Hard Asset Digest May 2021

May 2021

In this month’s issue, I’m bringing you my exclusive interview with Jeff Phillips — founder and president of boutique resource investment firm Global Market Development.

Click here to jump straight to the interview.

Over the last 25 years, Jeff’s firm has been instrumental in the financing and consulting of numerous highly successful resource companies. Investors who’ve followed his insights on precious metals, rare earths, uranium, and oil & gas have made some truly remarkable gains over the years.

Jeff has served as the principal financial backer of a number of precious metals resource companies including Animas Resources and Pediment Gold, both of which were later bought out by gold producers at substantial premiums.

He was among the very first resource stock experts to recognize the immense potential value of consolidation in the silver market back when silver was trading below $5 per ounce. It’s now approaching $30!

Mr. Phillips was also among the first market experts to recognize the global stranglehold China was putting on rare earths metals back in 2009. He immediately proceeded to finance all three of America’s publicly-traded rare earths mining companies realizing it would pay off handsomely once the market caught up to what he already knew.

Those who followed his insights in this market niche witnessed exponential gains as China’s rare earths dominance eventually reached the mainstream financial news outlets.

Is it about to happen again? You’ll find out in the upcoming interview!

Yet, before we get to that discussion, both gold and silver have been staging solid comebacks since April 1.

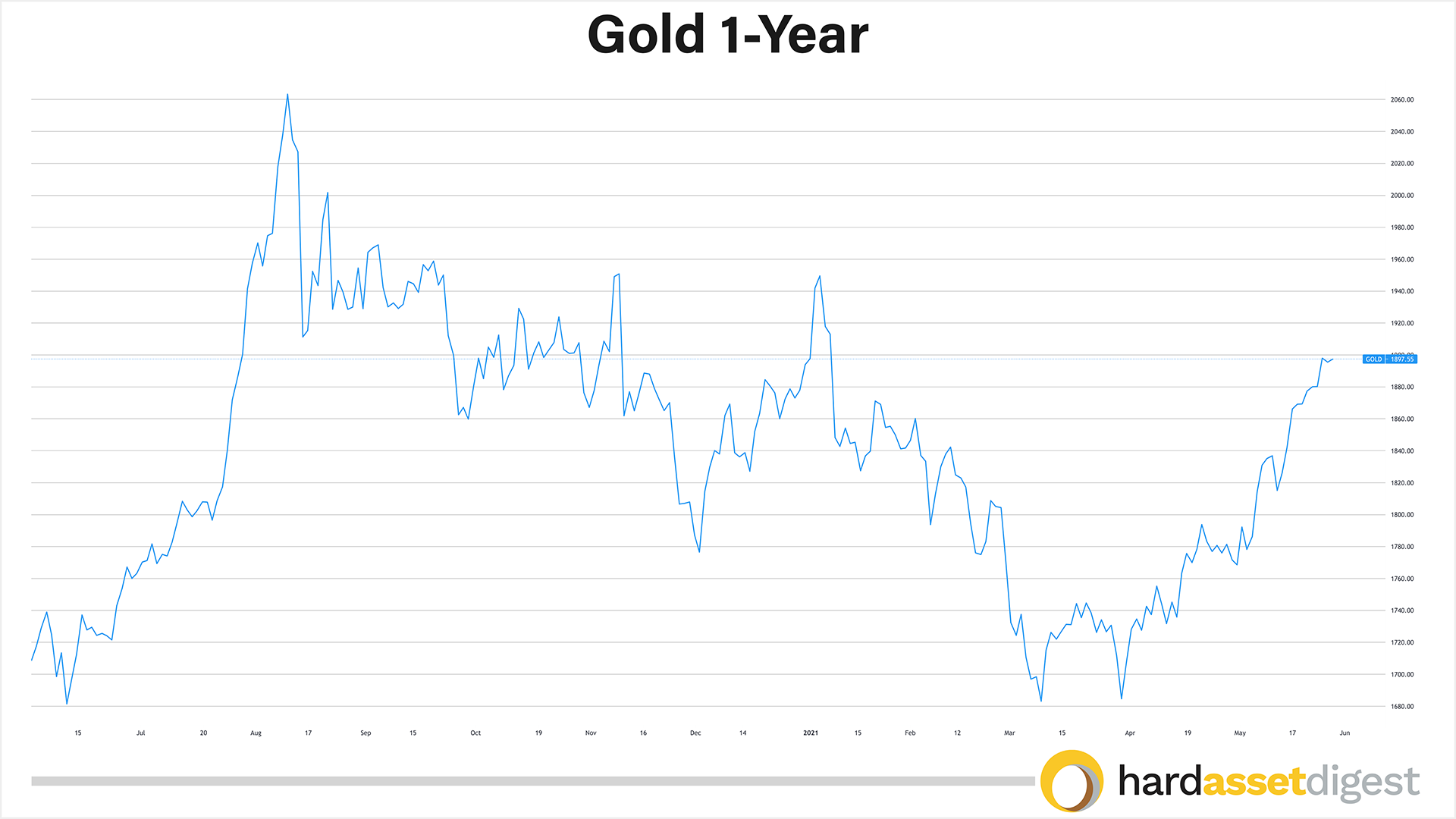

Gold has risen 13% from $1,680 an ounce — after putting in a double-bottom in the month of March — to currently just below $1,900 an ounce.

Silver has performed even better — rising 16% from around $24 an ounce to currently just below $28 an ounce.

We’ve been saying, for anyone who would listen, that the fundamentals for higher gold prices have been in place for some time based primarily on the loose monetary policies of the Fed and the ongoing devaluation of fiat currencies around the globe.

At the moment, selling in the gold space has been pretty well exhausted, flushing out a lot of the weaker players… which means the prospects for a near-term run back above $2,000 an ounce are now even brighter.

Likewise, I would not be surprised in the least to see silver breaking above $30 an ounce in the coming months, if not weeks.

As inflation rears its ugly head, real rates — or interest rates adjusted for inflation — will continue to be driven deeper into negative territory… which is extremely bullish for gold.

And one only needs to look at the $Trillions currently being spent or proposed — $900B stimulus at the end of last year + Biden’s $1.9T stimulus package, $2.3T infrastructure plan, and $1.8T American Families Plan — to know inflation, indeed, is just around the corner.

As my friend and colleague, Brien Lundin of Gold Newsletter, recently tweeted, “Like tequila shots, the first trillion is the hardest. After that, it goes down *smooth*.”

He continues,

“The bottom line is that whatever spending restraint there might have been, from either side of the political aisle, is now evaporated. Simply put, the Democrats have learned their lesson from wasting the first two years of Obama’s presidency. They aren’t going to waste this crisis, or their majority in Congress, this time. They’re going to get their agenda passed, to the maximum degree, while they can. So you can bet there’s even more coming. Which begs the question, what will be the repercussions of this complete disregard to fiscal responsibility? The answer is obvious. Whatever they might want to do in terms of monetary policy, the Treasury will be forced to issue ever-greater debt to pay for these monumental spending plans and the Fed will be forced to buy those securities.

