February 2021 Foundational Profits

February 2021 Foundational Profits

by Nick Hodge

» Being Contrarian > WallStreetBets

» Taking Some Profits

» Quick Comments On Gold & Cannabis

» Uranium

» Midas Gold

» Marching On

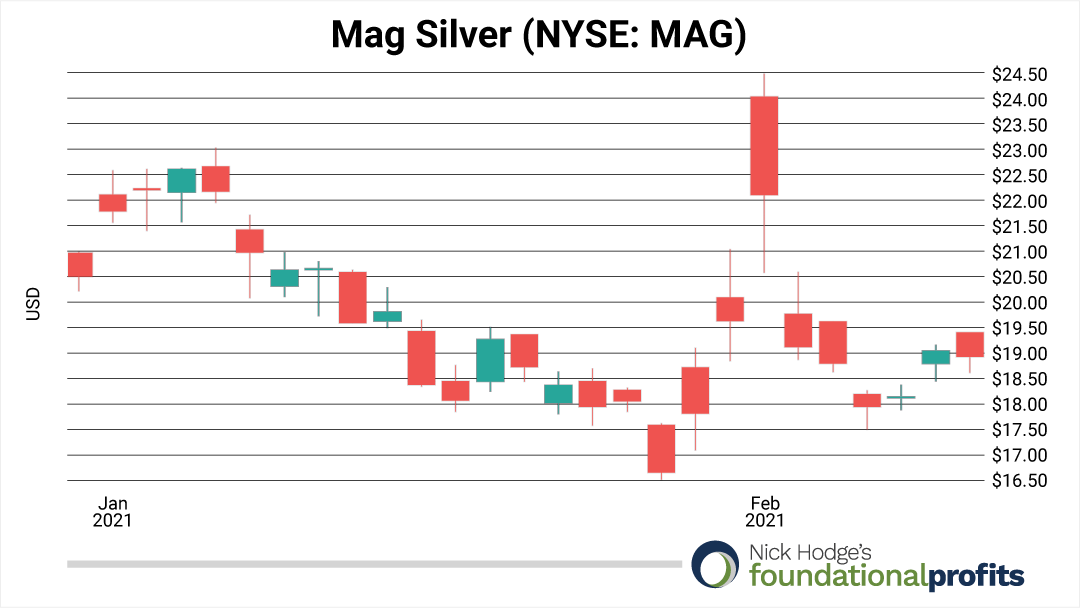

Your humble editor had you selling silver stocks last month before anyone had ever heard of WallStreetBets. (January Issue here).

Talk about being dialed-in.

We banked over 100% profits on Mag Silver (NYSE: MAG) above US$21.00. And you had plenty of price and volume to do that in the wacky month that followed.

We front-ran the crowd like a boss.

I don’t need to rehash the Reddit saga. Suffice it to say the masses are pissed off at the institutions. It’s par for the course for this Fourth Turning. There were marches in the street much of last year. Now, the ire is turning once again to Wall Street crooks instead of crooked cops.

The hive is alive. And now they know about zero commissions and penny stocks.

It feels like a top.

But my feelings don’t matter. Just like they didn’t matter when I was pressing the sell button on some silver stocks this month when many entrenched in the space were hashtagging away and thinking “this is the moment we’ve been waiting for.”

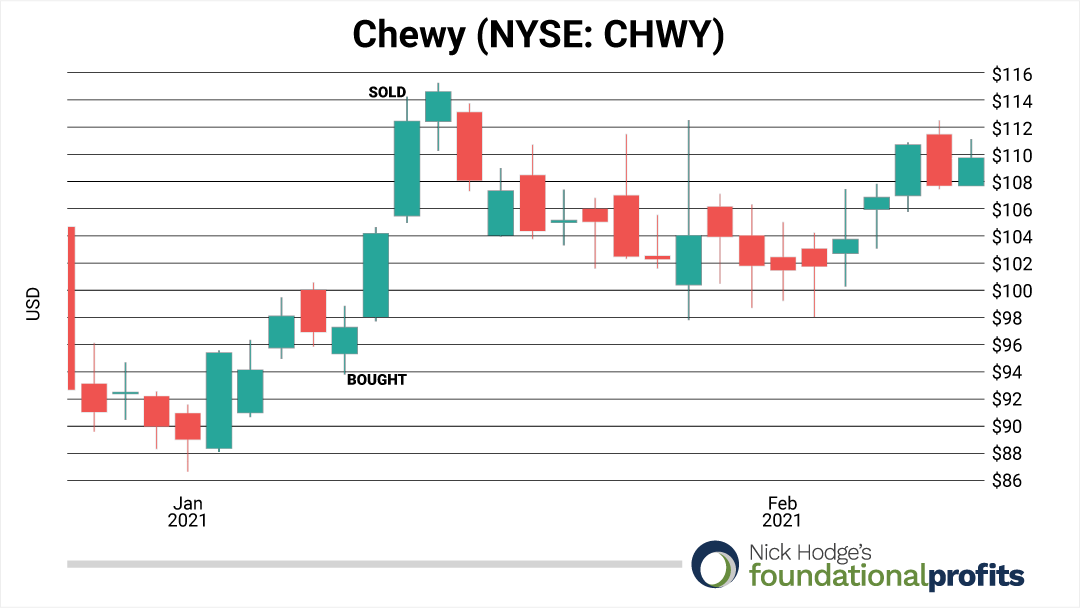

Just like they didn’t matter when we sold Chewy after holding it for three days on January 13. And it hasn’t been as high since as of this writing.

I’m not smart.

We are just in a ripping bull market across multiple asset classes and I’m getting better at taking profits. Also getting a bit better about picking out the winners within the winners.

We rotated into energy at the end of November 2020, for example, buying the SPDR Energy Select (NYSE: XLE). It has been the best-performing sector of the S&P since, as oil has inflated to $60 per barrel — the highest price in a year.

Stocks remain at record highs. We’ll see how much more we can get.

Corporate earnings for the S&P companies are looking the best they looked in a few years. Not only is earnings growth for the entire S&P not negative for the first time in in two years, but energy in particular has been much better than “analysts” expected.

Who knew?

And still, with Amazon, Bitcoin, Copper, Dogecoin and on down the alphabet hitting mult-year — if not all-time highs — there are the earliest whispers of change in the air.

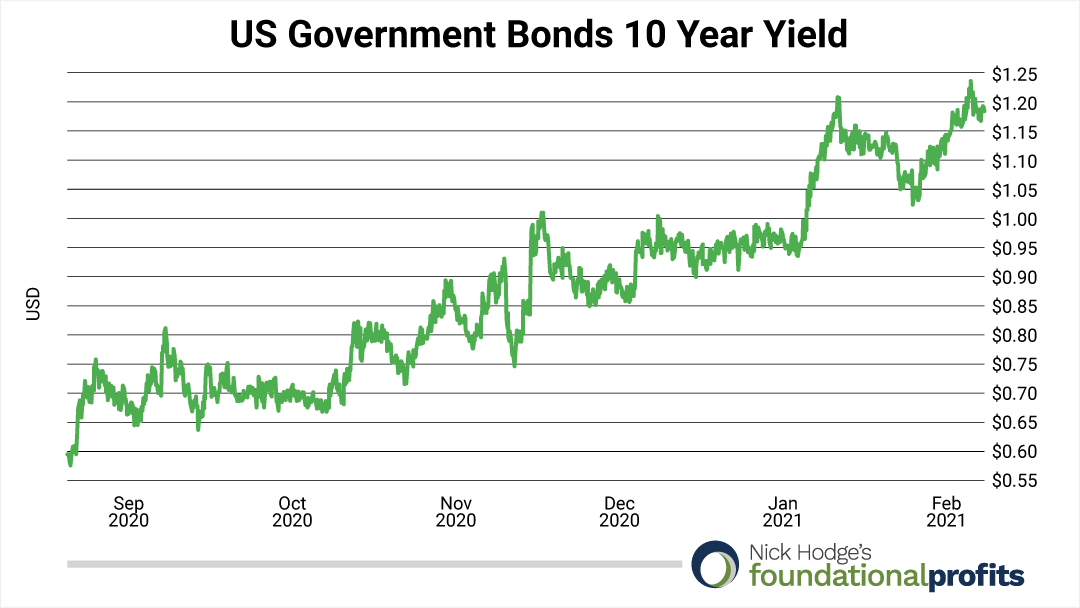

Subtly, like the melting of a snow pile, rates have started to wither ever so slightly. Their hot rise since the heat of summer has been what’s kept a lid on gold’s fire.

