Hard Asset Digest June 2021

June 2021

In this month’s issue, I’m sitting down with Mr. Nick Hodge — cofounder of Digest Publishing and publisher of Daily Profit Cycle.

Click here to jump straight to the interview.

Currently residing in Spokane, WA, after more than 30 years in northeastern Maryland, Nick is also the founder of the Hodge Family Office where he offers a series of products geared toward helping high-net-worth and retail investors manage their own money and financial destiny.

Previously, Nick founded the Outsider Club and built it into a financial publishing behemoth serving hundreds of thousands of investors and generating tens of millions of dollars in revenue.

Nick, whom I’ve had the pleasure of working with the last few years, spent his early thirties focusing on the world of private placements and has made millions for himself and his clients while helping to finance some of the most exciting early-stage companies in the resource, energy, cannabis, and biotech sectors.

Known for his “call it like you see it” approach to money and policy, Nick’s intuitive approach to using global change for financial gain has earned him followers across the globe and has led to countless media appearances.

When he’s not writing, investing, or flying around the world to meet with company executives, Nick can usually be found somewhere on his small ranch in the Inland Northwest with his lovely wife and three children pursuing the outdoor activities he grew up with and continues to love.

Exclusive Interview with Nick Hodge

Cofounder, Digest Publishing

Mike Fagan: Nick, it’s great to have you back on for what will be the final issue of Hard Asset Digest in its current format. And we’ll get to that and, more importantly, the exciting things we have in store for our audience members in just a moment.

But first… judging by crowd sizes at sporting arenas across the country these last few weeks, it really does feel like we’re finally exiting the worst days of the pandemic.

Now, if we could just get people to stop acting like complete idiots!

Nick Hodge: I’m not sure we’ll ever get that, Mike!

But it does feel good to be getting back to normal. It’s good to be getting back into the world and seeing actual faces, even though we’ll likely be dealing with the fallout in many respects for some time.

