January 2021 Foundational Profits

January 2021 Foundational Profits

by Nick Hodge

» Inauspicious Start

» Transitions

» Existing Holdings to Sell

» Existing Holdings to Buy

» New Idea: Buy Chewy

» Midas Feasibility

The New Year is off to an inauspicious start.

Call me a Cassandra, if you want. I’ve been called worse.

And I don’t mean it’s going to be unpromising for profits. I think we’ll see plenty of those.

But the costs they come with — rising inflation and a dying dollar and democracy — are also going to be great.

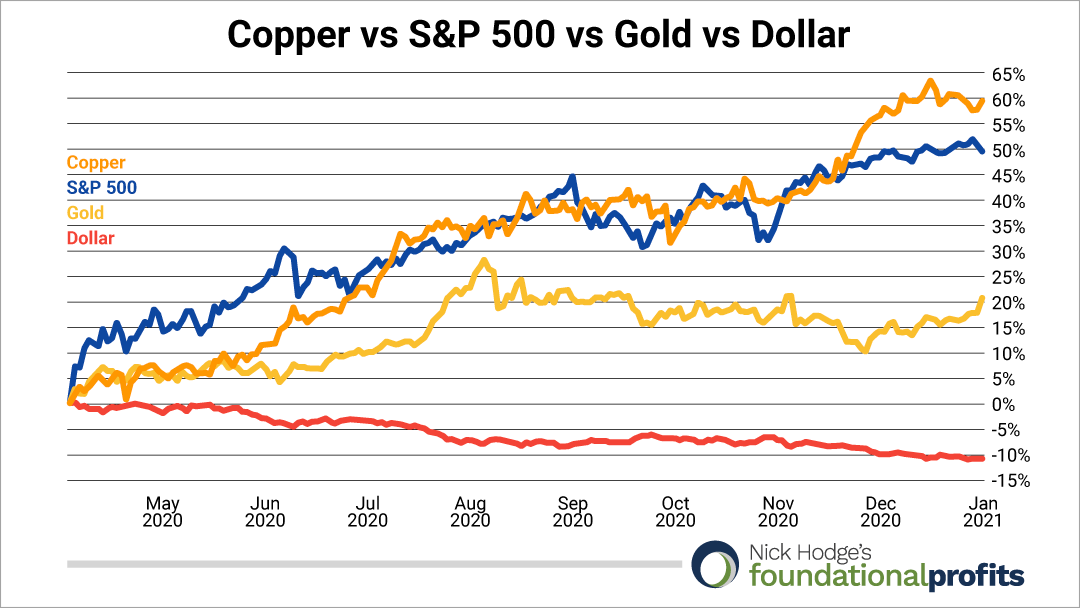

You either understand why assets are rocketing in price while the dollar deteriorates or you don’t.

The nine-to-five and chasing the Gaines-dashians will have you skiing down that bottom line there while stocks and commodities and currencies race higher.

It’s not just copper and gold that are inflating as the dollar buys less and less.

The government is about to mail out another round of checks and the plebes are giddy they could get $2,000.

They don’t understand that unless you trade those dollars for inflating assets you will soon find yourself dollarless. Maybe even homeless. Have you seen the street corners lately?

The system is pretty screwed up.

I don’t mean to be callous. But it’s not my system to fix. My responsibility is to myself, my family, and my immediate community circle. That includes you.

The best way I’ve found to be responsible is to ensure financial security amid what have been interesting times long before COVID.

The record debt and dying dollar were already a plague.

We were already in a stock bubble.

The US was already headed headlong into a generational struggle for ethical direction and power that was already resulting in both farcical and violent political acts.

COVID wasn’t the cake, it was the icing. And a new year is no magic wand. So while Nancy and Mitch serve it up, make sure you’ve got your eye on what really matters.

It is going to be a bumpy few years of unemployment, recovery, and political turmoil.

Let’s continue to pad our accounts against it.

Transitions

Last year was one of transitions. I left Angel Publishing to co-found Digest Publishing and this letter went from being called Wall Street’s Underground Profits to Foundational Profits.

In total, I closed more than 60% in gains last year under both banners. That included some big winners like:

• 112% on Sibanye Stillwater;

• 253% on K92 Mining; and

• 254% on Teranga Gold

It also included some missteps like losing nearly half on Teck Resources and Covanta Holdings.

As the entry-level letter to the newly-formed Hodge Family Office, this letter is transitioning into one that identifies market trends with a contrarian perspective, and harnesses upside from them via larger-cap companies and funds.

You have seen this transition unfold as we bought and sold both the utility and real estate sectors last year through their SPDR funds.

And we continued that late last year by buying the energy sector via the Energy Select Sector SPDR Fund (NYSE: XLE), which we’re still buying below US$38.00.

And also by buying the cannabis sector via the AdvisorShares Pure US Cannabis ETF (NYSE: MSOS), which we did last month below US$34.00. It’s already up more than 11%.

We also added some tech, buying IBM (NYSE: IBM) below $128, which we continue to do.

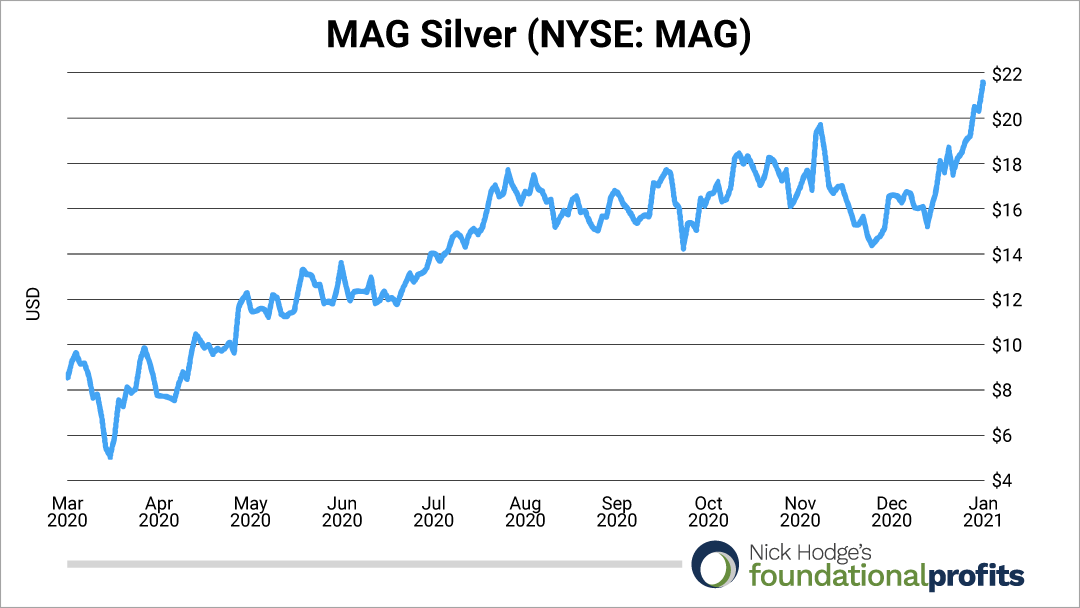

And we’ll continue the transition this month as we take some more profits from the precious metals sector while also buying select names in that sector showing relative value.

“You’re buying and selling precious metals stocks, Nick?”

Yep. I’m a walking contradiction, I know. How do you think my wife feels?

You gotta have some twisted neural pathways to see the world and markets the way I do.

Existing Holdings to Sell

Sell half of your MAG Silver (NYSE: MAG) above US$21.00 if you’re lucky enough to have bought it below US$11.00 when I first recommended it. That’s 100% in less than a year.

Sell all of your Almaden Minerals (TSX: AMM)(NYSE: AAU) above C$0.60. Almaden has been denied its environmental permit for the Ixtaca project. The news comes amid a lawsuit that I have been covering the details of since it started. I was wrong on the outcome. I’m not waiting around to see how it turns out. We are transitioning away from companies as small as Almaden as it is.

Existing Holdings to Buy

Buy Franco-Nevada (NYSE: FNV), as it has now fallen below its buy under price of US$130.00. It has traded below that price several times since the last issue, in which I told you it was getting close to being buy-rated again.

Buy Alamos Gold (NYSE: AGI) before it goes back over its buy under price of US$10.00. It has made a run at that price twice since November, and is threatening that level again.

Buy Altria (NYSE: MO) when it’s below our buy under price of US$40.00. It is hovering right around there. It is yielding over 8%, and that’s hard to comeby in this environment.

New Idea: Buy Chewy (NYSE: CHWY)

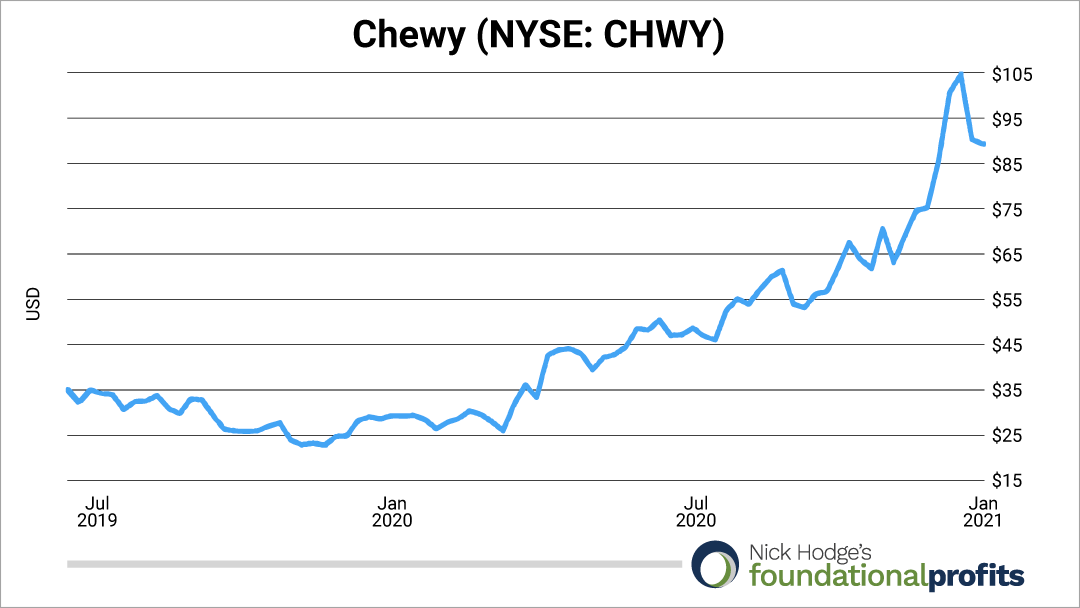

Pets are family. Especially for the large cohort of millennials who are treating dogs like babies instead of actually having them.

Add in a pandemic that keeps people out of the store to buy pet food… and you have a perfect bullish recipe for Chewy (NYSE: CHWY), which is an online retailer of pet goods. It IPO’d in mid-2019, and has since tripled in price to US$109.

A pullback this month is allowing us entry to the pet party.

The pet bull market is nothing new.

I was recommending stocks in the sector as far back as 2015. Since the early 2010s we have known that over 90% of pet owners consider their pets to be family. They buy them Christmas presents and give them birthday treats.

The pandemic saw record pet adoption.

Chewy is likely headed to profitability this year on the back of pandemic drivers. It is not only adding customers at its fastest rate ever, but those customers are spending more.

And it hasn’t even expanded internationally yet, with Canada on deck this year and Europe next year.

A selloff in COVID-themed names has led to an opportunity where we can buy Chewy below US$96.00.

Take it.

Yes, I am aware of the analogy you can make to the current stock bubble and Pets.com.

The Internet’s a bit different now.

They Aren’t Making More of It

Unlike printable fiat currency, things that are finite, or otherwise hard to produce and/or duplicate have been seeing stark rises in value.

Soybeans and copper are both up more than 30% in the past year. Gold and corn aren’t far behind.

I touched on this a bit last month, showing you a chart of copper at six-year highs alongside Rio Tinto (NYSE: RIO), the latter of which was trading at US$72.00.

Rio Tinto has gone up more than 6% in the past month. We’re now up 50% on Rio in less than two years, and copper continues to inflate.

But that’s not all.

We’re also up nearly 150% on Sibanye-Stillwater (NYSE: SBSW), the world's largest primary producer of platinum, second largest primary producer of palladium and third largest producer of gold.

And we’re up 305% on Ivanhoe Mines (TSX: IVN)(OTC: IVPAF) as it develops three world-class assets containing copper, platinum, palladium, and nickel.

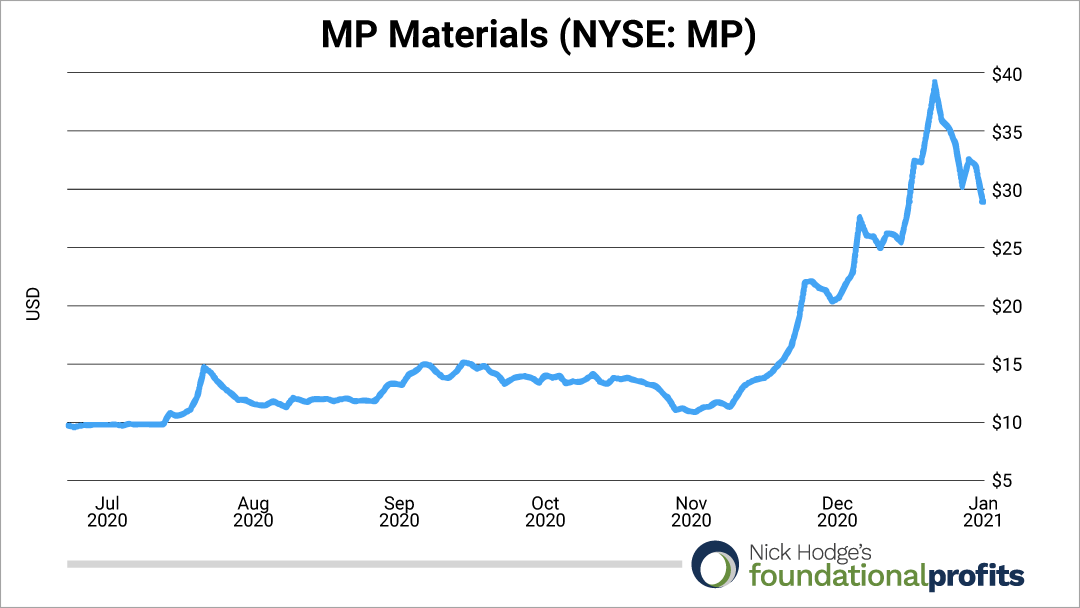

Our latest entry on this inflation bearing out in commodities is MP Materials (NYSE: MP), which we were able to establish a position in around US$14.00. It climbed over US$40.00 last month before pulling back, and we’re holding it for more.

And as I also hinted at last month, even uranium is getting in on the action. Spot uranium prices were up as much as 40% in the past year to just over US$34.00 per pound. They are now consolidating around US$30/lb.

We are up 54% on Cameco (NYSE: CCJ), and are only buying shares below US$11.00. They’ve been as high as $14.41 recently.

Uranium Energy Corp. (NYSE: UEC) has also climbed above its buy under price of US$1.63 to trade over US$2.00.

Not only has Cameco suspended production at Cigar Lake because of COVID, but the US Congress has now provided funding to establish a US Uranium Reserve.

There is clear support for nuclear energy, which is now being viewed more and more as necessary for a clean energy future — even among those who were formerly against it.

Congress can’t agree on anything. But they now concur uranium is important.

There are very few names in the uranium space. If you look at the holdings of the Global X Uranium ETF (NYSE: URA), for example, you will see that Cameco makes up more than 21% of it. UEC is 2.3% of it. So we already own nearly a quarter of that fund with just two names.

This is one sector where I’m confident we can own individual companies and not have to buy a fund. If this truly is the start of what we’ve been waiting for in uranium, I will add a new name in short order.

Midas Feasibility

Midas Gold (TSX: MAX)(OTC: MDRF) has released its Feasibility Study on the Stibnite Gold Project in Idaho.

It’s a monster, which we knew.

At US$1,850 gold, the project has an after-tax net present value (NPV) of US$1.9 billion and an internal rate of return (IRR) of 27.7%.

At US$2,100 gold, those numbers go to US$2.5 billion NPV and 32.4% IRR.

It will produce over 4.2 million ounces of gold over 15 years of mine life, as well as 118 million pounds of antimony. It would be the only US domestic source of antimony, which is a critical element (like rare earth and uranium).

All in sustaining costs are US$625 per ounce over the life of the mine, well in the lowest quartile of the industry.

The project would have a positive local economic benefit exceeding more than $1 billion in initial capital investment, and creating 550 direct jobs.

The large upfront capex has been pointed to as the one detractor. But a project of this scale — it would be the largest and highest-grade gold mine in the lower 48 — will get financed. And with John Paulson as the majority leader, you already have someone who can put together such a package if needed.

Shares continue to trade below our buy under price of C$1.50, and a value below that price. Currently trading at C$1.38 with a market cap of C$650M… it’s fetching less than 30% of the NPV in its feasibility study at current gold prices.

You also have permitting catalysts coming, which simply have to turn out better than it did for Almaden.

Wrap-Up

Even adding Chewy we have two open spots in our 20-spot portfolio.

In the bull market across asset classes that we’re in, I won’t let them remain unfilled for long.

The Fed remains dovish and is promising low rates and accommodation for years. Its chairman went on 60 Minutes last year and claimed they can keep buying assets because they digitally create money.

Gold and Bitcoin responded in kind.

IPOs are coming at their fastest pace in 20 years. Most of them aren’t profitable. They still go up.

The wealthiest 10% of Americans who own stock control 84% of that stock’s value. Own stocks.

With the Fed backstop and the half of Americans who don’t own stocks starting to wise up… and putting their “stimmy” money — as stimulus funds are being called — into stocks, we seem to be climbing walls of worry.

For now, the music is blaring and there are plenty of chairs. Even if we have to listen to it at home because large swaths of the economy remain closed or subdued.

I’ll let you know when they stop filling the punchbowl and start taking away chairs.

Call it like you see it,

Nick Hodge

Nick Hodge

Editor, Foundational Profits

Here is the current portfolio:

Open Positions

| Large Cap Sector Selections and Funds |

|

|

|

| Company |

Symbol |

Exchange |

Buy Limit |

| AdvisorShares Pure US Cannabis ETF |

MSOS |

NYSE |

$34.00 |

| Altria Group Inc. |

MO |

NYSE |

$40.00 |

| Chewy |

CHWY |

NYSE |

$96.00 |

| Energy Select Sector SPDR Fund |

XLE |

NYSE |

$38.00 |

| International Business Machines |

IBM |

NYSE |

$128 |

| Metals & Minerals |

|

|

|

| Company |

Symbol |

Exchange |

Buy Limit |

| Alamos Gold |

AGI |

NYSE |

$10.00 |

| Almaden Minerals |

AMM |

TSX |

C$1.00 |

| Artemis Gold |

ARTG |

TSXV |

C$5.50 |

| Cameco Corporation |

CCJ |

NYSE |

$11.00 |

| Franco-Nevada Corp. |

FNV |

NYSE |

$130.00 |

| GoldMining Inc. |

GOLD |

TSX |

C$2.50 |

| Hecla Mining |

HL |

NYSE |

$6.00 |

| Ivanhoe Mines |

IVN |

TSX |

C$3.75 |

| MAG Silver Corp. |

MAG |

NYSE |

$11.00 |

| Midas Gold Corp |

MAX |

TSX |

C$1.50 |

| MP Materials |

MP |

NYSE |

$13.00 |

| Rio Tinto |

RIO |

NYSE |

$52.00 |

| Sibanye Stillwater |

SBSW |

NYSE |

$8.50 |

| Uranium Energy Corp. |

UEC |

NYSE |

$1.63 |

Make sure you never miss an update or issue from Nick Hodge's Foundational Profits by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here.

Nick Hodge's Foundational Profits, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Nick Hodge's Foundational Profits does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.