“The bottom line is that whatever spending restraint there might have been, from either side of the political aisle, is now evaporated. Simply put, the Democrats have learned their lesson from wasting the first two years of Obama’s presidency. They aren’t going to waste this crisis, or their majority in Congress, this time. They’re going to get their agenda passed, to the maximum degree, while they can. So you can bet there’s even more coming. Which begs the question, what will be the repercussions of this complete disregard to fiscal responsibility? The answer is obvious. Whatever they might want to do in terms of monetary policy, the Treasury will be forced to issue ever-greater debt to pay for these monumental spending plans and the Fed will be forced to buy those securities.

In short, trillions of new dollars will be added upon the trillions already being created, exacerbating the out-of-control trends already in place. Because of the towering size of the federal debt (and its accelerating growth rate), interest rates must remain well below the rate of inflation, essentially forever. That means negative real rates, again essentially forever, which is in turn the recipe for much higher gold and silver prices.”

Of course, that’s not to say bet the entire farm on gold and silver. As is the case with virtually all market trends, there’ll be bumps and bruises along the way — just like the one we just witnessed with the recent pullback in the precious metals.

Yet, with the amount of spending going on and with no real way to pay for it other than tax hikes on the wealthy plus trillions more dollars in debt creation — allocating a portion of your wealth to gold and precious metals equities should pay off quite handsomely over the course of the next several years.

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

Exclusive Interview with Jeff Phillips

President of Global Market Development

Mike Fagan: Jeff, it’s great to have you back on especially now that we’re finally coming out of this pandemic. So first off, how are you and the family doing?

Jeff Phillips: Everyone's doing well, Mike. Thank you for having me on. And yes, it looks like things are starting to get somewhat better and we go from there.

Mike Fagan: Glad to hear… and yeah, it really does feel great to finally be getting there. And hopefully that’ll be the case globally pretty quick here as well.

Related to that, we're now in this environment of unprecedented money printing and debt creation. And after some stalling, we’re finally beginning to see some of that manifesting in the precious metals sector with gold looking like it's ready to move back above $1,900 an ounce and silver looking like it's poised to break above $30 an ounce. I’d love to get your take on the two precious metals we follow most closely.

Jeff Phillips: Well, Mike, you've definitely seen a high late last summer, early fall. You've seen a pretty good consolidation, and they're starting to move back up off of support.

And like you said, I think gold is around $1,860 an ounce right now which is great. But as I've told you before, I don't predict what something's going to do in the short-term because there's a lot of asset bubbles out there and a lot of unprecedented policies going on — which makes things very difficult to gauge in the near-term.

In the longer-term, there's no doubt in my mind that this is a massive asset bubble and interest rates are going to rise over time regardless if the Fed wants that or not. And gold will do well because you're going to see inflation. However, I don't know if that's going to play out in the next three months or the next three years.

Mike Fagan: Right but like you said… the overall trend is in. And speaking of volatility in commodities, you've always told me that when you're selecting precious metals equities to invest in, you really don't pay much attention to those short-term gyrations. You primarily look to companies that have the potential to develop big projects profitably at lower metals prices. And that's always made a lot of sense to me.

Can you tell my readers a little bit more about that strategy?

Jeff Phillips: Sure. The first thing you have to remember in the junior space is that the vast majority of these exploration firms don’t have a proven asset. They’re looking for one. And that increases the risk factor.

So what I do is I look for well-run companies that already have a resource at the PEA level, which is a pre-economic assessment or even a feasibility study or, even better, a bankable feasibility study.

You're trying to analyze companies to say, “Gee, at current metals prices, can they raise the requisite money and put this thing into production?” Or can a larger company such as an intermediate or major producer look at it and say, “Gee, we want to buy this out because it's going to be profitable for our bottom line.”

So I tend to speculate on companies that can do well at lower metals prices. And again, this is a speculative market. When it becomes in-favor, valuations can get completely out of whack where companies that are simply looking for gold can go up 10-fold or more.

I believe that type of market is coming at some point. Yet, to be honest, it's really a disadvantage to someone like me because what I’m trying to do is analyze companies to see if their assets are worth an investment stake. And in a raging gold bull market — which we will have at some point — everything tends to go up rapidly. And that includes a lot of the pretenders. So it’s tricky.

At the end of the day, I’d rather own companies that are going to be there when the game gets started because a lot of juniors inevitably get restructured and end up becoming overly diluted. So investing in quality companies with quality assets is my focus as they’re able to withstand the downside while also benefiting from the upside.

Mike Fagan: Yeah and I think a good example of that is the recent pullback in gold that we’re now on the other side of. And so let’s segue from there to a couple of the stocks we talked about last August.