And while it’s too early to tell just yet how much longer rates can inflate… I’ll be keeping a watchful eye — and some dry powder — to capitalize on whatever the next cycle is.

Existing Portfolio

As it stands, we have 16 of our 20 positions filled. Four of them are up significantly:

Sibanye-Stillwater (NYSE: SBSW) — Up 160%, trading above US$18.00. We’re only buying below US$8.50, so that is a hold. People are stealing catalytic converters again as palladium sits at over US$2,300 per ounce. We stole it first when no one was looking!

MP Materials (NYSE: MP) — Up 160%, trading above US$38.00. We’re only buying it below US$13.00. Who knew you needed rare earth metals for wind turbines and electric car batteries?!

Ivanhoe Mines (TSX: IVN)(OTC: IVPAF) — Up 271%, trading near C$7.00. We’re only buying below C$3.75. Now at a C$8 billion valuation as it heads into production at one of its three world-class copper-PGM-gold-nickel mines, Ivanhoe is a great candidate to take some profits and reduce some risk. Sell half your Ivanhoe above C$6.65.

Franco-Nevada (NYSE: FNV) — Up 100%, trading near US$126.00. We are buying this one below US$130.00, so it is still a buy. We were up much more on this position last year when gold was higher. This consolidation period in gold makes it a good time to buy.

Quick Comments

Alamos Gold (NYSE: AGI) is a buy under US$10.00 and is well below that price. It remains a top buyout candidate as a quality mid-tier producer with exploration upside in safe jurisdictions.

Artemis Gold (TSX-V: ARTG)(OTC: ARGTF) is an earlier stage, but similar story. It is fast-tracking development of the giant Blackwater gold project in British Columbia. Construction is planned to begin in just over a year, with permitting already underway for the clearing of key infrastructure areas. The project has an after tax net present value (NPV) of C$2.2 billion while it trades with a market cap of C$732 million. And that NPV is based on US$1,541 gold. It is a buy under C$5.50. And it’s worth a look as it is right near that price.

Hecla Mining (NYSE: HL) is a buy under US$6.00. It was below that most of January… until the “silver squeeze” came along. You’ll have a chance to buy it again below US$6.00 if silver is your thing.

International Business Machines (NYSE: IBM) was a bad call. Straight up. We bought it at US$128 and it has failed to keep pace with the rest of the tech sector after an earnings misstep in January. Sell it above US$122, take the small loss, and we’ll put it back to work elsewhere.

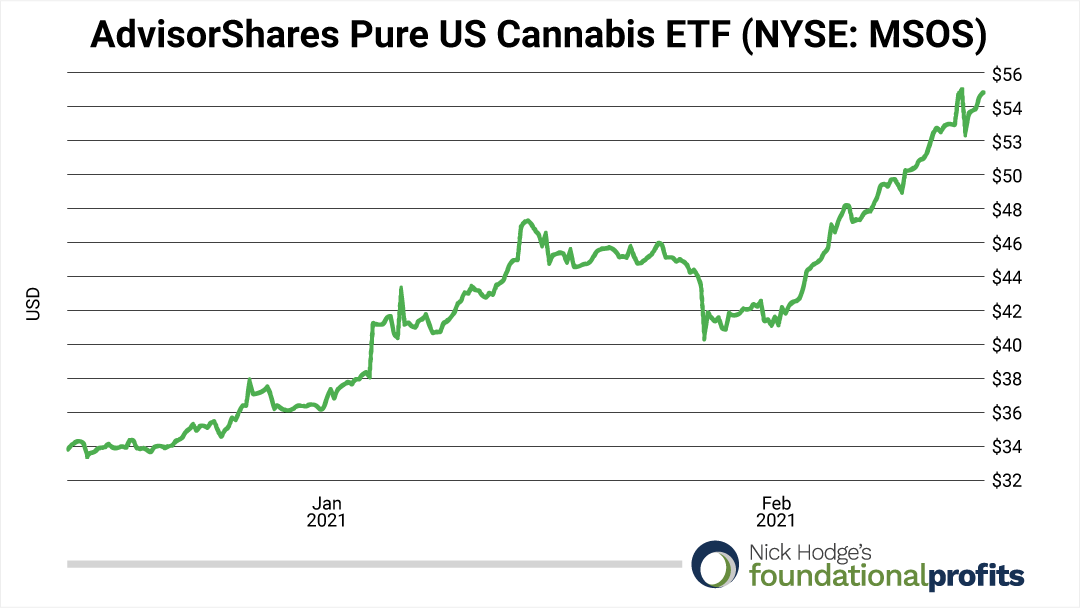

AdvisorShares Pure US Cannabis ETF (NYSE: MSOS), however, was a fantastic call. We started buying it below US$34.00 back in December. That puts us up more than 60% as it hit new highs above US$55.00 this week. I likely won’t cover many individual cannabis names in this letter. But we have three in the Family Office Advantage portfolio that are smokin’.

Uranium

Even uranium stocks are catching a bid.

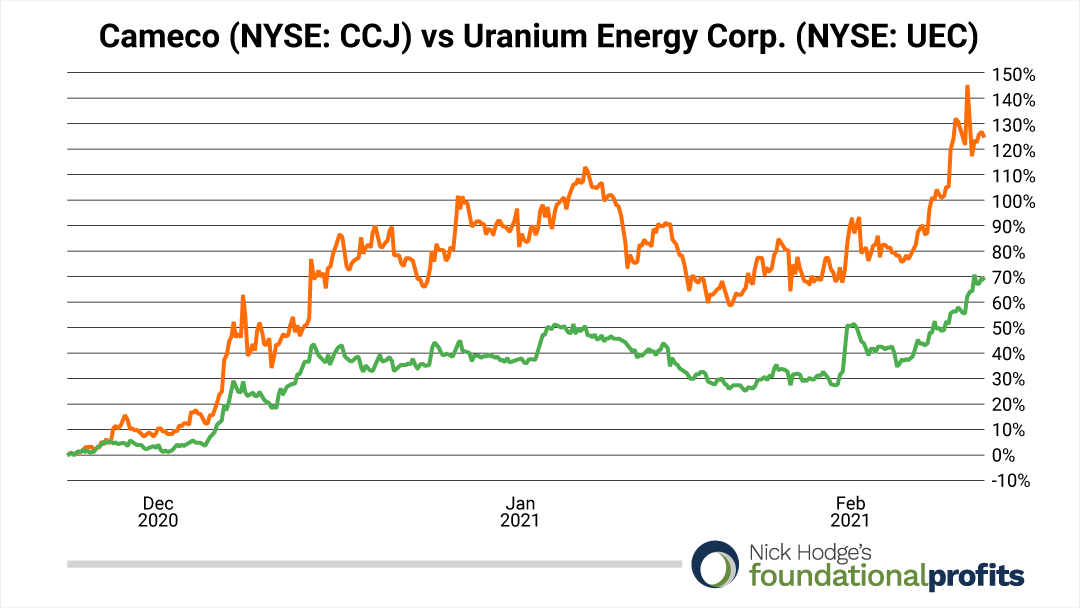

Cameco (NYSE: CCJ), the largest public uranium company, is up nearly 70% since November 2020. It now trades over US$16.00. We own it below US$10.00

Uranium Energy Corp. (NYSE: UEC) is up 120% since December.

The spot price of uranium itself is little changed, stuck right at the US$30 per pound mark. It’s the equities that are leading right now.

And they are doing it on no real news other than culmination of the fundamentals that have been ripe for a bull market for years.

I would still like to see the utilities come in and by before calling this a kick-off of a uranium bull. But the charts do look good so far, and certainly serve to underscore the point often made about uranium stocks: you need to be in when they turn because gains come fast.

UEC was under its buy under price of US$1.63 less than ten trading days ago. Now we’re up more than 30%. You should be buying on any pullbacks below that price.

Otherwise hang on tight. Uranium rides can be steep.

Midas Gold (TSX: MAX)(OTC: MDRPF)

Many questions have come in about Midas Gold.

Mostly, you want to know why it’s going down and not up.

The main answer is the entire gold sector has been weak as bond yields have improved for the past five months or so. Midas has come off with the gold price alongside many other gold juniors.

Midas was also heavily promoted last summer thanks in part to some advertising I was doing at the time. And it is now back to where it was trading last July, in the C$0.95-range.

But instead of C$0.95, you will see a share price of C$9.50. And this is because shares have consolidated on a 10-for-1 basis. This was part of a plan to list on the Nasdaq, which is now underway.

The company is now being led almost entirely by billionaire John Paulson through his Paulson & Co. fund. The same John Paulson who famously shorted the housing market in 2007, about which The Big Short was written.

I spoke with Marcelo Kim last week. He is the Chairman of the board and John Paulson’s right-hand man.

We are still expecting a draft record of decision later this year for the Stibnite project.

The stock has a real chance to be re-rated higher as it goes on a major US-exchange, and will be one of the largest gold development stories there.

I was told there are no plans to merge Midas with any other entities, and that as long as market conditions allow, the company will proceed to finance and build the mine on its own unless there is some other shareholder-approved offer in the interim.

We had been buying Midas Gold below C$1.50. With the pullback and the consolidation, the new buy under is C$10.00.

It is below that price now, and it’s a very high quality speculation on a positive permitting decision later this year as well as the resumption of the gold bull market we’re in after the current hiatus.

Marching On

Several of our holdings are still buy-rated. Those are where you should focus your efforts.

I have decided on at least one new recommendation — in the cleantech space. I will have that to you over the next month. Keep an eye out for it.

Enjoy the gains. Your portfolio should be... inflating.

Don’t forget to take some profits.

Call it like you see it,

Nick Hodge

Nick Hodge

Editor, Foundational Profits

Here is the current portfolio:

Open Positions

| Large Cap Sector Selections and Funds |

|

|

|

| Company |

Symbol |

Exchange |

Buy Limit |

| AdvisorShares Pure US Cannabis ETF |

MSOS |

NYSE |

$34.00 |

| Altria Group Inc. |

MO |

NYSE |

$40.00 |

| Energy Select Sector SPDR Fund |

XLE |

NYSE |

$38.00 |

| Metals & Minerals |

|

|

|

| Company |

Symbol |

Exchange |

Buy Limit |

| Alamos Gold |

AGI |

NYSE |

$10.00 |

| Artemis Gold |

ARTG |

TSXV |

C$5.50 |

| Cameco Corporation |

CCJ |

NYSE |

$11.00 |

| Franco-Nevada Corp. |

FNV |

NYSE |

$130.00 |

| GoldMining Inc. |

GOLD |

TSX |

C$2.50 |

| Hecla Mining |

HL |

NYSE |

$6.00 |

| Ivanhoe Mines |

IVN |

TSX |

C$3.75 |

| MAG Silver Corp. |

MAG |

NYSE |

$11.00 |

| Midas Gold Corp |

MAX |

TSX |

C$10.00 |

| MP Materials |

MP |

NYSE |

$13.00 |

| Rio Tinto |

RIO |

NYSE |

$52.00 |

| Sibanye Stillwater |

SBSW |

NYSE |

$8.50 |

| Uranium Energy Corp. |

UEC |

NYSE |

$1.63 |

Make sure you never miss an update or issue from Nick Hodge's Foundational Profits by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Nick Hodge's Foundational Profits, Copyright © 2021, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Nick Hodge's Foundational Profits does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.