Hard Asset Digest February 2021

February 2021

This month, we’re switching gears a bit by taking a detailed look at one of the mid-tier silver exploration and development companies in our Precious Portfolio — SilverCrest Metals Inc.

Click here to jump straight to our newly-updated Special Report: The New Standard in Silver: SilverCrest Metals Inc.

SilverCrest Metals has now announced a positive Feasibility Study on its high-grade Las Chispas Silver Project, Mexico, showing total Proven and Probable Reserves of 3.35 million tonnes grading 4.81 grams per tonne gold and 461 grams per tonne silver for 94.7 million ounces silver-equivalent.

The company also just raised US$138 million and has 8 drill rigs turning at Las Chispas as we speak. It’s not often you see a deposit of this size and grade with so much potential for resource expansion through targeted drilling.

It’s truly one of those perfect storms where you have an extraordinarily well-run company with a positive Feasibility Study on a large, proven high-grade resource with tons of money to drill a nearly unlimited number of already identified, high-quality targets.

Hence, as an exercise on a Canadian mining firm that’s done everything right in successfully bringing a company from the exploration stage through the various stages of development and now toward full-scale production — we see value in offering you a detailed look at the company and its future prospects for value growth as it builds out the Las Chispas Silver Mine.

Yet, before we delve into SilverCrest… let’s take a quick look at some of the metals we’re covering.

Copper

The red metal has been on a sustained upward trajectory for the better part of a year — eclipsing $4 per pound for the first time in nearly a decade.

And that uptrend could continue for years – of course, with intermittent pullbacks along the way – as the world turns to the electrification of pretty much everything.

When you look at the EV market in particular coupled with the dire need for infrastructure improvements not just in the US but globally — it’s clear the world is going to need lots and lots of copper going forward.

And that means the growth rate in copper demand could remain historically high for the next decade or so.

Naturally, Hard Asset Digest will continue bringing you what we believe are the best ideas in the copper space, as we have been, with miners such as:

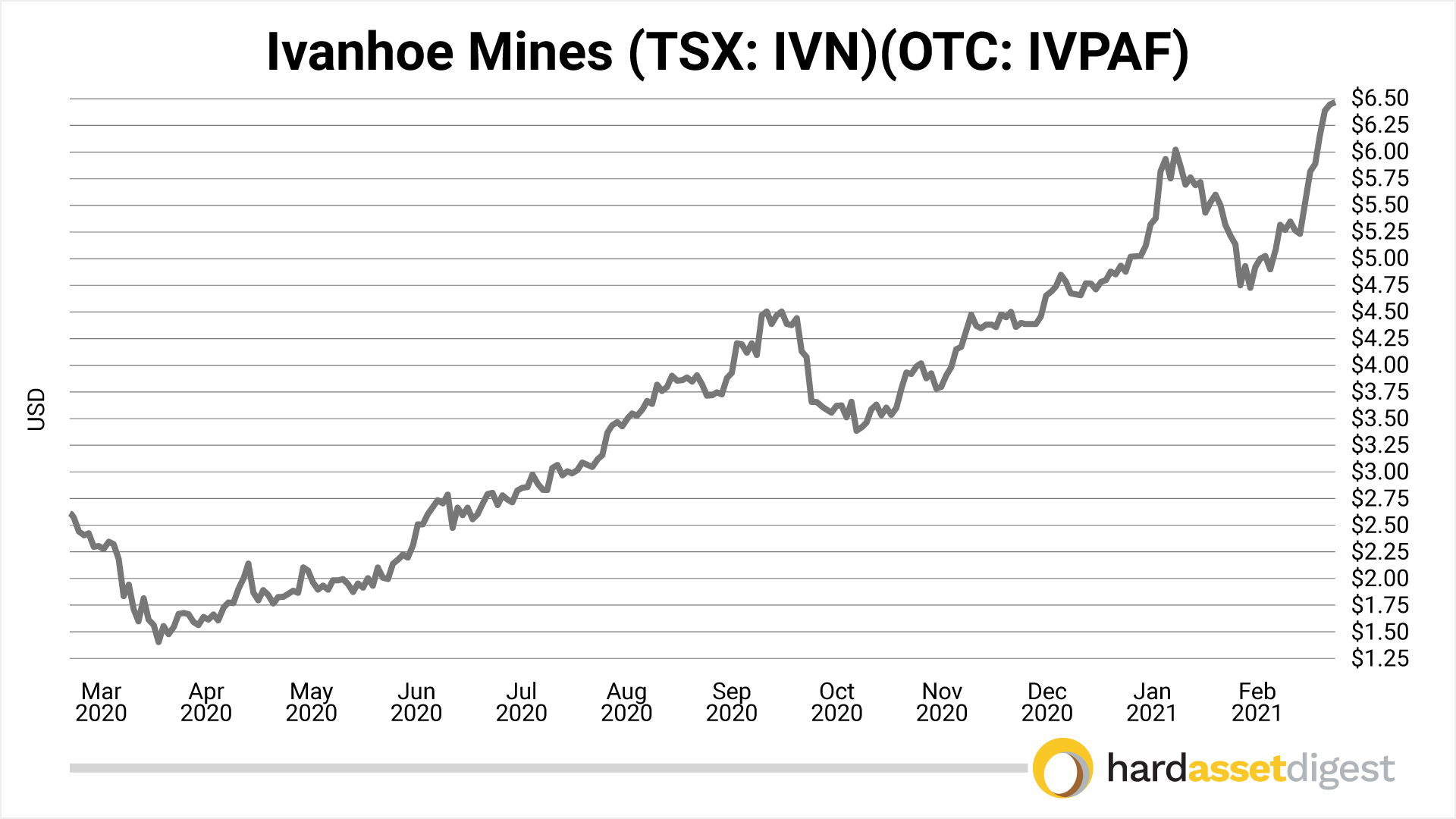

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF) with its Kamoa-Kakula Project in the DRC which is on-track for first production in Q3 2021.

-

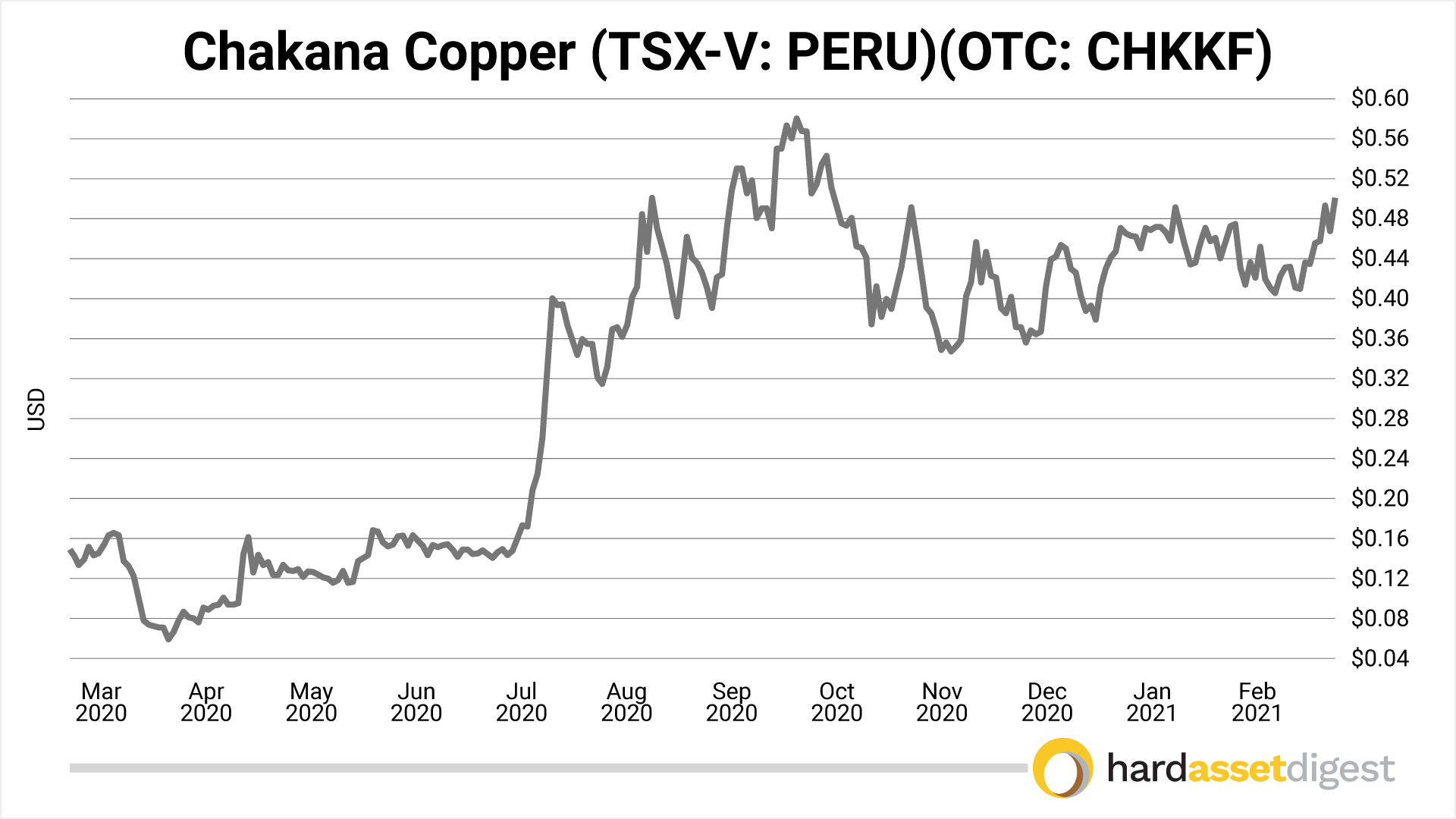

Chakana Copper (TSX-V: PERU)(OTC: CHKKF) with its Soledad Project in Peru which just recorded its best hole to-date at 4.04% copper, 2.79 grams per tonne gold, and 330 grams per tonne silver over 11 meters — representing one of the small cap stocks in our Precious Portfolio.

-

Regulus Resources (TSX.V: REG)(OTC: RGLSF) with its AntaKori Project, also in Peru, which just got bigger via its newly announced earn-in with Gold Fields.

-

Trilogy Metals (TSX: TMQ)(NYSE-Amex: TMQ) with its feasibility-stage Arctic deposit in Alaska which is one of the highest-grade known copper deposits in the world with an average grade of 5% copper equivalent — also in our Precious Portfolio.

Gold

The price gyrations in the yellow metal have been even more pronounced than anticipated with seemingly every bullish move north of $1,800 encountering equal and swift resistance pushing the metal back below that important marker.

Yet, it’s important to keep in mind that all of this whipsaw action is happening at a time when the longer-term fundamentals for higher gold prices remain firmly in place.

That includes inflation concerns from the trillions of US dollars currently being printed in the name of COVID relief and which will soon be followed up by $trillions more in infrastructure spending.

Interestingly enough, most of the other major precious and base metals – including platinum, palladium, copper, nickel, and zinc – are all trending higher. Thus, the question is… What’s wrong with gold… with the short answer being… Nothing—really!

Friend and Hard Asset Digest contributor – Brien Lundin of Gold Newsletter – had this to say last week in regard to what’s keeping a lid on gold prices:

Brien Lundin, editor

Gold Newsletter

A new tidal wave of stimulus money is about to flood the U.S. economy, inflation indicators are pointing straight upward, real rates are generally headed lower, commodity prices are soaring… yet gold is being dumped. Is there any sense to it all?

There is a long list of reasons why gold should be soaring right now. But no one seems to be listening. Gold is down another $20 today, adding to yesterday’s loss of about $24. It’s now trading below the November 24th bottom, a key support level that I’ve mentioned before.

As I noted above, the factors that should be working in gold’s favor are numerous. Considering that the Fed has no intention of raising rates any time in the foreseeable future (and simply can’t raise rates in any case, considering the size of the federal debt), the path to much higher gold prices should be clear.

But it hasn’t been. Granted, real rates, while generally headed lower, have been moving sideways over the past couple of weeks… and the dollar has put in a couple of days of strength. Still, gold has been refusing to respond to the bullish factors that have come around in its favor. And that’s not how an asset in a bull market behaves.

Right now, gold seems to be unable to overcome the short-term indications of higher inflation that are spooking investors afraid of potential Fed tightening. Of course, rising inflation is great for gold over the longer-term, but few traders are looking past tomorrow.

The good news, such as it is, is that a number of gauges of investor sentiment and price momentum seem to have bottomed over the past week, so the likelihood of a rebound, or at least a bounce, in the near future is high.

And as I noted, the future still looks very bright for the yellow metal.

Brien is one of the world’s foremost authorities on gold… and there’s no one I trust more when it comes to sound, unhyped research and opinion on the yellow metal.

In fact, I urge all of my readers to pick up a subscription to Gold Newsletter and to attend – of course, virtually for now – his New Orleans Investment Conference which is celebrating its 46th consecutive year.

Despite the choppiness in the gold price, another positive we can look to is that there really is no shortage of liquidity at present in the gold space for companies with sound management teams and solid exploration projects to raise money for additional drilling.

And that means speculators can expect plenty of news flow over the coming months as drill results continue to pour in from active explorers.

Keep in mind also that February tends to be “weakish” for the gold sector even in the best of years — so we could be setting up for a nice run, as Brien suggested, in the upcoming March to May period. Exercise patience for now.

Platinum Group Metals (PGMs)

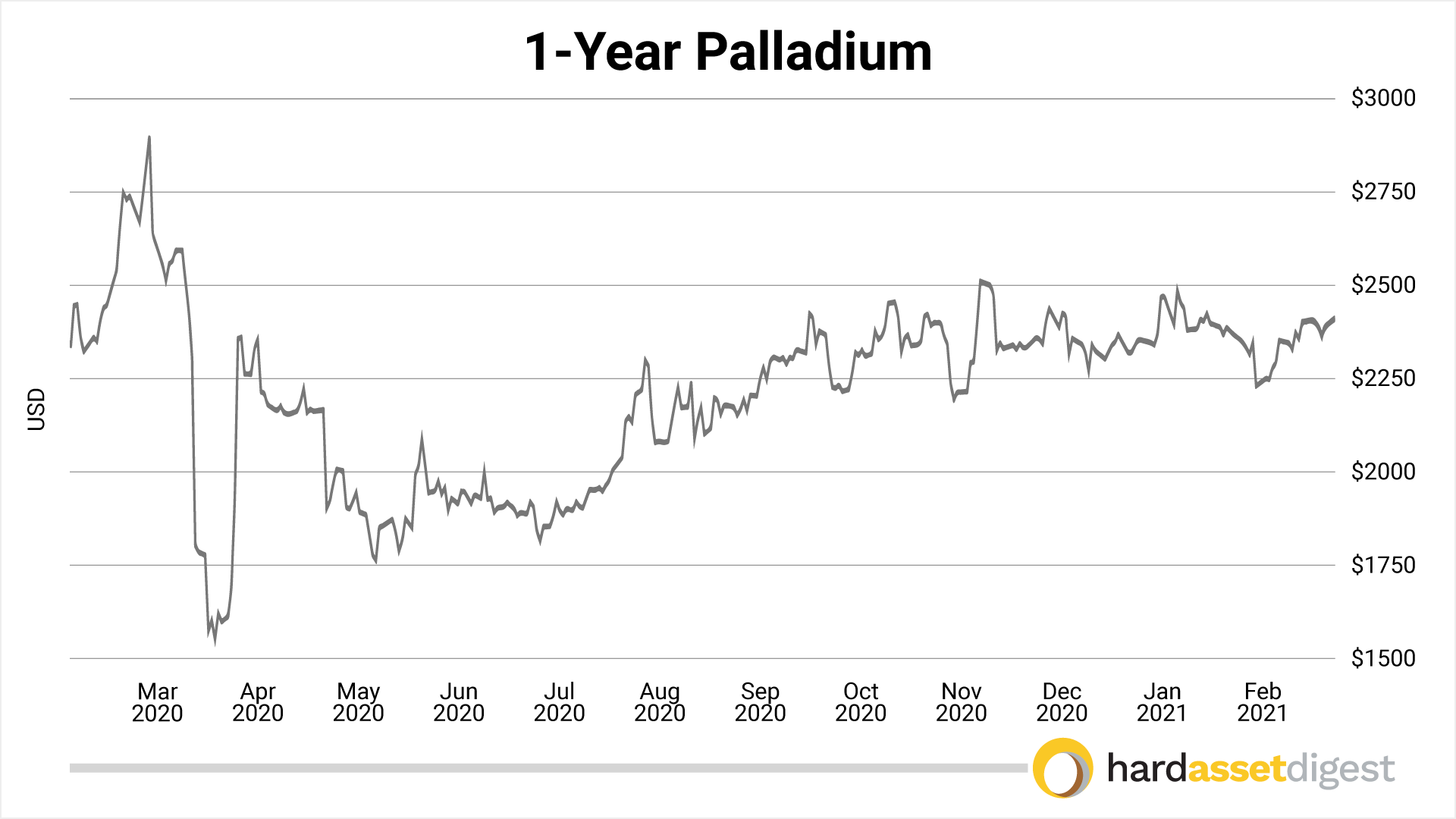

As touched upon earlier, PGMs such as platinum and palladium have been trending higher in recent months due in large part to their use in catalytic converters of cars, trucks, and buses as countries around the world – particularly the US, China, and in Europe – tighten emissions standards.

Nick Hodge, cofounder

Digest Publishing

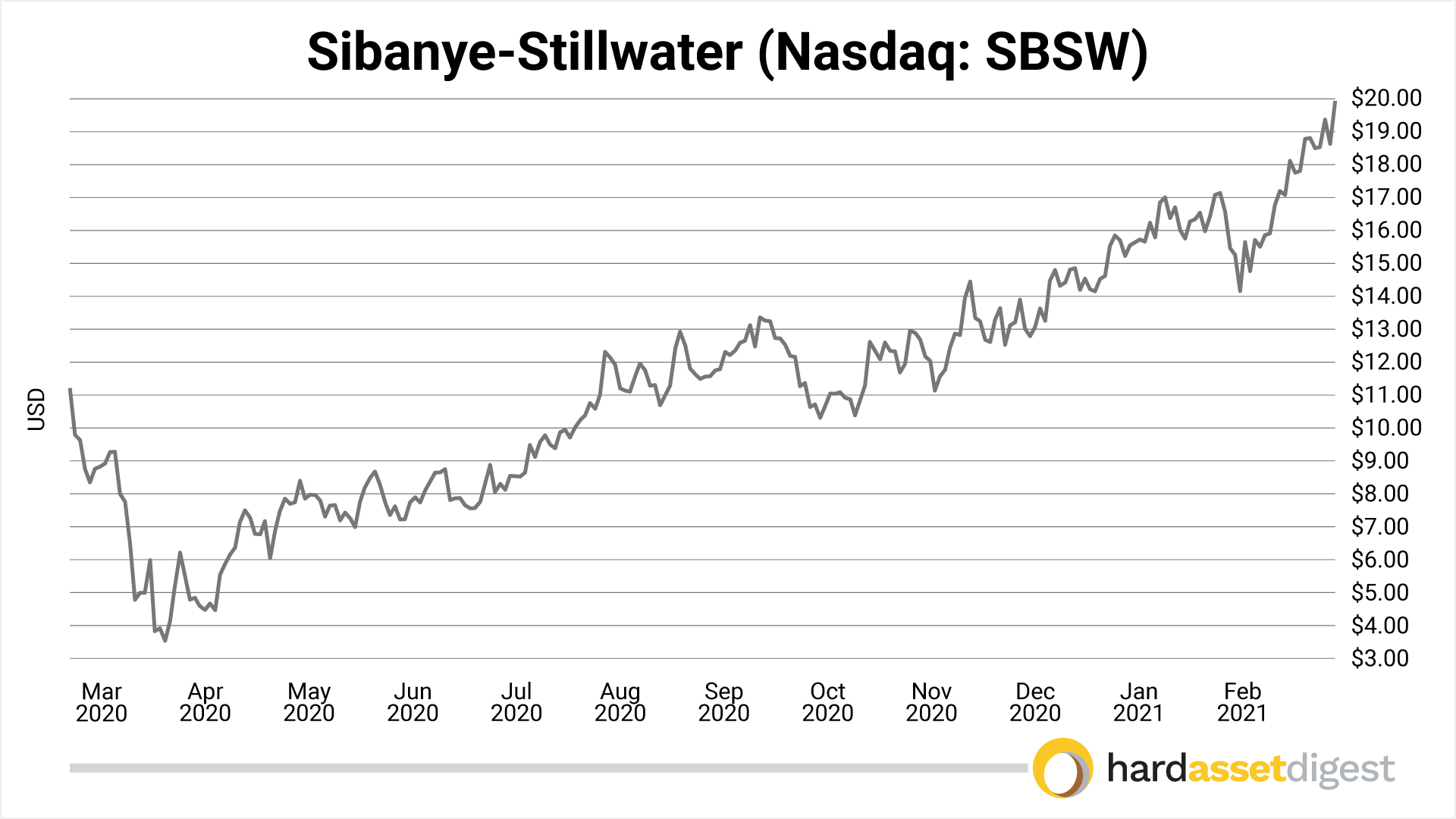

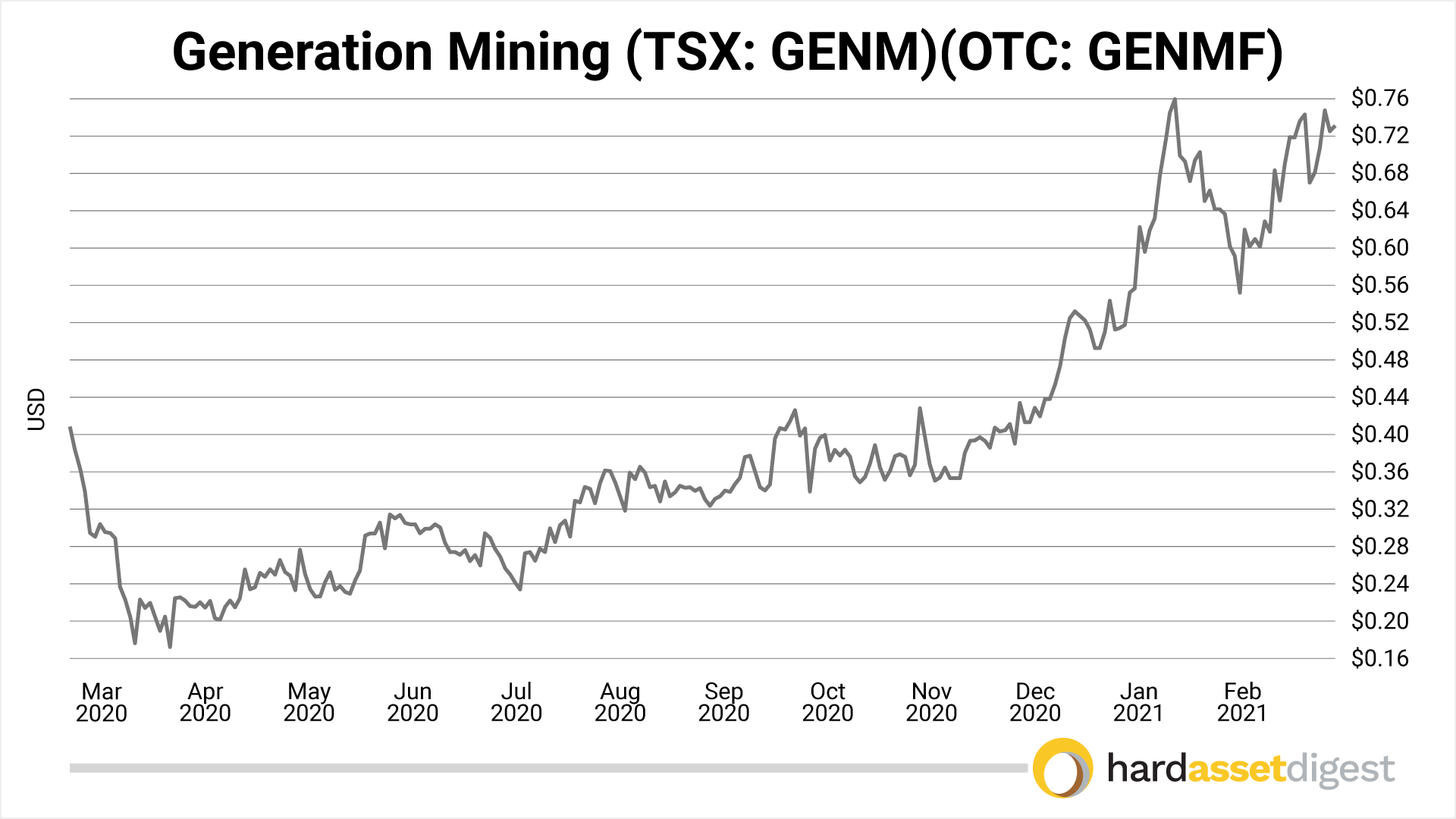

Again, Hard Asset Digest is on top of that bull market trend as well. In fact, in last month’s issue, Nick Hodge of Digest Publishing discussed major PGM producer Sibanye-Stillwater (also covered in April 2020 issue) and junior PGM developer Generation Mining.

- Sibanye-Stillwater (Nasdaq: SBSW) – which is one of the large-cap mining stocks in our Precious Portfolio – is the world’s third largest producer of palladium and platinum.

-

Generation Mining (TSX: GENM)(OTC: GENMF) is advancing the Marathon PGM Deposit in Canada – considered the largest undeveloped PGM mineral resource in North America – via a joint venture with Sibanye-Stillwater.

Overall, it appears that the base metals and PGMs will continue to outperform gold and silver in the immediate term.

And while that’s indeed a bit frustrating for all of us gold bulls… select gold-silver explorers with experienced management teams and high-potential projects should still be able to generate solid gains on positive results in the current market environment.

Remember, the longer-term picture for gold remains bullish… and our patience will undoubtedly be rewarded as inflation inevitably kicks in later this year.

It’s an important reminder that ALL metals tend to move in cycles, and it’s why we strive to cover the full spectrum of the metals space in the pages of Hard Asset Digest.

As a note, we’ll be back on our regular interview schedule starting next month. For now, please enjoy our Special Report: The New Standard in Silver: SilverCrest Metals Inc.

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

SilverCrest Metals Inc.

NYSE-American Stock Exchange: SILV

Toronto Stock Exchange: SIL

Rick Rule of Sprott Inc. (NYSE: SII) says…

We are near rock bottom in the gold market… and each and every time this market has recovered over the last 40 years… the upside has been between 200% and 1,200%!

That means select gold and silver stocks are poised to do very well in 2021 and that they belong in your well-diversified portfolio as a hedge against rising geopolitical uncertainty and a depreciating US dollar.

Like Rick says…

“If past is prologue, investors will do well in gold… speculators will do well in physical silver… but intelligent speculators could do extraordinarily well in the silver stocks!”

Rick Rule, President & CEO, Sprott US Holdings, Inc.

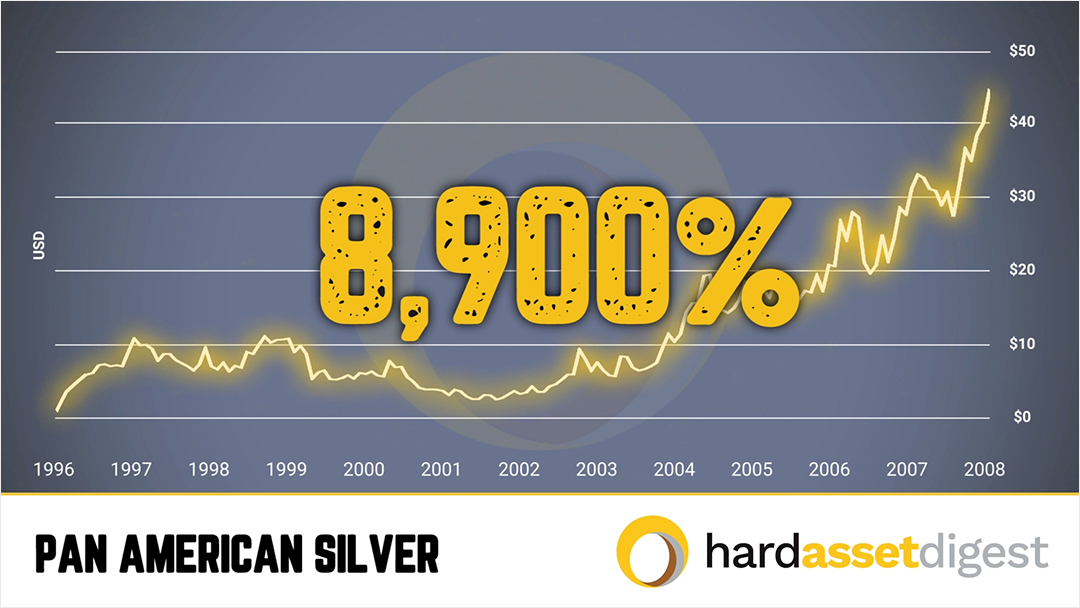

That’s the sector where Rick took Silver Standard from $0.72 to $45 and Pan American Silver from $0.50 to $45.

This Special Report, brought to you by Hard Asset Digest, details a silver exploration and development company Rick has been following for a number of years: SilverCrest Metals Inc. (NYSE-American: SILV)(TSX: SIL)

Overview

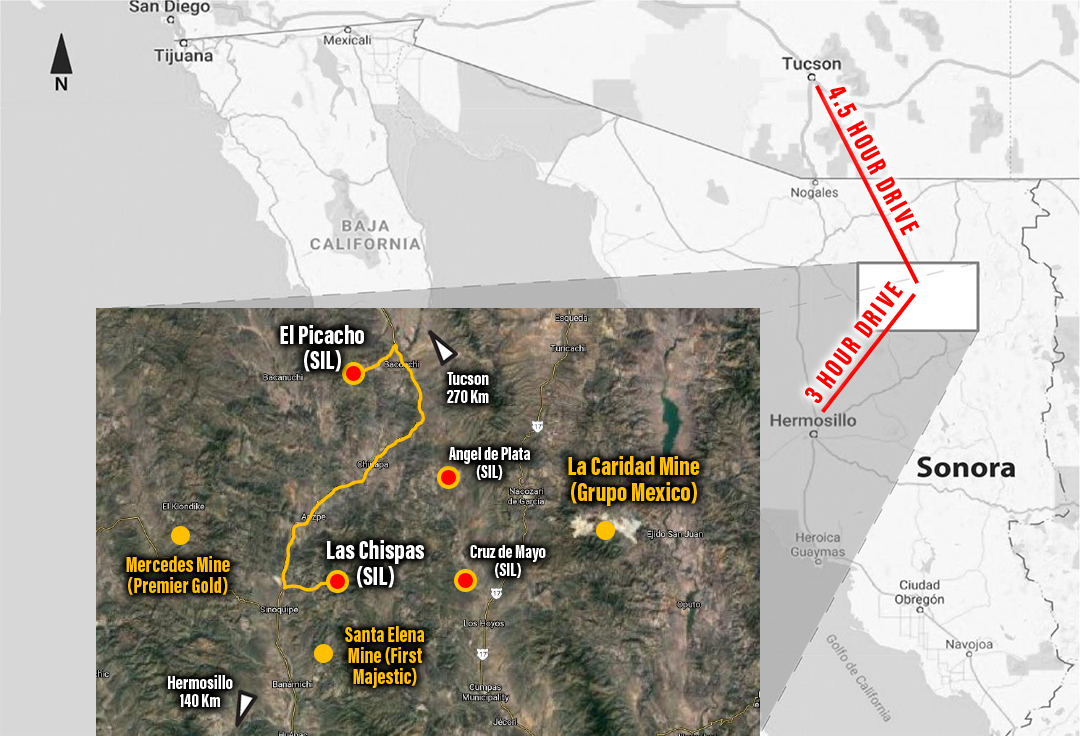

SilverCrest Metals Inc. is a Canadian-based precious metals exploration and development company focused on advancing its 100%-owned Las Chispas Silver-Gold Project — Sonora, Mexico.

Las Chispas, a past producer, is considered the 3rd highest-grade primary silver deposit in the world.

The ore from this project is so impressive that specimens from Las Chispas are on display at the New York Museum of Natural History.

2020 Drilling: Hole BV2-201 from the Babi Vista Splay Vein at Las Chispas reported 2.4 meters estimated true width grading 555 grams per tonne gold and 19,453 g/t silver — including 0.4 meters grading 3,366 g/t gold and 114,814 g/t silver.

The property consists of 28 concessions totaling 1,400 hectares (3,460 acres) and is located approximately 180 km (112 mi) northeast of Hermosillo — Sonora, Mexico.

SilverCrest Metals currently has 8 drill rigs turning at Las Chispas with several rigs focused on converting “resources” to “reserves” and the other half looking for new silver ounces to add to existing resources.

Translation: There should be no shortage of exciting drill results throughout 2021 as the company continues to intercept high-grade silver at a high rate of success.

2021 Feasibility Study

On February 2, 2021, SilverCrest Metals released a positive Feasibility Study on Las Chispas.

Feasibility Study Highlights

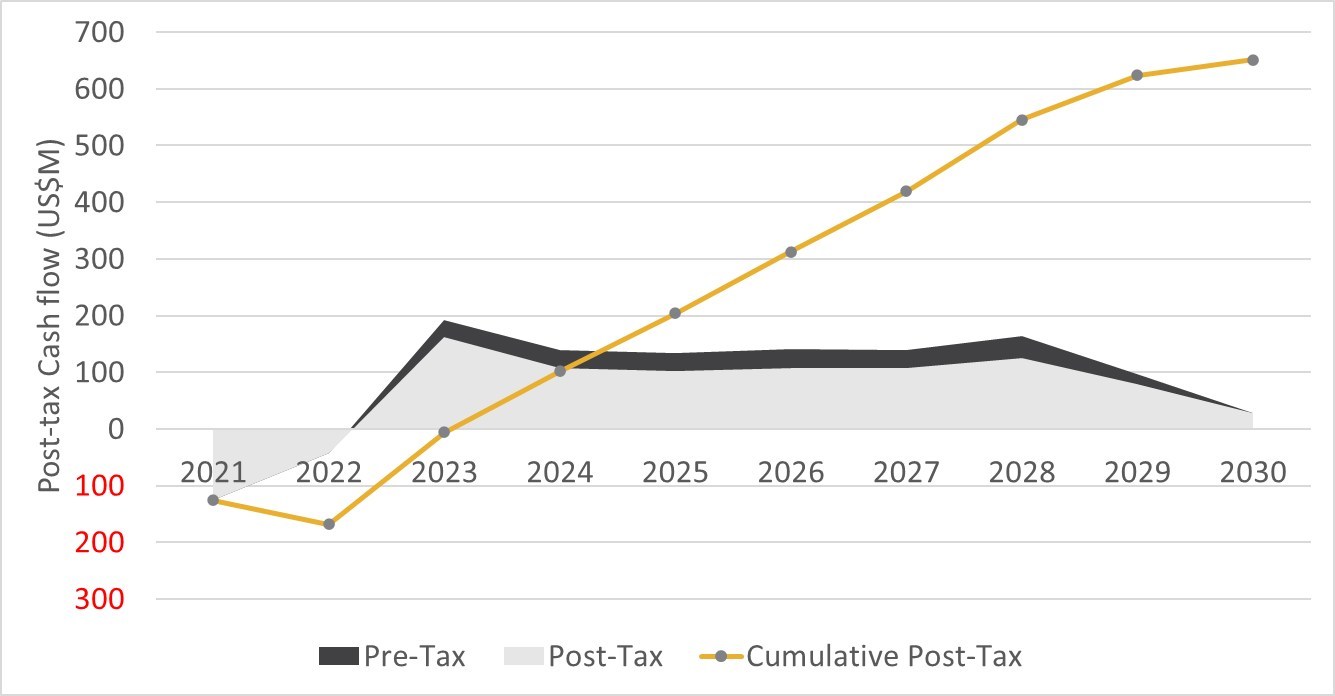

Using base case metal prices of $1,500/oz for gold and $19/oz for silver, Las Chispas generates a post-tax NPV of US$486 million with a post-tax IRR of 52% and a one-year payback (8.5 year mine life) at a 1,250 tonne per day throughput.

|

Downside Case (PEA Prices) |

Base Case |

Upside Case

(Spot Price -

Effective Date) |

|

Metal Prices |

| Gold ($/oz) |

$1,269 |

$1,500 |

$1,946 |

| Silver ($/oz) |

$16.68 |

$19.00 |

$27.36 |

|

Economics |

| Post-Tax NPV (5%, $ M) |

$370.4 |

$486.3 |

$802.5 |

| Post-Tax IRR |

42% |

52% |

74% |

| Undiscounted LOM Free Cash Flow ($ M) |

$510.7 |

$656.4 |

$1,054 |

| Payback period in years |

1.2 |

1.0 |

0.7 |

SilverCrest CEO, N. Eric Fier, commented:

“We are thrilled to have completed a robust Feasibility Study within five years of drilling the first hole at Las Chispas. The Feasibility Study confirms what we have believed for a while, that Las Chispas is economic as a stand-alone operation. It is important to note that the Feasibility Study is just a snapshot in time. We are already working hard to increase our high-grade reserves while simultaneously constructing the mine and process plant. We are excited about the extensive opportunities that remain to grow and optimize Las Chispas. We are greatly appreciative of our employees, partners in the community, contractors and our shareholders, who together have supported us to achieve this important milestone safely, quickly and in a very capital efficient manner. While there is a lot of hard work ahead of us, we look forward to making the shift to production and cash flow which we expect will finance our continued growth.”

The highlight factor for Las Chispas is its high-grade ore. The updated resource estimate includes:

- 107 million Indicated silver equivalent (AgEq) ounces in 2.66 million tonnes grading 6.82 grams per tonne (g/t) gold and 659 g/t silver; plus

-

29.7 million Inferred AgEq ounces in 1.24 million tonnes grading 4.35 g/t gold and 367 g/t silver; for a total of

-

136 million AgEq ounces.

Also highly relevant in the study are the Mineral Reserve estimates which reveal the project to be economically viable:

- Total Proven and Probable Reserves at Las Chispas now stand at 3.35 million tonnes grading 4.81 g/t; and gold;

-

461 g/t silver (879 g/t AgEq); for

-

94.7 million oz AgEq.

| Classification |

Tonnes |

Grade |

Contained Metal |

| (k) |

Au

(gpt) |

Ag

(gpt) |

AgEq

(gpt) |

Au

(koz) |

Ag

(Moz) |

AgEq

(Moz) |

| Total |

Proven |

336.5 |

6.21 |

552 |

1,091 |

67.1 |

6.0 |

11.8 |

| Probable |

3,014.7 |

4.65 |

451 |

855 |

451.0 |

43.7 |

82.9 |

| Proven + Probable |

3,351.2 |

4.81 |

461 |

879 |

518.1 |

49.7 |

94.7 |

Capex came in higher at $137 million versus the PEA number of $100 million due primarily to higher spending on underground access and a beefed up mill circuit (1,250 tonnes per day with capacity for 1,750 tpd) to deal with high contained clays in the ore.

Other main positives are increases in both the diluted grade and metallurgical recoveries.

The life of mine (LOM) diluted grade increased 23% from 714 g/t AgEq in the PEA mine plan to 879 g/t AgEq in the Feasibility Study.

Such a grade increase is not only impressive but also quite rare for deposits of this type. Typically, in underground mining [as you move into feasibility], you’ll see a slight decrease in average grade as more stringent dilution factors are applied with infill drilling smoothing out the higher grade areas.

Thus, the sharp 23% grade increase at Las Chispas is a testament to the particularly high-grade mineralization of the main Babicanora Zone coupled with the overall exceptional nature of the deposit.

The study produced solid improvements in metallurgy as well. Gold recoveries increased to 97.6% from 94.4% with silver recoveries increasing to 94.3% from 89.9% as compared to the PEA.

To sum up the 2021 Feasibility Study, the numbers are as good or better than what was produced in the PEA, which is a nice surprise and indicative of the significant grade increase.

The end result is an increase in LOM annual production from 9.6 million oz AgEq to 12.35 million oz AgEq.

The increased grade also allows SilverCrest to improve upon the life of mine AISC (All-in Sustaining Cost) to $7.07/oz AgEq from the PEA estimate of $7.57/oz AgEq.

And remember, silver is currently trading at almost 4X that level above $27 per ounce and appears on track to move even higher over the coming quarters.

Overall, the improvements from the PEA to the FS are considerable and place Las Chispas firmly in the lowest quartile for silver production costs.

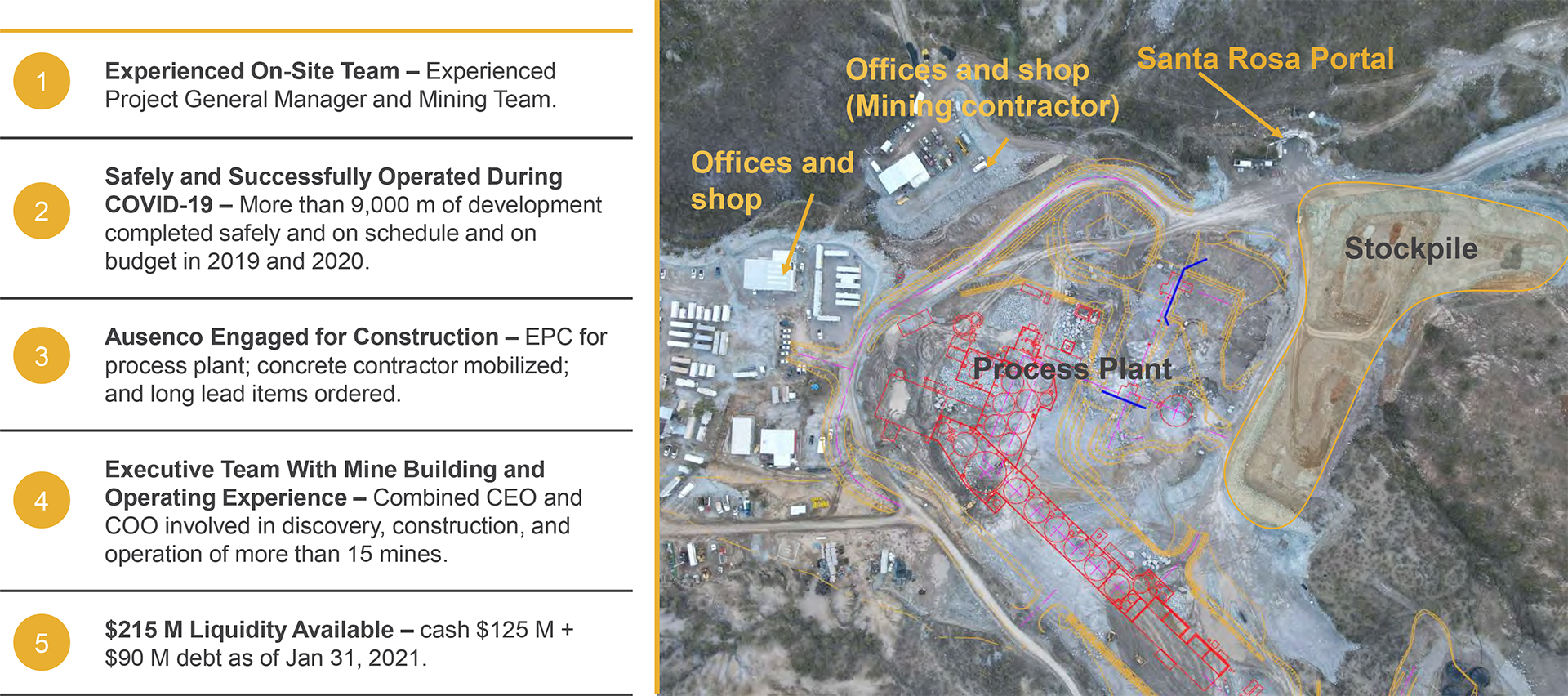

SilverCrest has announced its decision to build the Las Chispas mine – which is fully financed and permitted – with production slated to commence in Q2 2022.

Ready to Build

That’s pretty fast and, again, is a testament to the SilverCrest team which has a history of coming in on-time and under budget throughout the project’s timeline.

The primary remaining upside at Las Chispas lies in resource expansion drilling wherein SilverCrest has been able to hit on approximately 70% of its drill holes to-date via a finding-cost-per-ounce of just C$0.70 AgEq.

Hence, the prospects of SilverCrest increasing reserves through further exploration of the primary vein structures – as well as exploration of numerous undrilled vein structures – on the property remains high.

That also means the odds are very good that, ultimately, the mine life is extended with average production volumes increasing as the mine is developed.

The company is also highly committed to minimizing the environmental impact of the Las Chispas project with an unwavering focus on sound ESG policy with the finalization of its ESG Strategy Framework and with an ESG governance structure being established.

Environmental Focus

For speculators, the production decision moves SilverCrest out of the precarious “development stage” into the more predictable “pre-production” stage where share prices of companies with excellent projects like Las Chispas oftentimes double in share value.

Nevertheless, that could take some time for SilverCrest since traders started pricing in a production scenario for Las Chispas some time ago.

Yet, a substantial rise in share value could very well develop assuming we’re able to get silver prices back on a sustained upward trajectory to above $30 an ounce coupled with additional high-grade intercepts from 2021 drilling at Las Chispas.

Thus far, 45 veins have been identified with only 21 having had sufficient drilling to support at least an Inferred Mineral Resource estimate — and, thus, only those initial 21 are included in the current Feasibility Study.

The company intends to target Mineral Resource additions from those remaining veins while evaluating the significant potential to identify additional veins through continued surface exploration and drilling programs.

Surface exploration and initial drill-testing has identified an additional ~30 km of potential vein strike length to explore with the Mineral Resource currently representing approximately 18 km of vein strike length.

Several of the priority exploration opportunities announced for 2021 are within, or close to, the proposed footprint of the underground development. Hence, with successful exploration and potential Mineral Reserve conversion, these opportunities could allow for optimization of LOM, LOM grade, and ramp-up profiles.

Importantly, SilverCrest is well-funded to accomplish its near-term goals with the closing of a US$138 million bought deal financing with the bulk of those funds to be allocated toward:

- Expansion of the Las Chispas resources and reserves through drilling

-

Optimization of the mine and processing plant design

-

Exploration of regional targets

SilverCrest Metals: Proven Leadership

Remember, when it comes to astute resource stock speculation, Rick Rule says to focus on “serially successful” people and on deposits that have the ability to become large-scale operations.

“The serially successful people win again and again and again!” — Rick Rule

Led by N. Eric Fier, SilverCrest Metals is run by a highly successful team of industry professionals.

And, the company’s Las Chispas Silver-Gold Project – the 3rd highest-grade primary silver deposit in the world – has the potential to be a bona fide game changer.

BUILDING ON A TRACK RECORD OF SUCCESS

Experienced Team With A Proven Track Record

- N. Eric Fier, CEO – Built six mines and discovered over 1B ounces of Silver

- Pierre Beaudoin, COO – Designed and built Canada’s largest gold mine

|

Impressive “Base Case” Potential Economics (Feb 2021 Feasibility Study)

- Post-tax NPV of US$486 million with a post-tax IRR of 52% and a one-year payback (8.5 year mine life) at a 1,250 tonne per day throughput

- Feasibility Study includes only 21 of 45 veins and excludes potential to depth and newly acquired El Picacho

|

Strong Balance Sheet / Modest Capital Requirements Remain

- Cash and available debt of US$215 million as of 31 January 2021

- Potential for low capital intensity

|

Drilling Leverage

- 8 drill rigs turning – 20 km of untested strike length, 40% of drill hits above 350 gpt AgEq

- 552 intercepts over 1,000 gpt AgEq 143 over 5,000 gpt AgEq. 63 over 10,000 gpt AgEq

|

Efficient Use of Shareholder Capital

- ~ US$10 of EV created for every US$1 invested. US$138M spent as of Oct 30, 2020

- Finding cost per AgEq oz ~ US$0.70

|

Progressing Towards a Re-Rate

- Aggressive drill program ongoing, major permits in hand, strong social license, modest capital needs

- Growing high-grade Ag-Au stockpile on surface

|

|

SilverCrest Metals is headed by CEO, N. Eric Fier — a Certified Professional Geologist and Engineer with over 30 years of experience in the international mining industry including exploration, acquisition, development, and production of numerous mining projects in Mexico, Central America, Chile, Brazil and Peru.

N. Eric Fier

CEO & Director

30+ years experience,

Geological & Mining Engineer

Eric has in-depth knowledge of project evaluation and management, reserve estimation and economic analysis, construction, as well as operations management. Mr. Fier previously worked as Chief Geologist with Pegasus Gold, Senior Engineer & Manager with Newmont Mining, and Project Manager with Eldorado Gold.

Prior to the formation of SilverCrest Metals, Eric was a co-founder and COO of SilverCrest Mines Inc., which was acquired by First Majestic Silver in 2015. He was largely responsible for the successful implementation of a systematic and responsible “phased approach” business model that built the Santa Elena project into a successful and profitable mine.

Pierre Beaudoin

Chief Operating Officer

30+ years experience,

Operating & Project

Development and

Mineral Processing

Pierre Beaudoin, COO — is a mineral processing professional with over 30 years of international operating and project development experience. Prior to joining SilverCrest Metals, Mr. Beaudoin held the position of Senior VP of Capital Projects with Detour Gold where he led the design and construction of the Detour Lake Mine.

Prior to that experience, Pierre spent 16 years with Barrick Gold where he held management positions at the processing plants of Barrick operations in Canada and Western Australia and led study teams in Tanzania, Alaska, and Chile.

Recent Las Chispas Drilling

In January 2021, SilverCrest released assays for more than 100 infill holes from the Babicanora target — producing the following highlights:

- 2.4 metres at 38.06 grams per tonne gold (g/t Au) and 4,213.8 grams per tonne silver (g/t Ag), or 7,068 grams per tonne silver equivalent (g/t AgEq);

- 2.0 metres, 96.53 g/t Au and 2,898.9 g/t Ag, or 10,139 g/t AgEq;

- 0.4 metres 90.57 g/t Au and 75.4 g/t Ag, or 6,868 g/t AgEq; and

- 1.8 metres, 72.22 g/t Au and 160.8 g/t Ag, or 5,577 g/t AgEq

SilverCrest CEO, N. Eric Fier, commented:

“These Babicanora in-fill drill results show that we generally 'moved ounces around within a confined area' for these previously defined four veins, resulting in less continuous mineralized footprints but with higher grades, which is typical of late-stage exploration drilling. The reduced mineralized footprint in the Babi FW Vein will have minimal impact on total district mineralization. With the benefit of greater drilling density and understanding of lithologic and structural controls, we now have a higher confidence in our ability to identify additional high-grade mineralization for all veins in the Las Chispas district. The feasibility resource estimation will include 21 veins (5 veins containing a majority of the high-grade mineralization) of the known 45 veins. The best opportunities for resource expansion for the upcoming Feasibility Study are the Babi Vista Vein and Babi Vista Splay Vein, which were both discovered after the PEA release. We look forward to the announcement of the Las Chispas Feasibility Study later this month, which will include a Resource update and our maiden Reserve Estimate.”

As noted, SilverCrest currently has 8 rigs spinning at Las Chispas with the aim of expanding zones on the more recently discovered veins, which means the potential exists for additional resource expansion by way of the drill bit.

All in all, the veins have been determined to be a bit narrower on average than what was assumed in the previously announced PEA… yet, the average grade has come in 23% higher in the Feasibility Study — which essentially evens things out.

In Summary

Remember, in an incipient precious metals bull market, Rick Rule is fond of saying…

Gold moves first… Silver moves second but moves the furthest!

We went looking for The New Standard in Silver — and SilverCrest Metals certainly checks all of the pertinent boxes.

With cash and available debt of US$215 million [at 31 January 2021] and 135.3 million shares outstanding on a fully-diluted basis, SilverCrest Metals is well-positioned to advance its Las Chispas Project in 2021 and beyond to the benefit of SIL / SILV shareholders.

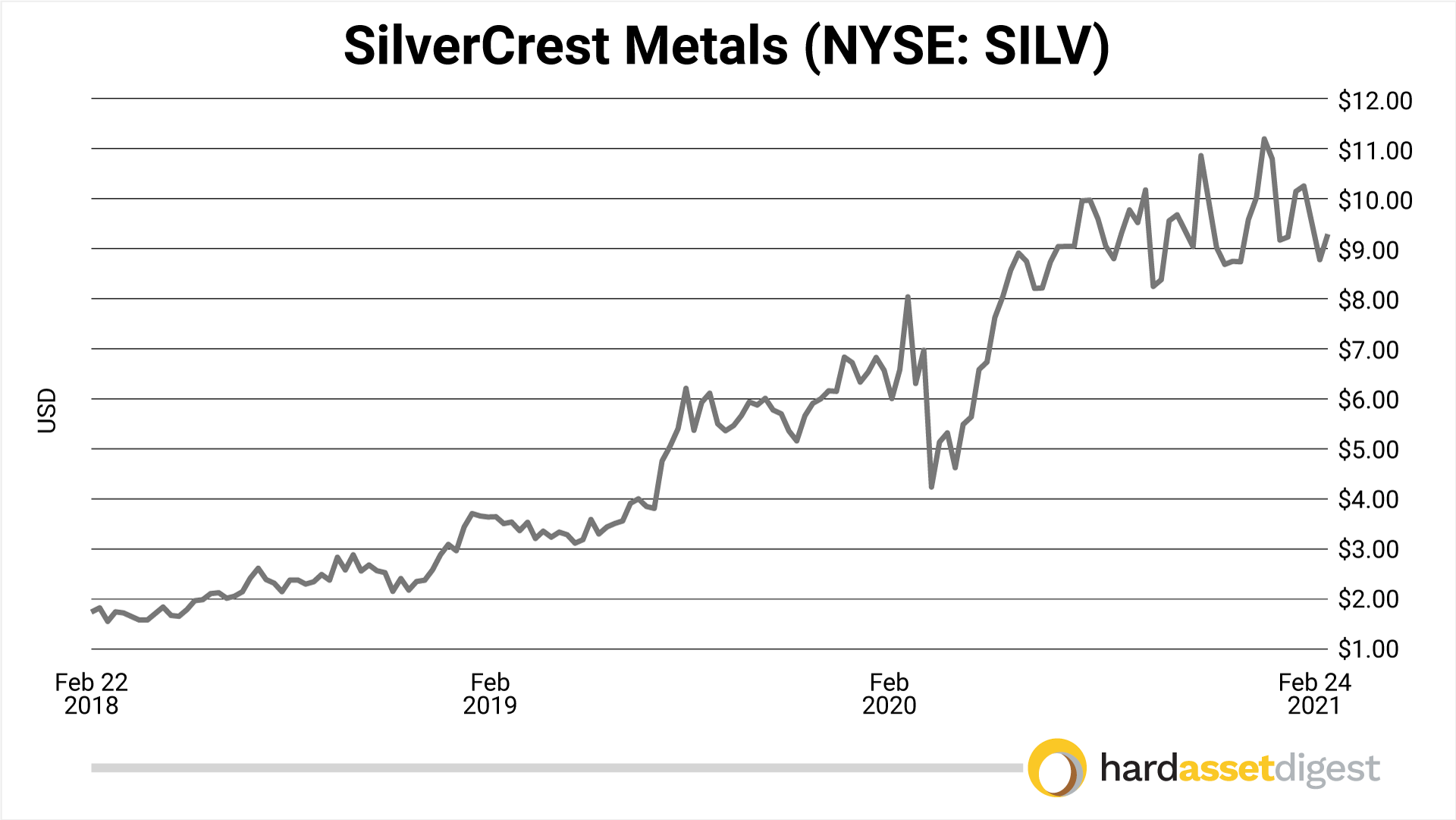

The company’s management team – led by N. Eric Fier and Pierre Beaudoin – has a proven record of delivering value to shareholders as demonstrated by the company’s 3-year price-chart below.

Rick Rule says…

Don't pay attention to the small mine narrative...

Small mines make small money but have big risks!

The company’s newly released Feasibility Study outlines an average production profile of 12.4 million oz AgEq over the seven full years of mine life (with years 2022 and 2030 as "partial years of production" due to ramp-up and ounces produced at the end of the mine life).

Average annual production over the full LOM is 10.0 million oz AgEq.

And as mentioned, the project is considered the 3rd highest-grade primary silver deposit on the planet… not to mention the fact that the current resource estimation includes just 21 of the known 45 veins.

Translation: SilverCrest’s Las Chispas Project offers resource stock speculators size, scale, and grade.

Naturally, there are numerous risks and potential pitfalls inherent in the resource stock arena, and SilverCrest Metals is not immune to such risks; always conduct your own due diligence.

Naturally, there are numerous risks and potential pitfalls inherent in the resource stock arena, and SilverCrest Metals is not immune to such risks; always conduct your own due diligence.

To learn more about SilverCrest Metals (NYSE-American: SILV)(TSX: SIL) be sure to:

We have four reports now available highlighting several opportunities for investment in the resource space.

Opportunities discussed in those reports and past issues include:

January 2021 Issue: Opportunities Mentioned by Nick Hodge

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Roxgold (TSX: ROXG)(OTC: ROGFF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Generation Mining (TSX: GENM)(OTC: GENMF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

December 2020 Issue: Opportunities Mentioned by Van Simmons

- 19th century: Liberty Seated half dimes, dimes, quarters, half dollars, silver dollars

- 20th century: Buffalo Nickels, Mercury Dimes, Walking Liberty Halves, Standing Liberty Quarters

- Barber dimes, quarters, and halves

- Common date: $10 Liberties, $5 Liberties

- 19th century quarter sets: Draped Bust Quarter, Capped Bust Quarter, Liberty Seated Quarter, Barber Quarter

- 20th century coin sets: Mercury Dimes, Walking Liberty Halves, Buffalo Nickels, Standing Liberty Quarters; other various: 8-piece sets, 10-piece sets, 12-piece sets

November 2020 Issue: Opportunities Mentioned by Gerardo Del Real

- Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF)

- Chakana Copper (TSX-V: PERU)(OTC: CHKKF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX-V:RVG)(OTC: RVLGF)

- Integra Resources (TSX-V: ITR)(NYSE-American: ITRG)

- Liberty Gold (TSX: LGD)(OTC: LGDTF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Energy Fuels (TSX: EFR)(NYSE-American: UUUU)

October 2020 Issue: Opportunities Mentioned by Joe Mazumdar

- Pan American Silver (TSX: PAAS)(Nasdaq: PAAS)

- Liberty Gold Corp. (TSX: LGD)(OTC: LGDTF)

- HighGold Mining (TSX.V: HIGH)(OTC: HGGOF)

- Bluestone Resources (TSV.V: BSR)(OTC: BBSRF)

- Trilogy Metals (TSX: TMQ)(NYSE-Amex: TMQ)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Blackstone Minerals (ASX: BSX)

- Clean Air Metals (TSX.V: AIR)

August 2020 Issue: Opportunities Mentioned by Jeff Phillips

- Lynas Corp. (OTC: LYSCF)

- MP Materials: Private Company

- Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX.V: RVG)(OTC: RVLGF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Chakana Copper (TSX.V: PERU)(OTC: CHKKF)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

May 2020 Issue: Opportunities Mentioned by Brien Lundin

- Great Bear Resources (TSX.V: GBR)(OTC: GTBDF)

- Energy Fuels Inc.(NYSE American: UUUU)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- First Mining Gold (TSX: FF)(OTC: FFMGF)

- Libero Copper & Gold (TSX.V: LBC)(OTC: LBCMF)

- GR Silver Mining (TSX.V: GRSL)(OTC: GRSLF)

April 2020 Issue: Opportunities Mentioned by Nick Hodge

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

February 2020 Issue: Opportunities Mentioned by James Dines

- Agnico Eagle Mines (TSX: AEM)(NYSE: AEM)

- Kirkland Lake Gold (TSX: KL) (NYSE: KL)

- Pan American Silver (TSX: PAAS) (NASDAQ: PAAS)

- Lynas Corp. (OTC: LYSCF)

- Canopy Growth (TSX: WEED) (NYSE: CGC)

- OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI)

Make sure you never miss an update or issue from Hard Asset Digest by adding editor@hardassetdigest.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here.

Hard Asset Digest, Copyright © 2020, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at editor@hardassetdigest.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Hard Asset Digest does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.