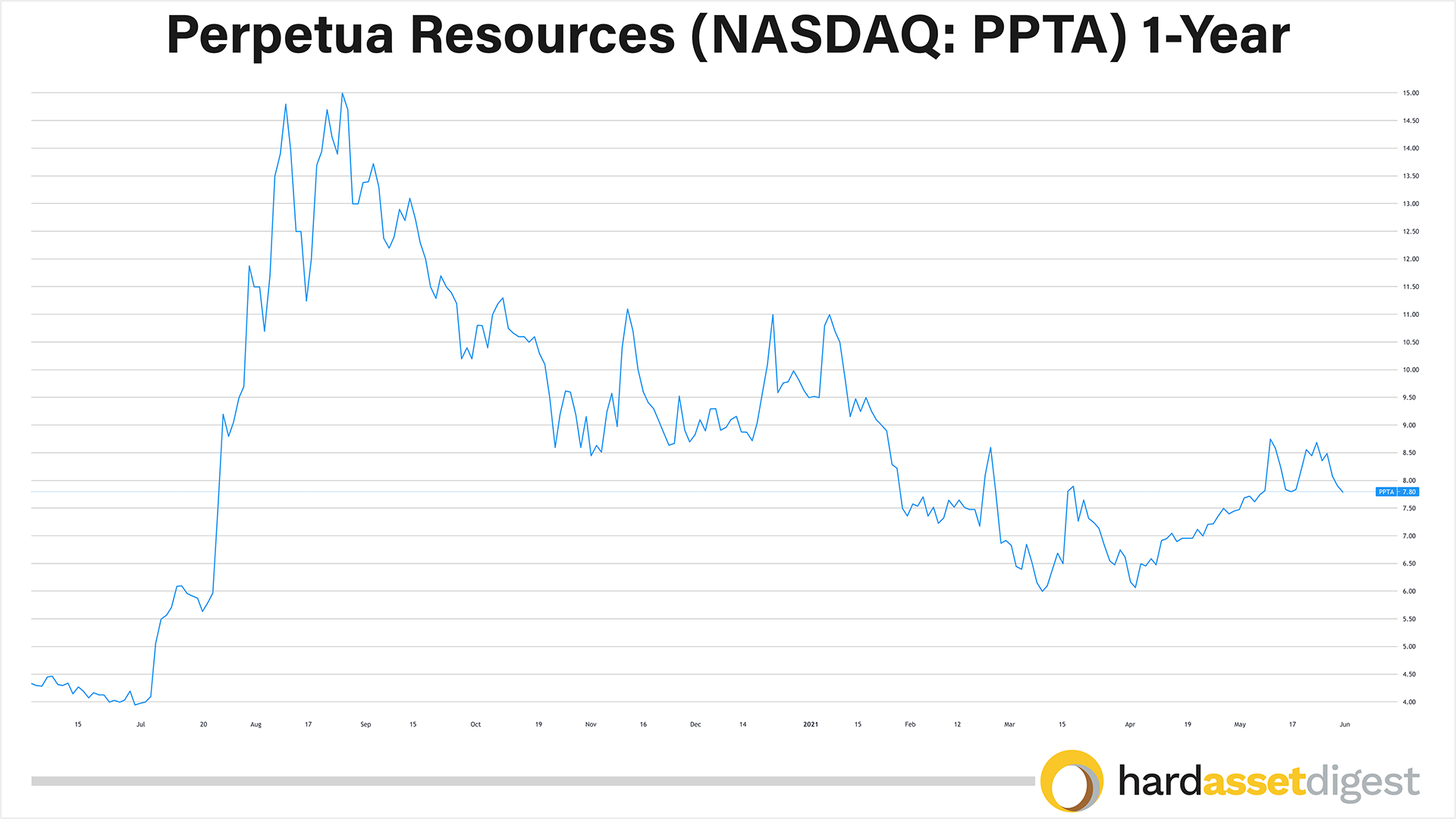

One of those was Midas Gold, which has since changed its name to Perpetua Resources (NASDAQ: PPTA)(TSX: PPTA). Of course, Perpetua is developing the flagship Stibnite Gold-Antimony Project in Idaho, which is considered one of the highest grade open-pit gold deposits in the United States.

They've had some pretty significant news lately; finished up their draft EIS last fall and moving into final permitting now. What’s next for Perpetua?

Jeff Phillips: Well, I don't have a crystal ball, Mike, but they are in final permitting and it's quite an advanced process. Perpetua is half owned by John Paulson — the well-known hedge fund manager who made a ton of money shorting the real estate market during the housing crisis.

Perpetua is his major gold holding. It’s got over 6 million ounces plus the antimony component. I think he owns 42% of the company. So when you're a shareholder of Perpetua, you're on the same team, so to speak, as John Paulson. Obviously, he's going to try to maximize his value. This is his leverage to inflation and everything else. He has other gold holdings but this is one of his most significant.

I think the stock is going to do well. It could go up five-fold in the right speculative market. But realistically, if they get their mine permit this year and a larger company offers them double their share price — perhaps Paulson would sell. And I think most shareholders would be more than happy with that.

But again, the real money is made in these markets not just on value but on speculation as speculative capital moves in. But yeah, I think Perpetua is going to be a takeout candidate without a doubt.

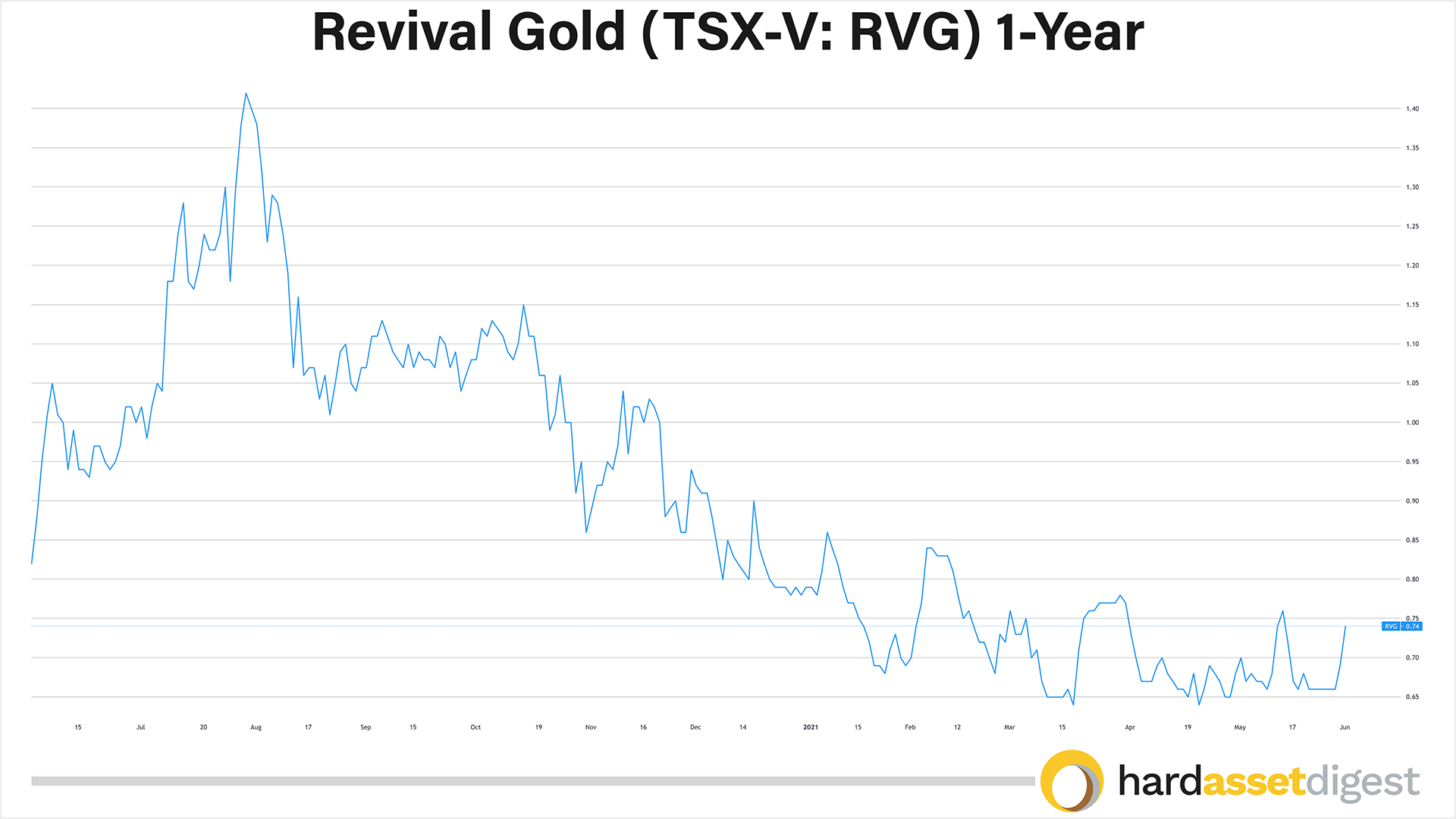

Mike Fagan: And then we’ve got Revival Gold (TSX-V: RVG)(OTC: RVLGF) which is developing the 3 million ounce Beartrack-Arnett Gold Project, also in Idaho. Its shares have pulled back from around C$1 per share to currently right around C$0.65.

I find this an interesting speculation as they’re about to resume drilling at the high-grade Joss Zone within the next few weeks. Do you see Revival potentially heating up once again as the drills get going?

Jeff Phillips: Yeah, Revival Gold is definitely an interesting speculation, Mike. As you said, it's come down a bit in price. I've bought it at higher prices. And again, it should be noted, all of these companies so far that you've asked me about — I'm a financial consultant for and a large shareholder.

My main goal is to make sure these companies do things that are in the best interest of shareholders and try to limit dilution until we can get to one of these really speculative markets in the resource sector that we tend to have every five, six, seven years.

Revival raised a large chunk of money last fall; around C$13 million if I remember correctly. There are warrants attached to that so inevitably you get some selling. We also had that temporary pullback in the gold price as you mentioned. So it has come back some.

I think Revival is one of the cheaper speculations out there. With a market cap below US$40 million and a current gold resource of 3 million ounces, the company currently trades for less than US$13 per ounce in the ground.

They’ll have the drills turning on a 5,000 meter program starting in June along with a potential restart of heap leach gold production with a goal, I think, of around 70,000 ounces per year.

People tend to get excited about those sorts of developments. But just on a value basis alone, Revival is extremely cheap for its ounces in the ground. It's a past-producing asset in Idaho. It was the largest past-producing gold mine in Idaho. They've discovered quite a bit more gold there.

So yeah, Revival is an excellent speculation. Like I said, I've bought it at higher prices. Just last week, I think I bought 100,000 to 200,000 shares. I had some bids in there — and the market was weak last week — and I got filled. But I think it's probably washing out with some of the financing, and I suspect it'll start heading back up to where it was last year as they begin to drill.

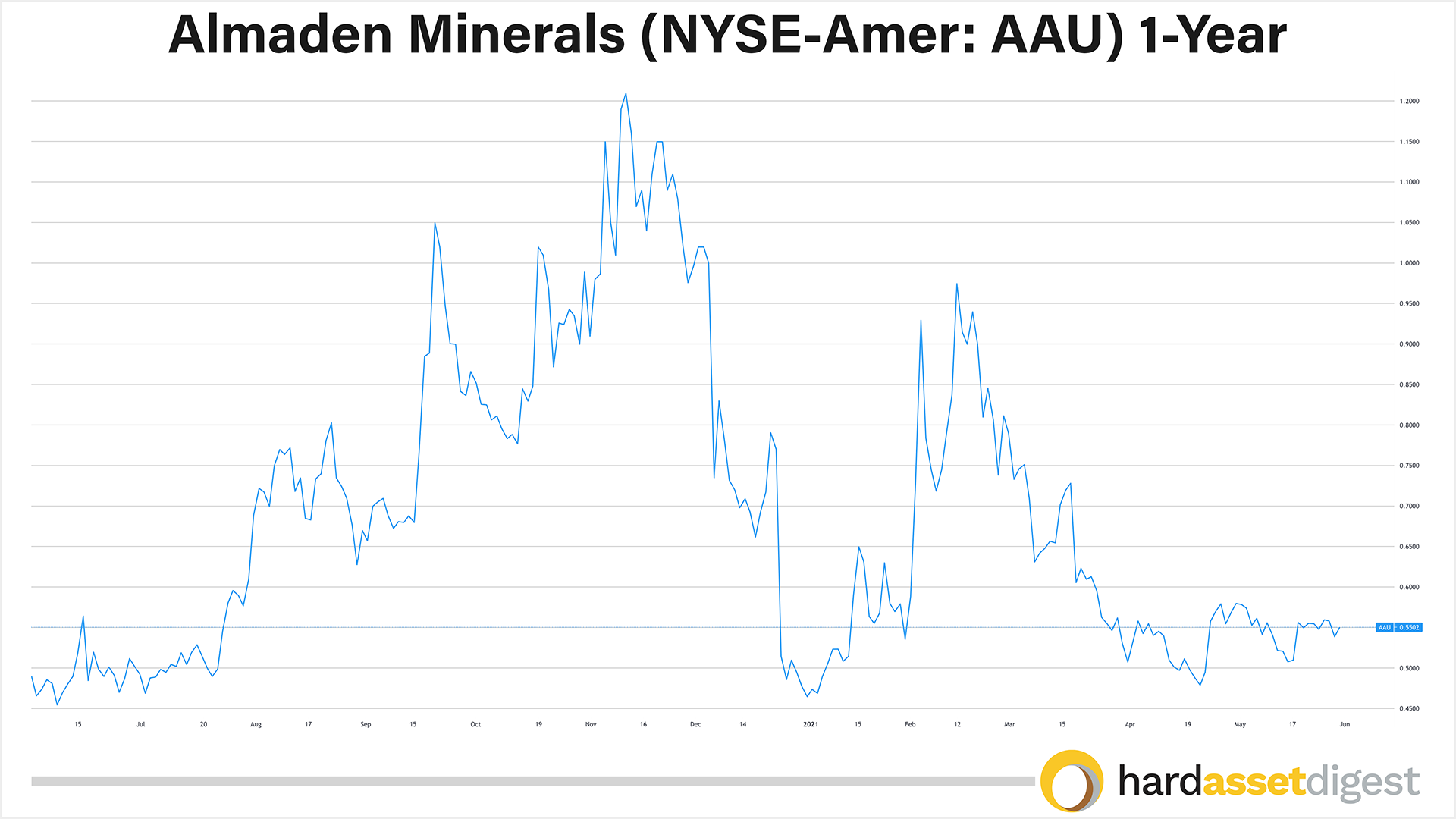

Mike Fagan: Excellent. And the last one I'll ask you about from the gold space is Almaden Minerals (NYSE-Amer: AAU)(TSX: AMM). They've been stuck in sort of a choppy trading pattern since last August.

They’re developing the multi-million ounce Ixtaca Gold-Silver Deposit in Pueblo State, Mexico. I know they've had permitting issues of their own. And I know you don't have a crystal ball but what can you tell me about Almaden at this juncture?

Jeff Phillips: Yeah, Ixtaca is an incredible deposit in Mexico. Both South America and Latin America — and the various countries therein — have lots of different issues that these North American exploration firms have to navigate. And it's certainly part of the reason why some people tend to focus on US, Canadian, and Western-friendly mining jurisdictions like Australia, which, of course, you pay a premium for.

But what happened with Almaden is you've got a government that's being more cautious on permitting and so forth. And so, basically, Almaden’s initial permit to build the mine was rejected. And again, it's a long story because it's all politics. But my belief is that it was part of the posturing that politicians do because, again, Almaden has done a great job in the local community. They're offering jobs; they're very well-supported locally.

It's mostly outside influencers that have put a monkey wrench in the deal. I suspect Almaden will be submitting their mine permit again this year. They've added some people to the board that are well connected and that have helped build mines in Mexico and are Mexican individuals themselves.

So I think it's a give and take. I think they're going to end up doing some things for the Mexican government and the mine will get permitted. There's a lot of profit in that mine so there's a lot of money to go around. Thus, at current prices, Almaden is a very good speculation, and they’re going to be drilling again this year.

Ixtaca has been a grassroots discovery for Almaden that's turned into a global resource of about 4 million ounces of gold equivalent; about 50/50 silver and gold. And they haven't even explored the entire property. It's a massive land package so there’s a ton of exploration upside.

Drilling is resuming and I think they'll make some additional discoveries. It’s a team that has a lot of experience in making new discoveries. They’re in the right gold market. I think this time next year, we’ll be talking about Almaden at much higher price levels.

Mike Fagan: Great! Jeff, turning to uranium, it’s well-understood that you can’t put a North American uranium mine into production at $30 uranium. Yet, it’s an interesting market and we’re starting to see some upward movement.

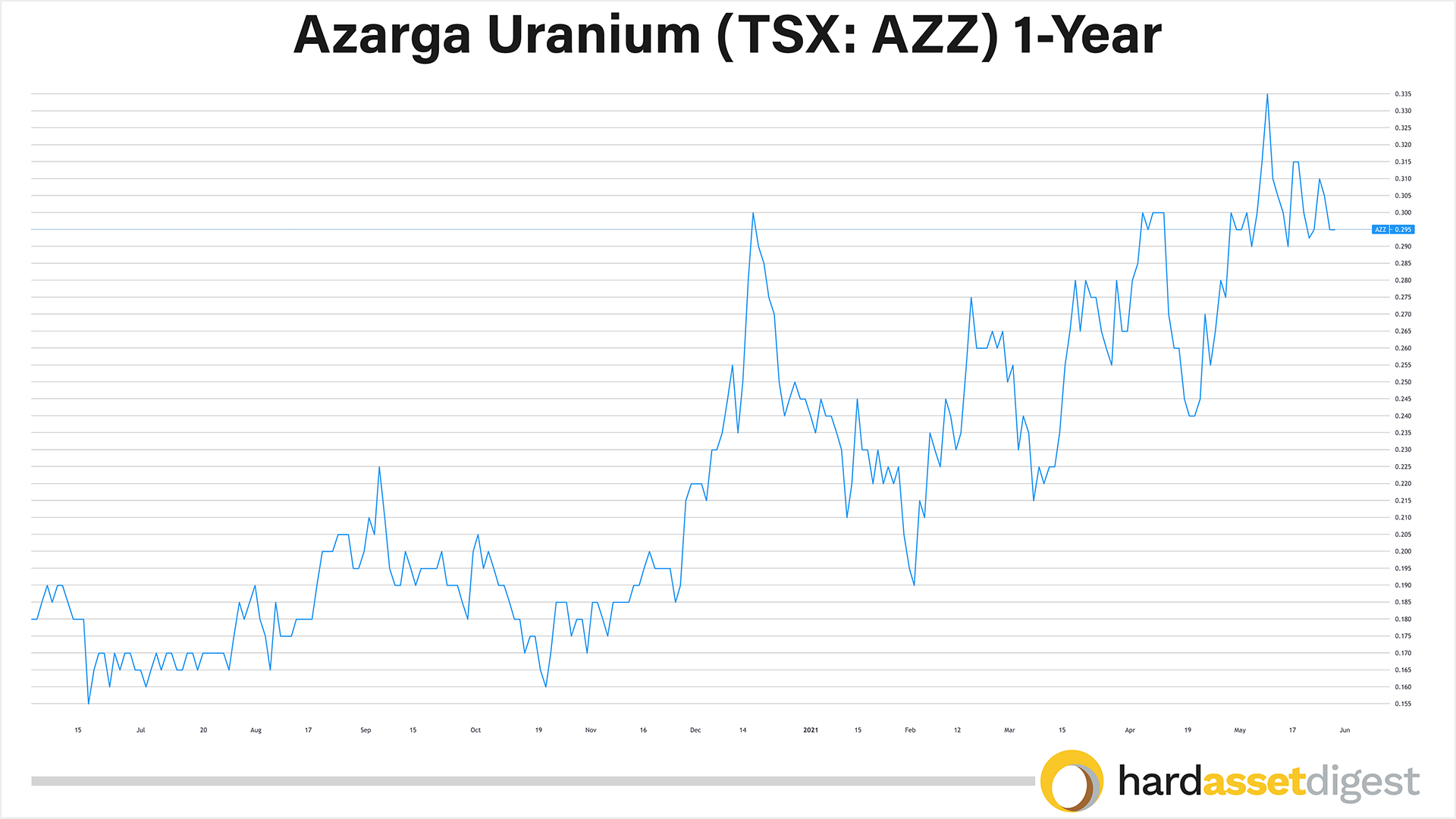

And that includes many of the juniors such as Azarga Uranium (TSX: AZZ)(OTC: AZZUF) which I own and which has moved up from about C$0.20 per share in early-March to around C$0.30 a share currently. What’s happening there?

Jeff Phillips: Yeah, like you said, we’re not seeing any uranium production in the US because prices remain low. To get mines going in the US, you really need a uranium price north of $50 per pound. We were sort of stuck below $30 for a while, and now prices are starting to tick back up.

A number of uranium juniors have done quite well of late, as you noted, based on a combination of assets under management and the prospects for higher uranium prices. And I think prices eventually do need to move up toward that crucial $50 level.

I own Azarga Uranium as well. They recently doubled the size of their Gas Hills ISR resource in Wyoming, and they’ve got final EPA permits in hand for their flagship Dewey Burdock project in South Dakota. So lots of great news on the development front for Azarga.

I think their stock recently hit a high of C$0.35 and has since come back just a bit. Again, without a doubt, uranium prices have to go higher in the future. It’s really just a timing thing. I'm perfectly happy to be buying something like Azarga Uranium with its multiple permitted ISR projects in the US. And just like Perpetua Resources, I think Azarga is a prime takeover target.

I also think it's one of the better uranium assets out there. And with the US government moving to secure some of our strategic metals, I think Azarga is exceptionally well positioned. Yet, I'm happy to be patient, Mike. I’ve bought it at higher prices and at lower prices.

Over time, I think it’s going to see a fantastic return. Will that be in one month or one year… well, it’s difficult to say. But I think now is a good time to be pecking away at the higher quality names in the uranium space — and Azarga is certainly one of them.

Mike Fagan: I couldn't agree more. And speaking of securing strategic metals, the rare earths sector has done quite well since our last interview.

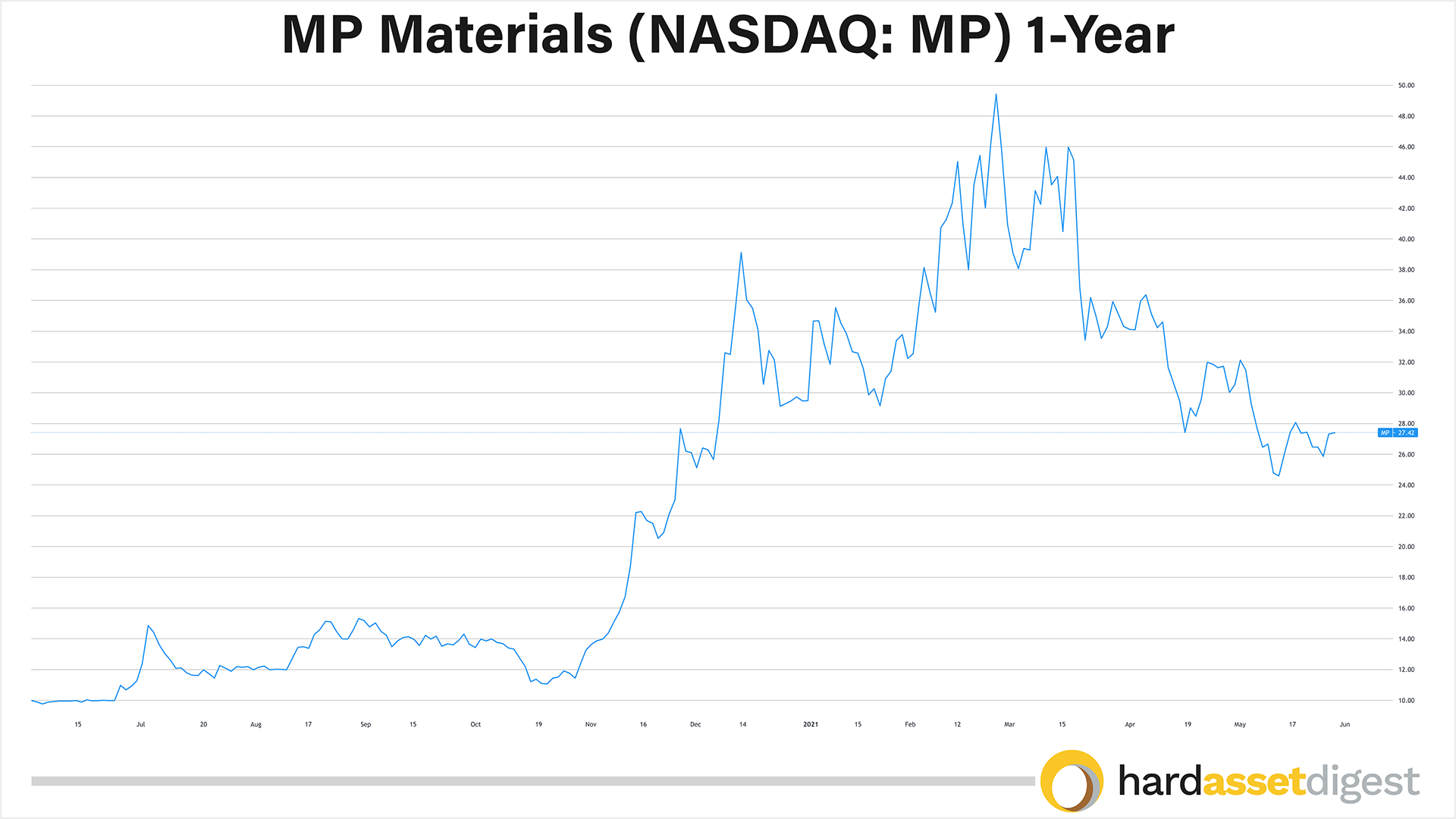

I think last time, we discussed Lynas Rare Earths (OTC: LYSCF) which produces out of Western Australia; MP Materials (NASDAQ: MP) which produces out of southern California; and Leading Edge Materials (TSX-V: LEM)(OTC: LEMIF) which is advancing the Norra Kärr mine project in Sweden. Each of those has had a substantial run-up since last summer.

Jeff Phillips: Yeah. I've taken profits on MP Materials because it did really well from the SPAC to the acquisition. Again, we could have a whole interview on this, but rare earths are controlled by China and they go into virtually everything. I saw today that President Biden was at a Ford plant touting his infrastructure plan and stating that if we don't go all-in on EVs — we’ll lose to China. And that’s true.

Yet, the problem is that we hardly produce any of the rare earth elements that go into EVs and solar panels and wind turbines and other green energy technologies. They’re mostly mined in China — and very environmentally unfriendly I might add. I mean, you want to talk about the Bitcoin hazard to the environment from all of the electricity generation required… just take a look at what they're doing to mine rare earths in China!

So rare earths are going to be extremely critical to a cleaner/greener future. The US government is going to have to spend lots of money to ramp up our rare earths production, including supply chains, refining, etc. It’s an extremely interesting sector. At different times, we’ve seen this market explode 10-fold from where you could have bought the stocks. We’ll probably see that again in the not too distant future.

As of right now, the only rare earths stock I own is Leading Edge Materials, which, as you mentioned, has the Norra Kärr heavy rare earths deposit in Europe. And so I like Leading Edge as a speculation.

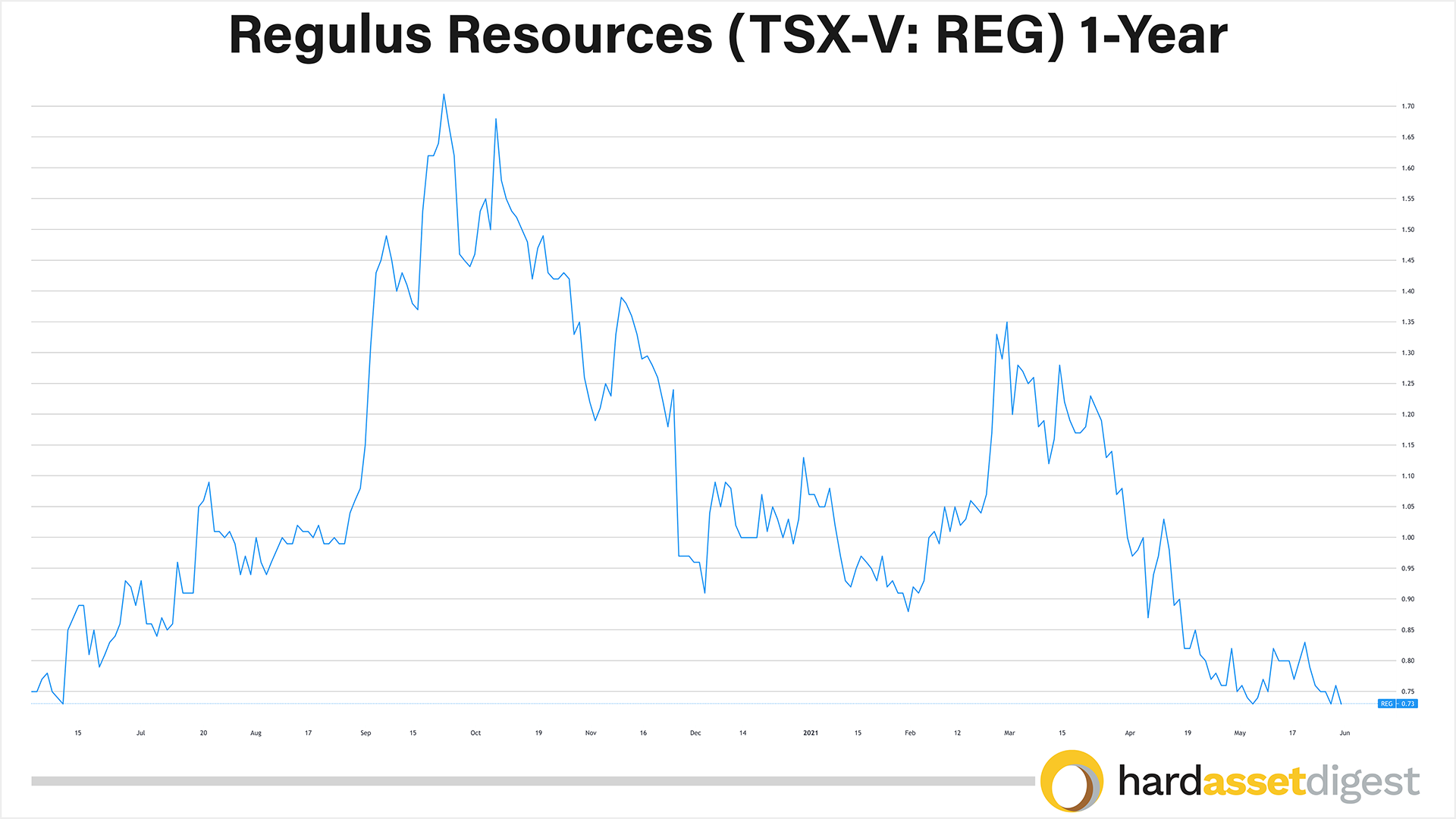

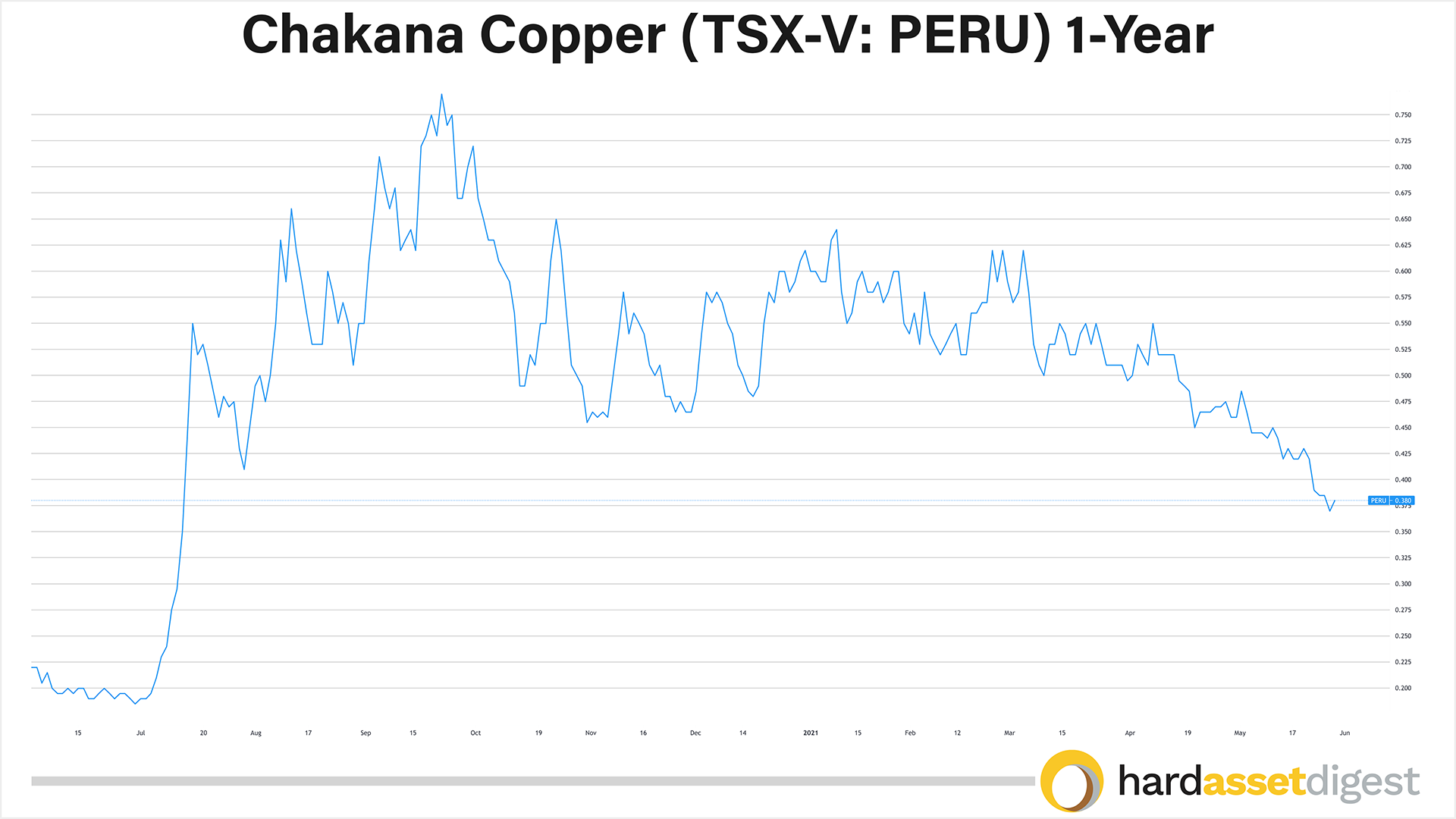

Mike Fagan: Excellent! And finally, turning to copper, we've got the red metal trading at 10-year highs well above $4.50 a pound. Last time, we discussed Regulus Resources (TSX-V: REG)(OTC: RGLSF) and Chakana Copper (TSX-V: PERU)(OTC: CHKKF), both of which have operations in Peru which is in the midst of a presidential run-off with plenty on the line for the mining industry there.

Jeff Phillips: Yeah, there really is no shortage of political elements to the copper space right now. You had Chile with elections just this last weekend with discussions about increasing the royalties mining companies pay. And, mind you, Chile is the world’s largest copper producer.

Peru, which is number two in global copper production, held its general election last month and will announce its run-off winner on June 6th. It’s between left-wing, or communist-leaning Pedro Castillo and right-wing, pro-business Keiko Fujimori. She’s the daughter of former president Alberto Fujimori who’s currently in jail.

Castillo is currently ahead by a couple of percentage points… so we’ll see how that shakes out. Fujimori is very pro-business but she obviously has a lot of baggage as far as her family goes.

A win by her would likely usher in a very pro-business environment wherein a lot of these Peru-focused explorers could really bounce. A win by Castillo… well, I think a lot of that is already baked into the mining stocks. They could get hit with a bit more of a downdraft, but, again, I don’t see Peru nationalizing its copper assets. They still need to attract outside investment into their mining sector.

So, to me, the uncertainty right now really is the worst thing. Once the run-off is settled, I think these stocks become very interesting. So if someone wants to wait a bit and see what the run-off brings — there’s probably a good case to be made for that.

Both Regulus and Chakana have tremendous copper assets. And I think they're both worth a lot more than their current market caps. So again, for those currently on the sidelines, you could potentially end up paying slightly more if the run-off goes the right way… or pay a little less but require a bit more patience if it goes the opposite direction.

But, like I said, both companies have tremendous copper assets.

Mike Fagan: Jeff, you've been a long-time collector of rare coins, classic cars, art pieces… really all kinds of different collectibles from all over the world. So you know I can’t let you go without getting your thoughts on the current non-fungible token, or NFT, craze!

Jeff Phillips: Yeah, I kinda saw that one coming, Mike! So, without a doubt, there are a lot of bubbles out there right now that are being driven by a lot of speculation and a lot of greed. And one thing you always have to remember is that all bubbles eventually burst.

Just look at cryptocurrencies… and I’m not even talking about the big three or four. Even those have come off significantly recently. But then you also have these lesser ones — ones created daily practically as jokes — that are of equal concern. Many have already met their predictable demise and it's a safe bet most of the others eventually will as well.

The bottom line is that asset prices in a number of sectors are going to come back to earth. Interest rates are going to go up to combat rising inflation. So again, people can speculate and gamble on mania-driven stuff like crypto and NFTs all they want. And maybe some of them go up another 50% from here. But eventually, the music stops and there are no chairs left.

Again, I prefer to own hard assets with real value. And that includes rare coins, art, and real estate. There’s always demand for those sorts of things. And getting back to resource stock speculation, it’s all about owning companies with solid assets that are run by management teams with a history of past success.

We talked about Revival Gold. To me, with the amount of gold they control — it’s an incredible speculation. For those interested in the junior space, buy a little Revival Gold at current prices. But always keep in mind that you are speculating. We talked about gold… and I think gold is going to do exceptionally well as people begin to realize that there are massive bubbles out there.

As these bubbles pop, and as inflation rears up, a lot of the smart money is going to find its way into gold which has been a store of value throughout human history and particularly during times of uncertainty. And I think we’re heading there once again.

Mike Fagan: Jeff, absolutely fantastic getting your insights as always. Thank you so much for coming back on. Let’s do it again soon!

Jeff Phillips: Any time, Mike. I appreciate you having me on. Talk soon.

We have four reports now available highlighting several opportunities for investment in the resource space.

Opportunities discussed in those reports and past issues include:

May 2021 Issue: Opportunities Mentioned by Jeff Phillips

- Perpetua Resources (NASDAQ: PPTA)(TSX: PPTA)

- Revival Gold (TSX-V: RVG)(OTC: RVLGF)

- Almaden Minerals (NYSE-Amer: AAU)(TSX: AMM)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Lynas Rare Earths (OTC: LYSCF)

- MP Materials (NASDAQ: MP)

- Leading Edge Materials (TSX-V: LEM)(OTC: LEMIF)

- Regulus Resources (TSX-V: REG)(OTC: RGLSF)

- Chakana Copper (TSX-V: PERU)(OTC: CHKKF)

April 2021 Issue: Opportunities Mentioned by Dr. Mark Skousen

- Franco-Nevada Corp. (NYSE: FNV)(TSX: FNV)

- B2Gold Corp. (NYSE: BTG)(TSX: BTO)

- Barrick Gold Corp. (NYSE: GOLD)(TSX: ABX)

- Pan American Silver (NASDAQ: PAAS)(TSX: PAAS)

- Grayscale Bitcoin Trust (OTC: GBTC)

- Amplify Transformation Data Sharing (NASDAQ: BLOK)

March 2021 Issue: Opportunities Mentioned by Adrian Day

- Barrick Gold (NYSE: GOLD)(TSX: ABX)

- Franco-Nevada (NYSE: FNV)(TSX: FNV)

- Royal Gold (NASDAQ: RGLD)

- Osisko Gold Royalties (NYSE: OR)(TSX: OR)

- B2Gold (NYSE-Amer: BTG)(TSX: BTO)

- Premier Gold Mines (OTC: PIRGF)(TSX: PG)

- Nomad Royalty (OTC: NSRXF)(TSX: NSR)

- Metalla Royalty (NYSE-Amer: MTA)(TSX-V: MTA)

- Elemental Royalties (OTC: ELEMF)(TSX-V: ELE)

- Star Royalties (TSX-V: STRR)

- Altius Minerals (OTC: ATUSF)(TSX: ALS)

- Pan American Silver (NASDAQ: PAAS)(TSX: PAAS)

- Fortuna Silver Mines (NYSE: FSM)(TSX: FVI)

- Magna Gold (OTC: MGLQF)(TSX-V: MGR)

January 2021 Issue: Opportunities Mentioned by Nick Hodge

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Roxgold (TSX: ROXG)(OTC: ROGFF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Generation Mining (TSX: GENM)(OTC: GENMF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

December 2020 Issue: Opportunities Mentioned by Van Simmons

- 19th century: Liberty Seated half dimes, dimes, quarters, half dollars, silver dollars

- 20th century: Buffalo Nickels, Mercury Dimes, Walking Liberty Halves, Standing Liberty Quarters

- Barber dimes, quarters, and halves

- Common date: $10 Liberties, $5 Liberties

- 19th century quarter sets: Draped Bust Quarter, Capped Bust Quarter, Liberty Seated Quarter, Barber Quarter

- 20th century coin sets: Mercury Dimes, Walking Liberty Halves, Buffalo Nickels, Standing Liberty Quarters; other various: 8-piece sets, 10-piece sets, 12-piece sets

November 2020 Issue: Opportunities Mentioned by Gerardo Del Real

- Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF)

- Chakana Copper (TSX-V: PERU)(OTC: CHKKF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX-V:RVG)(OTC: RVLGF)

- Integra Resources (TSX-V: ITR)(NYSE-American: ITRG)

- Liberty Gold (TSX: LGD)(OTC: LGDTF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Energy Fuels (TSX: EFR)(NYSE-American: UUUU)

October 2020 Issue: Opportunities Mentioned by Joe Mazumdar

- Pan American Silver (TSX: PAAS)(Nasdaq: PAAS)

- Liberty Gold Corp. (TSX: LGD)(OTC: LGDTF)

- HighGold Mining (TSX.V: HIGH)(OTC: HGGOF)

- Bluestone Resources (TSV.V: BSR)(OTC: BBSRF)

- Trilogy Metals (TSX: TMQ)(NYSE-Amex: TMQ)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Blackstone Minerals (ASX: BSX)

- Clean Air Metals (TSX.V: AIR)

August 2020 Issue: Opportunities Mentioned by Jeff Phillips

- Lynas Corp. (OTC: LYSCF)

- MP Materials: Private Company

- Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX.V: RVG)(OTC: RVLGF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Chakana Copper (TSX.V: PERU)(OTC: CHKKF)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

May 2020 Issue: Opportunities Mentioned by Brien Lundin

- Great Bear Resources (TSX.V: GBR)(OTC: GTBDF)

- Energy Fuels Inc.(NYSE American: UUUU)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- First Mining Gold (TSX: FF)(OTC: FFMGF)

- Libero Copper & Gold (TSX.V: LBC)(OTC: LBCMF)

- GR Silver Mining (TSX.V: GRSL)(OTC: GRSLF)

April 2020 Issue: Opportunities Mentioned by Nick Hodge

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

February 2020 Issue: Opportunities Mentioned by James Dines

- Agnico Eagle Mines (TSX: AEM)(NYSE: AEM)

- Kirkland Lake Gold (TSX: KL) (NYSE: KL)

- Pan American Silver (TSX: PAAS) (NASDAQ: PAAS)

- Lynas Corp. (OTC: LYSCF)

- Canopy Growth (TSX: WEED) (NYSE: CGC)

- OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI)