Hard Asset Digest January 2021

January 2021

Starting the new year off with a bang, I’m sitting down with Mr. Nick Hodge — cofounder of Digest Publishing and publisher of Daily Profit Cycle.

Click here to jump straight to the interview.

Currently residing in Spokane, Washington, after more than 30 years in northeastern Maryland, Nick is also the founder of the Hodge Family Office where he offers a series of products geared toward helping high net worth and retail investors manage their own money and financial destiny.

Previously, Nick founded the Outsider Club and built it into a financial publishing behemoth serving hundreds of thousands of investors and generating tens of millions of dollars in revenue.

By 24, he had co-authored his first book on investing, Investing in Renewable Energy: Making Money on Green Chip Stocks. By 30, he’d published his second: Energy Investing For Dummies.

Nick, whom I’ve had the pleasure of working with the last couple of years, spent his early thirties focusing on the world of private placements and has made millions for himself and his clients while helping to finance some of the most exciting early-stage companies in the resource, energy, cannabis, and biotech sectors.

Known for his “call it like you see it” approach to money and policy, Nick’s intuitive approach to using global change for financial gain has earned him followers across the globe and has led to countless media appearances.

When he’s not writing, investing, or flying around the world to meet with company executives, Nick can usually be found somewhere on his small ranch in the Inland Northwest with his beautiful wife and three children pursuing the outdoor activities he grew up with and continues to love.

In this issue, Nick and I discuss the current environment of unlimited money printing and dollar debasement and what that means for gold and related securities. Plus, Nick gives us his recommendations from a number of sectors including gold and gold royalties, platinum group metals, and uranium.

Before we get to that, I’d like to share with you our Special Report on two potential takeover candidates from the precious metals sector: Mid-tier silver producer Hecla Mining; and mid-tier gold producer Alamos Gold.

Hecla and Alamos offer speculators exposure to gold/silver with current production plus exploration upside. Both pay a quarterly dividend, and both have the potential to be bought out by a larger producer at a substantial share price premium in the current metals cycle.

Mid-Tier Takeovers for 2021

Two Top Candidates for Premium Takeovers

Rick Rule of Sprott Inc. (NYSE: SII) – one of our esteemed contributing experts at Hard Asset Digest – says the climate is ripe for a steady stream of mergers and acquisitions, not merely in precious metals, but throughout natural resources.

Bigger companies are more liquid, so they have a lower cost of capital. They spread opportunity sets over a bigger asset base, and they have less general and administrative expenses relative to their operating expense. So there’s huge drivers to M&A.

There are two ways to play it. One, find the companies that are vulnerable to takeover. Not just companies that appear cheap, but companies where there’s a logical strategic buyer for the asset.

You have to dig deep to play this game and that is precisely what we’ve done with the two takeover candidates featured below.

The other is to find the teams that have a history of being able to buy assets that are cast off by others in amalgamation.

Rick often talks about the historic examples of Silver Standard, Pan American, and Lumina Copper. Those were teams that were able to buy assets that had languished in other corporate vehicles and then build enormous companies out of them.

So, again, there’s two ways to play M&A. One, buy the targets. And two, back the teams that use the M&A market to grow more rapidly than they otherwise could. Both of those approaches should do very well in the current metals cycle.

In general, buying the targets can result in a more immediate win as target companies are typically bought out at a substantial premium to the current share price.

They also offer the added benefit of having the potential to appreciate on their own through the advancement of projects within their own portfolio — especially in a rising commodities market; in this case, gold/silver. And on top of that, many mid-tier producers, including the two featured below, pay a quarterly dividend.

Following are two exemplary precious metals miners that we believe are well-positioned as key potential takeover targets in the current metals cycle.

Hecla Mining Co. (NYSE: HL)

Established in 1891, Hecla Mining Company is the largest and lowest cash cost silver producer in the United States and is responsible for about one-third of all silver produced in the USA.

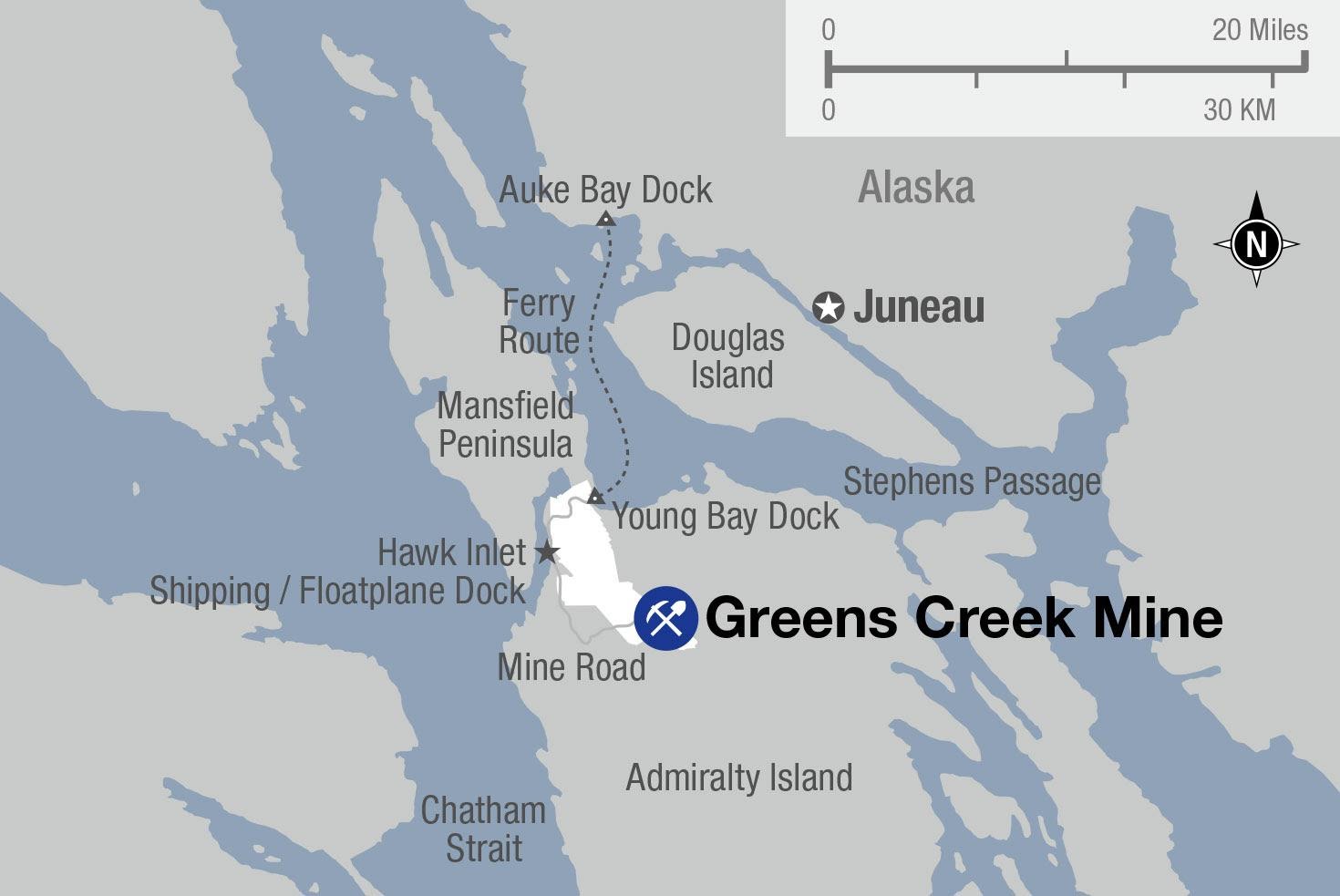

The company has operating silver mines in Alaska (Greens Creek), Idaho (Lucky Friday), and Mexico (San Sebastian) and is a growing gold producer with operating mines in Quebec, Canada (Casa Berardi) and Nevada (Fire Creek).

In addition to its diversified silver and gold operating and cash-flow generating base, Hecla has a number of exploration properties and pre-development projects in 8 world-class silver and gold mining districts in North America.

With an active exploration and development program, the company has consistently grown its reserve base for future production with reserves totaling 212 million ounces of silver and 2.7 million ounces of gold reserves — all calculated using some of the lowest price assumptions in the industry.

Hecla Mining has done an outstanding job managing the COVID-19 crisis including bringing in a lab to Juneau, Alaska, to provide real-time testing at the Greens Creek mining operation.

In Q3 2020, the company produced 3.5 million ounces of silver and 41,000 ounces of gold, and, aided by strong silver margins, recorded its highest level of free cash flow in a decade.

Hecla’s 100%-owned and operated Greens Creek mine in southeast Alaska is one of the largest and lowest-cost primary silver mines in the world. Last year, the mine produced 9.9 million ounces of silver at an average cash cost of $1.97 per ounce (Note: silver currently trades north of $25 per ounce).

Hecla’s 100%-owned and operated Greens Creek mine in southeast Alaska is one of the largest and lowest-cost primary silver mines in the world — representing the cash generating engine of the company: 22% increase in silver reserves in 2019; 10 million oz silver production, $101 million in cash flow.

Hecla recently announced the following mining updates:

Greens Creek Mine, Alaska: At the Greens Creek mine, 2.6 million ounces of silver and 12,838 ounces of gold were produced in the quarter. Higher silver production compared to the third quarter of 2019 was due to slightly higher ore production and grades. The mill operated at an average of 2,340 tons per day (tpd). Greens Creek’s nine months production was higher than anticipated due to higher silver grades. The fourth quarter assumes planned grades.

Lucky Friday Mine, Idaho: At the Lucky Friday mine, 636,389 ounces of silver were produced in the quarter. The mine has continued normal operations during the pandemic with the ramp-up proceeding as planned. Lucky Friday is expected to increase production in the fourth quarter to full throughput before the end of the year resulting in an estimated annual production of approximately 3 million ounces in 2021.

Casa Berardi Mine, Quebec, Canada: At the Casa Berardi mine, 26,405 ounces of gold were produced in the quarter, including 6,800 ounces from the East Mine Crown Pillar pit, with the decrease primarily due to lower mill throughput resulting from major planned mill maintenance activities. The mill operated at an average of 3,138 tpd. Casa Berardi’s nine-month production was lower than anticipated because of the government-mandated shutdown and planned mill maintenance activities, but production in the fourth quarter should increase due to expected high-grade underground production from the East Mine.

San Sebastian Mine, Durango, Mexico: At the San Sebastian mine, 0.3 million ounces of silver and 1,931 ounces of gold were produced in the quarter. Mining was completed in the third quarter and milling is expected to be completed in the fourth quarter of 2020. The mill operated at an average of 512 tpd. The Company continues to explore this highly prospective land package and will evaluate further mining based on exploration success.

Nevada Operations (Elko County, NV): At the Nevada operations, ore mined during the quarter has been stockpiled for the third-party processing expected in the fourth quarter. Gold production may not be realized until the first quarter of 2021. Mining of non-refractory ore is substantially complete. Mining of refractory ore for the bulk sample test is expected to continue through the remainder of 2020. Production from this test is expected to be between 5 and 10 thousand ounces of gold.

Additionally, Hecla has acquired a ~10% interest in junior silver company, Dolly Varden (TSX-V: DV)(OTC: DOLLF), which is advancing a 40 million-plus ounce silver project in British Columbia, Canada.

Hecla also recently announced a 50% increase in its quarterly dividend plus a lower realized price threshold for its silver-linked dividend. On a per ounce produced basis at $25, the aggregate dividend returns more than 5% of the silver price.

Alamos Gold Inc. (NYSE: AGI)(TSX: AGI)

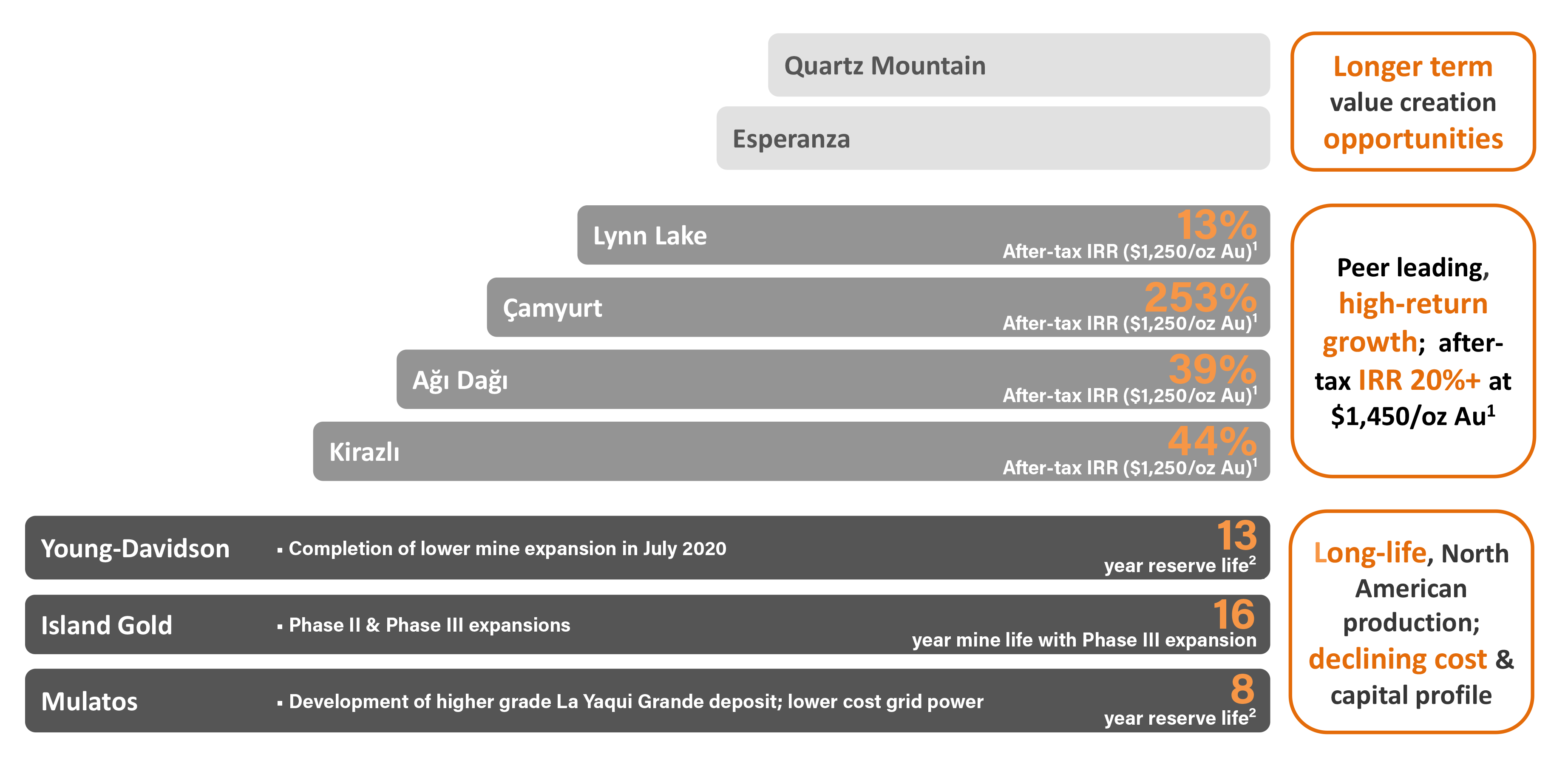

Alamos Gold – which was formed in 2003 via the merger of Alamos Minerals and National Gold – is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America.

That includes the Young-Davidson and Island Gold mines in northern Ontario, Canada, and the Mulatos mine in Sonora State, Mexico.

Additionally, the company has a leading growth profile via a significant portfolio of development stage projects in Canada, Mexico, Turkey, and the United States.

Alamos boasts a long-life reserve base with 9.7 million ounces in Proven and Probable Mineral Reserves plus 7 million ounces in the M&I (Measured & Indicated) category and another 5.9 million ounces in the Inferred category.

The company produces well over 400,000 ounces of gold per year on average from its combined operations at AISC (All-In Sustaining Cost) of $1,030-$1,070 per ounce.

The Young-Davidson Mine near Kirkland Lake, Ontario, is the company’s flagship operation and is considered one of Canada’s largest underground gold mines. At ~140,000 gold ounces per year at AISC (All-In Sustaining Cost) of $1,180-$1,220 per ounce, the project should continue to serve as a foundation for growth for Alamos for many years to come.

The company’s Island Gold Mine, also located in Ontario, is regarded as one of Canada’s highest grade and lowest cost gold mines. Through ongoing exploration success, its Mineral Reserves and Resources have continued to grow in size and quality.

The mine produces ~135,000 gold ounces per year at AISC of $740-$780 per ounce. The mine is expected to produce over 240,000 ounces annually once the Phase III expansion is completed in 2025.

The Mulatos Mine is Alamos Gold’s founding operation. It was acquired for $10 million and has produced over two million ounces of gold and has generated more than $400 million in free cash flow since 2005. At ~145,000 gold ounces per year at AISC of $940-$980 per ounce, Mulatos remains a consistent gold producer and significant cash flow generator for Alamos with strong exploration potential.

Alamos has paid a dividend every year for more than a decade and has returned over US$179 million to shareholders to date. Most recently, the company declared a quarterly dividend of US$0.015 per common share.

So there you have… two very well-run precious metals producers with low-cost production profiles in Tier-1 jurisdictions that are well worth a detailed look.

Next month, I’ll be profiling a silver exploration and development company that’s advancing a large, high-grade silver-gold project in one of Mexico’s richest mineral districts.

Now — please enjoy my exclusive interview with Mr. Nick Hodge.

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

Exclusive Interview with Nick Hodge

Cofounder, Digest Publishing

Mike Fagan: Nick, it’s great to catch up with you! I’m really excited to get your thoughts on the markets and metals as we enter what will hopefully be a fruitful year that brings some semblance of normalcy back to our daily lives.

I know I miss being able to travel and attend all sorts of different events… and I imagine you feel the same way as well. Yet, at the same time, it also feels like it’s been a really important time for family and reflection in the face of this terrible pandemic.

Nick Hodge: It’s been absolutely weird, Mike! My oldest daughter is in preschool and next week we'll have our first parent-teacher conference and we’ll be doing that over Zoom… so no going into the classroom to meet the teacher is just one example. And so I think everyone has had to sort of adapt and make changes in their own life.

And thank goodness we’ve been able to accommodate and make a living out of our homes while also doing quite well in the market… all as a result of things I’m sure we'll be talking about in the coming minutes.

It seems like – albeit with a couple of new coronavirus variants we’ll have to keep an eye on – with vaccines starting to be disseminated and people starting to commit to wearing masks and with another round of stimulus on the way that we should be looking to get to the other side of this thing pretty soon.

And I’m certainly looking to get there for the reasons you mentioned… getting back to travel both for business and for leisure as well as attending other events. I think you're right that it has allowed us to spend a bit more time with family and with those closest to us and to really appreciate that time.

To a certain extent, with three very young ones at home, it’s time to get back to a schedule — as my wife would say!

MF: Yeah, exactly! My son is going through the same sort of thing with missing out on most of his sophomore year of high school last year… and then likely all of his junior year this year… and so hoping he’ll be able to have somewhat of a normal in-person senior year starting this coming fall culminating in an actual graduation ceremony.

NH: Yeah… it seems like so many of those major life milestones that we’ve always taken for granted are now happening in such different ways.

MF: Very true… and a lot has also happened for you, Nick, on the publishing side of things since our last interview… so I’ll let you get right into the news of the day, which is the launch of Digest Publishing – which I’m thrilled to say I’m a part of – along with the main content hub that’s also coming together rather nicely at the Daily Profit Cycle website.

NH: Yes and we're thrilled to have you be a part of it, Mike! Since we last spoke, I left Outsider Club and Angel Publishing to form Digest Publishing. And I’m proud and excited to announce the launch of Daily Profit Cycle, which is our free website with daily market commentary.

Of course, we have your publication, Hard Asset Digest, as well as your Precious Portfolio.

And we have Gerardo Del Real who has launched his two publications — Junior Resource Monthly and Junior Resource Trader.

Gerardo Del Real, editor

Junior Resource Monthly

Junior Resource Trader

And then I have my three publications under the Hodge Family Office banner — Hodge Family Office, Hodge Family Office Advantage, and Foundational Profits.

So yeah… lots and lots of changes but it’s exciting to have all of the letters up and running under a new brand and to have some of our former subscribers follow us over.

We certainly appreciate that loyalty and have enjoyed reconnecting with them, and we look forward to this new endeavor and the new year. And again, excited to have you a part of it!

MF: Very much appreciated, Nick. And I'll be sure to add those links so readers can check out the various publications to see what’s on offer.

Nick, you have a proven knack for being way ahead of the herd on all sorts of market trends whether that’s precious and base metals, renewable energy sources, cannabis, or what have you.

Yet on sort of a personal note… when our paths first crossed a few years ago, you were telling me about your exodus from city life on the eastern seaboard to the relative tranquility and sustainability of life in rural Washington State.

You were clearly ahead of the herd on that trend as well! And not to suggest you saw the pandemic coming… but I think it’s safe to say your reasoning for the move has proven both wise and timely for you and your family. Can you talk to that a bit?

NH: Honestly, Mike, I appreciate the move we’ve made to Spokane every single day. Being able to be in a rural place and have that space and also have what I would view as the better connections that come with the rural community and rural neighbors.

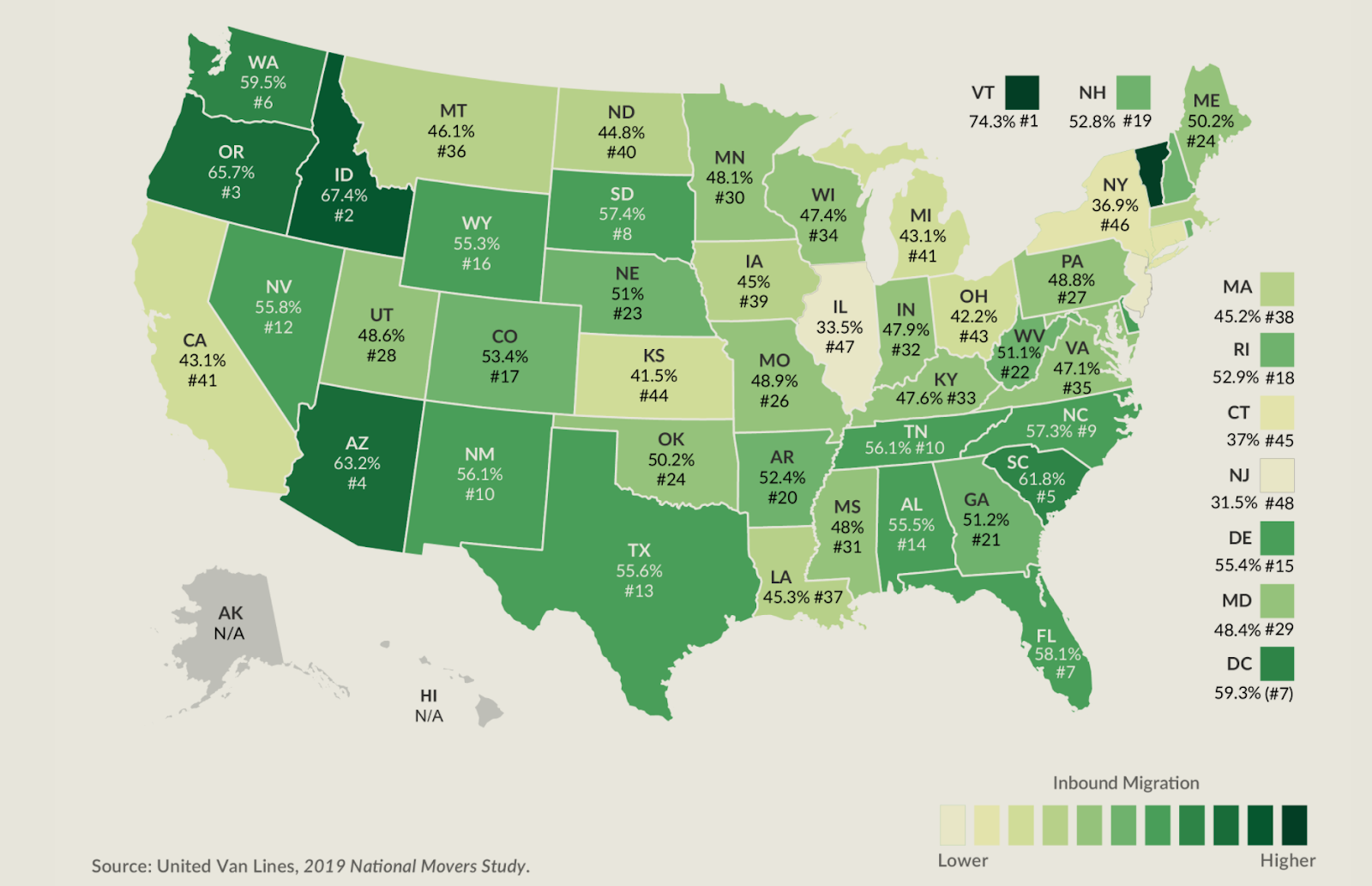

And it’s not just me… you know, the trend continues. There are maps you can look up showing the states that people are leaving most and the ones they're flocking to.

Where Americans Are Moving

Like you said… it’s a lot of states with those bluer skies and greener pastures so to speak. And a lot of states with more favorable tax jurisdictions, which I think is a large part of the trend, right? People wanting their dollar to go farther by not having to give so much of it to the government.

And I guess to get a little bit esoteric, or a little bit out there, as part of The Fourth Turning, Neil Howe would say that, “Like-minded cohorts and like-minded age bracket people end up migrating to similar locations.”

I just find that part of The Fourth Turning absolutely fascinating. Because if I look at the rural road I live on, which is gravel by the way, the couple of neighbors that I've come to know and hunt with and that our families hang out with are all in the same age bracket… within 10 years of each other.

And we all have kids about the same age. So I just think it’s funny how that ends up working out… and I think it’s a trend that’s going to continue.

MF: Yeah, I can absolutely see that. Oh and The Fourth Turning is definitely on my near-term reading list! I’ve perused it just a tiny bit and was immediately taken by how it seems to have accurately predicted the arrival of the pandemic… and to think it was written back in 1997!

NH: Yeah, it’s crazy! And what’s going to be interesting in terms of the migration of people is how much land or real estate people are ultimately going to be able to afford as real estate and other asset classes continue to inflate.

A lot of people I’ve talked to recently who are in the house buying process have been outbid or have seen houses sold off-market above asking price. I’m sure you've heard similar stories.

And so that’s par for the course when you have a dollar that’s eroding in value and where you have people trying to take advantage of historically low rates to become real estate owners — but maybe not so much so in cities these days.

MF: Right. Yeah. And speaking of the pandemic and the devaluation of the US dollar, we’ve already seen multiple trillions in stimulus spending, and we’ll likely see that expanded by yet another, let’s call it an even $2 trillion, very soon in the name of covid relief.

So Nick, as a student of monetary theory, if you will, what do you see as being the endgame for this truly unprecedented and uncapped level of money printing? And secondly, where do you see the price of gold going as a result?

NH: Endgame is really tough, Mike. I mean, I've written a couple of times that I think you’ll see some sort of Bretton Woods-type agreement over the next couple of years that may or may not involve precious metals and may or may not involve some form of digital currency. There’s been digital dollar bills floating around Congress and congressional banking acts for the past two or three years now… and so that’s not a new or crazy idea.

And while I don’t know what the endgame is… I can tell you where I see the game heading. I can tell you what I see in front of me and you can go back and check the last time we spoke, which I believe was last April, and we were already talking about trillions of dollars at that point, right?

Now you've got a new administration with Biden talking about the first round of stimulus that he’s going to pass being multiple trillions of dollars. And I doubt that'll be the last round. There'll be some sort of a recovery package after that.

And we haven’t even gotten to an infrastructure bill, which is sorely needed, and so I think there’s a lot more spending yet to come.

The other thing that’s happened since you and I last spoke is the dollar has deteriorated by more than 10%. I was writing recently that since March or April of last year, the dollar, as indicated by the DXY, has deteriorated by a staggering 12%.

That’s more than a dime out of every dollar in your pocket!

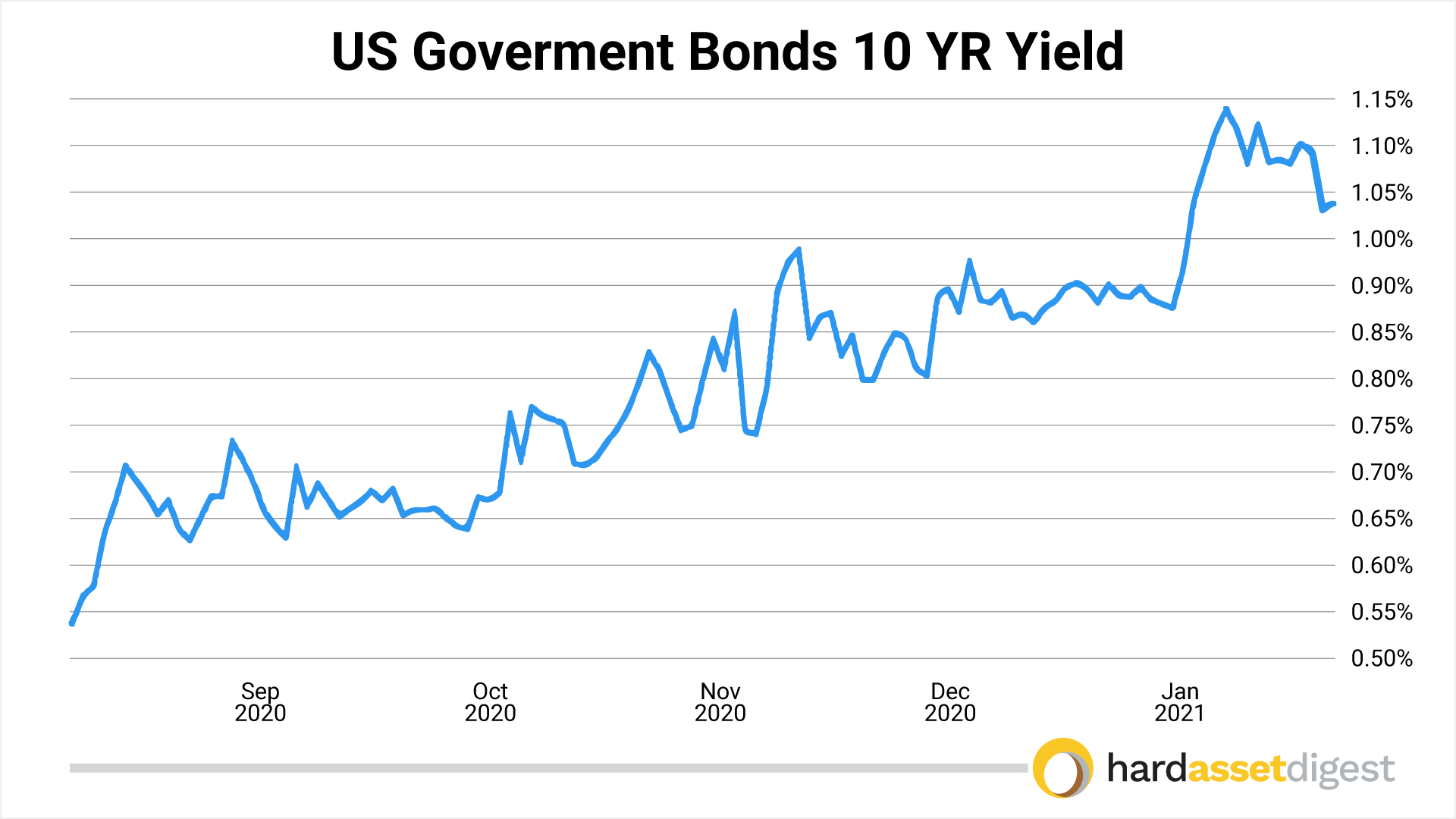

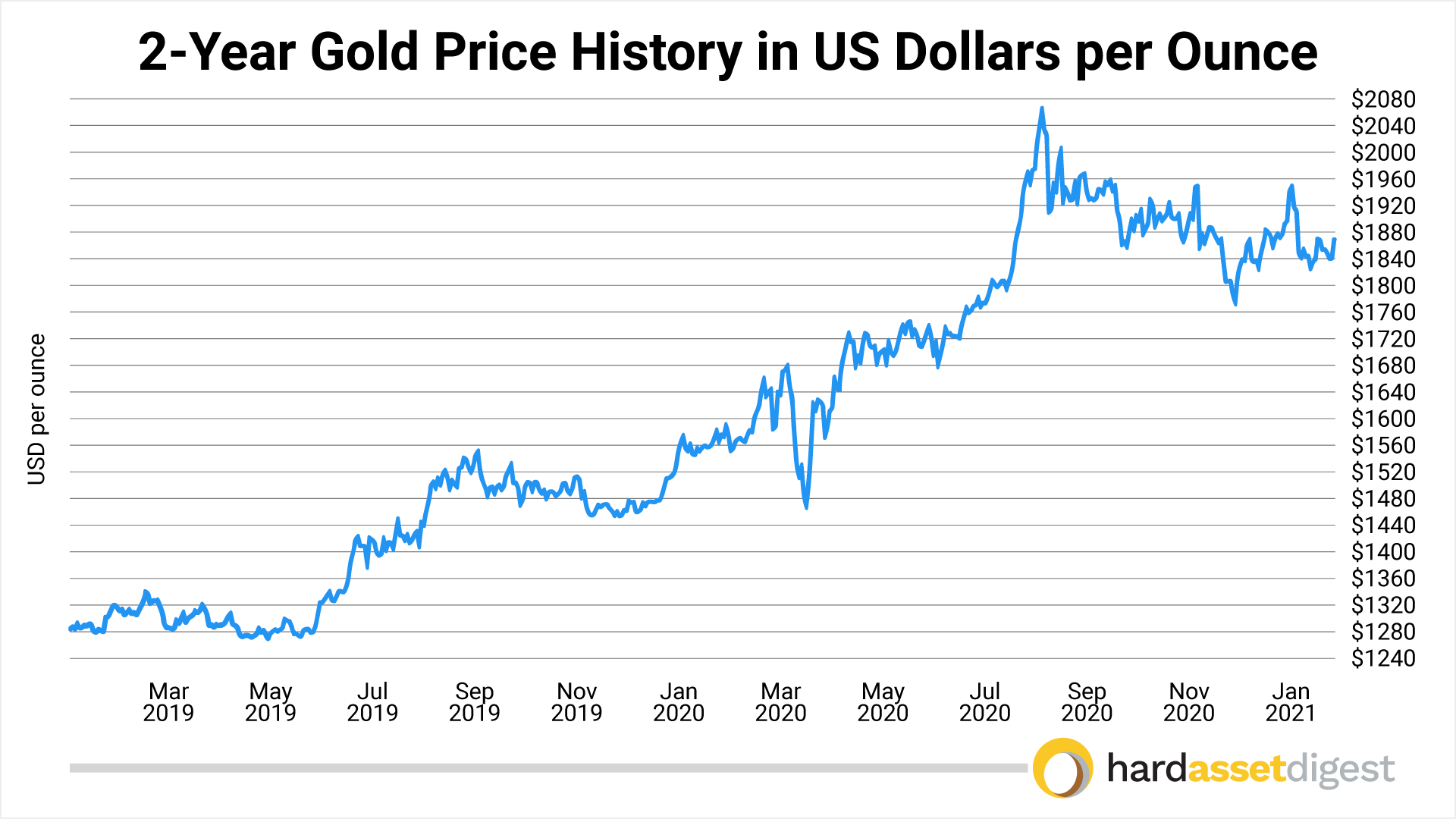

At the same time, the Fed continues to do what the Fed continues to do… and now you've got Yellen in the new administration as well. And so it’s all very interesting because you also asked about gold, which recently rose to record prices but has since pulled back and has consolidated a bit because rates have started to go up.

If you look at a chart of US 10-year rates, for example, they’ve more than doubled since August.

That’s really what’s been keeping a thumb on gold… and that’s what people have failed to understand and what gold bugs have failed to comprehend. It’s a bit counterintuitive because you always hear that when there’s inflation or when there’s money printing and when the dollar is going down — gold should be going up, right?

And we have all of those things. We have rampant inflation as evidenced by record stock prices and 8-year high copper prices and Bitcoin at $41,000. And you have a deteriorating dollar, as I just said, and you have more of that to come. And yet, here is gold not responding, right?

That’s because rates have started to go up. And so with gold yielding nothing, and with other assets inflating so fast, including stocks, I mean, you have to put stocks in an asset class, right… there’s just been other places that are going up faster than gold.

So while it’s boring for now… I think that once we get through this – let’s call it a mini-cycle of inflation manifesting elsewhere – we can get gold back to new highs, which, it’s had a couple of good days recently and has been back up above $1,850 an ounce. I think once we get gold back to the $1,950-level and have that hold… then it can once again start testing new highs above $2,000.

And once that happens… it’s Game-On from there!

I guess what I would add to that is a lot of other asset classes are inflating. A lot of small cap stocks have gone up very quickly. Cannabis stocks and energy stocks are now starting to reinflate. And so it’s a bit of a boring time in the precious metals.

Hence, you should be using that, and your readers should be using that, to take advantage of the quality precious metals equities that you and the other experts have been covering here in Hard Asset Digest over the last several months.

MF: Right, exactly! And sticking with the yellow metal, Nick, you cover the full gamut of the gold stock sector for your subscribers from the high-risk junior explorers to the mid-tier producers and royalty companies. So let’s go over a few of your recommendations.

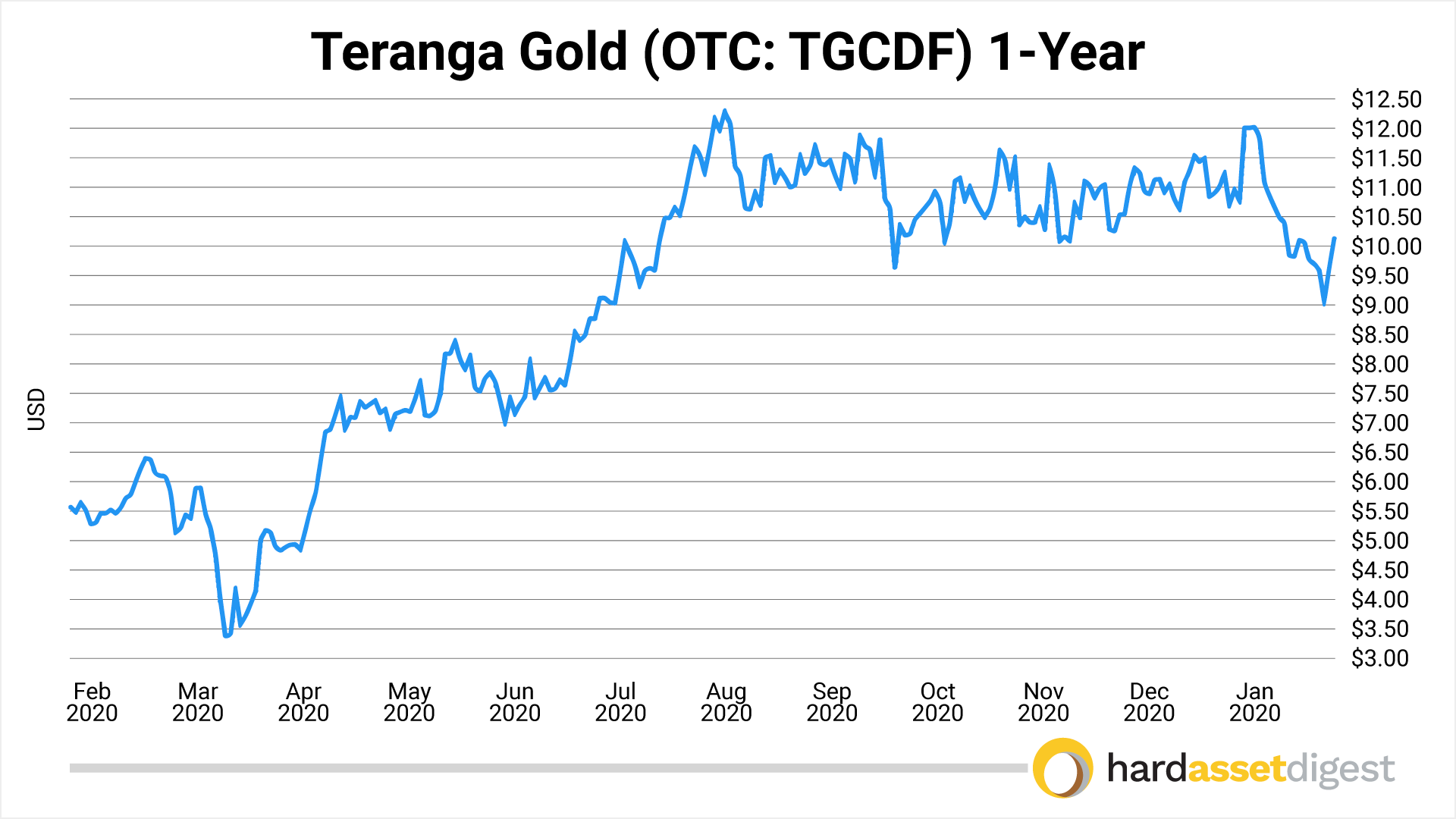

Mid-tier producer Teranga Gold (TSX: TGZ)(OTC: TGCDF) – which you and I discussed in our last interview at around US$6 per share – has been a big winner for you and your subscribers. Teranga is now joining forces with Endeavor Mining to form a brand new senior gold producer.

How were you able to foresee that amalgamation… and is there perhaps another mid-tier you have your eye on as a potential near-term takeover target?

NH: Oh man… I’m not necessarily sure I foresaw the amalgamation. I think what I saw in Teranga was a quality, relatively low-cost gold producer in Africa with a high growth profile.

The company has had the Sabodala Project and was building another asset called Wahgnion and then had other exploration assets on top of that as well. And this was long before they struck their deal with Barrick to get to Massawa as Barrick started shedding non-Tier-1 assets.

And then, you've got another much larger company active in the continent in Endeavor who came in and made an offer. It looks like that deal is going to go through.

Since you and I spoke, the stock has doubled. It’s pulled back a bit along with most of the sector. But, nonetheless, a 100% gain in less than a year is pretty good! And I just look for assets that are able to grow and that are not being recognized by the market.

A couple of years ago when I was talking about Teranga, not too many people had heard of it. And it’s sometimes those overlooked gems that can give you a good win. And Teranga Gold ended up being one of those.

MF: Absolutely! So any other hidden gold gems on your radar right now that you can share with my audience?

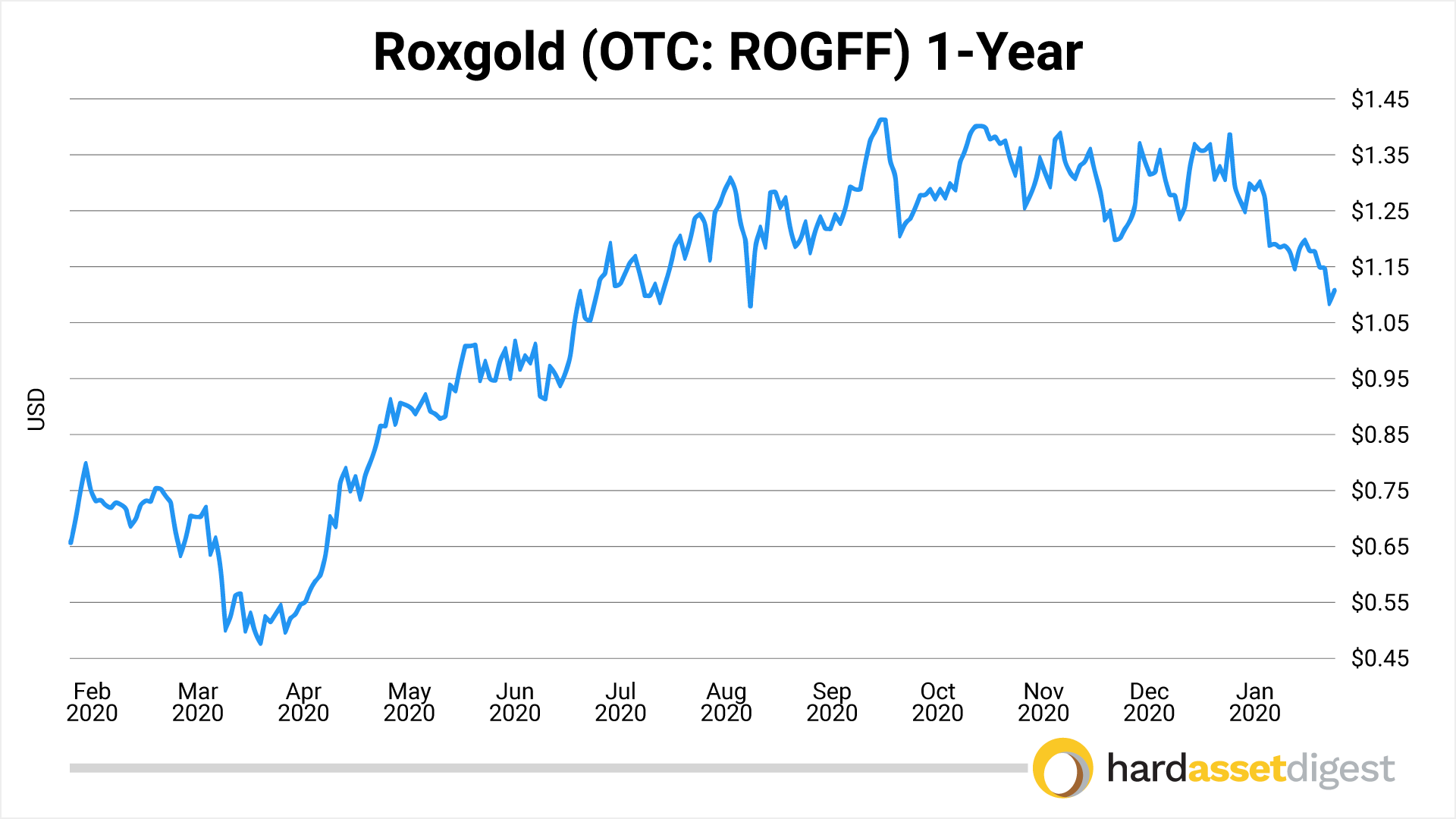

NH: Well, I do have one that I’ve yet to recommend in any letter… but as they say, variety is the spice of life! It’s one I've long thought was going to get bought out, also in Africa — Roxgold (TSX: ROXG)(OTC: ROGFF).

And they’ve been putting out some pretty high-grade drill results and have been operating themselves. And it makes logical sense for them to be a takeout candidate. So Roxgold is certainly one I have on my list.

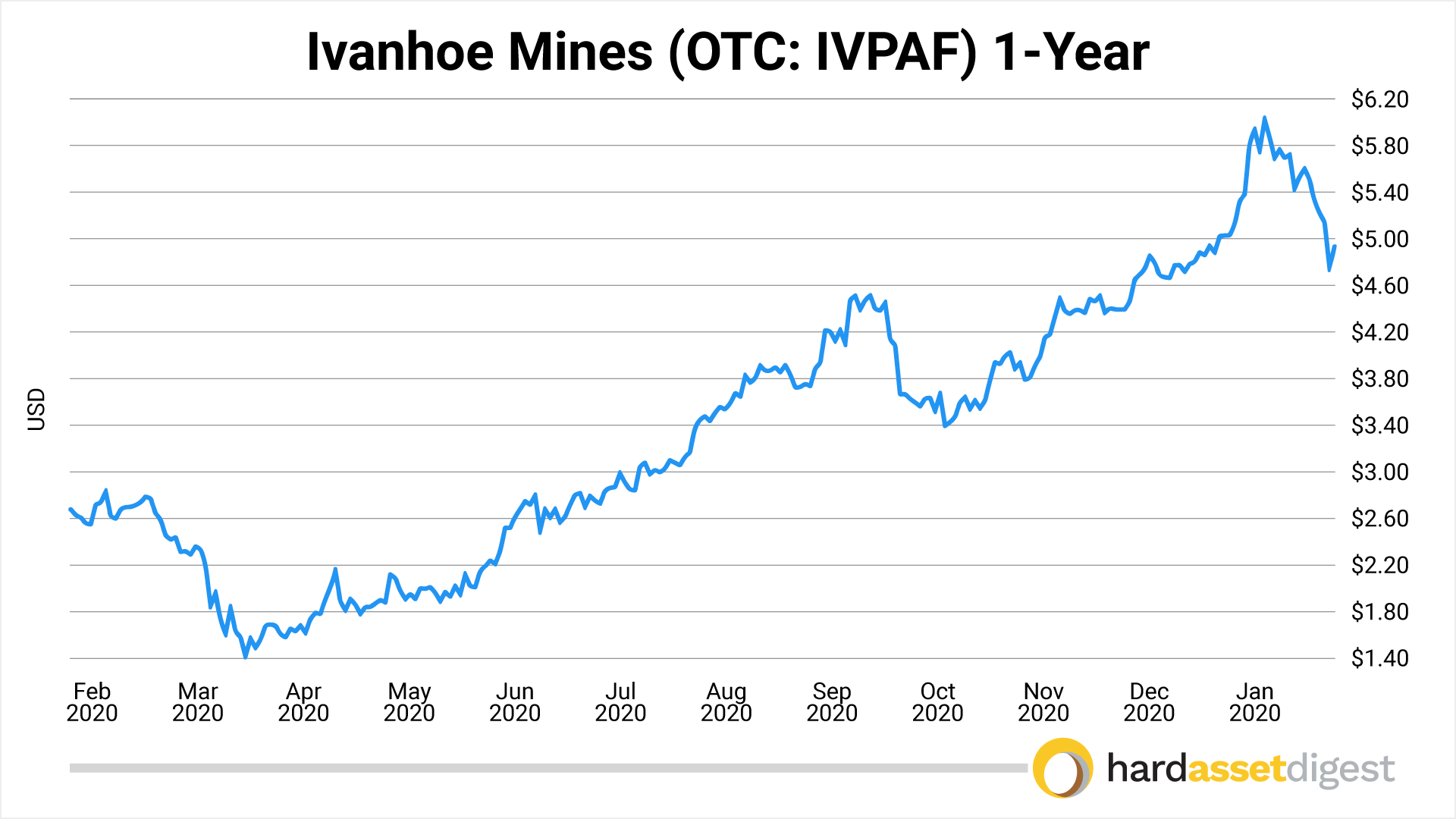

MF: Excellent! Also around that same time, I recall you were accumulating gold-copper-PGM developer Ivanhoe Mines (TSX: IVN)(OTC: IVPAF) near the US$2 per share level; it’s now trading firmly above $5. Are you still bullish on Ivanhoe at these levels?

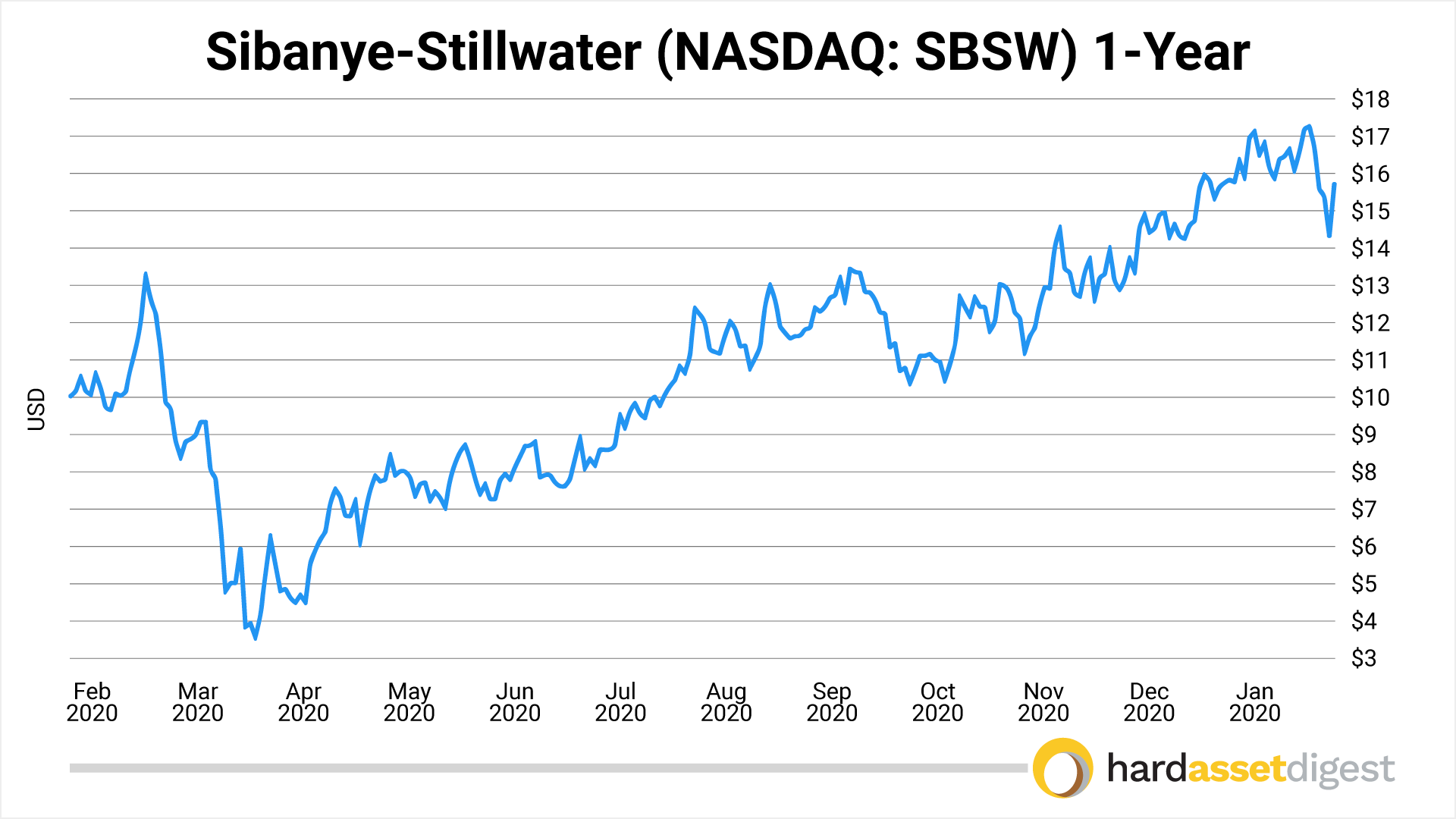

And with the positive outlook for metals in 2021 including gold, copper, platinum, and palladium — can you give my readers a name or two from the base metals or PGM space? I know Sibanye-Stillwater (Nasdaq: SBSW) certainly has been a big winner for you in the PGMs.

NH: Ivanhoe and Sibanye have both done quite well. And Ivanhoe, you might even say, has done phenomenally well as it develops three world-class assets with multiple metals that have all seen price ascensions over the last couple of years.

Ivanhoe has Kamoa in Africa and then Platreef and Kipushi. And at a US$6.5 billion valuation, and with the stock doing what it’s done, it might be hard for some people to see a path higher. But at the same time, there’s no assets in the world that compare to those across multiple categories, giving you access to, as you said, copper and platinum group metals as well.

And so I've sold a tiny bit of my Ivanhoe position but just a tiny bit. I continue to hold most of that position and continue to think it’s going to be one of the go-to names if you're looking for large, world-class mineable assets that are going to provide what’s needed for this next round of electrification and electric vehicles, right? Because you're talking about not just copper and PGMs but nickel as well with Ivanhoe… and Sibanye-Stillwater continues to look great.

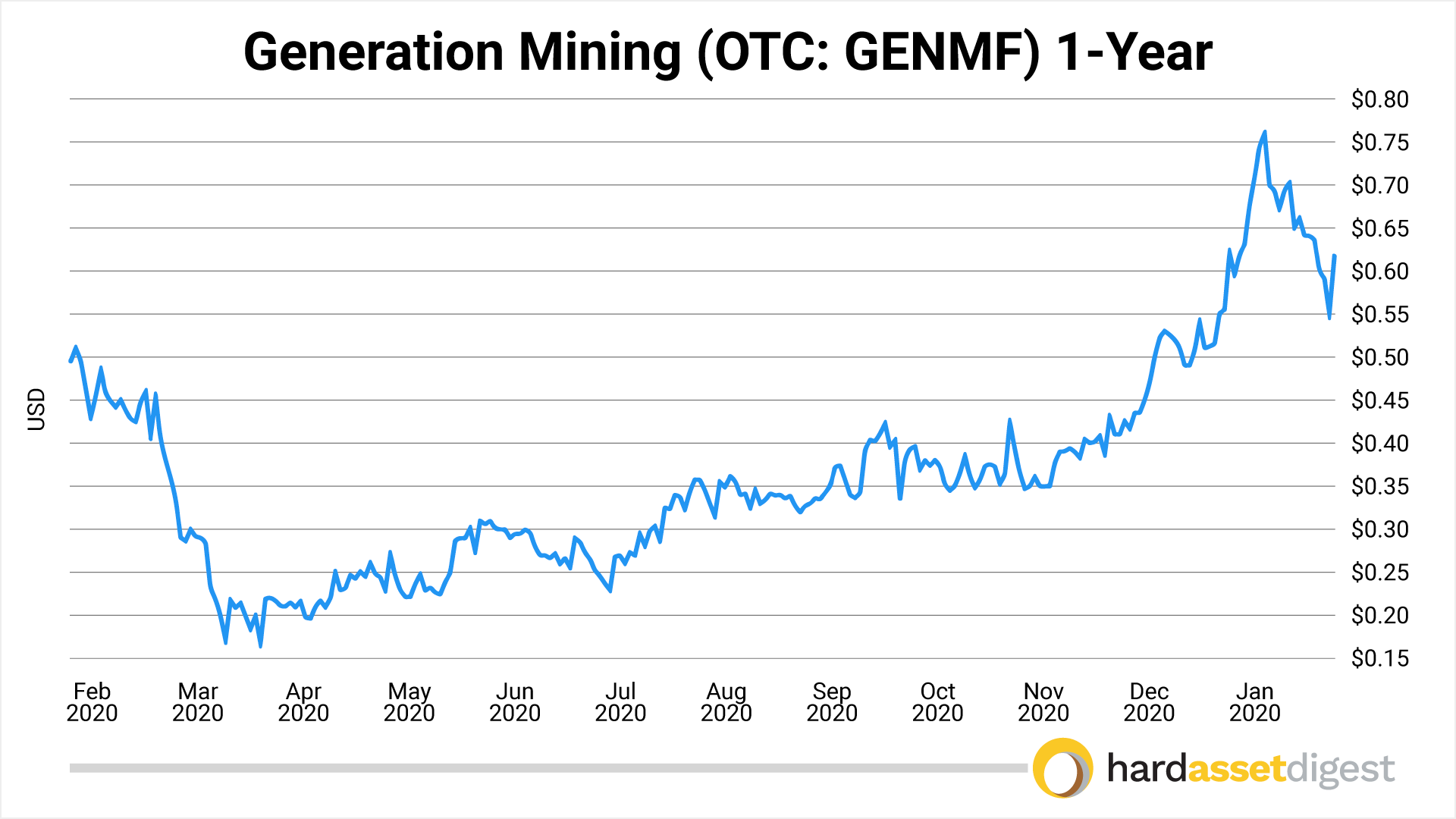

You're asking for a new name? Generation Mining (TSX: GENM)(OTC: GENMF) with their Marathon palladium asset has been one that’s impressed me over the past couple of months. And I guess I regret not having taken a position sooner.

So if you're looking for one that’s in a good jurisdiction – and by the way which actually has close ties to the other name you mentioned in Sibanye-Stillwater – then Generation Mining is one worth taking a look at.

MF: Nick, I’ve got to get your take on uranium. I know you and your business partner Gerardo Del Real – along with a lot of other resource experts such as Rick Rule and Jeff Phillips – have been calling for a powerful resurgence in the uranium sector for a number of years.

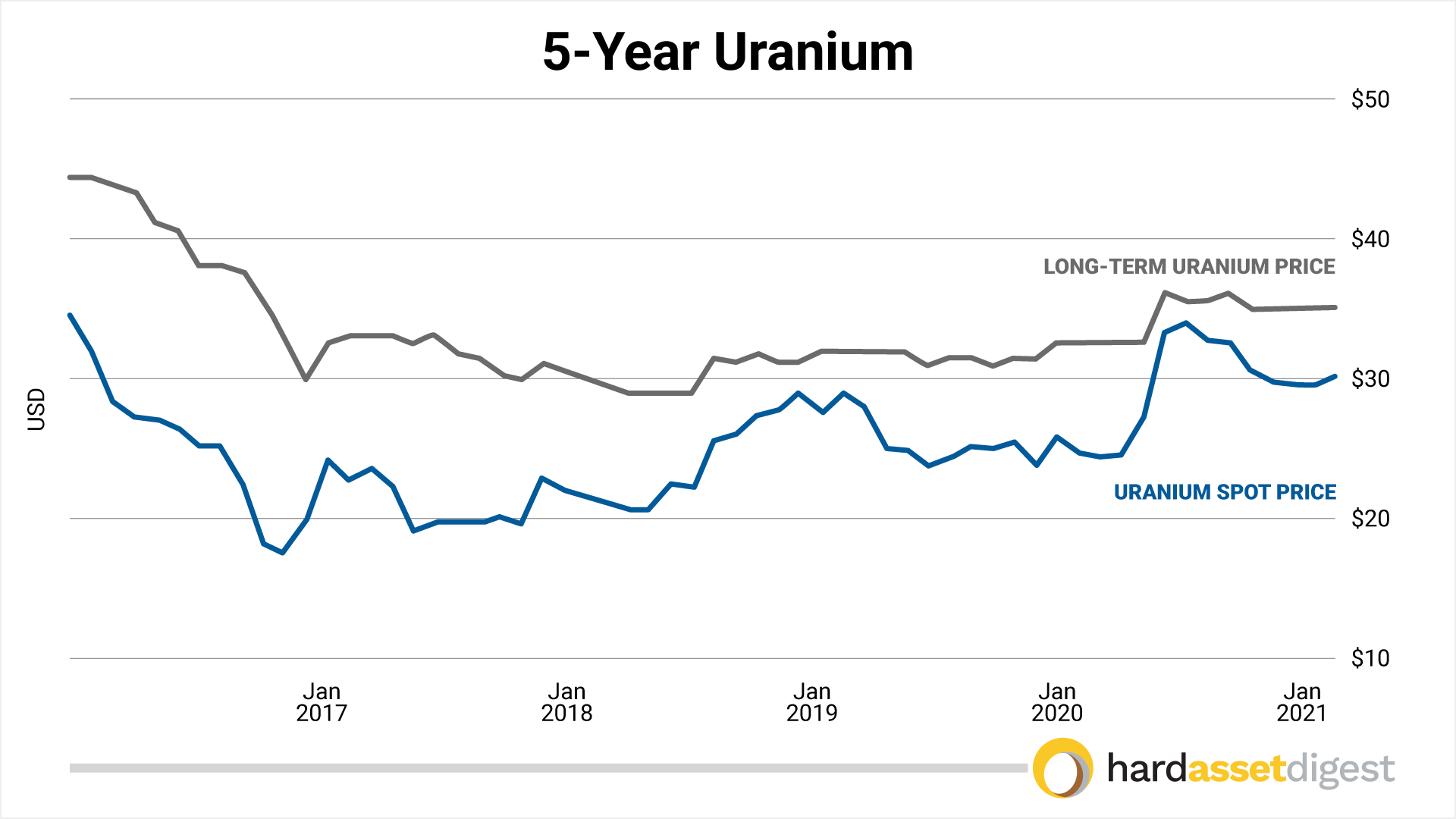

Needless to say, ever since Fukushima in 2011, the recovery for uranium has been akin to watching paint dry! So I’m just going to put it out there: Is 2021 finally the year uranium bulls pop the cork on the champagne?

And secondly, what junior developers should speculators be looking at now while uranium is still kinda stuck in that $30 per pound range?

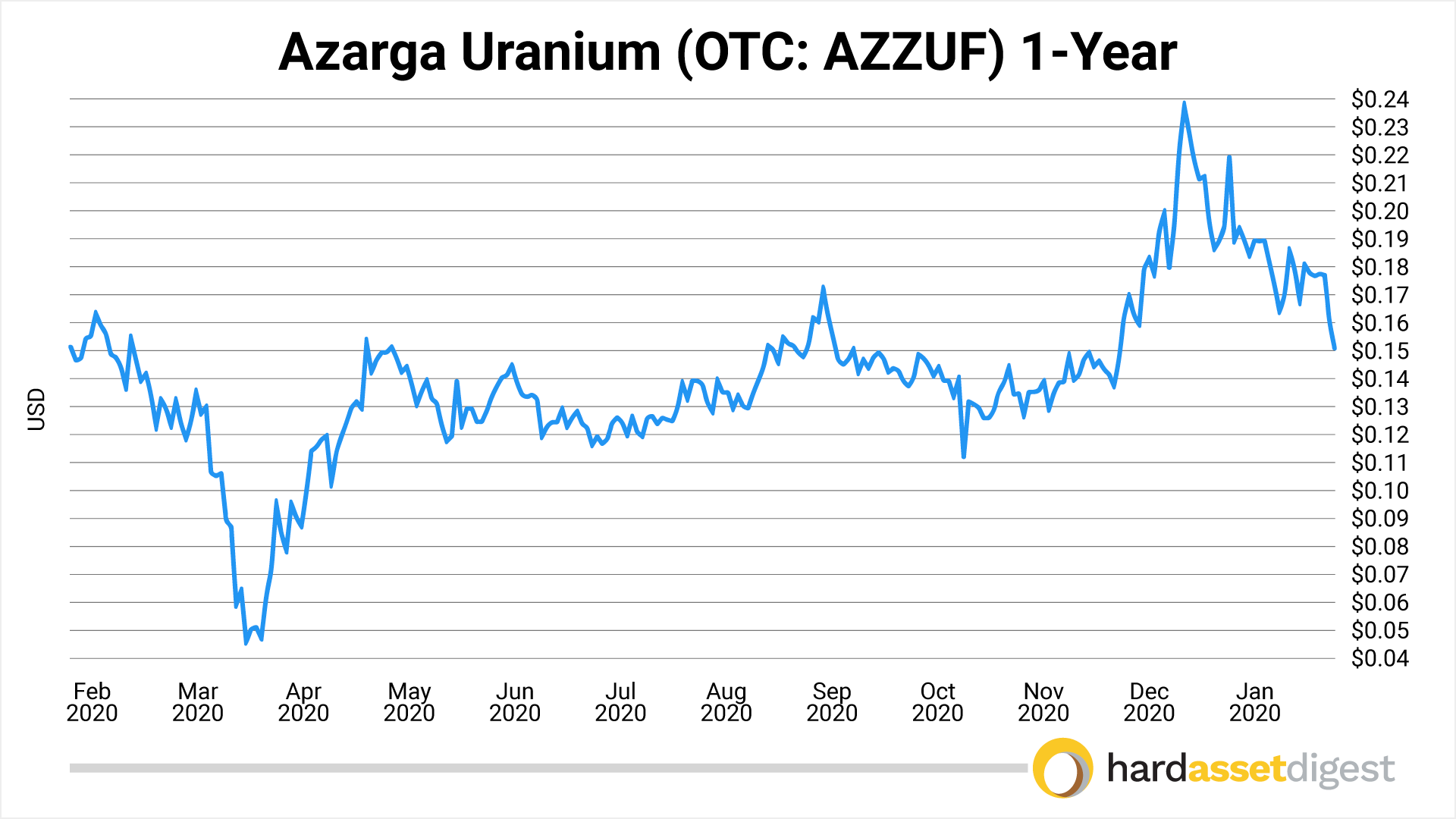

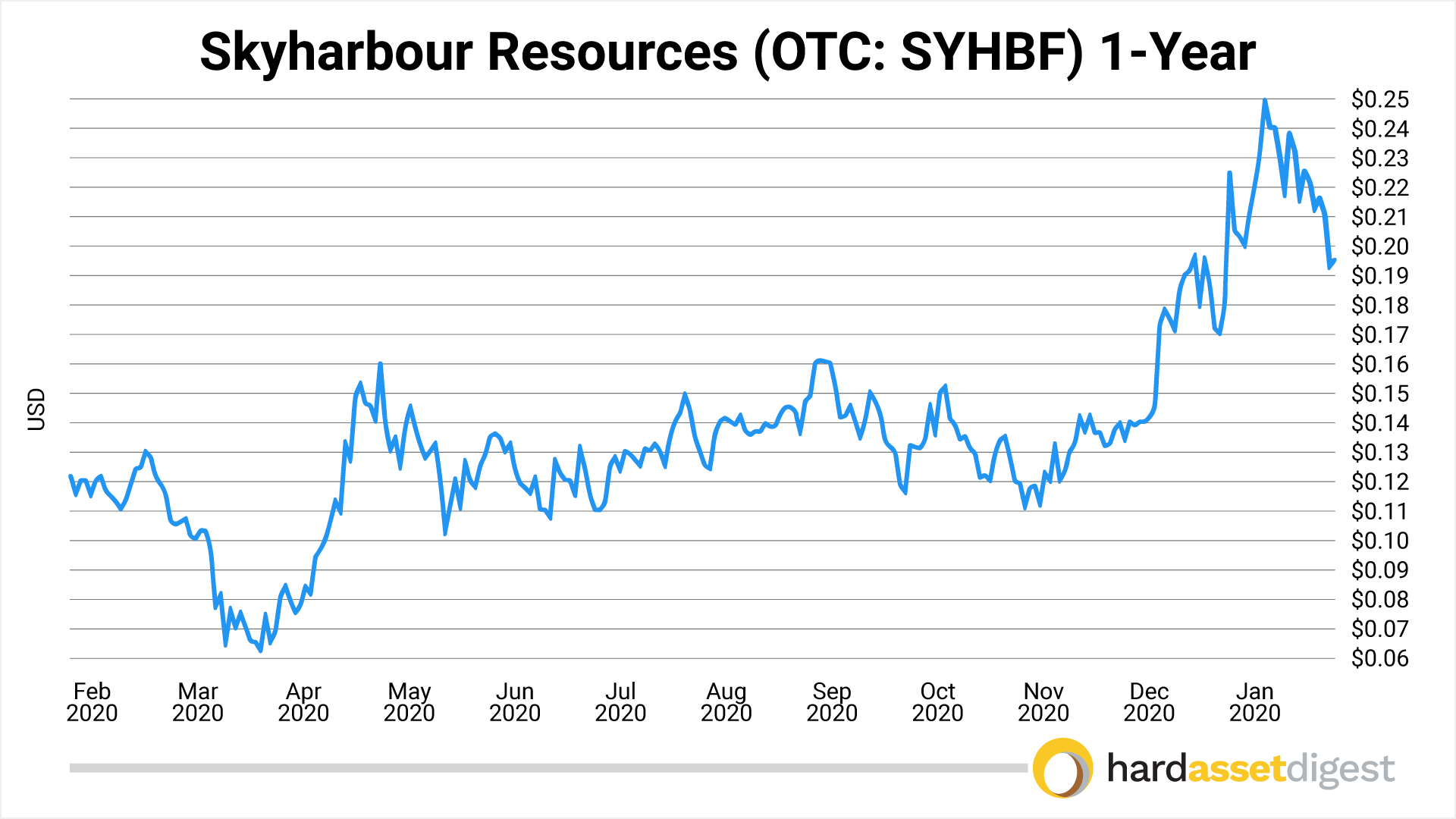

NH: I think some uranium bulls have already popped their corks, Mike! And I’m not sure if that’s premature or not. But if you look at the charts of some of the uranium equities, they’ve done quite well in recent months including two that you and I talked about last time.

So before we get to those names, let’s just talk about the fundamentals for a little bit. You have a sector here that was already in a structural supply deficit by tens of millions of pounds, as far as what’s able to be taken out of the ground under $50 a pound. And the COVID-19 pandemic has just exacerbated that with mine supply taken offline in Kazakhstan and the opacity that comes with that. So you don’t really have clarity around what that fully looks like.

And the same thing with Cigar Lake being taken offline twice now and what that means as far as not only supply being taken offline, but Cameco having to go into the market and buy at the spot price to satiate its existing contracts.

So it seems like the timeline, if it was already soon, has been expedited even more. But I continue to say what you need for the uranium price to really get going is the utilities to come in and buy. And we’ve yet to see that happen. But the pressure has got to be on them because their contracts are rolling over, some this year, and then really starting materially in 2022 and beyond. And so they’ve got to come in and start to buy at some point, right?

And they’ve got to be cognizant that the last time Cigar Lake went offline – which remember is some 7%, 8%, 10% of world supply – uranium prices went to record highs.

So you’d think they’d want to start locking in contracts sooner rather than later. And that’s really what’s needed because we need to see where these contracts are going to go because you can’t contract at the $30 per pound spot price – which is where we're at now – because not enough production can come online at those price levels. It has to be materially higher.

If you look at some of the well-known names, like Cameco for example, many of those have done well in recent months. And then the names you and I talked about last time; one was Azarga Uranium (TSX: AZZ)(OTC: AZZUF). And Azarga has since got its final permits from the EPA for its Dewey Burdock Project in South Dakota.

And being in America, Azarga actually has the best undeveloped in-situ uranium asset in the US at a time when Congress has just funded a national uranium reserve. So that’s certainly a good place to be. They were able to raise $6 million on the back of that EPA permitting news… so Azarga continues to be a name to look at.

And then the other one we discussed last time was Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF). And while their stock has done well since you and I last spoke, I feel it continues to be a relatively overlooked name in the space given that it has a flagship asset that’s producing solid drill results at its Moore Uranium Project in Canada’s Athabasca Basin. And it also has several partner-operated projects as well… all in the Athabasca.

Looking at those two charts, you can see that they’ve both done quite well over the past year. And both would be ones I would continue to look to for exposure to the sector for two reasons:

One, there’s just not a lot of quality names in the uranium space. For example, if you look at the Uranium ETF, URA, you’ll see that there are not a lot of quality names in there. Naturally, you have industry leaders like Cameco and Denison. But then where do you go from there, right? There’s just not a lot of quality to choose from.

And two, even if the move ends up being next year instead of this year… you’ll be positioned. That is critical in explosive sectors like uranium where a large portion of the gains come early in the cycle.

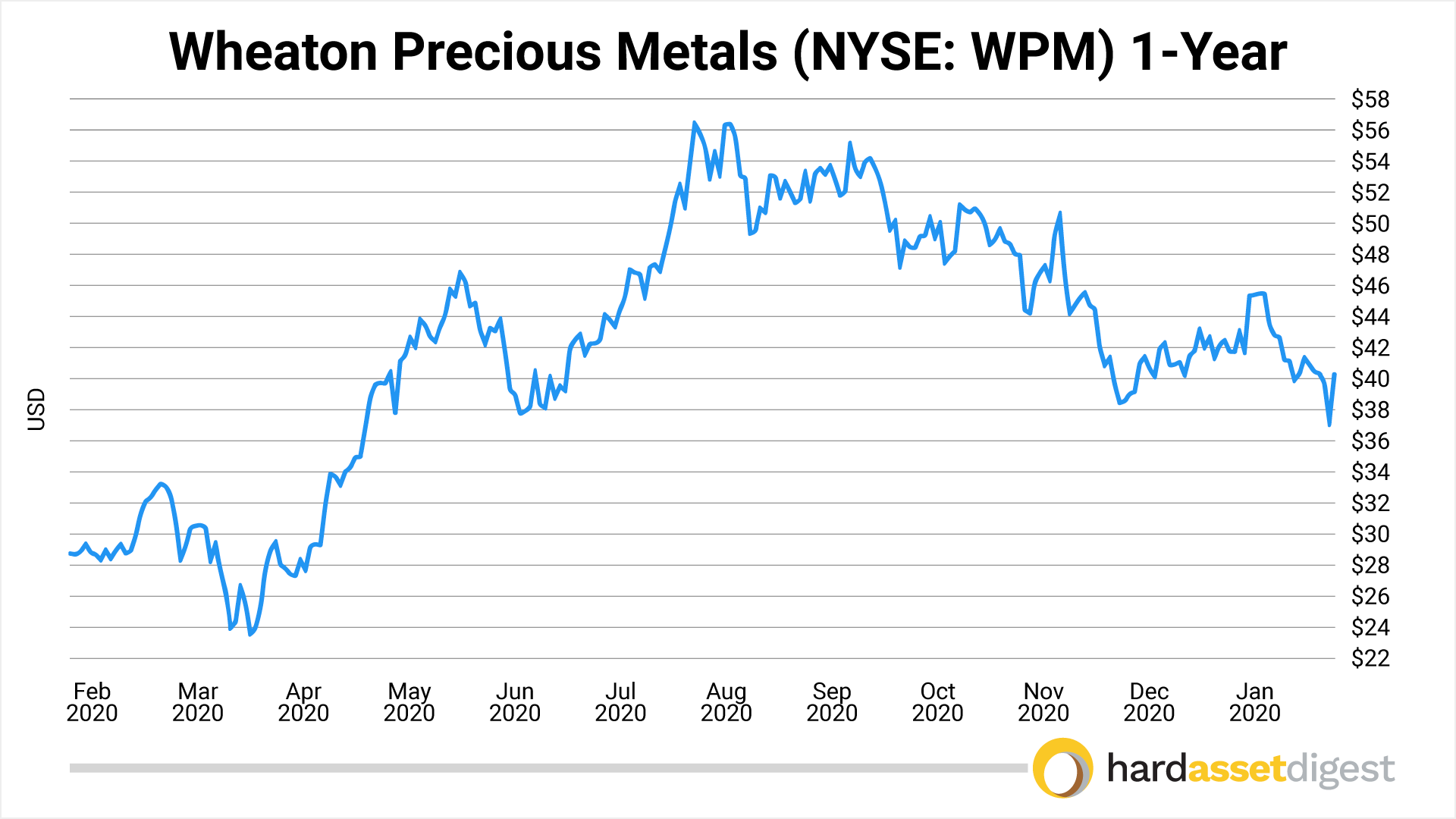

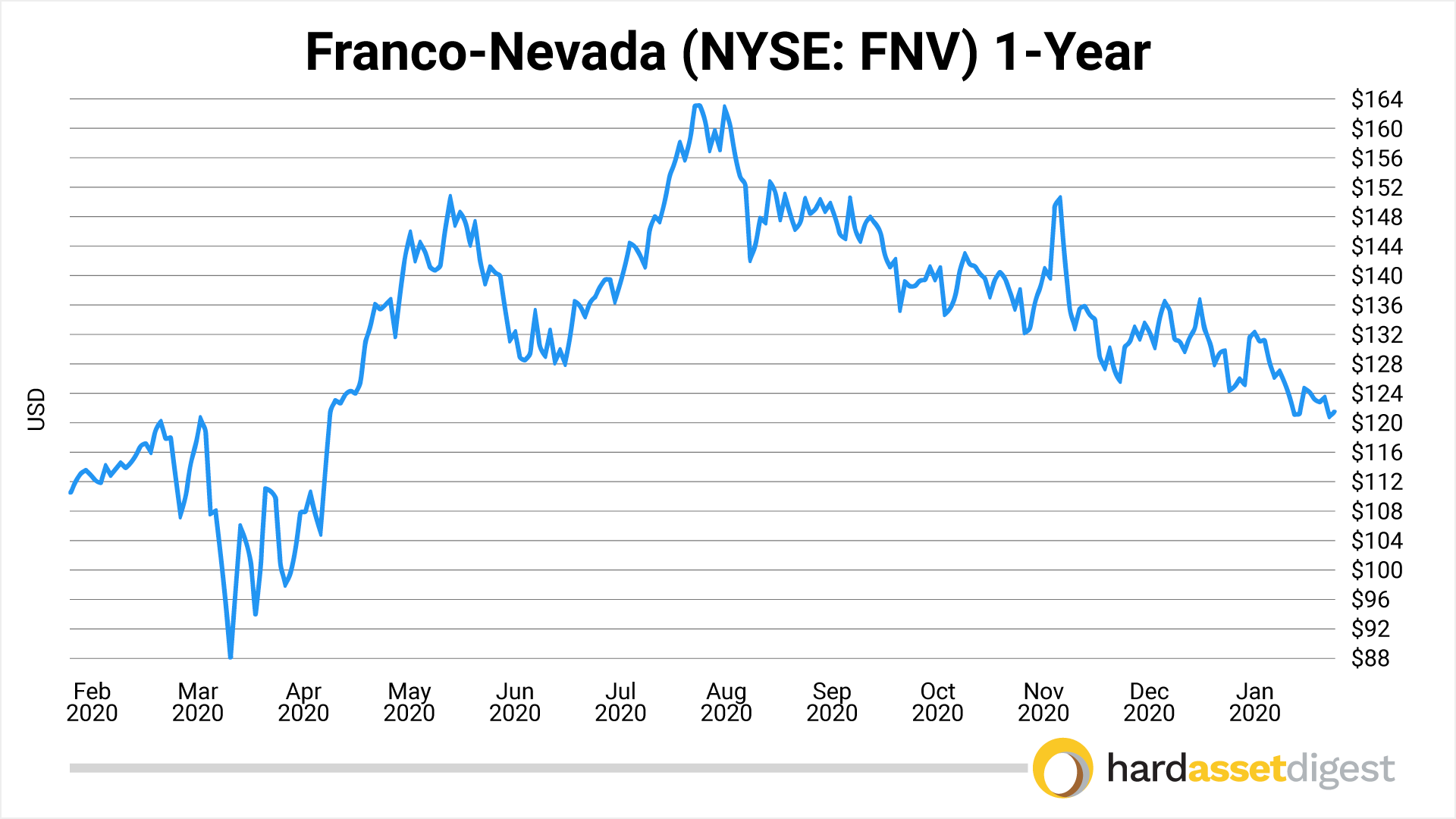

MF: Nick, getting back to precious metals, your subscribers have also done extraordinarily well in the larger royalty and streaming companies like Wheaton Precious Metals (TSX: WPM)(NYSE: WPM) and Franco-Nevada (TSX: FNV)(NYSE: FNV). For those who may not be familiar… these firms offer speculators direct exposure to the metals produced by other companies without the inherent risks of developing or operating a mine.

In looking at their charts, both Wheaton and Franco have come back to earth price-wise since around the middle of last summer. And so the question is… are those two companies now trading at levels where speculators may want to consider staking an initial position?

NH: Well, what we’ve done in my entry-level letter is we’ve taken a bit of profits from Wheaton Precious Metals, which has outperformed a little bit, and I've advised purchasing Franco-Nevada for those who maybe don’t own it or are looking to add to their holdings in the royalty space.

And that’s just a function of balancing out one that has outperformed, which is Wheaton, to one that has a bit of catching up to do in Franco-Nevada. Historically, they’ve traded pretty close to one another… and so that’s been my strategy with the larger royalty players.

There’s also a couple of new names that have come into the space of late. And what’s been interesting is that, as gold was hitting record prices… you’re often told and what has historically been the case… is that the miners and especially the junior miners outperform the price of gold, right? That’s because they give you leverage to the price of gold.

Yet, what has happened – at least so far this time and I don’t think it’s going to be the case forever and certainly not once gold gets back to new highs – but what happened last year is that it was the royalty companies that actually outperformed and delivered the most leverage to the price of gold.

And so they’ve become a key place for investors to look to deploy capital. The market has done what the market does to accommodate that. And now we’re seeing some new royalty names entering the market.

The other thing that’s interesting to note in the royalty space is how the royalty companies have been valued. And what I mean by that is, if you look at Wheaton and Franco, for example, which were spun out of Newmont and Goldcorp back in the day — they’ve gone on to rise in value to match their parent companies on a market cap basis.

Now, what Gerardo Del Real has been able to find is a company that’s recently been spun out of a top-ten gold producer. Their royalty portfolio was spun out and is now trading under another company.

If history is any indicator – and if its market cap has to rise like Franco and Wheaton rose to match their parent companies’ valuation – then this company has to rise by at least 10 times. And you may even be able to make a case for 20 times the current valuation.

And so that’s a very interesting new royalty company in the gold sector that just started trading in recent months that your readers might want to take a look at. We made a video about it so your readers can learn more.

Click the video to learn about Gerardo Del Real's Top-Pick in the Gold Royalty Space.

MF: Nick, I want to again thank you for your time… I always feel illuminated by your unique insights and I’m sure my readers will benefit greatly as well. I’m excited to see what the new year will bring… is there anything else you’d like to add before I let you go?

NH: Only that the same way that it has been somewhat counterintuitive for gold not to have gone up more than it has in recent months with a rise in inflation and a perpetually eroding dollar… counterintuitively, stocks can continue to go higher even though they're already sitting at record prices.

Certainly, there’s more stimulus coming. The Fed seemingly won’t let the market go down. And because of how depressed earnings were last year, a lot of companies are going to post some pretty significant earnings growth numbers in the current quarter based on how dismal some of those numbers were much of last year due to covid.

And so there’s actually some fundamental reasons why stocks could trend higher still to go along with all the free money in the world. So don’t count out the possibility of stocks continuing their dizzying upward trend. And that’s just one more thing to keep an eye on in addition to everything else we discussed.

MF: Yeah and as we’re oft reminded in resource speculation…. patience is sometimes the wisest course of action even though, at times, it can feel quite daunting as things go south or when things just seem sluggish to get going in the direction all of your experiences and instincts tell you they should be moving.

NH: Exactly… and the patience to ride out this current bubble. And I guess another word of caution is to keep an eye on when those chairs start being taken away because I think you're seeing quite a bit of euphoria in the broader indices at the moment.

And like I just said, I think that can last a bit longer… but you'll want to be looking for the first signs of that starting to wear off and then to position accordingly.

MF: Nick, always appreciated… let’s do this again soon! Be well and stay safe!

We have four reports now available highlighting several opportunities for investment in the resource space.

Opportunities discussed in those reports and past issues include:

January 2021 Issue: Opportunities Mentioned by Nick Hodge

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Roxgold (TSX: ROXG)(OTC: ROGFF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Generation Mining (TSX: GENM)(OTC: GENMF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

December 2020 Issue: Opportunities Mentioned by Van Simmons

- 19th century: Liberty Seated half dimes, dimes, quarters, half dollars, silver dollars

- 20th century: Buffalo Nickels, Mercury Dimes, Walking Liberty Halves, Standing Liberty Quarters

- Barber dimes, quarters, and halves

- Common date: $10 Liberties, $5 Liberties

- 19th century quarter sets: Draped Bust Quarter, Capped Bust Quarter, Liberty Seated Quarter, Barber Quarter

- 20th century coin sets: Mercury Dimes, Walking Liberty Halves, Buffalo Nickels, Standing Liberty Quarters; other various: 8-piece sets, 10-piece sets, 12-piece sets

November 2020 Issue: Opportunities Mentioned by Gerardo Del Real

- Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF)

- Chakana Copper (TSX-V: PERU)(OTC: CHKKF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX-V:RVG)(OTC: RVLGF)

- Integra Resources (TSX-V: ITR)(NYSE-American: ITRG)

- Liberty Gold (TSX: LGD)(OTC: LGDTF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Energy Fuels (TSX: EFR)(NYSE-American: UUUU)

October 2020 Issue: Opportunities Mentioned by Joe Mazumdar

- Pan American Silver (TSX: PAAS)(Nasdaq: PAAS)

- Liberty Gold Corp. (TSX: LGD)(OTC: LGDTF)

- HighGold Mining (TSX.V: HIGH)(OTC: HGGOF)

- Bluestone Resources (TSV.V: BSR)(OTC: BBSRF)

- Trilogy Metals (TSX: TMQ)(NYSE-Amex: TMQ)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Blackstone Minerals (ASX: BSX)

- Clean Air Metals (TSX.V: AIR)

August 2020 Issue: Opportunities Mentioned by Jeff Phillips

- Lynas Corp. (OTC: LYSCF)

- MP Materials: Private Company

- Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX.V: RVG)(OTC: RVLGF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Chakana Copper (TSX.V: PERU)(OTC: CHKKF)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

May 2020 Issue: Opportunities Mentioned by Brien Lundin

- Great Bear Resources (TSX.V: GBR)(OTC: GTBDF)

- Energy Fuels Inc.(NYSE American: UUUU)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- First Mining Gold (TSX: FF)(OTC: FFMGF)

- Libero Copper & Gold (TSX.V: LBC)(OTC: LBCMF)

- GR Silver Mining (TSX.V: GRSL)(OTC: GRSLF)

April 2020 Issue: Opportunities Mentioned by Nick Hodge

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

February 2020 Issue: Opportunities Mentioned by James Dines

- Agnico Eagle Mines (TSX: AEM)(NYSE: AEM)

- Kirkland Lake Gold (TSX: KL) (NYSE: KL)

- Pan American Silver (TSX: PAAS) (NASDAQ: PAAS)

- Lynas Corp. (OTC: LYSCF)

- Canopy Growth (TSX: WEED) (NYSE: CGC)

- OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI)

Make sure you never miss an update or issue from Hard Asset Digest by adding editor@hardassetdigest.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here.

Hard Asset Digest, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at editor@hardassetdigest.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Hard Asset Digest does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.