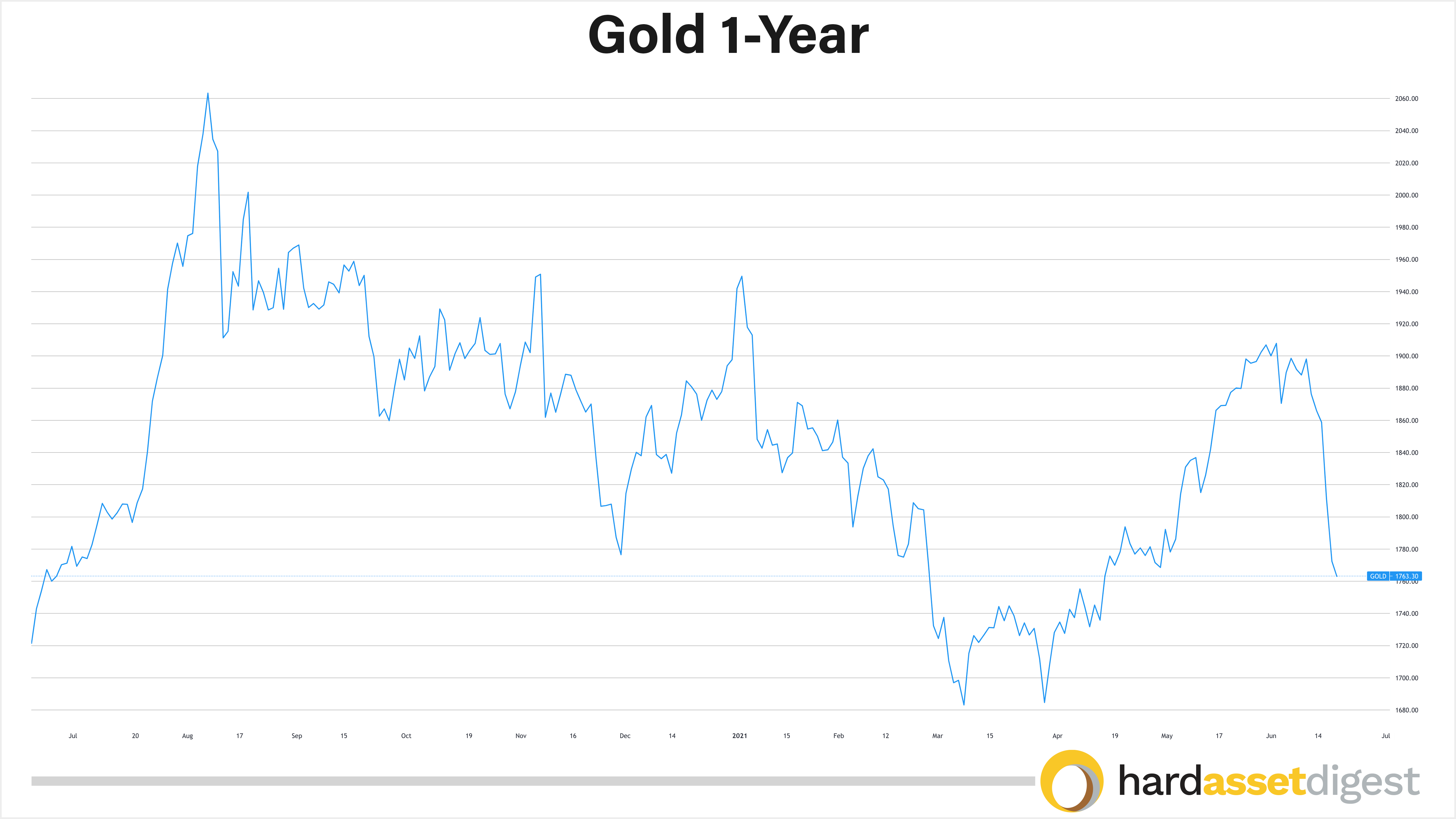

Mike Fagan: Very true. Back in January, Nick, we talked extensively about gold and uranium. We also discussed a few of the resource companies you cover in your publications.

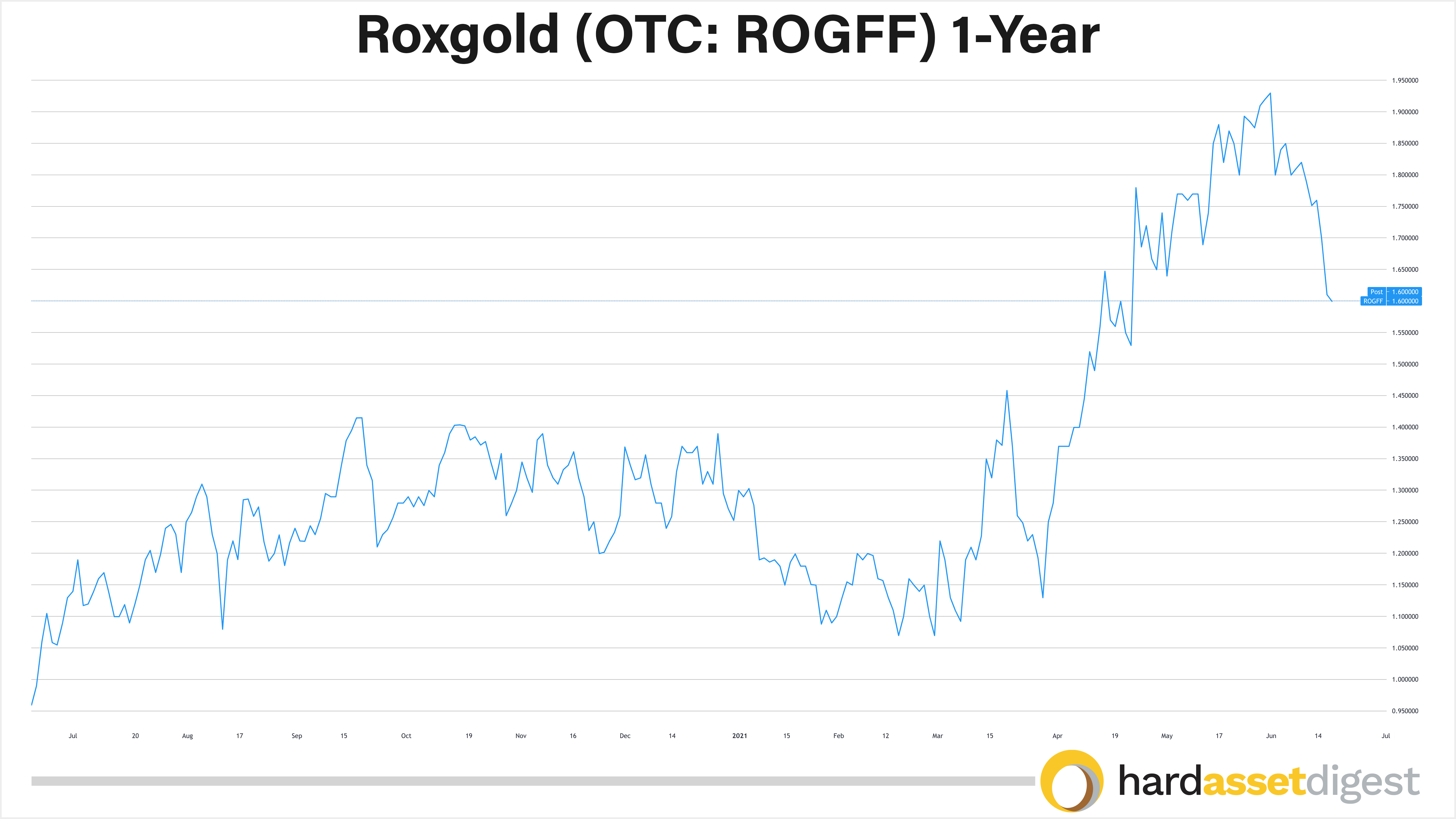

If you will, let’s start with a couple of updates beginning with Teranga Gold, which was acquired by Endeavour Mining (OTC: EDVMF)(TSX: EDV) this last February — and Roxgold (TSX: ROXG)(OTC: ROGFF), which is in the process of being bought out by Fortuna Silver Mines (NASDAQ: FSM)(TSX: FVI).

Nick Hodge: I can’t believe it’s been six months already! Time flies in a historic bull market coupled with a pandemic, apparently.

Back in January, the tie-up between Endeavour and Teranga had been announced. But even before that, shares of Teranga had risen to over C$16.00 amid record gold prices last year. That’s four to five times higher than where my readers and I were buying it as recently as two years ago.

The deal closed in February, making Endeavour a top ten senior gold producer — and the largest in West Africa — with producing assets in Senegal, Cote d’Ivoire, and Burkina Faso.

In January, you asked me if I had my eye on any other mid-tiers as a potential near-term takeover target. And I told you that one I’d been following for a long time as a takeout candidate was Roxgold.

Roxgold is also active in West Africa. It has one producing mine and is approaching a construction decision on another.

Sometimes this blind squirrel finds a nut I guess! Because Fortuna Silver offered to buy Roxgold in April 2021 for $1.1 billion.

The deal still needs shareholder approval. And I’m not sure Fortuna shareholders like the deal too much. But either way, Roxgold shares have done really well, so I hope some of your readers were able to benefit from that.

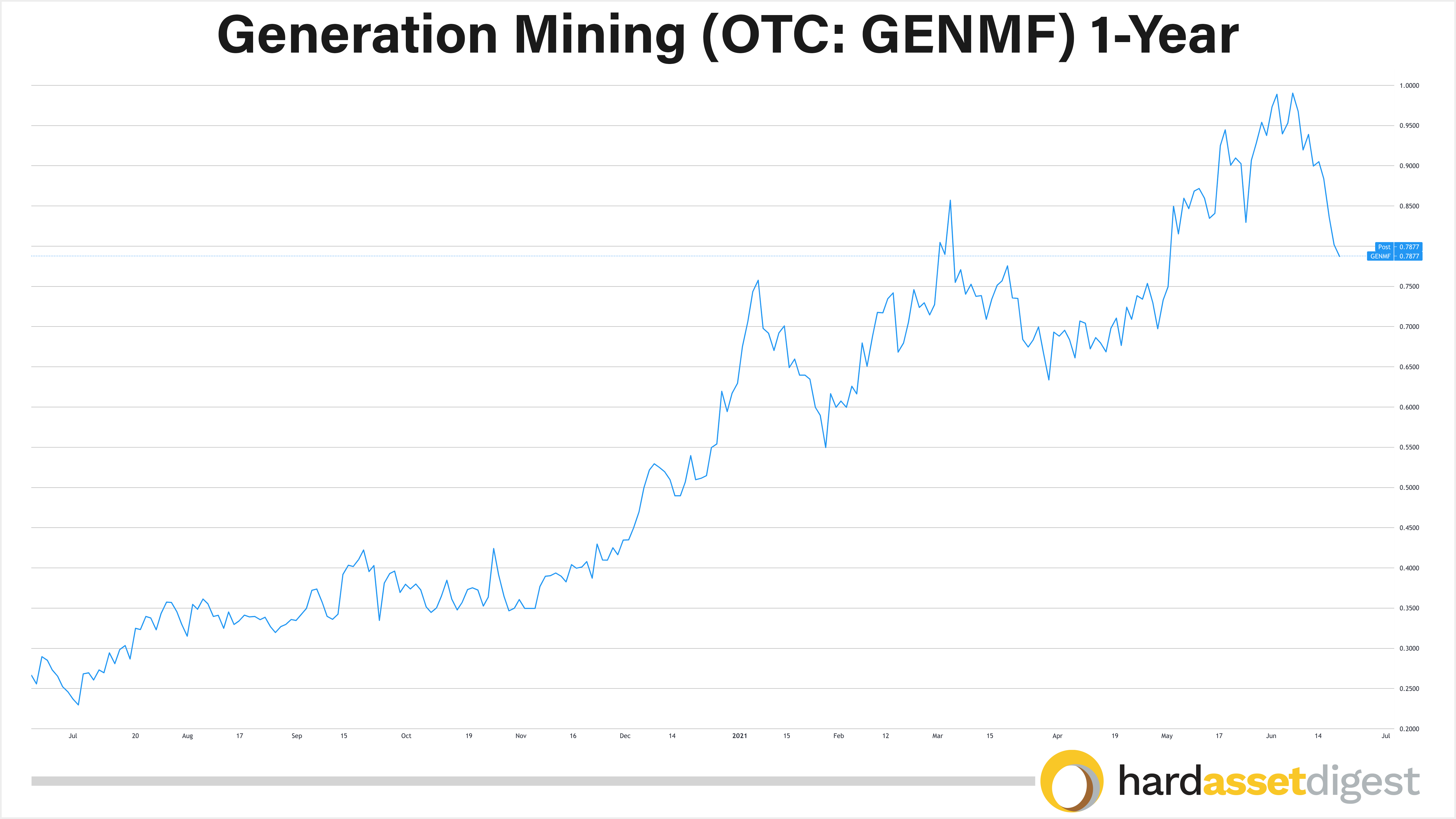

Mike Fagan: We also discussed Generation Mining (TSX: GENM)(OTC: GENMF) which is advancing the Marathon palladium-copper project in Ontario, Canada. What’s the latest there?

Nick Hodge: Generation has been on a tear, too, Mike. It’s developing the Marathon project in Ontario, which is the best undeveloped PGM deposit in North America.

Generation acquired a 51% interest in the project from NYSE-listed Sibanye Stillwater in 2019 and has since increased its ownership stake to 80%.

In March, a feasibility study showed the project had a net present value of C$1.07 billion and an internal rate of return of 29.7%. That’s after tax.

And that was done at lower metal prices. At current prices, the project has an NPV closer to C$2 billion.

For the past few months, it has been putting out some really impressive drill results. So we know the project is larger than that feasibility study shows, too. There are even two known deposits that weren’t included in the study.

A production decision is looming next month. And that’s also the date by which Sibanye can exercise its right to back into 51% of the project.

Whether it owns 80% or 49%, I think Generation is a good company to own if you want PGM and copper exposure because of the quality of the asset.

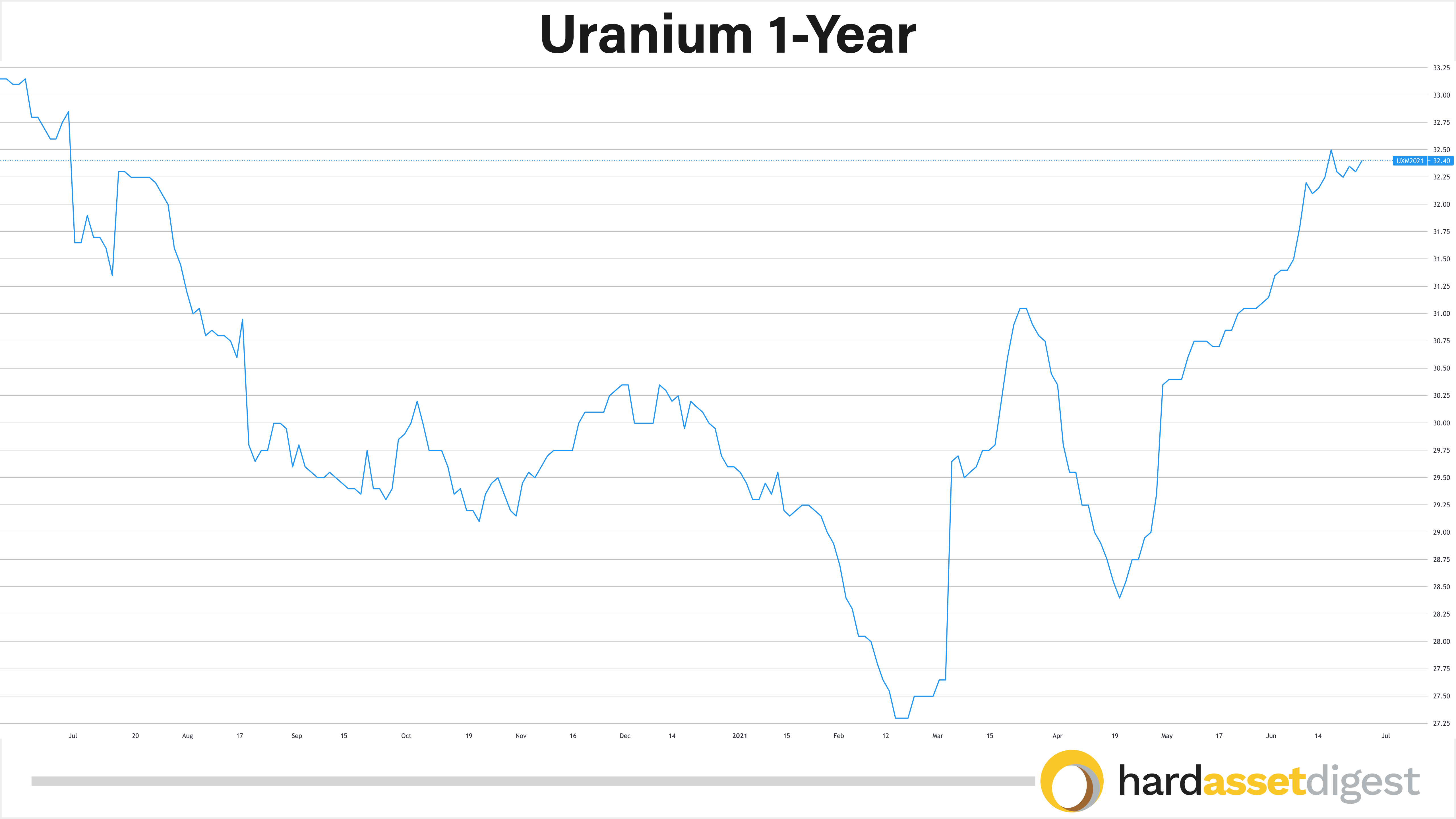

Mike Fagan: Turning to the uranium sector, last time, we discussed the fundamentals for higher uranium prices — and we’re starting to see some movement there with uranium rising from $28 per pound to currently above $32 per pound.

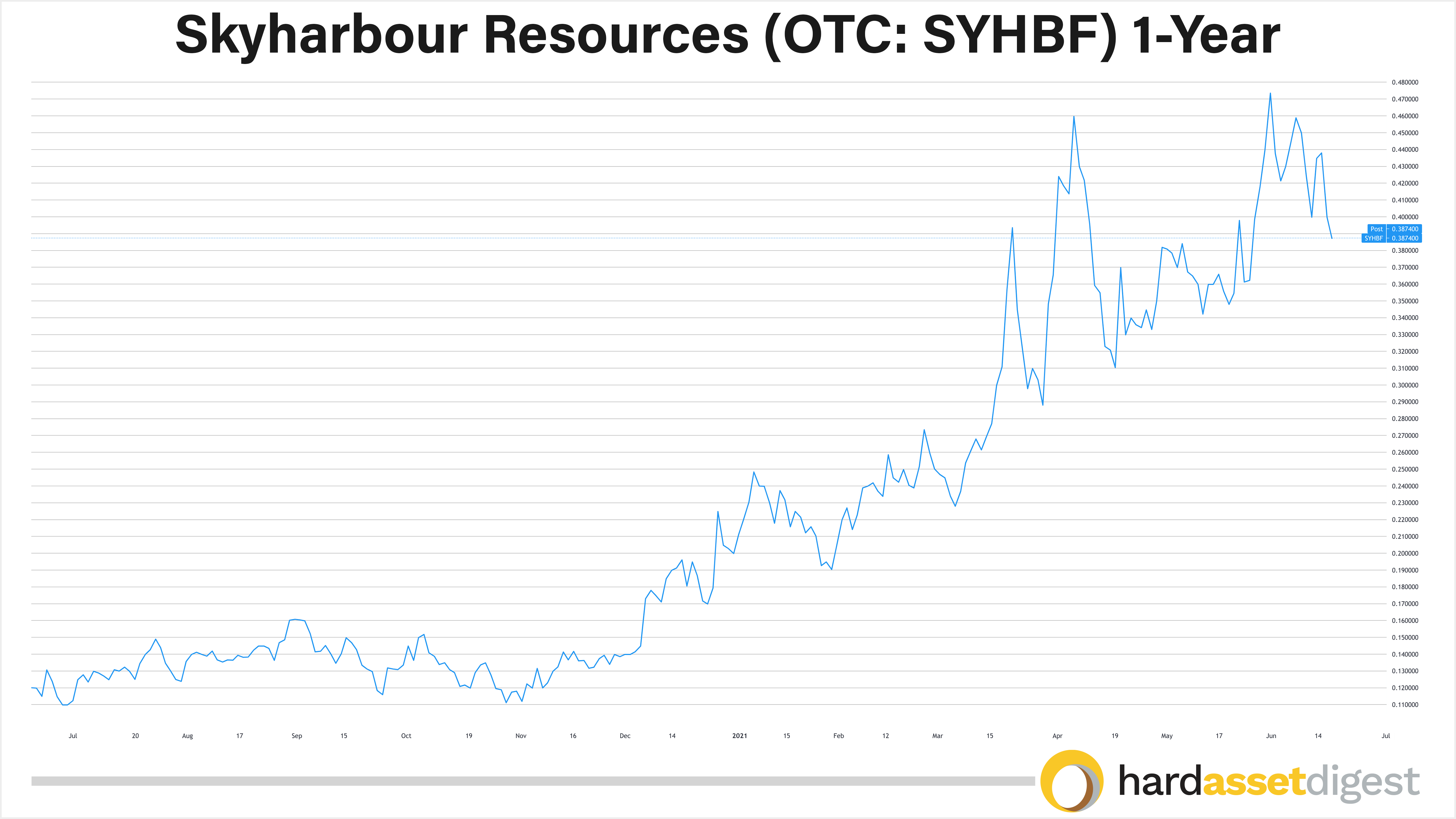

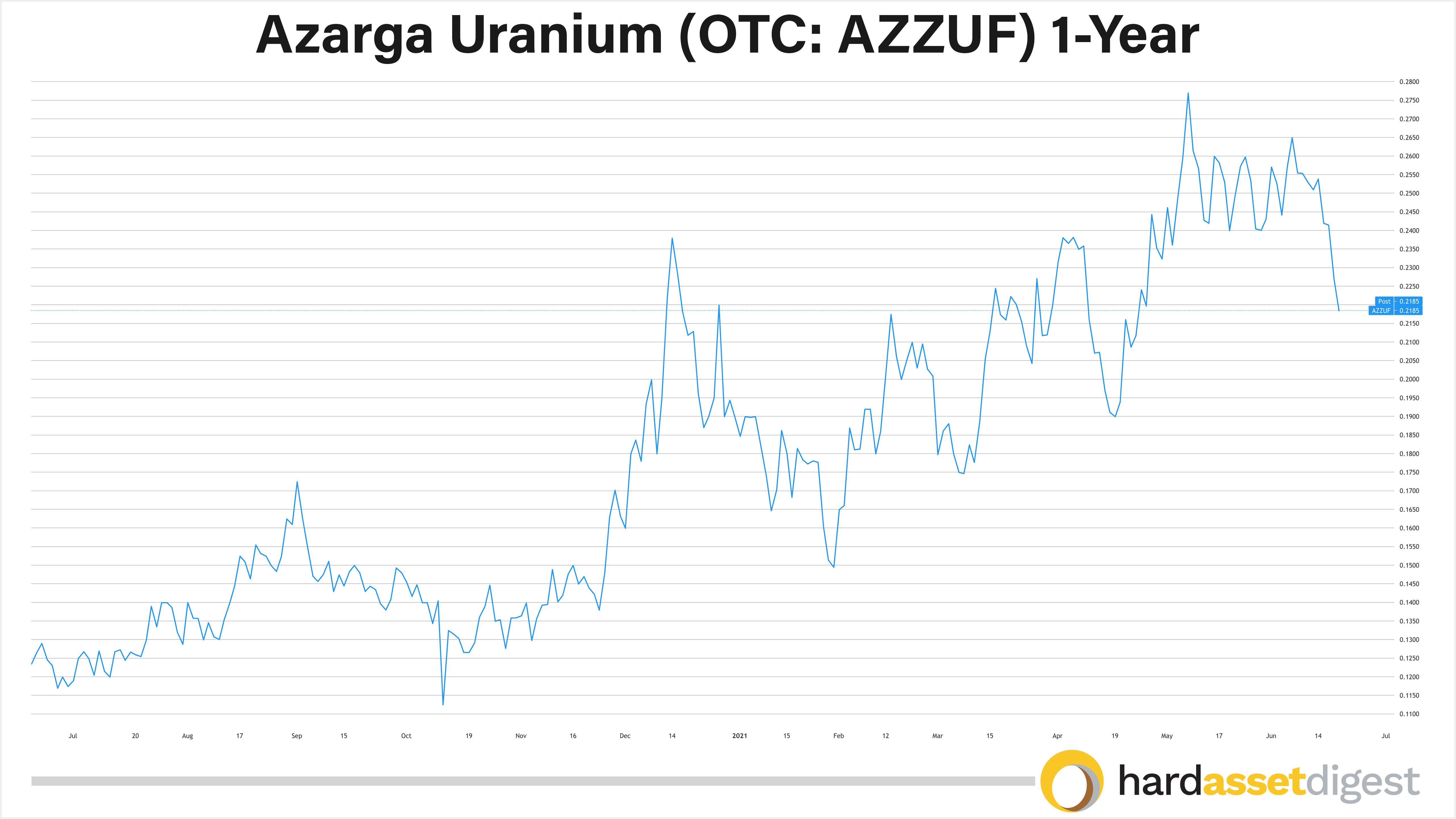

If all the same to you, Nick, let’s skip the fundamental talk this time around and go straight into a couple of key company updates. What’s the latest with Azarga Uranium (TSX: AZZ)(OTC: AZZUF) and Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF) — both of which are up significantly since our January interview?

Nick Hodge: The uranium school is a small one and tends to swim together.

Skyharbour has been off to the races with the rest of the pack — up more than 100% already this year. It has partners exploring several projects while it undergoes drilling at its flagship Moore project. So lots of newsflow, which is good when the sector is hot.

Azarga has a bit of catching up to do, as it’s “only” up 33% this year. Its Dewey Burdock project in South Dakota is now fully permitted. It’s one of the best undeveloped in-situ uranium assets in the US. And that’s going to be important given that Biden sees uranium through a green lens. It’s also expanding its resources across the state border at its nearby Gas Hills project.

A lot to like with both of those companies, especially if the fundamentals keep playing out and the utilities come back in to contract as expected.

Mike Fagan: Excellent! So switching gears… let’s discuss the metamorphosis of Hard Asset Digest from its current interview format to what it will soon become. And I know you have some additional exciting news to share.

Nick Hodge: Well, metamorphosis is the perfect word, I think, for both its relation to geology and the transformation and growth we’re about to go through.

This letter is published by Digest Publishing, which I head up along with Gerardo Del Real. We are in the process of improving our products, how they serve you, and how you interact with them.

We will soon be launching a premium members-only site that will allow you to log in and see your model portfolios. It will also house all your past issues and reports in one place.

In conjunction with this new site, we’re also streamlining our products and launching new ones to make sure we serve you our best possible research and give you access to more opportunities than ever.

As part of that, we will no longer be publishing Hard Asset Digest or Precious Portfolio in their current forms.

As a member, don’t worry. You don’t have to do a thing. And Mike isn’t going anywhere. I’ll formally announce all the details soon.

You’ll be getting Gerardo’s Junior Resource Monthly on the same terms as your current Hard Asset Digest membership.

And we’re going to give you a free year of my Foundational Profits, which covers the full breadth of the market.

In market speak, we effectively forward split your benefits and memberships and renamed the parent company.

Mike Fagan: I’m excited, too, Nick, because, while Hard Asset Digest has focused squarely on natural resources, you cover a variety of sectors in Foundational Profits including Clean Energy and Cannabis — both of which appear to be on the cusp of major breakouts.

Can you provide a quick overview of those two sectors and what readers can expect in the coming weeks and months as complimentary Foundational Profits subscribers?

Nick Hodge: Sure. It’s a monthly service that covers the entire market, including a model portfolio and buy and sell alerts.

I give monthly macro analysis encompassing fundamentals, technicals, timing, and market psychology. And then I distill that analysis into actionable recommendations using highly liquid companies and sector-themed funds listed on major exchanges.

We’re in oil funds. Tobacco stocks. Even semiconductors.

But I also identify and exploit trends that are going on in the market. You mentioned two.

Clean energy is all the rage right now. But like anything else, it’s cyclical. It was also all the rage back in 2008 when I wrote a book about it. Today, with Biden in office, there is a renewed focus on renewable energy, electric vehicles, and all-things clean. And I have recommendations for that as well.

Same with cannabis. My readers have been profiting from the new trend of smaller US operators being the leaders of growth and focus of acquisitions. Two recommendations await new members once the switch takes place.

Mike Fagan: I love it! I mean, I’ve always stressed the importance of proper portfolio diversification, and this broader focus lends itself well to that. Wrapping things up, Nick, what’s next on the near-term horizon?

Nick Hodge: Well, Digest Publishing is growing rapidly.

We just soft-launched a new service called Junior Resource Insider for high-net-worth and institutional clients. It’s where they’ll get access to Gerardo’s pipeline of private deals in the junior mining space. Readers can check that out here.

Keep an eye out for a letter from me next month about the launch of our premium members-only website and the new products you’ll be able to access as part of it.

Mike Fagan: Nick, as always, thank you so much for your unique insights and for your invaluable expertise. I’m excited for this transition and I trust current readers are as well!

Without a doubt, there’s lots of transitioning taking place in the market right now as we make our way out of the pandemic. And I’m ecstatic to be working alongside you and Gerado and the rest of the Digest Publishing team as we continue to forge a profitable path for ourselves and, most importantly, for our loyal audience members.

Nick Hodge: Well, I’m excited, too. And we didn’t even talk about what’s next for you. But like I said, you’re not going anywhere. We have yet another new product planned that everyone reading today will get access to for free once it’s ready to unveil.

It hasn’t even been a year since we formally launched Digest Publishing with me and Gerardo as front-facing figures. So I’m really excited about this next phase of growth for us and our members.

Mike Fagan: Very exciting indeed and happy to be a part of it. Thank you again, Nick.

And to my readers, thank you so much for being an important part of Hard Asset Digest. I know you’ll miss the monthly interviews, and I will as well. But we’ve got a lot of great stuff planned… so stay tuned!

In Closing,

I’d like to take a brief moment to thank everyone who has participated in Hard Asset Digest over the past two years, especially our most valued asset — our loyal subscribers.

It’s been a great thrill of mine bringing you exclusive monthly interviews with the top names in the resource space… and I’ve very much enjoyed your many comments and helpful suggestions along the way!

Special thanks goes out to all of our contributors starting with my close friend and colleague, Jeff Phillips, whom I’ve had the pleasure of knowing and working with since the mid-nineties.

Of course, none of this would have been possible without the incipient support and ongoing contributions of Rick Rule, who believed in me and who has believed in this enterprise since day one.

Van Simmons, thank you for introducing me — along with many of my fellow readers — to the wonderful world of numismatics for which I am truly grateful. Mickey Fulp, thanks for your incomparable geologic expertise and for taking the time to sit down with me to explain the finer points of what makes for an economic mineral deposit.

To Mr. James Dines, who has cemented his legacy as the Father of Investor Psychology — thank you for the life lessons you continue to bring. Dr. Mark Skousen, thank you for delivering the straight talk on economic theory as no one else can.

Brien Lundin, Adrian Day, Brent Cook, Joe Mazumdar, and John Kaiser — each a renowned resource editor and longtime family friend and colleague — thank you kindly for your fine contributions and for your continued support.

And finally, to Nick Hodge and Gerardo Del Real — thanks for your continued belief in me and for bringing me into your Digest Publishing family. I’m truly excited for this next chapter in our evolution.

As Gerardo would say… Let’s Get It!

Sincerely,

Mike Fagan, editor

Hard Asset Digest

We have four reports now available highlighting several opportunities for investment in the resource space.

Opportunities discussed in those reports and past issues include:

May 2021 Issue: Opportunities Mentioned by Jeff Phillips

- Perpetua Resources (NASDAQ: PPTA)(TSX: PPTA)

- Revival Gold (TSX-V: RVG)(OTC: RVLGF)

- Almaden Minerals (NYSE-Amer: AAU)(TSX: AMM)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Lynas Rare Earths (OTC: LYSCF)

- MP Materials (NASDAQ: MP)

- Leading Edge Materials (TSX-V: LEM)(OTC: LEMIF)

- Regulus Resources (TSX-V: REG)(OTC: RGLSF)

- Chakana Copper (TSX-V: PERU)(OTC: CHKKF)

April 2021 Issue: Opportunities Mentioned by Dr. Mark Skousen

- Franco-Nevada Corp. (NYSE: FNV)(TSX: FNV)

- B2Gold Corp. (NYSE: BTG)(TSX: BTO)

- Barrick Gold Corp. (NYSE: GOLD)(TSX: ABX)

- Pan American Silver (NASDAQ: PAAS)(TSX: PAAS)

- Grayscale Bitcoin Trust (OTC: GBTC)

- Amplify Transformation Data Sharing (NASDAQ: BLOK)

March 2021 Issue: Opportunities Mentioned by Adrian Day

- Barrick Gold (NYSE: GOLD)(TSX: ABX)

- Franco-Nevada (NYSE: FNV)(TSX: FNV)

- Royal Gold (NASDAQ: RGLD)

- Osisko Gold Royalties (NYSE: OR)(TSX: OR)

- B2Gold (NYSE-Amer: BTG)(TSX: BTO)

- Premier Gold Mines (OTC: PIRGF)(TSX: PG)

- Nomad Royalty (OTC: NSRXF)(TSX: NSR)

- Metalla Royalty (NYSE-Amer: MTA)(TSX-V: MTA)

- Elemental Royalties (OTC: ELEMF)(TSX-V: ELE)

- Star Royalties (TSX-V: STRR)

- Altius Minerals (OTC: ATUSF)(TSX: ALS)

- Pan American Silver (NASDAQ: PAAS)(TSX: PAAS)

- Fortuna Silver Mines (NYSE: FSM)(TSX: FVI)

- Magna Gold (OTC: MGLQF)(TSX-V: MGR)

January 2021 Issue: Opportunities Mentioned by Nick Hodge

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Roxgold (TSX: ROXG)(OTC: ROGFF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Generation Mining (TSX: GENM)(OTC: GENMF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

December 2020 Issue: Opportunities Mentioned by Van Simmons

- 19th century: Liberty Seated half dimes, dimes, quarters, half dollars, silver dollars

- 20th century: Buffalo Nickels, Mercury Dimes, Walking Liberty Halves, Standing Liberty Quarters

- Barber dimes, quarters, and halves

- Common date: $10 Liberties, $5 Liberties

- 19th century quarter sets: Draped Bust Quarter, Capped Bust Quarter, Liberty Seated Quarter, Barber Quarter

- 20th century coin sets: Mercury Dimes, Walking Liberty Halves, Buffalo Nickels, Standing Liberty Quarters; other various: 8-piece sets, 10-piece sets, 12-piece sets

November 2020 Issue: Opportunities Mentioned by Gerardo Del Real

- Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF)

- Chakana Copper (TSX-V: PERU)(OTC: CHKKF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX-V:RVG)(OTC: RVLGF)

- Integra Resources (TSX-V: ITR)(NYSE-American: ITRG)

- Liberty Gold (TSX: LGD)(OTC: LGDTF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Energy Fuels (TSX: EFR)(NYSE-American: UUUU)

October 2020 Issue: Opportunities Mentioned by Joe Mazumdar

- Pan American Silver (TSX: PAAS)(Nasdaq: PAAS)

- Liberty Gold Corp. (TSX: LGD)(OTC: LGDTF)

- HighGold Mining (TSX.V: HIGH)(OTC: HGGOF)

- Bluestone Resources (TSV.V: BSR)(OTC: BBSRF)

- Trilogy Metals (TSX: TMQ)(NYSE-Amex: TMQ)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Blackstone Minerals (ASX: BSX)

- Clean Air Metals (TSX.V: AIR)

August 2020 Issue: Opportunities Mentioned by Jeff Phillips

- Lynas Corp. (OTC: LYSCF)

- MP Materials: Private Company

- Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX.V: RVG)(OTC: RVLGF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Chakana Copper (TSX.V: PERU)(OTC: CHKKF)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

May 2020 Issue: Opportunities Mentioned by Brien Lundin

- Great Bear Resources (TSX.V: GBR)(OTC: GTBDF)

- Energy Fuels Inc.(NYSE American: UUUU)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- First Mining Gold (TSX: FF)(OTC: FFMGF)

- Libero Copper & Gold (TSX.V: LBC)(OTC: LBCMF)

- GR Silver Mining (TSX.V: GRSL)(OTC: GRSLF)

April 2020 Issue: Opportunities Mentioned by Nick Hodge

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

February 2020 Issue: Opportunities Mentioned by James Dines

- Agnico Eagle Mines (TSX: AEM)(NYSE: AEM)

- Kirkland Lake Gold (TSX: KL) (NYSE: KL)

- Pan American Silver (TSX: PAAS) (NASDAQ: PAAS)

- Lynas Corp. (OTC: LYSCF)

- Canopy Growth (TSX: WEED) (NYSE: CGC)

- OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI)