise with amazement.

Popular sites like Zillow say my home is worth 60% to 75% more than I paid for it four years ago.

First-time homebuyers are being priced out in many markets as homes routinely sell for above asking price with waived inspections.

Many homes are now being sold off-market. These so-called “pocket listings” are sold through a realtor’s network before a sign even goes up in the front yard.

Inflation, of course, can be pointed to as an overarching reason why. Free money has to go somewhere.

But there’s also more to it than that.

There is a nationwide migration underway as locations like Bozeman, Montana become some of the hottest real estate markets in the country, flooded with people who can now work at home with out-of-Montana-type salaries.

There is also a reopening underway from the pandemic.

And you have an entire generation of millennials coming of age — the oldest of which are about to turn 40. There are 90-some million of us (your humble editor is an early-edition millennial minted in 1983) versus 60-some million Baby Boomers.

I bought a home to raise my family four years ago. An entire generation now needs to do the same.

You also have private equity money in the housing market, now buying up entire condominiums and neighborhoods in a culmination of everything I just laid out: free money going into hard assets with rising prices with sound fundamentals also behind it.

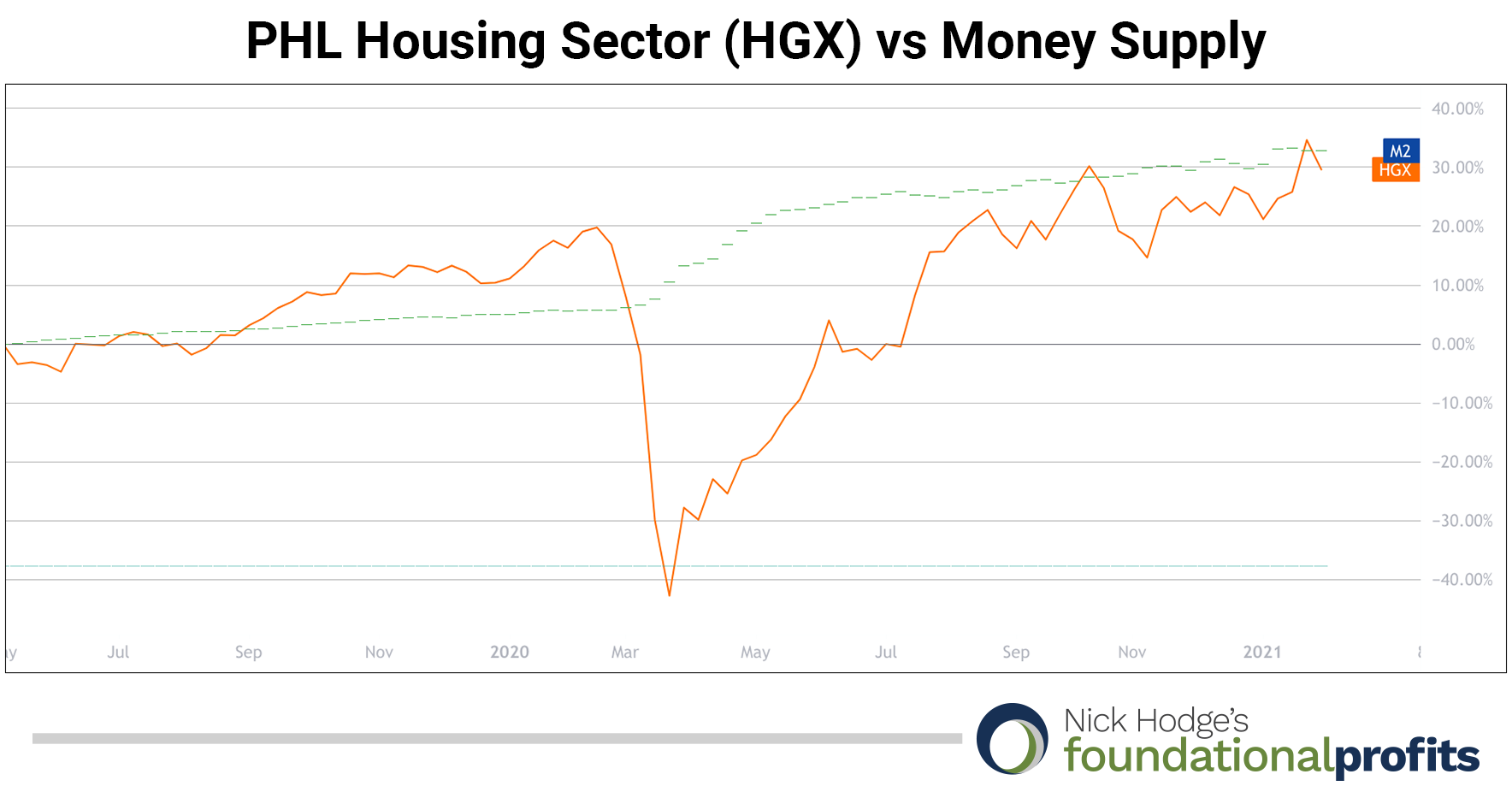

And like precious metals, the new housing stock is slow and expensive to create, making it a hard asset. The Philadelphia Housing Index, for example, has kept exact pace with the expansion of the money supply over the past two years just like gold has.

All that to say I think real estate prices, on the whole, can continue to go higher. And I want to own more of it.

Not all real estate is created equal of course. There are different types of residential and commercial real estate. I’m more bullish on the former than the latter, especially on the cheaper end of the spectrum.

The longer-term implications of our great nation’s monetary policy are that fewer people have more and more people have less. Don’t shoot the messenger.

There are going to be fewer people who can afford to own homes.

Like I told you with copper: you want to own the copper assets, not be the guy trading in stolen scrap copper.

It’s the same thing in this unfolding real estate situation: you want to be the landlord and not the renter.

Real estate as a stock sector is starting to pick up. It’s the third-worst performing sector of the past year but the second-best performing sector of the past three months as the market begins to reflect what I just laid out above.

| Sector |

3-Month Performance |

YTD Performance |

| Energy |

11.59% |

45.34% |

| Real Estate |

10.81% (second best) |

26.23% (third worst) |

| Consumer Discretionary |

10.55% |

39.60% |

| Health Care |

9.86% |

27.18% |

| Industrials |

8.54% |

49.53% |

| Information Technology |

8.44% |

39.72% |

| Communication Services |

7.76% |

43.36% |

| Financials |

6.38% |

57.78% |

| Materials |

3.95% |

49.47% |

| Consumer Staples |

1.54% |

23.24% |

| Utilities |

0.85% |

16.01% |

The traditional way to own that would be through the

XLRE Real Estate Select SPDR (NYSE: XLRE). That gets you exposure to the entire sector: malls, cell towers, housing, public storage, etc.

Like I said, I want to drill down a bit. I want to own manufactured housing.

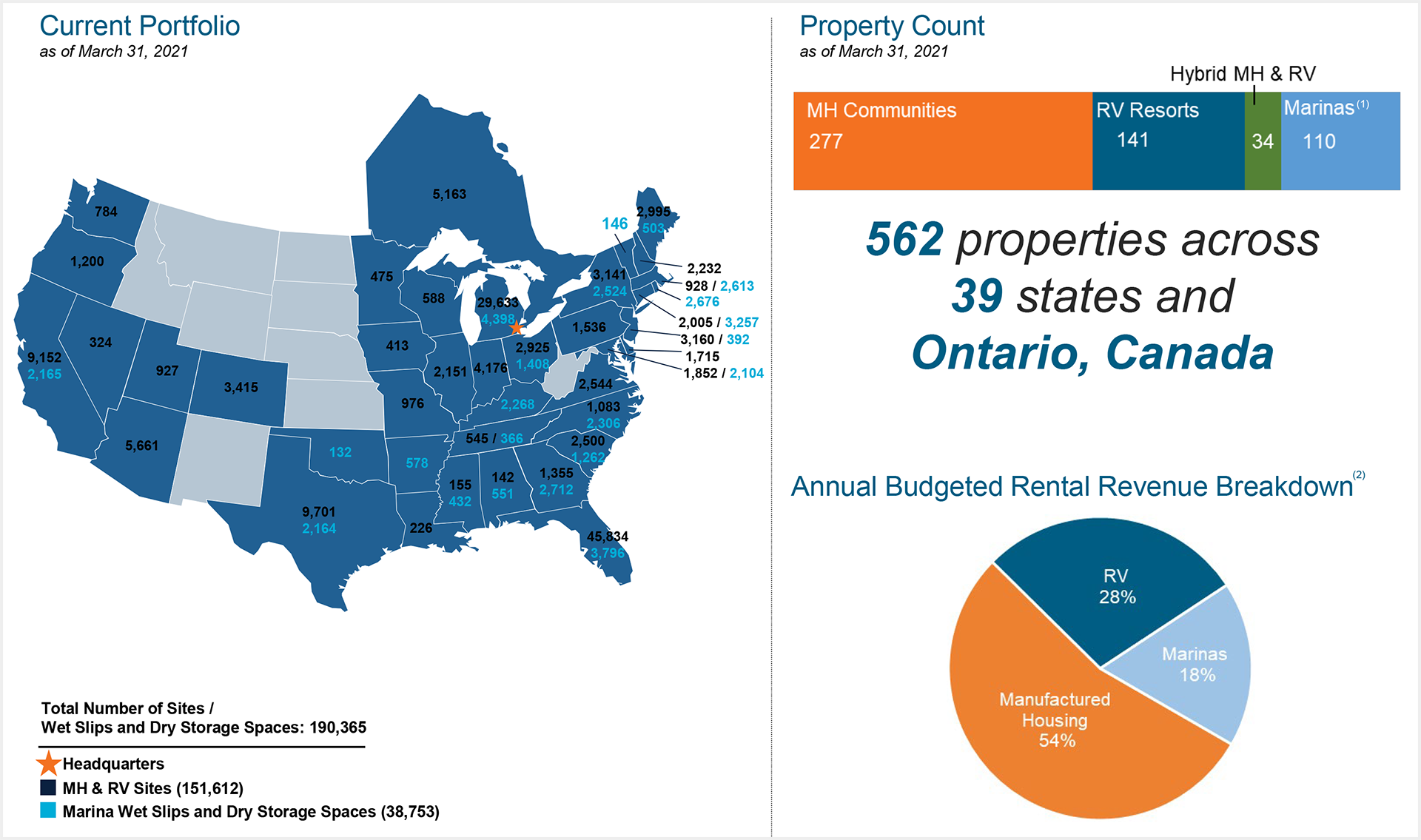

Buy Sun Communities (NYSE: SUI) below $180.

Sun Communities is a leading owner and operator of manufactured housing communities, RV resorts, and marinas.

It has over 150,000 manufactured homes and RV sites across over 400 communities. It also has over 38,000 marina wet slips and dry storage spaces across 110 marinas.

It's a good way to play ongoing themes in real estate.

Not only is affordable housing inventory at historic lows, forcing more people to rent… boat and RV sales are up as a result of people being more flexible to work anywhere and having a bit of extra cash because of stimulus payouts.

Buy Sun Communities (NYSE: SUI) below $180 as our exposure to the real estate and real estate investment trust sector.

Golden Updates

I mentioned

GoldMining (NYSE: GLDG) as a buy under US$2.00. It remains below that price as it moves closer to unlocking value from some of its projects. It already has nearly 30 million ounces of gold equivalent across all categories in several projects spanning North and South America. And it recently created royalties on some of those projects and spun them out into a new company called Gold Royalty Corp that is also listed on the NYSE. GoldMining’s shares in Gold Royalty alone are worth C$150 million at current prices. It’s also drilling for the first time, so resource expansion news is on the horizon as well. Over the past month, Haywood reiterated its “buy” rating and C$4.25 price target and H.C. Wainwright targeted shares at C$5.75. GoldMining remains a buy under US$2.00.

Recent CEO Interview here.

We were expecting a draft record of decision for

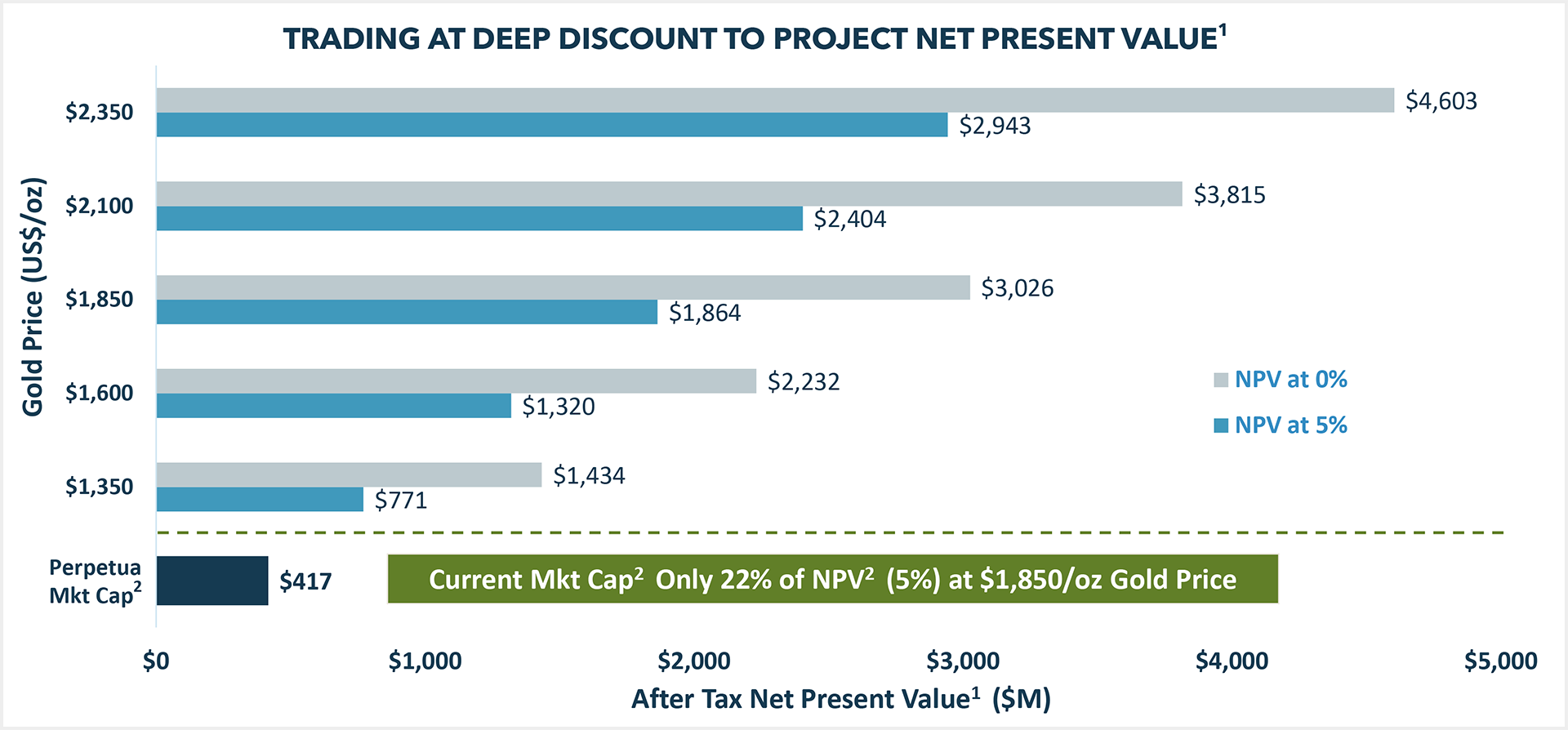

Perpetua Resources’ (NASDAQ: PPTA) Stibnite project in Q3 2021. That is this quarter. The timing has now been updated, again. But this time there is meaning in the delay. For you long-time readers, Perpetua — back when it was still Midas — submitted its Plan of Restoration and Operations (PRO) to the U.S. Forest Service in 2016. The permitting process shares a birthday with my now five-year-old daughter. I have held my shares since 2013. You don’t need a reminder that mining projects take a very long time to develop, permit, and build. But I offer this one anyway.

The project is already one of the largest gold reserves in the U.S. When built, it will be one of the largest, highest-grade gold mines in the country.

The news this month pushes back the draft record of decision by a year — to Q4 2022. But it also eliminates all other development scenarios being considered.

The U.S. Forest Service is advancing with the design of the project as laid out in Perpetua's modified Plan of Restoration and Operations 2, which was submitted last August after incorporating changes from public feedback and optimization studies. Basically, the government is going with the company’s plan and giving the public one more round of feedback. Shares were up in the U.S. on the news, showing investors appreciate that the alternative development plans have now been eliminated.

Perpetua is now essentially a proxy for gold prices until it is approved. This is not a bad thing. We’ve held it so long already that it’s clearly worth holding it longer given the permitting and construction lines up with what should be higher gold prices.

Officially, it’s a buy under US$8.25. But you should treat it as something you buy during “blood in the street” periods for gold prices during the continued permitting period.

Wrap Up

Our 20-position portfolio has 17 positions filled.

I continue to be bullish on stocks, and most bullish on energy, materials, and real estate. This is reflected in the portfolio with our sector positioning.

The financial sector is also bullish though banks are one of the few sectors I’m loath to buy for moral reasons. I am looking at perhaps getting some exposure via the insurance subsector.

I am also looking at some of the other real estate sectors but want to see how this reopening cycle continues to develop before adding more.

And I have a higher-risk idea in the materials sector that I’m incredibly bullish on. We’ve done well in this letter with oil and copper and silver, and this is a similar commodity-type play. It’s in a sector of the energy market that is experiencing a supply shortage and I’ve identified a way to play it that so far has yielded gains of 3,000%. I will have more details on it for you soon. Keep an eye out for an interview this week that sets the stage for what I see coming.

Enjoy your summer holidays and travel!

Nick Hodge

Nick Hodge

Editor, Foundational Profits