Hard Asset Digest April 2021

April 2021

Returning this month is none other than Dr. Mark Skousen, editor-in-chief of Forecasts & Strategies — a popular, award-winning investment newsletter currently celebrating its 41st year in publication.

Dr. Skousen is also the founder and producer of FreedomFest (www.freedomfest.com) – the world’s largest gathering of free minds!

This year’s event is being held at a very special location, which Mark and I discuss in detail in the upcoming interview.

Click here to jump straight to the interview.

From a former analyst to the CIA to authoring more than 25 books — Mark is a true Renaissance man whose bestsellers include The Making of Modern Economics, The Big Three in Economics, and The Maxims of Wall Street (www.skousenbooks.com).

You’ve likely seen Mr. Skousen countless times as a regular contributor to news and business programs on networks such as CNBC (Larry Kudlow, Rick Santelli), ABC, CNN, Fox News, and C-SPAN.

Dr. Skousen earned his Ph.D. in monetary economics from George Washington University in 1977 and has taught economics and finance at Columbia Business School, Barnard College, Mercy College, Rollins College, and Chapman University — where he’s currently a Presidential Fellow. Last year, he received the “My Favorite Professor” award at Chapman.

Mark has been a columnist for Forbes magazine and has written articles for The Wall Street Journal, Reason, Human Events, the Daily Caller, and The Journal of Economic Perspectives.

Few in American academia have had a greater impact on economics and investing than Dr. Skousen, and, in 2018, in honor of his work in economics and finance, Steve Forbes presented him with the Triple Crown in Economics.

Heralded as one of the 20 Most Influential Living Economists — it’s been a personal thrill of mine getting to know Dr. Skousen over the years, and I’m excited to bring you this exclusive interview.

Yet, before we get to that, I have a Special Report to share with you called The Book of Levi: Picks & Shovels for the New Gold Bull Market.

The Book of Levi

Picks & Shovels for the New Gold Bull Market

While proper diversification is key to any well-balanced portfolio, it’s also important to have proper diversification within one’s resource-specific investments with a focus on buying the best companies run by the best management teams.

We think the stock featured in this report is an excellent way to get quality exposure to all aspects of the precious metals sector via a team that’s been proving its weight in gold for decades.

It's a play that offers investors access to physical commodities through its tax advantage trust, which holds over $6 billion worth of precious metals.

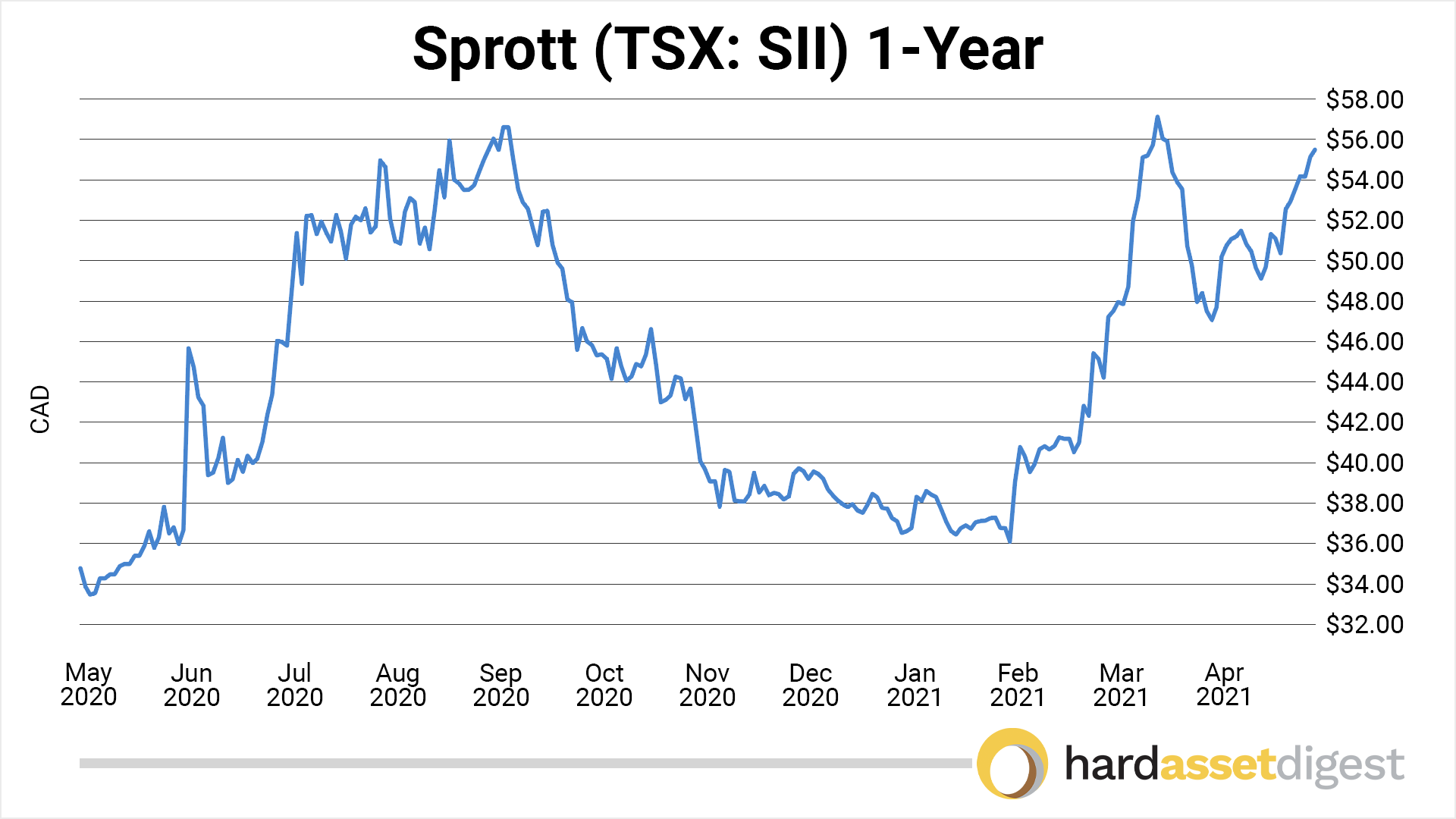

The company is Sprott Inc. (TSX: SII)(NYSE: SII).

Sprott Inc. is an alternative asset manager and global leader in precious metals investments offering physical bullion trusts, managed equities, mining ETFs, as well as private equity and debt strategies.

At the same time, it's the largest secured lender for mine construction in North America. And if that weren't enough, it also manages in excess of $2 billion worth of precious metals equities.

Sprott covers all branches of the resource business — a true picks-and-shovels play — and pays a quarterly dividend of US$0.25 per common share.

Here’s how Sprott bills itself:

Sprott is a global asset manager providing investors with access to highly-differentiated precious metals strategies.

We are specialists. Our in-depth knowledge, experience and relationships separate us from the generalists. Sprott’s specialized investment products include innovative physical bullion trusts, managed equities, mining ETFs, as well as private equity and debt strategies.

We also partner with natural resource companies to help meet their capital needs through our brokerage and resource lending activities. Sprott is a global asset manager with offices in Toronto, New York and London. Sprott’s common shares are listed on the New York Stock Exchange and the Toronto Stock Exchange under the symbol SII.

Sprott today serves over 200,000 global clients and has approximately $17.4 billion in assets under management as of December 31, 2020.

Founded nearly 40 years ago by Eric Sprott, the firm has been a backer of hard asset investments for decades and has now grown into a global powerhouse touching all facets of the industry — from asset management and brokerage services to mining finance, bullion funds, and digital gold.

The Sprott Advantage

By selling dry goods and, later, riveted jeans to the small general stores supplying the gold rush in San Francisco — Levi Strauss was able to make a fortune without prospecting or mining.

Similarly, Sprott Inc. is in a position to build shareholder value in the current resource bull market without having to actually explore, develop, or produce any mining projects.

In essence, it’s a company that provides goods and services for mining companies and investors.

Here’s how Sprott breaks down its business:

- Asset Management (Exchange-listed, Actively-managed)

-

Resource Financing (Sprott Resource Lending)

-

Wealth Management (Sprott Capital Partners, Sprott USA)

Sprott’s exchange-listed funds and trusts include:

- Sprott Physical Gold And Silver Trust

-

Sprott Physical Gold Trust

-

Sprott Physical Silver Trust

-

Sprott Physical Platinum And Palladium Trust

-

Sprott Gold Miners ETF

-

Sprott Junior Gold Miners ETF

-

Sprott Focus Trust

-

Sprott Gold Equity Fund

-

Sprott Hathaway Special Situations Strategy

John Hathaway, CFA

Managing Director,

Senior Portfolio Manager

Those last two funds, by the way, are managed by John Hathaway, who came to Sprott in 2020 after 23 years managing the Tocqueville Gold Fund.

Prior to that, he was with Hudson Capital Advisors, Oak Hall Advisors, and David J. Green & Company.

You can learn more about the company’s impressive leadership team here.

On February 26, 2021, Sprott Inc. released its Q4 2020 and full-year 2020 results.

Highlights include:

- Record $17.4 billion in AUM (Assets Under Management) in 2020, an 88% increase over the prior year.

-

Net income of $6.7 million in Q4 2020, up $5.3 million from the prior period; $27 million on a full-year basis, up $16.8 million.

-

Adjusted base EBITDA of $14.8 million in Q4 2020, up $7.3 million or 98% from the prior period; $44.2 million on a full-year basis, up $15.2 million or 52%.

-

Net fees of $26.2 million in Q4 2020, up $14.8 million from the prior period; $76.3 million on a full-year basis, up $34.3 million or 81%.

-

Gain on investments of $5.1 million on a full-year basis, up $6.2 million.

-

Successfully negotiated an amendment to the original terms of the Tocqueville Asset Management gold strategies purchase agreement, enabling the company to retain the full benefits of any additional increase in AUM expected over 2021.

Sprott Inc. has approximately 25.7 million shares outstanding for a current market cap of around C$1.3 billion.

With a hand in nearly every corner of the mining business, Sprott Inc. offers a great picks-and-shovels play in an emerging resource bull market.

To learn more about what Sprott does, how to invest in their products, or how to become a client… check out the Sprott Corporate website and the Sprott Corporate Brochure.

I hope you’ve enjoyed our Special Report. A quick word on gold: April has seen gold firm up from US$1,700 to about US$1,775 per ounce as the pace of federal spending continues to accelerate.

That includes the Biden administration’s new American Families Plan, which proposes another US$1.8 trillion in spending on child care, education, and paid leave.

That’s on top of $trillions more in stimulus and proposed infrastructure spending — which, altogether, arrives at a gargantuan price tag of about US$6 trillion… and we haven’t even reached the mid-point of 2021!

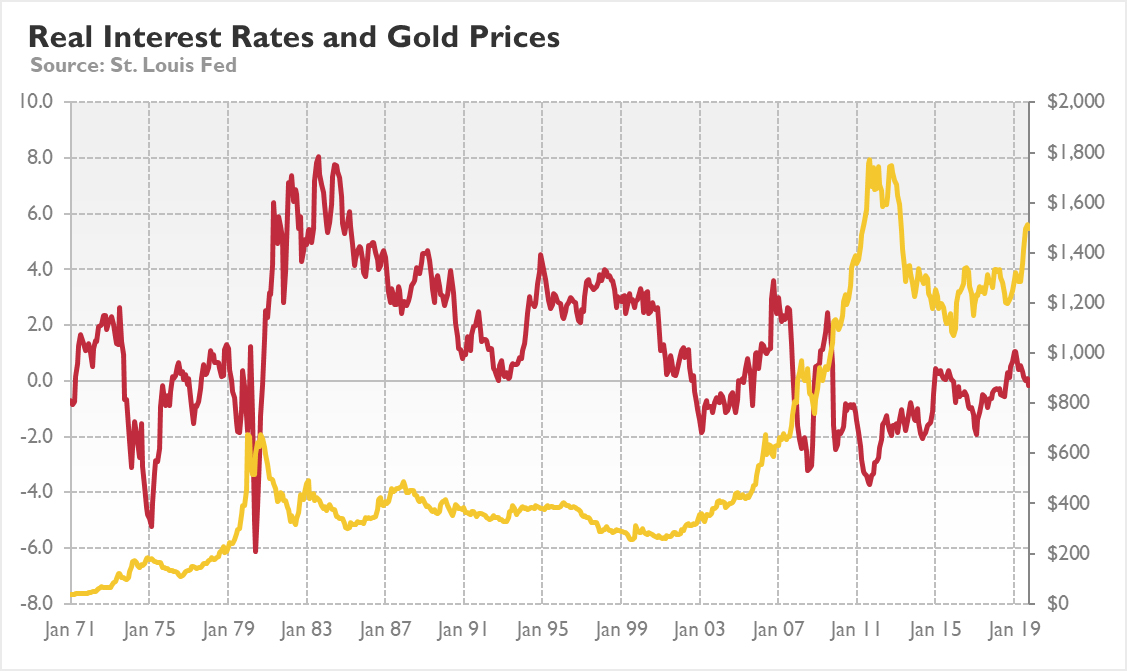

In short that means — because of the towering size of the federal debt — nominal interest rates must remain well below the rate of inflation into perpetuity.

That in-turn means negative real rates into perpetuity, which is highly bullish for gold and silver.

Remember, the biggest booms in the gold market have historically occurred in negative real rates environments… first during the late-1970s when both nominal interest rates and inflation rates were high and later in the 2000s when both nominal interest rates and inflation rates were low.

Today, we’re looking at a double whammy of sorts with an expected rise in inflation as we navigate our way out of the pandemic combined with historically low nominal interest rates.

It’s a recipe for driving real interest rates deeper into negative territory — which, again, is very bullish for the yellow metal. Plus we can expect silver to follow gold’s lead and eventually take the reins of the precious metals bull market to even greater heights.

It’s truly an exciting time to be a speculator in the resource space, and I’m thrilled to be able to bring you insights and investing ideas from some of the brightest minds in the sector.

So let’s get to it with my exclusive interview with Dr. Mark Skousen of Forecasts & Strategies. Enjoy!

Yours In Profits,

Mike Fagan, editor

Mike Fagan, editor

Hard Asset Digest

Exclusive Interview with Dr. Mark Skousen

Editor-In-Chief, Forecasts & Strategies

Mike Fagan: Dr. Skousen, thank you so much for coming back on! I always jump at the opportunity to talk with you, and I honestly can’t wait to get your thoughts on the state of the economy — especially in the current climate of untethered deficit spending.

So let’s start, if you will, with your sort of 10,000-foot view of where we sit now as we slowly make our way out of the pandemic to where we’re heading in the next, say, 12 to 18 months.

Dr. Mark Skousen: Mike, happy to be back on! The markets and the economy have looked strong so far — even under a new administration. Currently, I'm still 100% invested in stocks, technology, and commodities. But we are sowing the seeds of a bear market with monstrous deficit spending and the money supply rising sharply.

More inflation is headed our way, which is bullish for inflation hedges such as gold, silver, real estate, and some digital currencies.

My biggest fear is the radical proposals coming out of the Biden-Harris administration: wasteful government spending, sharply higher taxes on the wealthy and investors, and more regulation. It's discouraging to see all of the positive policies of lower taxes and deregulation gradually disappearing.

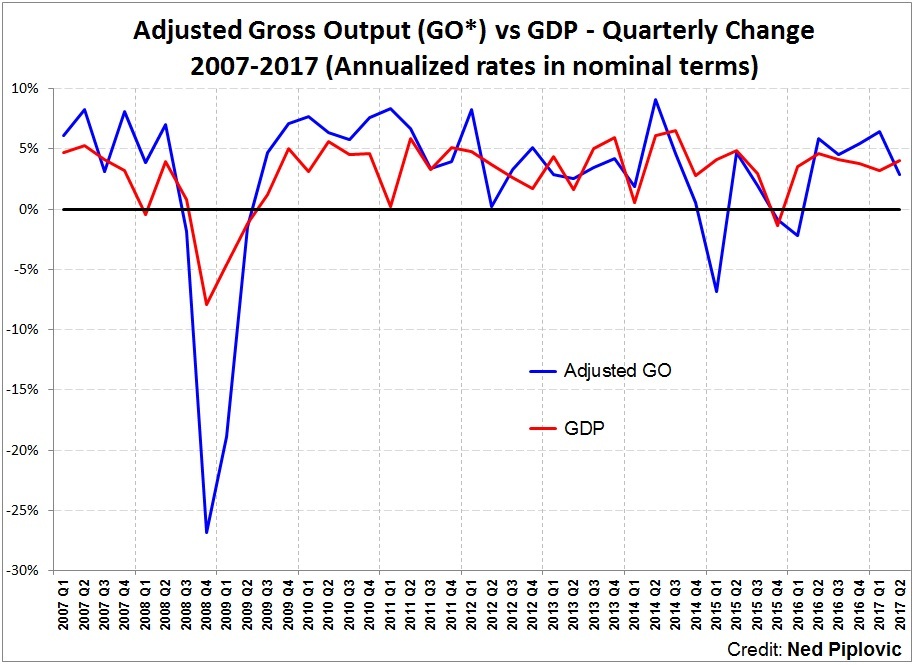

Mike Fagan: Agreed and yet another swipe at people who put in the hard work to achieve financial success in this country. There’s also been a lot of talk in economic circles of late in regard to gross output versus GDP. Gross output, which takes into account all stages of production, came in at about $46 trillion last year — or more than double that of GDP.

So applying those metrics to 2021, do you see the robust boost in gross output as a leading indicator of increased consumption and increased business spending or is it more reflective of the unprecedented levels of government spending we’re seeing?

Dr. Mark Skousen: Mike, I'm glad you brought up gross output (GO) — the new macro statistic I’ve been advocating for years and which is now being reported quarterly by the federal government (U.S. Bureau of Economic Analysis or “BEA”) along with GDP.

Think of GO as the "top line" in national income accounting and GDP as the "bottom line." GO measures spending at all stages of production while GDP measures just final or finished goods and services. GO is more than double GDP, like you said, and much more volatile because it includes the supply chain, or B2B spending.

GO shows two things: One, business spending is much bigger than consumer spending; contrary to what the media says, consumption is not the largest sector of the economy and does not drive the economy. Actually, consumer spending is the effect, not the cause of prosperity (Say's law). And two, GO is a leading indicator of what GDP is going to do in the future. Right now, GO is growing faster than GDP, which is a good sign.

Government spending is rising sharply but it's no substitute for the private production of goods and services in the US and around the world. You can't just print your way to prosperity. The longer the government shuts down the economy, the greater the risk of stagflation — a recession with higher prices like we saw in the 1970s.

I issue a quarterly press release when the new GO data comes out. For the latest press release and more academic papers on GO, your readers can go to www.grossoutput.com.

Mike Fagan: Of course, President Biden is now calling for a $3 trillion infrastructure package with a focus on green tech, which he plans to fund, in part, via massive corporate tax hikes and, of course, trillions more dollars in deficit spending.

One only needs to drive around America to realize we are in dire need of infrastructure improvements. But the big question is… who should pay for it, right? Do you agree, Mark, with the way the federal government is going about infrastructure?

Dr. Mark Skousen: Mike, Biden's infrastructure bill is as phony as a $3 bill!

Only 5% of the $2.9 trillion is going to rebuilding our roads, highways, and bridges. The rest is going to other things such as nursing homes and other vested interests. It's a shame.

Even then, most infrastructure is traditionally financed by private companies and the states — not the federal government. It certainly needs to be done. I've travelled to dozens of countries, and almost all of them have better roads, freeways, airports, bridges, and infrastructures than we do. We should be embarrassed. I just don't think the Feds will do a good job.

Mike Fagan: There’s also growing concern that the Biden administration is going to eliminate the long-term capital gains tax break, which just seems criminal to me.

If that does happen, do you see it as something that could sort of derail the stock market’s performance as people and businesses defer the sale of assets? And what effect do you think that would have on the price of gold?

Dr. Mark Skousen: President Biden just announced that he is going to eliminate the long-term exemption from the capital gains tax, causing the rate to go up to over 43% for anyone earning more than $1 million, plus whatever the tax rate is statewide.

It's a confiscatory disaster and will deter millionaires and entrepreneurs from taking risks in creating new products — the backbone of progress. I can see why Wall Street is nervous about it passing. Let's hope some Democrats have the sense to reject this stupid policy of tax and spend.

I teach the correct theory of taxation in my classes at Chapman University. The "benefit principle" is the only legitimate principle of taxation — known also as the "user pay" concept. Taxation should be linked to the extent that someone or firm benefits from government service. But to impose a tax unrelated to its benefit is inefficient and dangerous.

Keynesian economists and policy makers are oblivious to the "user pay" or "benefit principle," and rely on the phony "ability to pay" concept. They favor a progressive tax on wealthy taxpayers and investors. In the case of the capital gains tax, it distorts investment decisions and where to invest capital.

Hong Kong has the most capital-efficient tax system in the world — zero percent! Under the Hong Kong model, investment capital can easily go to its most efficient use. But with high tax rates, even as little as 10%-15%, it begins to distort the allocation of capital and to lower economic growth.

I can understand a modest 5% capital gains tax to pay for the benefits of government such as establishing a stable, peaceful rule of law. But by what "benefit principle" can a government justify rates of 24% to 43%? It can't!

It's a disgrace that so few citizens understand the sound principles of taxation. I devote a whole chapter to the theories of taxation in chapter 21 of my free-market textbook, "Economic Logic" (available for only $35 at www.skousenbooks.com).

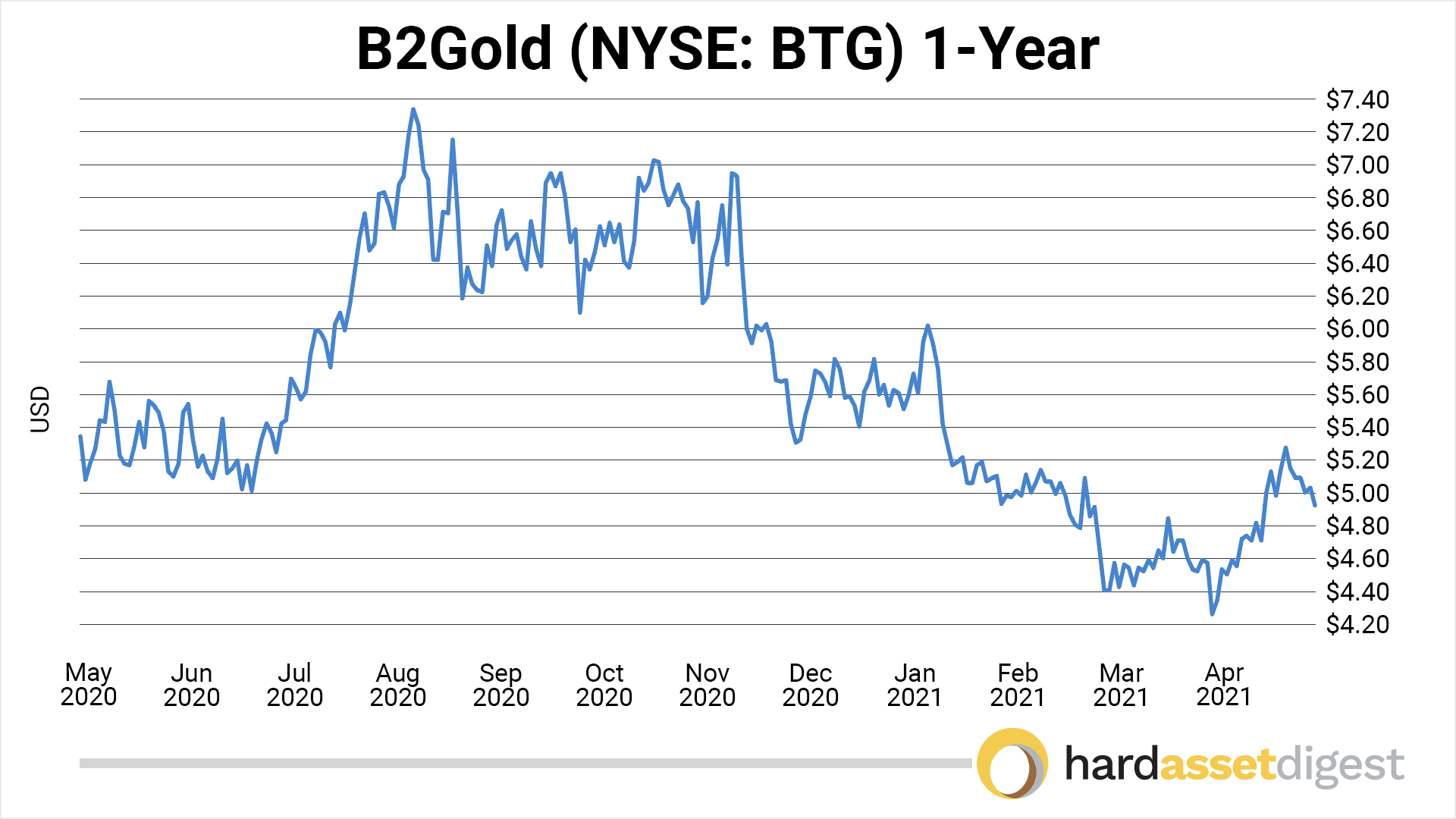

Mike Fagan: Mark, turning to the gold market — in our discussion from June of last year — we talked about Franco-Nevada Corp. (NYSE: FNV)(TSX: FNV) and B2Gold (NYSE: BTG)(TSX: BTO) as a couple of your top gold picks.

Both stocks went on quite a run after we spoke. Of course, all gold stocks sort of took it on the chin from about September of last year to February of this year with the pause in the gold rally.

Yet today, with gold and silver firming back up, both stocks are making solid comebacks and are very close to where they were trading last summer. So I have to ask… are Franco-Nevada and B2Gold buys at current price levels?

Dr. Mark Skousen: Mike, I prefer B2Gold over Franco-Nevada. Franco-Nevada is a great mining finance company but it's still selling for over 80 times earnings and has a pitifully small dividend (less than 1%) for a royalty and streaming company.

Meanwhile, B2Gold is selling for less than 9 times earnings and has a rising dividend yield of over 3% — one of the highest in the mining industry. It is enjoying record revenues, earnings, and dividends. The only reason it's not priced at $7 or $8 today is because of the political/military risks of its mines being located in Africa and the Philippines.

Mike Fagan: Yeah, I really like B2Gold too. I own it and recently recommended it to my Precious Portfolio subscribers. Any other gold/silver stocks you can recommend to my audience?

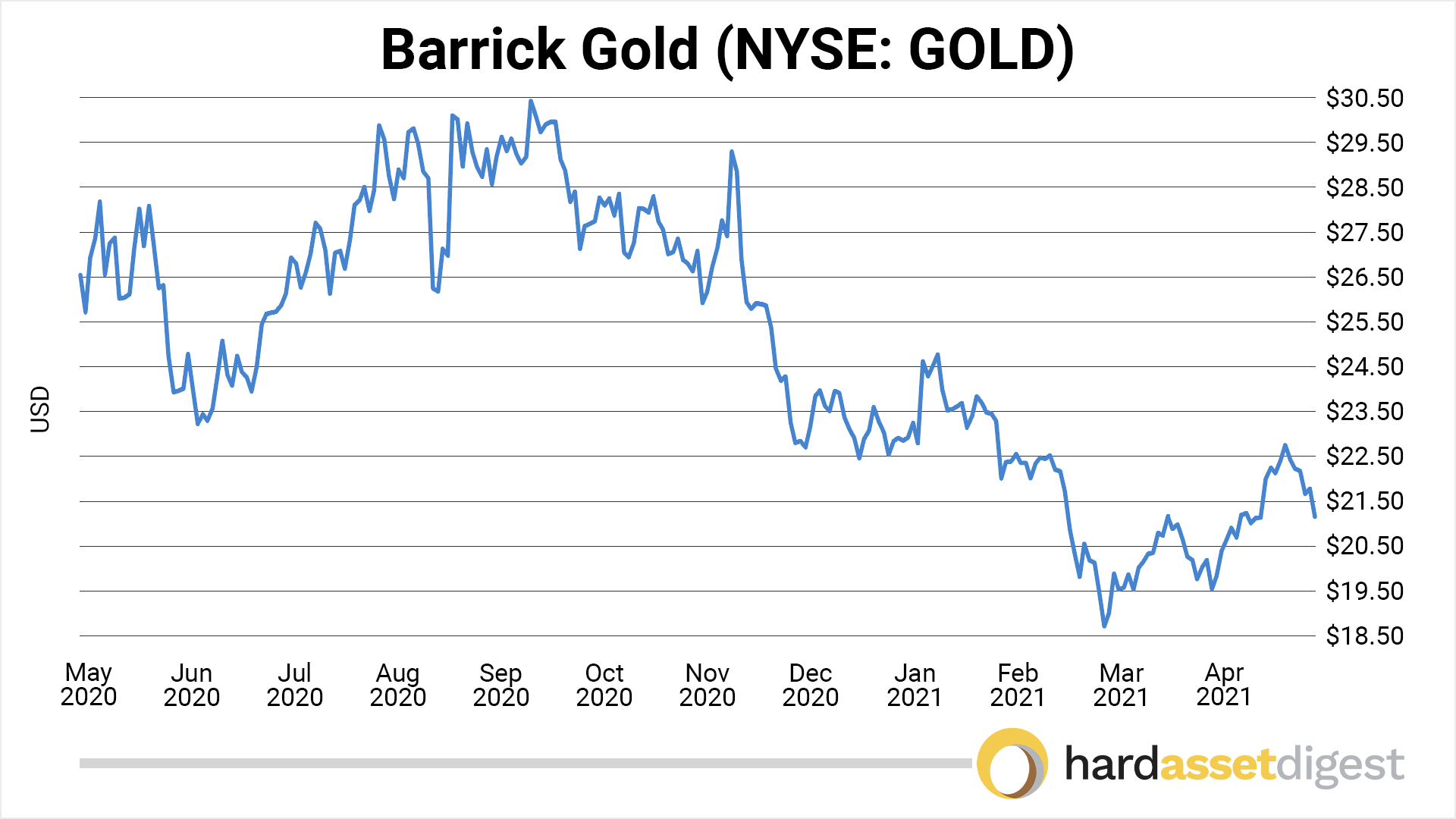

Dr. Mark Skousen: I like Barrick Gold (NYSE: GOLD)(TSX: ABX), which I am recommending in my trading services. It has a decent dividend yield (1.5%) and is selling for 17 times earnings.

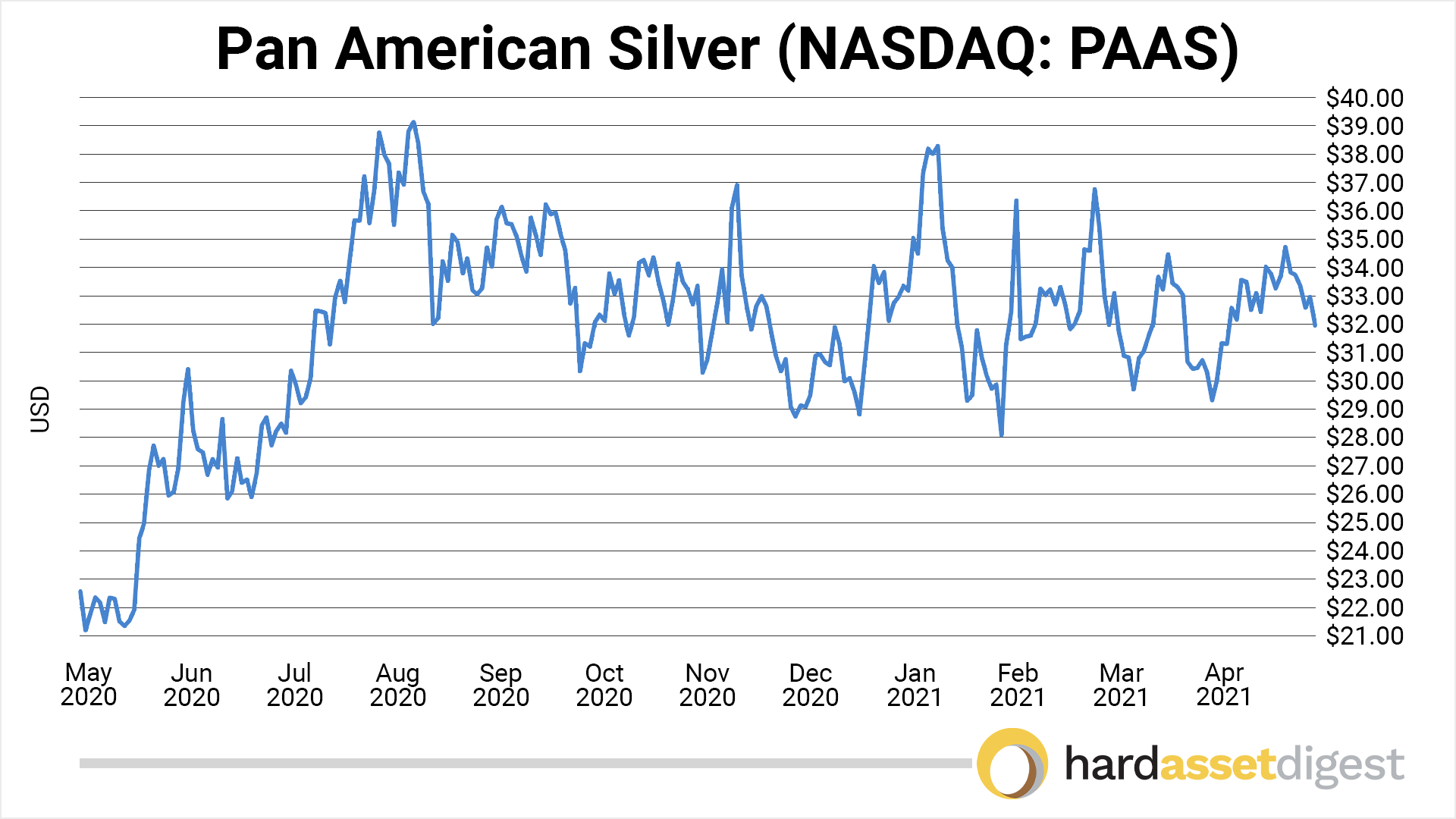

Pan American Silver (NASDAQ: PAAS)(TSX: PAAS) also looks good as a leveraged way to play silver.

In general, gold stocks have been suppressed recently by a strong dollar, higher long-term interest rates, and the rise of Bitcoin as an alternative inflation hedge. But I think, eventually, gold and silver will head much higher. And I recommend buying both gold-silver coins and stocks.

Mike Fagan: Wow, great minds do think alike as I’ve got both stocks in my Precious Portfolio service as well!

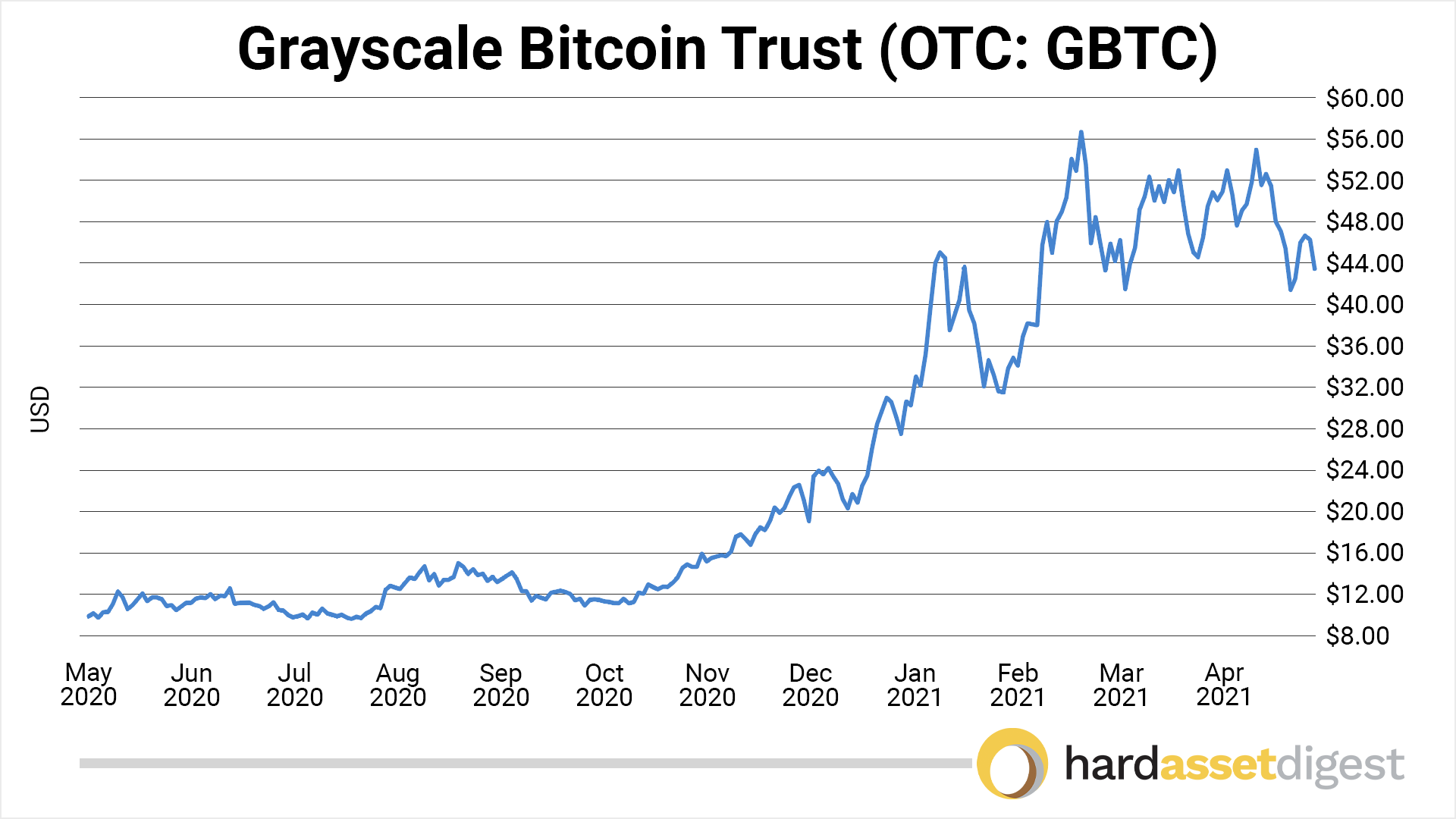

Speaking of Bitcoin, Mark, you’ve been a proponent of digital currencies for some time. And your subscribers have done quite well with your recent recommendation of Grayscale Bitcoin Trust (OTC: GBTC), which has gone from $18 to currently right around $45 per share.

Of course, earlier this month, Bitcoin suffered a flash crash, plunging nearly 14% in less than an hour from just below $60K to $51K. The price has since worked its way back to above $55K.

What’s your take on that episode, and any concern regarding the long-term viability or acceptance of Bitcoin as a currency alternative? I mean, pretty soon you’ll be able to buy a Tesla with Bitcoin — which is something I think not that many people saw coming, right? Yet, at the same time, the federal government certainly wants its pound of flesh!

Dr. Mark Skousen: Mike, I have recommended bitcoin-related investments off and on for the past five years and have made a lot of money in Grayscale Bitcoin Trust — although we sold half of our position after making 200% on our money in three months. Why get greedy!

I feel that digital currencies are a legitimate asset class once all of the hype settles down. The blockchain technology is a huge advance in data storage and record keeping in financial and real estate transactions.

I like investing in Amplify Transformation Data Sharing (NASDAQ: BLOK) — a fund that invests in blockchain companies that will benefit from the blockchain technology.

I don't trust the government at all when it comes to approving a new currency that they can't control. I'm not surprised that authoritarian regimes in India, China, and Turkey are trying to suppress Bitcoin or are creating their own digital currencies. To protect your assets, I recommend investing in both digital currencies and gold/silver.

Mike Fagan: And staying with that theme, Mark, we’ve got this escalating war on personal privacy and this war on wealth — particularly for those of us who work hard to save for our future and for the benefit of our children and grandchildren.

What do you see as the biggest threats we face in terms of our personal liberties and prosperity — and what steps can we take to mitigate those encroachments?

Dr. Mark Skousen: Mike, Americans are quixotic when it comes to how we view wealth. We all want to be rich but are envious of those who are already rich. Surveys show that the majority of Americans favor taxing the rich, and that's why the Democrats are constantly pushing for higher taxes on the wealthy.

Even the majority of wealthy Americans favor higher taxes on themselves — Warren Buffett being an excellent example. Once again, they don't understand the sound principles of taxation. The key to economic growth is capital investment and high saving rates. But if you tax capital and savings at high rates, you won't get economic growth. You will get stagnation.

Most politicians and Keynesian economists don't realize that a tax on the income of wealthy Americans is a tax on capital. A tax on interest and dividends is a tax on capital. A federal estate and inheritance tax is a tax on capital. And a capital gains tax is a tax on capital.

Who can better use capital — the public (the state) or private enterprise? I dare say if you asked Warren Buffett, "Who would do a better job of investing your capital; you or the government?" even he would say, "I would!"

A wealth tax is one of the worst taxes you can impose because not only is it a tax on capital — which fuels economic growth — but it takes away your financial privacy. It makes everyone a criminal because you are forced to disclose all of your hidden assets including coins, jewelry, diamonds, art work, real estate, stocks and bonds, etc.

Do you really want the government having a list of ALL your assets?

Mike Fagan: Definitely not! And that’s one of the reasons why I brought up investing in gold and silver bullion/coins. I think collecting coins is a great way to store wealth in as private a manner as possible. Plus, it’s a lot of fun!

Dr. Mark Skousen: Absolutely! Mike, I've been a collector of gold and silver coins, not bullion, all of my adult life. My first investment was a silver dollar after reading Harry Browne's books in the 1970s.

I've been recommending Morgan silver dollars, junk silver, and bullion coins for a long time. I like the gold double eagles and one-ounce gold bullion coins issued by various countries.

The American eagle silver dollar is our official symbol at my annual FreedomFest conference.

American eagle silver dollar.

American eagle silver dollar.

And we encourage attendees to buy silver dollars in large numbers from the coin dealers at our show. It's an insurance policy; up to 5% of your investments. Just make sure they are stored safely!

Mike Fagan: Yes… and so let’s talk about FreedomFest! Time flies, right, with 2021 marking 15 consecutive years for the event! I know last year was a difficult situation with your regular host city, Las Vegas, pulling the plug on all in-person events sort of at the last minute.

This year, you’re back to what FreedomFest has always stood for and that is an in-person gathering of like-minded people who are concerned about their personal liberties continually being stripped away by the encroachment of government.

The event is open to people from all walks of life and all sides of the political spectrum and features keynote speakers and workshops spanning everything from wealth-building and personal liberty to the arts and science.

And this year, you’re holding the event in a very special place. Can you tell my readers about that and what they can expect from this year’s FreedomFest?

Dr. Mark Skousen: Absolutely, Mike. FreedomFest is meant to be THE place where freedom lovers from around the country come together once a year to learn, network, socialize, and celebrate liberty — or what's left of it!

It's been a big success over the years with 2,000 to 2,500 attendees every July. We have hundreds of speakers and exhibitors, all of the freedom organizations, the Anthem film festival, and a 3-day financial freedom conference. Authors, professors, economists, politicians, heath experts, musicians, and investors come in droves.

Every year, we have a big-name celebrity speaker, such as William Shatner, George Foreman, Kevin O'Leary of Shark Tank fame, and even Donald J. Trump in 2015. As John Fund says, "FreedomFest doesn't just ride the wave — it invents it."

Steve Forbes and John Mackey (CEO, Whole Foods Market) are our co-ambassadors and attend the entire conference.

For the past 14 years, we've held it annually in Las Vegas — an intellectual feast in the entertainment capital of the world. But last year, the imperial governor shut us down with a hearing, apology, or offer to compensate us for our huge financial losses. We discovered rather quickly that Nevada was not as libertarian as we thought! I'm still in shock how the monied casino interests apparently had no sway with the almighty government.

So we made the decision to leave Sin City and move our conference to the Badlands of Rapid City, South Dakota. We are only 20 minutes away from Mount Rushmore. The dates are July 21-24.

The move turned out to be a wise one as we already have over 2,100 attendees coming! We are likely to have over 3,000 attendees. People are coming from all over the country — flying, driving, biking, even coming in RVs and making it a family vacation.

I'm amazed how many people have never seen Mt. Rushmore in person. We are planning many excursions during FreedomFest. It's God's country there — really beautiful.

Your audience members can check out our list of big-name speakers, panels, and debates at www.freedomfest.com and you can register there as well. Or they can also call our toll-free number at 1-855-850-3733, ext 202 to register.

If you’ve never been, you’ll be glad you came. It will change your life meeting so many people of like minds. Plus it can be highly profitable!

Mike Fagan: Yes and speaking of profitability, last year, you announced a Secret Gold Stock that you all but guaranteed would double in 12 months. Well, you actually did a hell of a lot better than that with the stock more than tripling in less than 3 months!

Do you have a Secret Gold Stock to unveil at this year’s FreedomFest?

Dr. Mark Skousen: Indeed, I do! Last year, we were shut down so I didn't get to reveal it to the attendees. But this year, we will be meeting.

I have a great source for deeply undervalued mining companies… and this year's pick definitely has the potential to double or triple in value.

I can't reveal this stock to all of my 15,000-plus subscribers so I'm limiting the "Secret Gold Stock" to those who attend the conference in July. Stay tuned!

Mike Fagan: Some great incentive right there!

Dr. Mark Skousen: Yes and with a record 3,000 expected attendees, our biggest concern right now is hotel space. Rapid City is no Las Vegas! We’re taking over all of the hotels in the entire city. We just confirmed a block of rooms in several more hotels but they will sell out fast. I urge you all to call now and make your reservations.

Mike Fagan: Mark, you’re also the editor of Forecasts & Strategies — a highly-regarded and widely-read investment advisory that’s currently celebrating its 41st year of publication. Not to age you, but we’re talking the beginning of the Reagan administration here! You also offer a number of trading services.

Would you mind telling my readers a little bit about what’s on offer at Forecasts & Strategies and how they can sign up?

Dr. Mark Skousen: Thanks, Mike. I did start my newsletter, Forecasts & Strategies, in the year that Ronald Reagan was elected. I consider him the greatest president of the 20th century, and we actually met up several times.

My first promotion for my newsletter announced "Reaganomics will work! Sell your gold and silver and buy stocks and bonds!" It failed miserably because nobody believed me. But my forecast proved to be accurate, and I have been writing my monthly newsletter for 41 years and counting.

I'd like to think my investment advice has improved with age. And I've had a number of good calls, and my portfolio has consistently beat the market for the past 15 years. I plan to keep writing for another 10 years at least — so come join me.

In addition to the monthly newsletter, you will receive my hotline every Monday. For details, your audience members can go to www.markskousen.com. We offer an introductory first-year subscription for only $77 (full price is $250 a year).

I also have four trading services that offer ways to make money fast using stock options. Your readers can visit my website for details.

Mike Fagan: Mark, thank you for that. And again, thank you for your time and for your invaluable insights. Let’s do it again soon… oh, and can I get an AEIOU?!!

Dr. Mark Skousen: Thank you for having me on again, Mike! As you know, I always sign off my hotline with the phrase, "AEIOU." Your readers can look it up to figure out what it means.

Mike Fagan: Love it! Thank you again, Dr. Skousen.

Dr. Mark Skousen: My pleasure, Mike.

We have four reports now available highlighting several opportunities for investment in the resource space.

Opportunities discussed in those reports and past issues include:

April 2021 Issue: Opportunities Mentioned by Dr. Mark Skousen

- Franco-Nevada Corp. (NYSE: FNV)(TSX: FNV)

- B2Gold Corp. (NYSE: BTG)(TSX: BTO)

- Barrick Gold Corp. (NYSE: GOLD)(TSX: ABX)

- Pan American Silver (NASDAQ: PAAS)(TSX: PAAS)

- Grayscale Bitcoin Trust (OTC: GBTC)

- Amplify Transformation Data Sharing (NASDAQ: BLOK)

March 2021 Issue: Opportunities Mentioned by Adrian Day

- Barrick Gold (NYSE: GOLD)(TSX: ABX)

- Franco-Nevada (NYSE: FNV)(TSX: FNV)

- Royal Gold (NASDAQ: RGLD)

- Osisko Gold Royalties (NYSE: OR)(TSX: OR)

- B2Gold (NYSE-Amer: BTG)(TSX: BTO)

- Premier Gold Mines (OTC: PIRGF)(TSX: PG)

- Nomad Royalty (OTC: NSRXF)(TSX: NSR)

- Metalla Royalty (NYSE-Amer: MTA)(TSX-V: MTA)

- Elemental Royalties (OTC: ELEMF)(TSX-V: ELE)

- Star Royalties (TSX-V: STRR)

- Altius Minerals (OTC: ATUSF)(TSX: ALS)

- Pan American Silver (NASDAQ: PAAS)(TSX: PAAS)

- Fortuna Silver Mines (NYSE: FSM)(TSX: FVI)

- Magna Gold (OTC: MGLQF)(TSX-V: MGR)

January 2021 Issue: Opportunities Mentioned by Nick Hodge

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Roxgold (TSX: ROXG)(OTC: ROGFF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Generation Mining (TSX: GENM)(OTC: GENMF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

December 2020 Issue: Opportunities Mentioned by Van Simmons

- 19th century: Liberty Seated half dimes, dimes, quarters, half dollars, silver dollars

- 20th century: Buffalo Nickels, Mercury Dimes, Walking Liberty Halves, Standing Liberty Quarters

- Barber dimes, quarters, and halves

- Common date: $10 Liberties, $5 Liberties

- 19th century quarter sets: Draped Bust Quarter, Capped Bust Quarter, Liberty Seated Quarter, Barber Quarter

- 20th century coin sets: Mercury Dimes, Walking Liberty Halves, Buffalo Nickels, Standing Liberty Quarters; other various: 8-piece sets, 10-piece sets, 12-piece sets

November 2020 Issue: Opportunities Mentioned by Gerardo Del Real

- Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF)

- Chakana Copper (TSX-V: PERU)(OTC: CHKKF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX-V:RVG)(OTC: RVLGF)

- Integra Resources (TSX-V: ITR)(NYSE-American: ITRG)

- Liberty Gold (TSX: LGD)(OTC: LGDTF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Energy Fuels (TSX: EFR)(NYSE-American: UUUU)

October 2020 Issue: Opportunities Mentioned by Joe Mazumdar

- Pan American Silver (TSX: PAAS)(Nasdaq: PAAS)

- Liberty Gold Corp. (TSX: LGD)(OTC: LGDTF)

- HighGold Mining (TSX.V: HIGH)(OTC: HGGOF)

- Bluestone Resources (TSV.V: BSR)(OTC: BBSRF)

- Trilogy Metals (TSX: TMQ)(NYSE-Amex: TMQ)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Blackstone Minerals (ASX: BSX)

- Clean Air Metals (TSX.V: AIR)

August 2020 Issue: Opportunities Mentioned by Jeff Phillips

- Lynas Corp. (OTC: LYSCF)

- MP Materials: Private Company

- Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX.V: RVG)(OTC: RVLGF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Chakana Copper (TSX.V: PERU)(OTC: CHKKF)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

May 2020 Issue: Opportunities Mentioned by Brien Lundin

- Great Bear Resources (TSX.V: GBR)(OTC: GTBDF)

- Energy Fuels Inc.(NYSE American: UUUU)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- First Mining Gold (TSX: FF)(OTC: FFMGF)

- Libero Copper & Gold (TSX.V: LBC)(OTC: LBCMF)

- GR Silver Mining (TSX.V: GRSL)(OTC: GRSLF)

April 2020 Issue: Opportunities Mentioned by Nick Hodge

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

February 2020 Issue: Opportunities Mentioned by James Dines

- Agnico Eagle Mines (TSX: AEM)(NYSE: AEM)

- Kirkland Lake Gold (TSX: KL) (NYSE: KL)

- Pan American Silver (TSX: PAAS) (NASDAQ: PAAS)

- Lynas Corp. (OTC: LYSCF)

- Canopy Growth (TSX: WEED) (NYSE: CGC)

- OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI)